Table of Contents

Introduction

Creator Economy Statisitcs: The Creator Economy is an evolving digital ecosystem where individuals generate income by creating and sharing original content, products, or services directly to online audiences. This economy grew alongside the rise of social media and e-commerce platforms, enabling creators such as influencers, artists, educators, and gamers to build personal brands and earn through sponsorships, advertisements, subscriptions, and direct sales. Technological advancements have democratized content creation, making it accessible to anyone with internet access, thus transforming how creativity and expertise are shared and monetized without reliance on traditional media or corporate intermediaries.

The Creator Economy industry encompasses the platforms, tools, investors, and businesses that support creators’ activities and monetization efforts. It includes social media networks, content marketplaces, payment systems, analytics services, and creator enablement tools that allow individuals to grow their audience, manage their presence, and commercialize their work. This industry is rapidly expanding with millions of active creators worldwide and significant capital inflows. It is shifting traditional marketing approaches as brands increasingly partner with creators for authentic engagement and niche targeting.

For Proper Guidance for your Business, Invest On Report Here: https://market.us/purchase-report/?report_id=136026

TLDR: Editor’s Choice

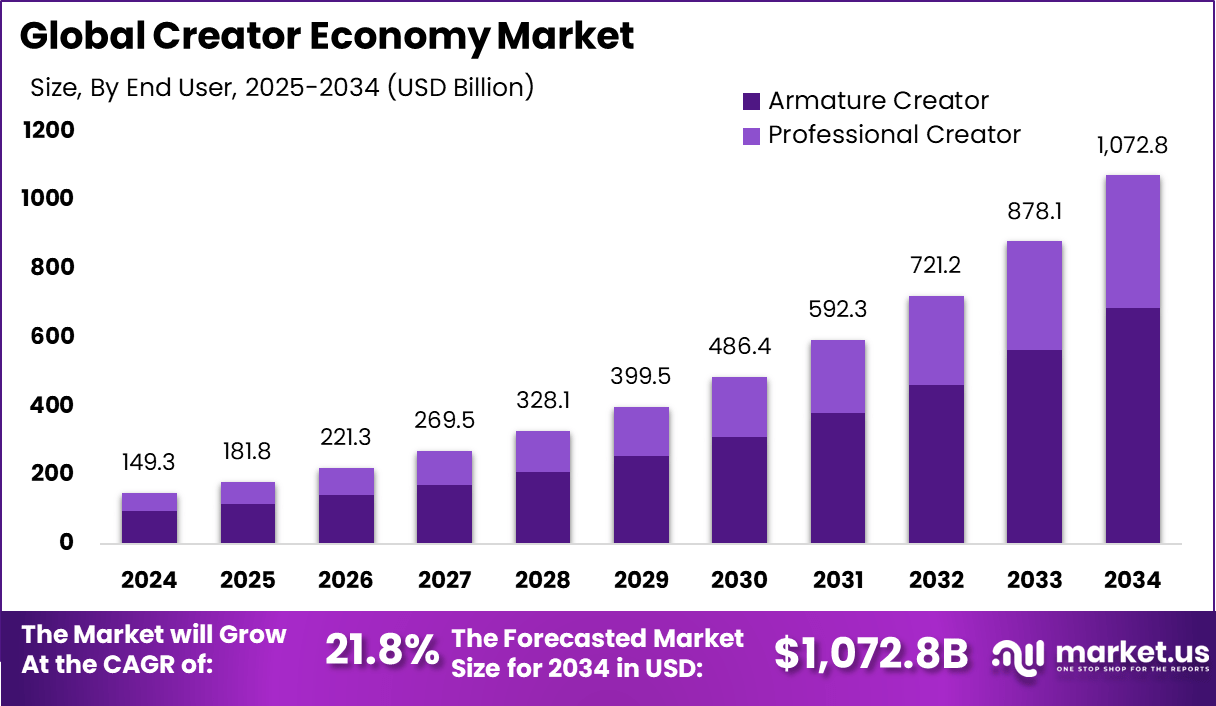

- The global creator economy is set to grow from USD 149.4 Billion in 2024 to USD 1,072.8 Billion by 2034, at a strong 21.8% CAGR.

- Only 4%-10% of creators earn over USD 100K annually, making high-income professionals rare.

- YouTube, Instagram, and TikTok deliver the best ROI for brand campaigns.

- Over 91% of creators now use generative AI to scale content production.

- Around 500 million people are active in the passion economy.

- Gender split shows 52% men, while 46.7% of creators work full-time.

- Just 13% are Gen Z, and 67% have 1K–10K followers, highlighting micro-creators’ dominance.

- On average, creators take 6.5 months to earn their first dollar.

- 70% spend 10 hours or fewer weekly on content production.

- Merchandise businesses generate USD 500 Million+ annually within this ecosystem.

- Shopify leads the creator economy revenues with USD 5.2 Billion.

Recent Developements

- In March 2025, the Government of India announced the creation of a USD 1.0 billion fund, with an immediate allocation of USD 47 million to the Indian Institute of Creative Technology. This initiative was introduced alongside the WAVES 2025 summit, with the aim of strengthening innovation, enhancing skills, and expanding opportunities in the country’s creative industries. The move highlights India’s commitment to nurturing talent and advancing its global position in content creation and digital entertainment.

- During the same month, UNESCO partnered with the Knight Center for Journalism in the Americas to conduct a large-scale training program that attracted over 10,000 participants. The program emphasized critical areas such as audience trust, ethical influence, and media literacy. This effort was designed to reinforce responsible journalism practices and address the growing challenges of misinformation in the digital era.

- In February 2025, Gushcloud International in collaboration with Azure Capital Partners launched the Azure-Gushcloud Entertainment Finance Fund. This fund was structured to provide financing support for content creators, offering opportunities for global brand partnerships, monetization of digital content, and licensing across multiple platforms. The initiative underscored the rising importance of financial infrastructure in empowering creators within the expanding digital entertainment economy.

Creator Economy Market Size

Key Takeaways

- Social Media Platforms led with 27.8% share, showing their dominance as the primary base for creators to build and engage audiences.

- Video Streaming Platforms followed with 24.5% share, driven by demand for long-form and high-quality content.

- Video content dominated by format with 23.8% share, reflecting consumer preference for visual storytelling.

- Music content captured 18.3% share, supported by short-form audio, independent artists, and streaming growth.

- Brand Collaborations were the leading monetization method at 23.5%, as brands partner with creators for authentic reach.

- Advertising Revenue accounted for 20.9%, remaining vital but behind direct brand deals.

- Armature Creators made up 64.1%, reflecting low entry barriers and side-hustle culture.

- Professional Creators represented 35.9%, highlighting structured full-time creation.

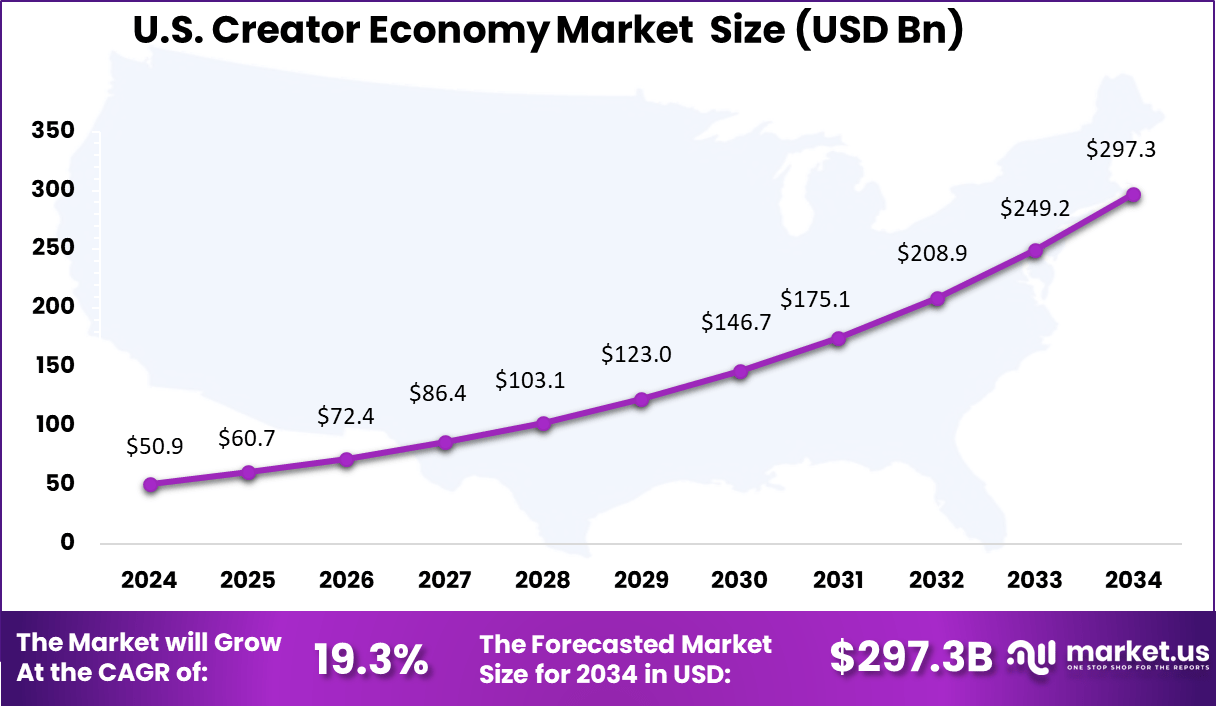

- The U.S. Creator Economy reached USD 50.9 Billion in 2024, with a strong 19.3% CAGR, showcasing significant growth momentum.

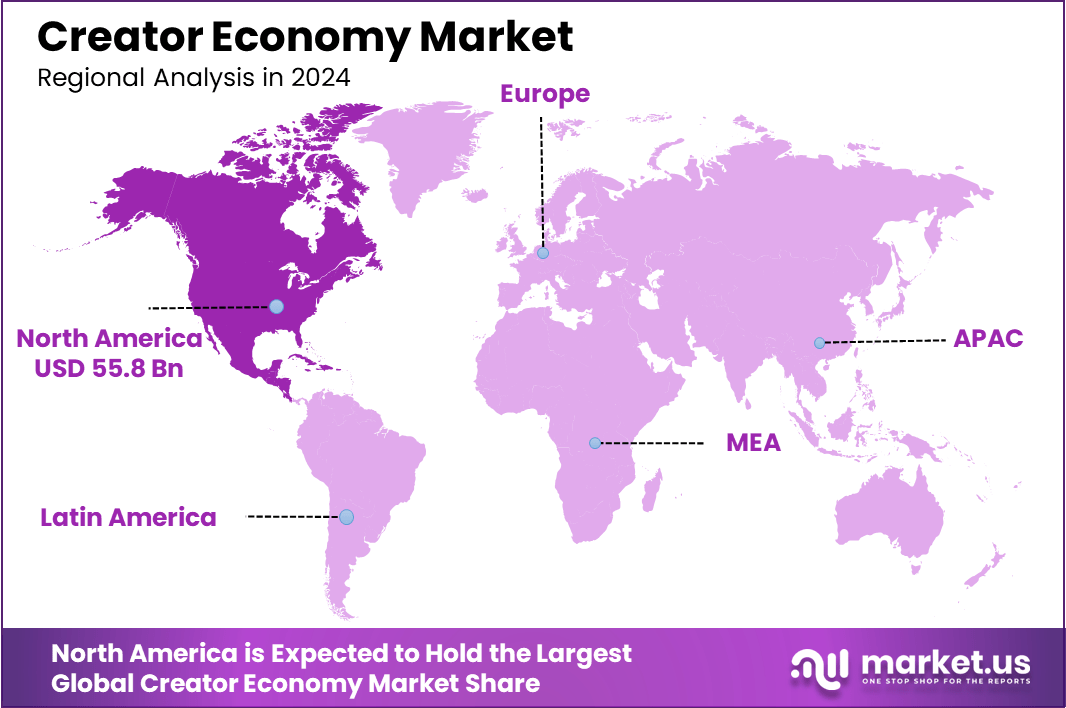

- North America held a 37.4% share, led by established platforms, monetization tools, and mature digital infrastructure.

Creator Economy Statistics

- According to Internet news times, More than 91% of creators use generative AI to scale content output.

There are 200+ million creators worldwide, highlighting the vast scale of the ecosystem. - Fueled by 4.2 billion social media users, creators benefit from massive reach.

- Around 500 million people are active in the passion economy, turning hobbies into income streams.

- By demographics, 52% of creators are men, while Gen Z accounts for only 13%, showing stronger participation from Millennials and older groups.

- 67% of creators have 1,000–10,000 followers, emphasizing the strength of micro-influencers.

- Nearly 1 in 4 people today identifies as a content creator, reflecting mainstream adoption.

- In monetization, 68.8% of creators depend on brand deals as their primary revenue stream.

- Merchandise is highly lucrative, generating USD 500+ Million annually.

- Shopify leads the creator support ecosystem with USD 5.2 Billion revenue, showing its dominance in powering creator-led businesses.

Google Trends

Interest over time

Interest by region

Regional Highlights: A Global Perspective

The US Creator Economy Market is valued at approximately USD 50.9 Billion in 2024 and is predicted to increase from USD 123 Billion in 2029 to approximately USD 297.3 Billion by 2034, projected at a CAGR of 19.3% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 37.4% share, holding USD 55.8 billion in revenue in the global creator economy market. This leadership was driven by a mature digital infrastructure, widespread smartphone usage, and a highly engaged social media population.

Creator Economy Market Share by Region (%), 2019-2024

| Country | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| The US | 92.2% | 92.0% | 91.8% | 91.6% | 91.4% | 91.2% |

| Canada | 7.8% | 8.0% | 8.2% | 8.4% | 8.6% | 8.8% |

Platform Analysis

Creator Economy Market Share by Platform Analysis (%), 2019-2024

| Platform | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Social Media Platforms | 31.7% | 31.2% | 30.6% | 30.1% | 29.2% | 29.0% |

| Content-Sharing Platforms | 15.3% | 15.2% | 15.2% | 15.1% | 15.1% | 15.0% |

| Video Streaming Platforms | 22.2% | 22.6% | 22.9% | 23.2% | 23.8% | 23.9% |

| Audio Platforms | 12.0% | 12.1% | 12.2% | 12.4% | 12.5% | 12.6% |

| Gaming Platforms | 10.9% | 11.2% | 11.5% | 11.9% | 12.3% | 12.5% |

| Others (E-commerce Platforms, etc.) | 7.9% | 7.7% | 7.5% | 7.3% | 7.1% | 7.0% |

Content Type Analysis

Creator Economy Market Share by Content Type Analysis (%), 2019-2024

| Content Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Video | 21.9% | 22.5% | 23.0% | 23.5% | 24.3% | 24.4% |

| Written | 9.9% | 9.7% | 9.4% | 9.2% | 8.9% | 8.7% |

| Gaming | 17.2% | 17.2% | 17.2% | 17.2% | 17.1% | 17.2% |

| Music | 19.6% | 19.4% | 19.3% | 19.2% | 18.9% | 19.0% |

| Photography, Art, and Memes | 11.2% | 11.0% | 10.9% | 10.7% | 10.6% | 10.4% |

| Audio | 13.3% | 13.4% | 13.6% | 13.7% | 13.9% | 14.0% |

| Others (Educational, etc.) | 6.9% | 6.8% | 6.6% | 6.5% | 6.3% | 6.2% |

Monetization Method Analysis

Creator Economy Market Share by Monetization Method Analysis (%), 2019-2024

| Monetization Method | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Advertising Revenue | 24.8% | 24.3% | 23.8% | 23.3% | 22.4% | 22.1% |

| Subscriptions | 17.1% | 17.7% | 18.3% | 18.9% | 19.8% | 20.0% |

| Donations and Tips | 7.5% | 7.2% | 7.0% | 6.7% | 6.5% | 6.3% |

| Affiliate Marketing | 12.2% | 12.3% | 12.3% | 12.4% | 12.4% | 12.5% |

| Brand Collaborations | 21.0% | 21.3% | 21.7% | 22.1% | 22.6% | 22.7% |

| Merchandise | 11.6% | 11.6% | 11.5% | 11.5% | 11.3% | 11.4% |

| Others | 5.8% | 5.6% | 5.4% | 5.2% | 5.0% | 4.9% |

End User Analysis

Creator Economy Market Share by End User Analysis (%), 2019-2024

| End User | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Professional Creator | 65.4% | 65.0% | 64.5% | 64.1% | 63.5% | 63.3% |

| Armature Creator | 34.6% | 35.0% | 35.5% | 35.9% | 36.5% | 36.7% |

Key Market Segments

By Platform

- Social Media Platforms

- Content-Sharing Platforms

- Video Streaming Platforms

- Audio Platforms

- Gaming Platforms

- Others (E-commerce Platforms, etc.)

By Content Type

- Video

- Written

- Gaming

- Music

- Photography, Art, and Memes

- Audio

- Others (Educational, etc.)

By Monetization Method

- Advertising Revenue

- Subscriptions

- Donations and Tips

- Affiliate Marketing

- Brand Collaborations

- Merchandise

- Others

By End User

- Professional Creator

- Armature Creator

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- Top Key Players in the Market

- Alphabet Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Note (*): Similar analysis will be provided for other companies as well.

- Amazon.com, Inc.

- ByteDance

- Meta Platforms

- Spotify AB

- Netflix Inc.

- Snap Inc.

- Pinterest, Inc.

- X Corp.

- Canva

- Roblox Corporation

- Etsy, Inc.

- Patreon, Inc.

- Discord Inc.

- Substack Inc.

- Alphabet Inc.