Table of Contents

Overview

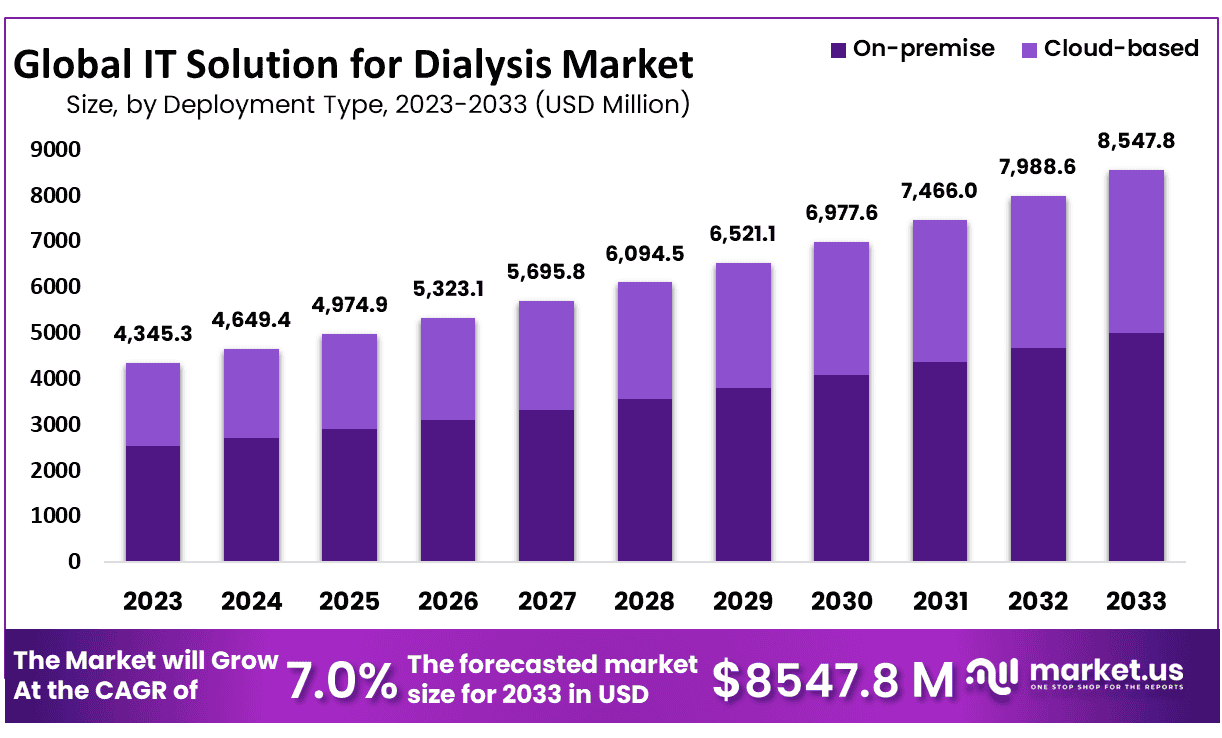

New York, NY – Sep 19, 2025 –The Global IT Solution for Dialysis Market size is expected to be worth around USD 8547.8 Million by 2033 from USD 4,649.4 Million in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2033.

The healthcare sector is witnessing significant progress with the introduction of advanced IT solutions tailored for dialysis management. This development is set to improve patient care, streamline operations, and ensure greater efficiency in dialysis centers worldwide.

The newly launched IT solution integrates patient management, treatment scheduling, and real-time monitoring into a unified digital platform. The system has been designed to support nephrologists, nurses, and healthcare administrators by providing accurate data, enhancing communication, and reducing administrative burdens.

Through electronic health record (EHR) integration, the solution ensures that patient histories, dialysis prescriptions, and treatment outcomes are securely stored and instantly accessible. Advanced analytics and reporting tools allow healthcare providers to track patient progress, identify potential complications early, and optimize treatment strategies.

In addition, the solution supports remote monitoring capabilities, enabling physicians to follow patient status beyond the clinic. This is particularly vital in enhancing continuity of care and addressing the growing demand for home-based dialysis treatments.

The adoption of IT-enabled dialysis management is expected to improve clinical outcomes, reduce medical errors, and increase operational efficiency. As the global dialysis patient population continues to rise, digital transformation within renal care has become a necessity rather than an option. This solution represents a decisive step toward patient-centered, technology-driven healthcare delivery, setting new standards for the future of dialysis management.

Key Takeaways

- Market Size: The IT solutions for dialysis market is projected to reach approximately USD 8,547.8 million by 2033, rising from USD 4,345.3 million in 2023.

- Market Growth: The market is forecasted to expand at a compound annual growth rate (CAGR) of 7.0% between 2024 and 2033.

- Deployment Type Analysis: In 2023, on-premise solutions accounted for 58.3% of the overall market share, reflecting their continued dominance.

- Application Analysis: Within applications, data acquisition held the leading position with a 35.2% share in 2023.

- Regional Analysis: North America led the global market, contributing 39.2% of the share and generating revenues of USD 1,703.3 million in 2023.

- Collaborations and Partnerships: Key players are actively pursuing strategic collaborations and partnerships to strengthen dialysis IT offerings and broaden their market presence.

- Integration of AI and Analytics: The adoption of artificial intelligence (AI) and advanced analytics is emerging as a major trend, providing predictive insights and improving patient care in dialysis services.

- Remote Monitoring: Innovations in telehealth platforms and mobile applications are enabling remote monitoring of dialysis patients, enhancing both patient engagement and healthcare delivery.

Technical Analysis of IT Solutions for Dialysis

IT solutions for dialysis rely on integrated software platforms that combine electronic health records (EHR), data acquisition systems, and real-time patient monitoring. These platforms are designed to manage vast amounts of clinical data, including treatment history, lab results, and dialysis prescriptions, ensuring secure storage and instant accessibility.

Advanced data analytics and artificial intelligence (AI) enhance predictive modeling, enabling early detection of complications such as fluid imbalance or vascular access failure. On-premise solutions currently dominate due to their reliability and data control, though cloud-based platforms are emerging as scalable alternatives offering remote access. Application modules for data acquisition and patient scheduling optimize workflow efficiency while reducing administrative errors.

Telehealth-enabled systems and mobile applications facilitate remote monitoring, improving patient engagement beyond clinical settings. Overall, dialysis IT solutions integrate precision, automation, and connectivity, delivering advanced tools that improve patient care, reduce medical errors, and enhance operational performance across renal healthcare facilities.

Regional Analysis

The global IT solutions for dialysis market is segmented into North America, Western Europe, Eastern Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa. Among these, North America dominates the market, holding 39.2% of the global share and generating USD 1,703.3 million in revenue in 2023. The region’s leadership is largely attributed to the adoption of inorganic growth strategies, particularly collaborations and partnerships, which have strengthened expertise in developing IT platforms dedicated to nephrology research.

A notable example includes the partnership between Fresenius Medical Care North America and Acumen Physician Solutions. In March 2017, the companies jointly launched Acumen 2.0, an advanced electronic health record (EHR) and practice management solution designed specifically for nephrology practices. This initiative highlighted their commitment to innovation in dialysis IT solutions while reinforcing their strong market presence.

In contrast, regions such as the Middle East and parts of Africa face significant challenges. Saudi Arabia, the United Arab Emirates, Egypt, and other countries encountered supply chain disruptions that hindered the transportation of critical dialysis-related goods. To address such issues, NHS England has been working closely with the renal community, establishing emergency renal operational delivery networks. These networks, led by designated coordinators, collaborate with essential care providers to mitigate risks for critical patients.

Despite these efforts, a persistent supply-demand imbalance remains a concern, particularly due to constraints in equipment availability. This factor is anticipated to have a notable impact on the financial trajectory of the global dialysis IT solutions market over the forecast period.

Emerging Trend

- Growth of home dialysis supported by digital tools

Home dialysis has been increasing, which has been enabled by remote monitoring and connected devices. In the U.S., home dialysis use among Medicare beneficiaries reached ~35% for those with Medicare as secondary payer in 2022 (about 30% peritoneal dialysis and 5% home hemodialysis). Across the broader population, incident patients on home dialysis about doubled from 2011–2021. These shifts are consistent with policy incentives and the maturation of home-support technologies. - Remote patient monitoring (RPM) is becoming routine in peritoneal and home HD programs

Multiple clinical studies report that RPM for automated peritoneal dialysis (APD) and broader CKD care is associated with fewer hospitalizations and improved blood-pressure and fluid outcomes, supporting wider operational adoption. - Telehealth integration into in-center dialysis workflows

Telemedicine has been woven into dialysis rounds and follow-ups. Evidence shows more frequent patient-provider contacts without higher hospitalization, and qualitative data suggest strong patient acceptance when visits are aligned to in-center schedules. - Push toward data interoperability (FHIR/APIs)

Regulations and federal blueprints emphasize shared, standards-based data exchange so dialysis EHRs, RPM platforms, labs, and payers can interoperate. CMS and ONC materials promote FHIR-based patient access and payer–provider exchange, enabling smoother care coordination and analytics. - Early adoption of AI/ML for risk prediction

Peer-reviewed studies in 2024–2025 describe machine-learning models for mortality and adverse-event prediction in hemodialysis cohorts, indicating an emerging pathway for proactive care pathways and resource targeting. - Wearables and connected peripherals for dialysis

Health-system playbooks in the UK report pilots of wearable sensors (e.g., smart patches) to track vitals and hematologic parameters in hemodialysis patients, illustrating practical routes to scale RPM beyond machine telemetry. - Continued focus on infection control and resilient digital pathways

Guidelines produced during COVID-19 accelerated virtual triage, digital consent, and remote education for dialysis services—practices that have persisted to protect vulnerable patients and staff.

Use Cases

- Priority use cases for IT in dialysis (with numbers)

- Remote patient monitoring for APD (home peritoneal dialysis)

- What it does: daily automated uploads (treatment time, fill/drain, UF), alerts for deviations, and nurse dashboards.

- Impact reported: a matched study found ~39% lower hospitalization rate (incidence rate ratio, IRR 0.61) and ~54% fewer hospitalization days (IRR 0.46) for APD with RPM vs. without RPM.

- RPM for broader dialysis populations (cloud-based programs)

- What it does: aggregates vitals, symptoms, and machine data; flags risk; supports early outreach.

- Impact reported: implementation associated with ~45% lower hospitalization rate and ~42% shorter length of stay in program evaluations.

- Tele-nephrology during in-center hemodialysis

- What it does: scheduled video encounters during chair time, multidisciplinary virtual rounding, documentation into the EHR.

- Impact reported: programs observed more frequent monthly visits (greater likelihood of ≥4 visits/month) without an increase in hospitalizations suggesting improved access and continuity

- Home dialysis enablement and patient education portals

- What it does: digital training modules, secure messaging, supplies tracking, and reminders integrated with EHR and payer portals.

- Why it matters: home dialysis uptake is rising (see above), and policy programs (e.g., Medicare’s ESRD Treatment Choices model) explicitly incentivize home modalities portals and training apps reduce onboarding friction and support adherence.

- Interoperable data exchange across dialysis centers, hospitals, and payers

- What it does: FHIR APIs and patient-access APIs connect dialysis EHRs with labs, hospitals, and Medicare Advantage/Medicaid plans for faster referrals, transplant evaluation sharing, and quality reporting.

- Regulatory context: CMS interoperability framework and patient-access rules promote API-based exchange and payer–provider data sharing.

- AI-assisted risk stratification

- What it does: models that predict mortality or complications in hemodialysis patients using routine EHR/lab features; used to prioritize outreach and personalize targets (e.g., ultrafiltration, dry-weight reviews).

- Evidence signal: recent peer-reviewed work in 2025 reports validated mortality-prediction models in hemodialysis cohorts, indicating feasibility for clinical decision support pathways. (Deployment must align with FDA CDS/SaMD guidance—see below.)

- Wearable vitals and anemia trend tracking for in-center HD

- What it does: continuous vitals capture between sessions plus periodic hemoglobin/hematocrit estimates to detect intradialytic instability or occult anemia trends; care teams receive dashboards and alerts.

- Operational learning: NHS transformation case studies document real-world pilots within renal services, supporting scalability assessments.

- Virtual infection-control workflows and incident response

- What it does: remote pre-screening, tele-consults, and digital cohorting to keep vulnerable patients and staff safer; documentation templates and patient messaging.

- Rationale: national guidance established these digital practices during the pandemic, which remain relevant for respiratory seasons and outbreaks.

Conclusion

The introduction of IT solutions for dialysis marks a transformative step in renal care, enabling better patient outcomes and greater operational efficiency. By integrating electronic health records, remote monitoring, predictive analytics, and telehealth services, these solutions support both in-center and home-based dialysis.

The adoption of digital platforms is helping providers reduce hospitalizations, detect complications early, and optimize treatment schedules. With home dialysis usage rising and healthcare systems prioritizing interoperability, these solutions are positioned to become essential tools in modern nephrology. Ultimately, IT-enabled dialysis management sets a new benchmark for patient-centered, technology-driven healthcare delivery worldwide.