Table of Contents

Introduction

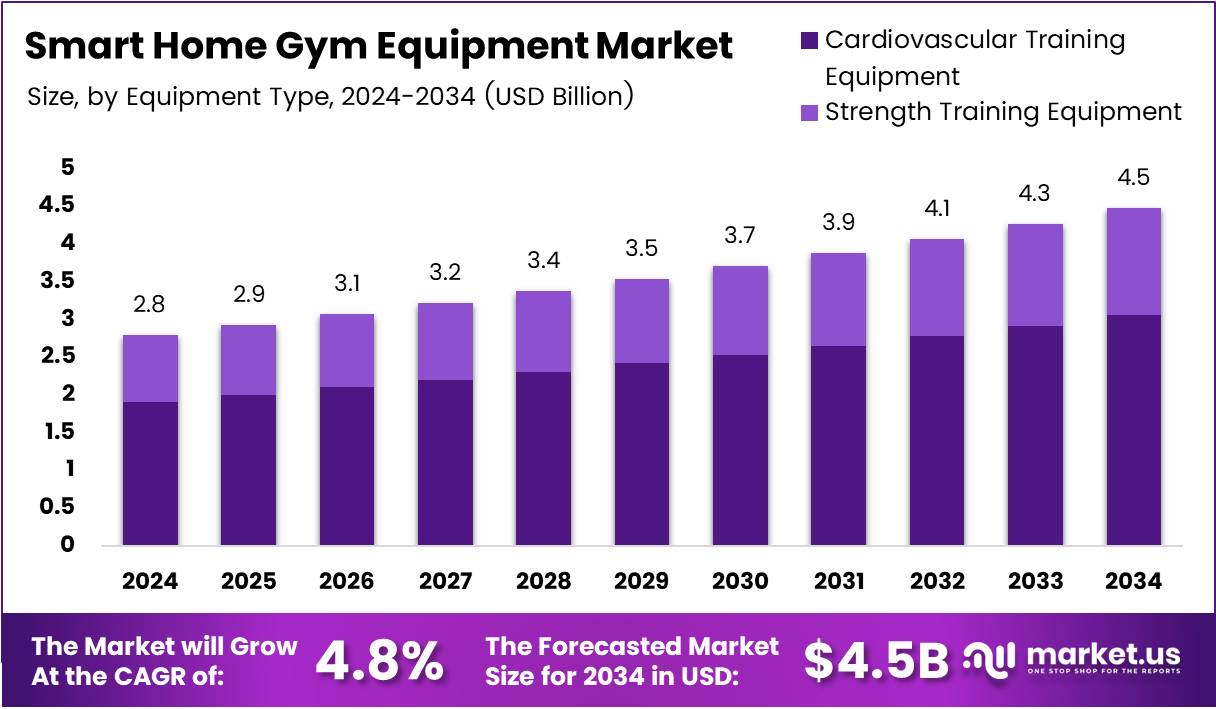

The Global Smart Home Gym Equipment Market is projected to reach USD 4.5 Billion by 2034, up from USD 2.8 Billion in 2024, expanding at a CAGR of 4.8% during 2025–2034. This growth is largely driven by the rising adoption of connected fitness devices, AI-powered solutions, and personalized digital training platforms.

Moreover, as consumer lifestyles evolve, the demand for convenient, at-home fitness experiences continues to accelerate. Transitioning away from traditional gyms, individuals now prioritize smart home equipment that offers both accessibility and advanced features, creating strong momentum for sustained market expansion.

Key Takeaways

- The global Smart Home Gym Equipment Market is projected to reach USD 4.5 Billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

- In 2024, Cardiovascular Training Equipment held a dominant share of 68.3% in the By Equipment Type segment.

- In 2024, the Beginner segment led the By End User Analysis with a 59.2% share.

- In 2024, Sport Stores/Independent Departmental Stores dominated the By Distribution Channel segment with a 34.9% share.

- North America leads the market with a 43.8% share, valued at USD 1.2 Billion.

Market Segmentation Overview

By Equipment Type

In 2024, Cardiovascular Training Equipment dominated with a 68.3% share, supported by strong demand for treadmills, bikes, and rowers for home workouts. Transitioning from gyms to home fitness, consumers favored these products for convenience and health benefits. Strength training equipment is growing, yet remains a secondary segment.

By End User

The Beginner segment accounted for 59.2% of the market in 2024. Driven by new fitness enthusiasts, beginners prefer smart, user-friendly equipment offering guided sessions and digital tracking. The Professional segment, though smaller, caters to advanced fitness enthusiasts and continues to gain momentum with specialized devices.

By Distribution Channel

In 2024, Sport Stores/Independent Departmental Stores dominated with a 34.9% share, thanks to their physical presence and ability to provide product demonstrations. Transitioning into e-commerce, Supermarkets/Hypermarkets and Specialty Stores are also gaining traction, broadening consumer accessibility.

Drivers

1. Increasing Adoption of Smart Fitness Devices

The market is fueled by the growing popularity of AI and IoT-powered gym equipment. These devices deliver personalized workouts, performance tracking, and convenience, meeting consumer demand for technology-enabled fitness solutions.

2. Rising Focus on Health and Wellness

Post-pandemic health awareness continues to drive demand for at-home fitness solutions. Consumers seek reliable, flexible, and efficient workout equipment that improves physical and mental well-being while aligning with evolving health-conscious lifestyles.

Use Cases

1. Personalized Home Workouts

Smart gym equipment integrates AI-based coaching and virtual training platforms, allowing users to access guided sessions from their homes. This makes fitness more inclusive and adaptable for varying levels of users.

2. Data-Driven Health Tracking

Connected equipment syncs with apps to monitor progress in real time, from calorie counts to heart rate metrics. This use case empowers consumers to set measurable goals and track improvements.

Major Challenges

1. Limited Awareness and Education

Despite technological innovation, a lack of awareness regarding smart gym equipment’s benefits continues to limit adoption, especially in emerging markets.

2. Space and Privacy Concerns

Urban consumers often face space limitations that make bulky equipment impractical. Additionally, growing data privacy concerns over connected devices collecting sensitive health data remain a barrier.

Business Opportunities

1. Compact and Multi-Functional Equipment

Manufacturers are innovating compact, foldable, and multi-functional devices to address space limitations while offering complete workout solutions in smaller homes.

2. Integration with Virtual Fitness Platforms

The rise of smart apps, virtual coaching, and VR fitness experiences presents significant opportunities. This aligns well with consumer demand for interactive and immersive home workouts.

Regional Analysis

1. North America Market Leadership

North America dominates with a 43.8% share, valued at USD 1.2 Billion in 2024. High adoption of AI-driven fitness devices and growing wellness programs support regional growth.

2. Asia Pacific Emerging Growth

Asia Pacific is experiencing rapid growth, driven by a rising middle-class population, growing disposable incomes, and increasing interest in personalized smart fitness solutions.

Recent Developments

- March 2024 – BowFlex filed for Chapter 11 bankruptcy and was acquired by Johnson Health Tech for USD 37.5 million, expanding its fitness portfolio.

- March 2024 – Fitnessmith acquired Gym Source USA’s commercial equipment and service divisions, strengthening its market presence.

- 2024 – Interactive Strength Inc. signed a letter of intent to acquire a connected fitness equipment company with USD 15 million in revenue.

- 2024 – Unitree announced the launch of its PUMP MAX home fitness equipment line on Kickstarter, featuring advanced multipurpose gym solutions.

- September 2024 – OxeFit raised USD 17.5 million in funding to accelerate development of AI-powered fitness training systems.

Conclusion

The Smart Home Gym Equipment Market is on a strong growth trajectory, projected to reach USD 4.5 Billion by 2034. With increasing demand for personalized, connected, and space-efficient fitness solutions, the industry is positioned for continued innovation and adoption across global markets.