Table of Contents

Introduction

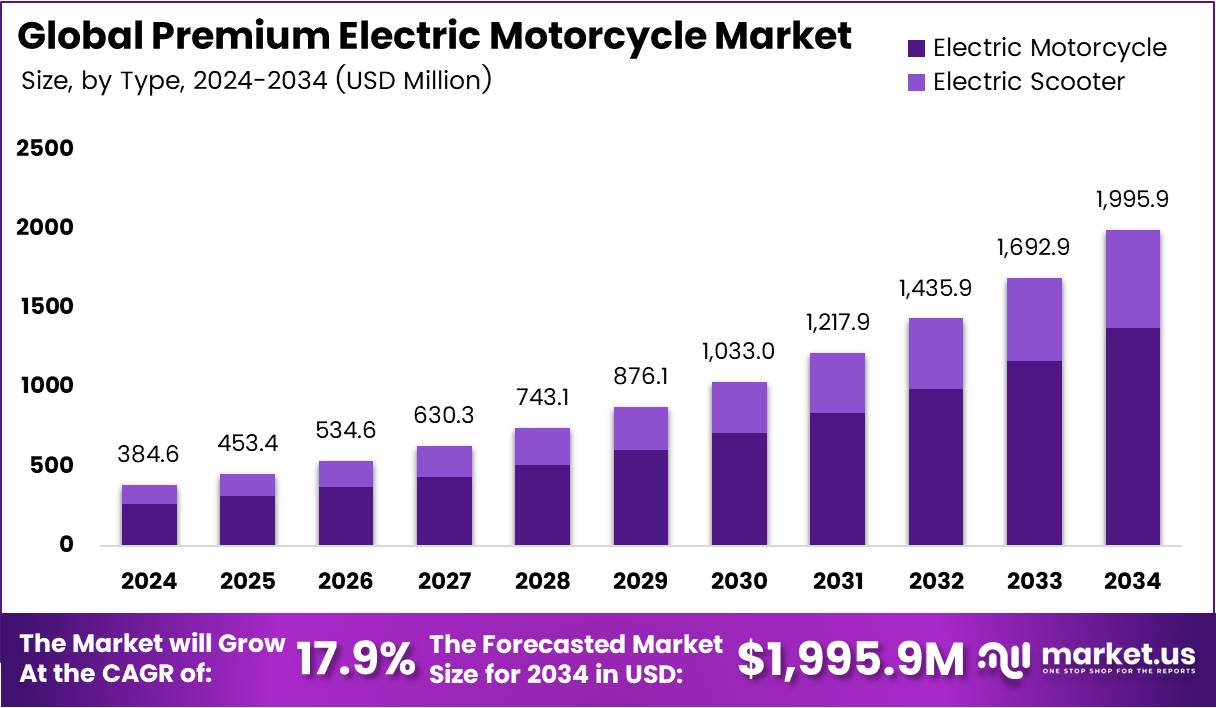

The Global Premium Electric Motorcycle Market is entering a dynamic growth phase, projected to surge from USD 384.6 Million in 2024 to USD 1995.9 Million by 2034. With rising demand for sustainable transport, governments and manufacturers are accelerating innovation, offering consumers advanced motorcycles that blend performance, efficiency, and environmental responsibility.

Transitioning from niche adoption to mainstream recognition, premium electric motorcycles are benefiting from strong regulatory support, technological advances, and increasing consumer awareness of eco-friendly alternatives. This upward momentum underscores the market’s potential to transform the global two-wheeler industry, redefining mobility with sustainable and high-performance choices.

Key Takeaways

- The Global Premium Electric Motorcycle Market is projected to reach USD 1995.9 Million by 2034, from USD 384.6 Million in 2024, growing at a CAGR of 17.9% during the forecast period from 2025 to 2034.

- Electric motorcycles dominate with 68.9% of the market share, offering superior torque, advanced battery technology, and enhanced stability.

- Sport motorcycles lead the premium market with 57.3% market share, driven by high-performance demand and advanced aerodynamics.

- The 10-15 kWh battery segment holds 39.2% of the market share, offering a balanced combination of performance, range, and cost.

- Personal use applications account for 78.7% of the premium electric motorcycle market, reflecting growing adoption for commuting and recreational purposes.

- North America leads the market with 45.9% market share, valued at USD 176.2 Million, due to strong demand for sustainable transportation and government incentives.

Market Segmentation Overview

By Types

Electric motorcycles command 68.9% share, favored for their superior torque, extended range, and high-performance design. Consumers are drawn to advanced battery technology, which offers a premium riding experience. In contrast, electric scooters maintain a smaller segment share, focusing on urban mobility and affordable premium entry points.

By Product

Sport motorcycles dominate with 57.3%, as consumers favor powerful motors, advanced suspension systems, and aerodynamics. Off-road motorcycles cater to adventure riders with robust builds and terrain-ready features, while touring and cruiser models expand versatility, addressing diverse consumer preferences across premium categories.

By Battery Capacity

The 10-15 kWh category holds 39.2%, balancing cost and performance. Below 10 kWh batteries remain entry-level, ideal for short commutes. Larger capacities, such as 15–20 kWh and above 21 kWh, attract performance riders seeking extended ranges, faster acceleration, and higher endurance.

By Application

Personal use dominates with 78.7%, driven by growing adoption in daily commuting and recreational riding. Commercial applications, though smaller, are expanding across delivery, rental, and fleet segments, leveraging cost savings, brand visibility, and operational efficiency advantages.

Drivers

Increasing Demand for Sustainable Transportation

The growing emphasis on reducing carbon footprints is driving premium motorcycle adoption. Consumers are increasingly prioritizing eco-friendly mobility solutions that deliver both performance and environmental benefits, pushing premium electric motorcycles into mainstream consideration.

Government Incentives Fuel Adoption

Tax rebates, subsidies, and regulatory frameworks worldwide are lowering entry barriers. Reduced registration fees and financial incentives are accelerating adoption, making premium electric motorcycles more accessible and attractive to eco-conscious buyers.

Use Cases

Personal Lifestyle and Commuting

Premium electric motorcycles are widely used for commuting and leisure, offering advanced features, connectivity, and efficiency. Their eco-friendly nature aligns with lifestyle choices of urban professionals seeking sustainability without compromising performance.

Commercial Fleet and Delivery

In logistics and delivery services, premium electric motorcycles reduce operating costs and carbon emissions. E-commerce players are adopting them for last-mile delivery, supporting corporate sustainability goals and enhancing brand image.

Major Challenges

Limited Charging Infrastructure

A lack of charging networks, particularly in rural regions, restricts long-distance adoption. This infrastructure gap creates barriers for consumers who prioritize convenience and accessibility.

Range Anxiety and Consumer Skepticism

Concerns over limited range, charging times, and battery durability persist. Many potential buyers remain cautious about long-term performance reliability compared to traditional motorcycles, delaying broader adoption.

Business Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in Asia, Latin America, and Africa create untapped opportunities. These markets are poised to embrace premium electric motorcycles as infrastructure and awareness improve.

Advancements in Fast-Charging Technology

Developments in ultra-fast charging can significantly reduce range anxiety. Companies focusing on faster, reliable charging networks will gain a competitive advantage and boost consumer confidence in premium models.

Regional Analysis

North America

With 45.9% share valued at USD 176.2 Million, North America leads due to robust government incentives, sustainability awareness, and consumer preference for high-performance vehicles. The region’s strong charging infrastructure development further enhances adoption.

Asia Pacific

Asia Pacific is poised for rapid growth, led by China and Japan. Government subsidies, strong domestic manufacturing, and fast-growing charging networks are enabling the region to emerge as a key hub for premium electric motorcycles.

Recent Developments

- August 2025 – Ultraviolette raised $21 million in a funding round led by TDK Ventures to scale production and expand operations.

- January 2025 – Oben Electric secured INR 50 Crore in Series A funding, bringing total investment to INR 150 Crore, supporting pan-India expansion.

- September 2025 – Maeving raised $15 million to strengthen its US presence and expand distribution networks.

- July 2024 – Matter secured $35 million in Series B funding led by Helena to accelerate electric mobility growth and product development.

- July 2024 – Harley-Davidson invested $89 million to expand its electric motorcycle manufacturing plant, boosting production capacity.

Conclusion

The Premium Electric Motorcycle Market is advancing rapidly, fueled by sustainability goals, government support, and technology breakthroughs. With North America and Asia Pacific leading adoption, and sport motorcycles dominating the premium category, the industry is poised for strong expansion. As charging infrastructure improves and consumer confidence grows, premium electric motorcycles will redefine mobility in the coming decade.