Table of Contents

Introduction

AI Statisitcs: Artificial Intelligence continues to grow rapidly and change many aspects of life and business. By 2025, around 78% of organizations have adopted AI in at least one part of their operations, up from 55% just the year before. This widespread adoption is seen across sectors like healthcare, finance, media, and retail. Around 66% of people globally engage with AI regularly, showing how much it has become a part of everyday life. For instance, healthcare has embraced AI with 90% of hospitals now using it for diagnosis and monitoring. At work, roughly 40% of employees in the US report using AI tools, a jump from 20% just two years ago.

Businesses are also seeing financial impacts from AI. One major AI company reported reaching $13 billion in annual recurring revenue, demonstrating AI’s strong commercial growth. Another company in the AI data and analytics space has grown its annual revenue to $3.7 billion, showing how enterprises rely on AI to handle complex workflows. Not only are established firms growing, but new AI startups are securing large funding rounds, for example, one recently raised over $4 billion, highlighting strong investor interest.

This article breaks down key AI statistics and outlines expected growth trends for the future.

Top Editor’s Choice: TLDR

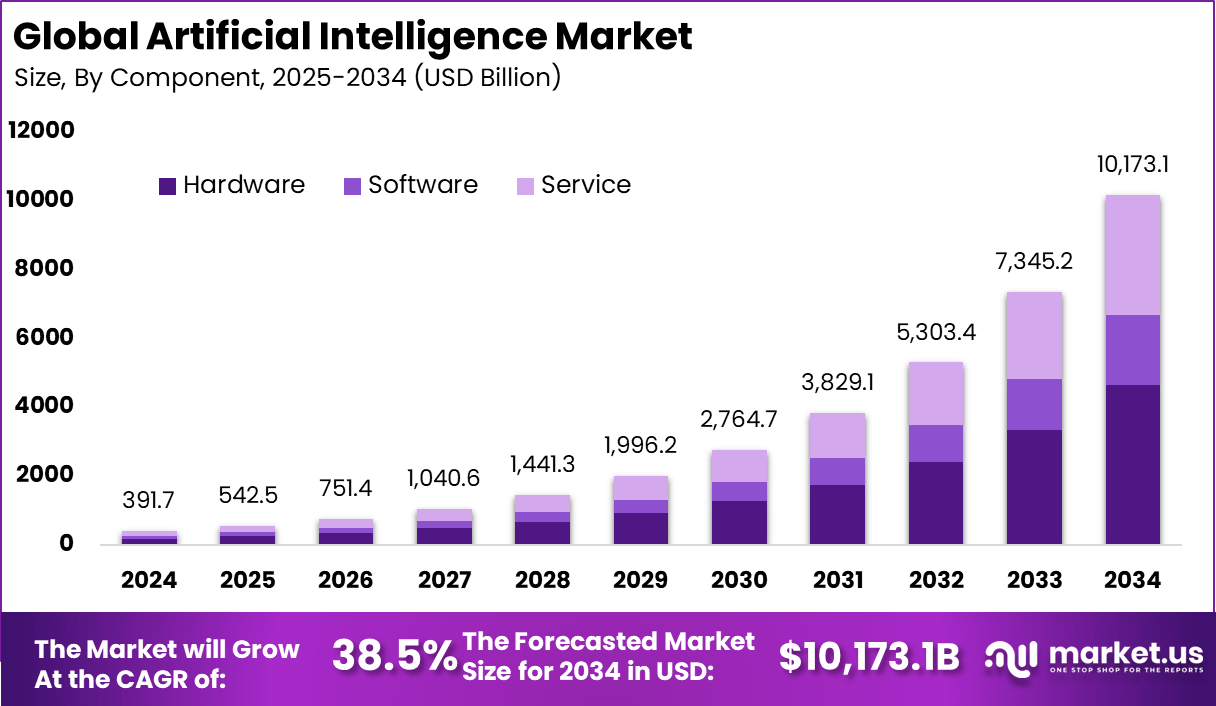

- The global AI market was valued at USD 391.70 Billion in 2024 and is projected to surge to USD 10,173.05 Billion by 2034, growing at a remarkable CAGR of 38.5% (2025–2034).

- In 2024, North America dominated with revenues of USD 143.75 Billion, driven by advanced digital infrastructure and strong AI investments.

- The AI industry is expected to grow 5x in the next five years, underlining its rapid global adoption.

- 77% of companies are already using or exploring AI, and 83% of companies view AI as a top business priority.

- 9 out of 10 organizations believe AI provides a competitive advantage.

- By 2025, 97 million people are projected to work in the AI sector, offsetting the elimination of 85 million jobs by creating 97 million new roles, resulting in a net gain of 12 million jobs.

- 63% of organizations aim to adopt AI globally within three years, with 82% planning to invest in agentic AI for decision automation.

- By 2028, 33% of enterprise software applications will integrate agentic AI, expected to automate 15% of daily work decisions.

- Consumer adoption is evident, with 39% comfortable with AI agents handling service appointments and 75% of generative AI users employing it for task automation.

- In Europe, 13.48% of enterprises used AI in 2024, with the information and communication sector showing the highest adoption.

- AI is transforming industries: Netflix generates USD 1 Billion annually from AI-driven recommendations, and 38% of medical providers already use AI in diagnosis.

- 48% of businesses leverage AI for big data utilization, while 75% of executives see AI as a gateway for business transformation.

- Despite optimism, risks are rising: 56.4% increase in harmful AI incidents was recorded, though 76% of experts still believe benefits outweigh risks.

For Proper Guidance for your Business, Invest On Report Here: https://market.us/purchase-report/?report_id=59640

Funding and fundraising

- OpenAI leads with the highest funding of around $21.9 billion, making up about 41.5% of the total for top AI firms.

- Anthropic follows with approximately $9.7 billion raised, focusing on safe and trustworthy AI development.

- Databricks secured about $10 billion in funding, contributing to its valuation rise above $60 billion.

- xAI raised roughly $6 billion, positioning itself as a notable player in the AI space.

- Mistral AI, founded in 2023, quickly gathered around $1.2 billion in investments, reflecting strong early investor confidence.

- Perplexity AI raised about $915 million, earning an $8 billion valuation for its AI-powered search technologies.

- Big tech companies are heavily investing: Meta has allocated $65 billion through 2025 in data centers for AI; Amazon Web Services is investing over $100 billion in AI infrastructure expansion in 2025.

- Nvidia, a key AI hardware supplier, continues pushing innovations in AI chip technology and enterprise AI tools.

- Alphabet is expanding AI development with Gemini AI and growing cloud AI offerings backed by solid funding.

- Some large funding rounds include $1 billion Series A for AI drug discovery and $650 million Series F for AI-driven market intelligence platforms.

(Source: Market.us)

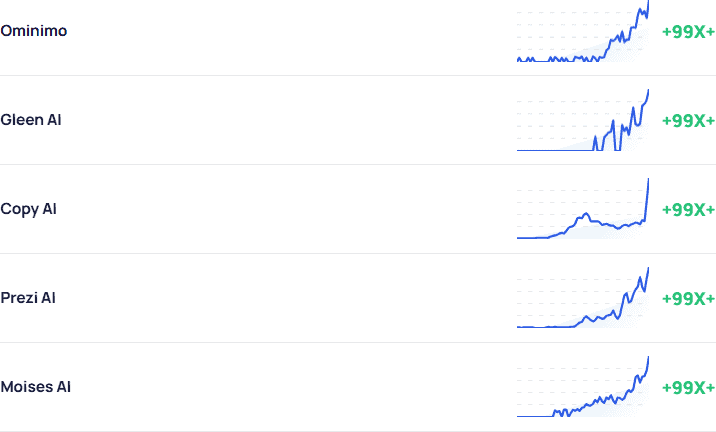

Trending AI Startups

(Source:explodingtopics.com)

AI Market Size and Growth

The AI market is a rapidly evolving sector driven by broad digital transformation across industries. It encompasses software, hardware, and services that enable machines to perform tasks requiring human intelligence. The market sees strong growth globally, with North America leading due to advanced technology adoption and supportive policies. AI’s integration ranges from automation in business processes to complex fields like healthcare diagnostics and autonomous systems. This widespread adoption signals AI moving from niche to mainstream business utility.

Top driving factors of the AI market include the democratization of AI through cloud platforms, which simplify AI deployment for enterprises without deep technical expertise. These platforms reduce barriers by offering pre-trained models and scalable APIs, enabling even small and midsize companies to leverage AI. The demand for AI is also fueled by ongoing digital transformation, modernization of infrastructures, and the push for autonomous decision systems. Another strong driver is the surge in available data and improved computing power, allowing AI to produce more accurate insights and automation capabilities. These factors combined create a robust environment for AI innovation and usage.

Key Takeaways

- Hardware dominated the market, capturing 45.6% share, reflecting its essential role in AI infrastructure.

- Cloud-based deployment led with a significant 67.8% share, driven by scalability and cost-effectiveness.

- Machine Learning (ML) was the most widely adopted technology, holding 43.5% share, powering a wide range of AI applications.

- The Healthcare sector led the verticals, accounting for 25.7% share, fueled by AI-driven diagnostics, personalized medicine, and administrative automation.

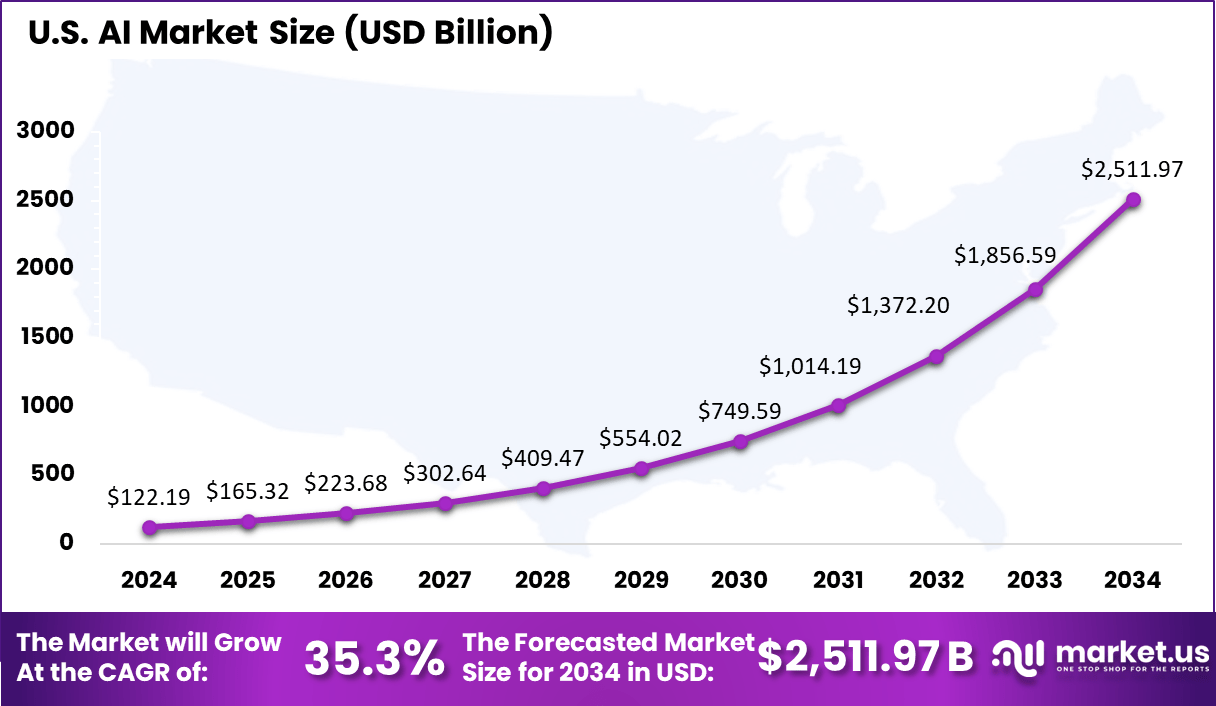

- The U.S. AI market was valued at USD 4.67 Billion in 2024, expanding at a 13.7% CAGR, underpinned by strong investments in AI research and development.

- North America dominated globally, capturing 34.6% market share, driven by extensive adoption across multiple industries.

- China is a leader in AI adoption, with 58% of companies actively using AI and 30% evaluating integration, highlighting its commitment to becoming a global AI powerhouse.

United States AI Market Size

The US Artificial Intelligence Market was valued at USD 122.19 Billion in 2024, with a robust CAGR of 35.3%. The robust startup ecosystem in the U.S., with strong venture capital backing, also plays a pivotal role in driving innovation and commercializing AI solutions at a faster pace than other regions.

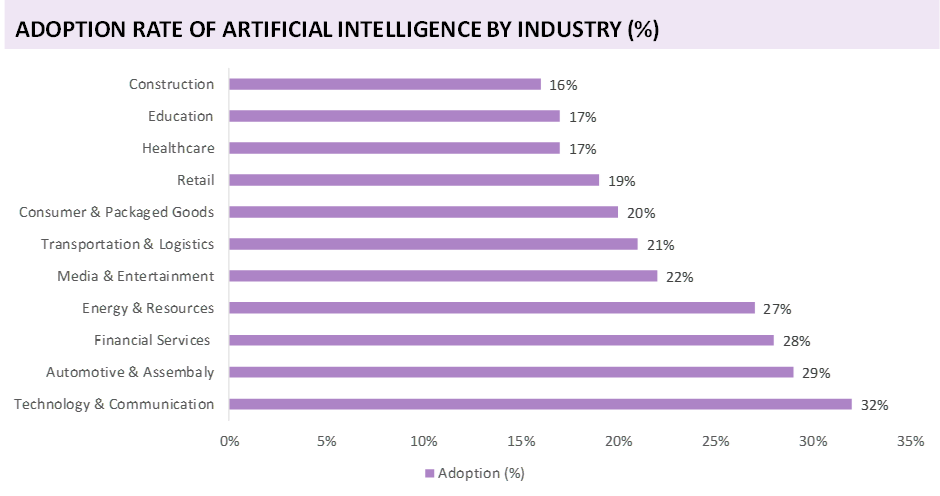

Adoption Rate Statistics

- Construction has the lowest AI adoption rate at 16% in 2024.

- Education and healthcare sectors are both at 17% adoption.

- Retail has reached an AI adoption rate of 19%.

- Consumer and packaged goods companies have achieved 20% adoption.

- Transportation and logistics firms report a 21% adoption rate.

- Media and entertainment industries are now at 22% adoption.

- Energy and resources have seen adoption rise to 27%.

- Financial services surpass others with an adoption rate of 28%.

- Automotive and assembly industries are at 29% adoption.

- Technology and communication leads all sectors with 32% AI adoption.

(source: market.us)

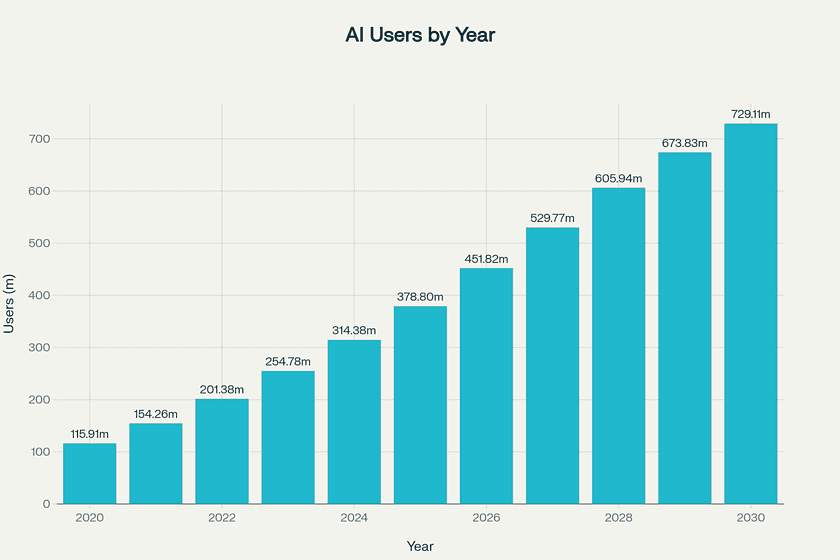

No. Of User Worldwide

| Year | Number of AI Users |

|---|---|

| 2020 | 115.91 million |

| 2021 | 154.26 million |

| 2022 | 201.38 million |

| 2023 | 254.78 million |

| 2024 | 314.38 million |

| 2025 | 378.8 million |

| 2026* | 451.82 million |

| 2027* | 529.77 million |

| 2028* | 605.94 million |

| 2029* | 673.83 million |

| 2030* | 729.11 million |

(Source: resourcera.com)

Agentic AI Statistics

- In 2024, the Ready-To-Deploy Agents segment held a dominant market position, capturing more than a 58.5% share of the Global Agentic AI Market.

- In 2024, the Productivity & Personal Assistant segment held a dominant market position, capturing more than a 28.2% share of the Global Agentic AI Market.

- In 2024, the Multi Agent segment held a dominant market position, capturing more than a 66.4% share of the Global Agentic AI Market.

- In 2024, the Enterprises segment held a dominant market position, capturing more than a 62.7% share of the Global Agentic AI Market.

- The US Agentic AI Market size was exhibited at USD 1.58 Billion in 2024 with CAGR of 43.6%.

- In 2023, North America held a dominant market position in the global Agentic AI Market, capturing more than a 38% share.

- According to the financial express, by 2028, 33% of enterprise applications will feature Agentic AI, a significant leap from less than 1% in 2024.

- According to OECD, 90% of constituents are ready for AI agents in Public Service.

For Proper Guidance for your Business, Invest On Report Here:- https://market.us/purchase-report/?report_id=138574

Top Growth Factors

| Growth Factor | Description |

|---|---|

| Democratization via Cloud AI | Cloud-native AI platforms reduce barriers to AI adoption and accelerate use case development |

| AI Integration in Enterprise | Automation, predictive analytics, personalized services drive industry adoption |

| Advancements in Generative AI | Rise of generative AI for content creation, conversational AI, code generation |

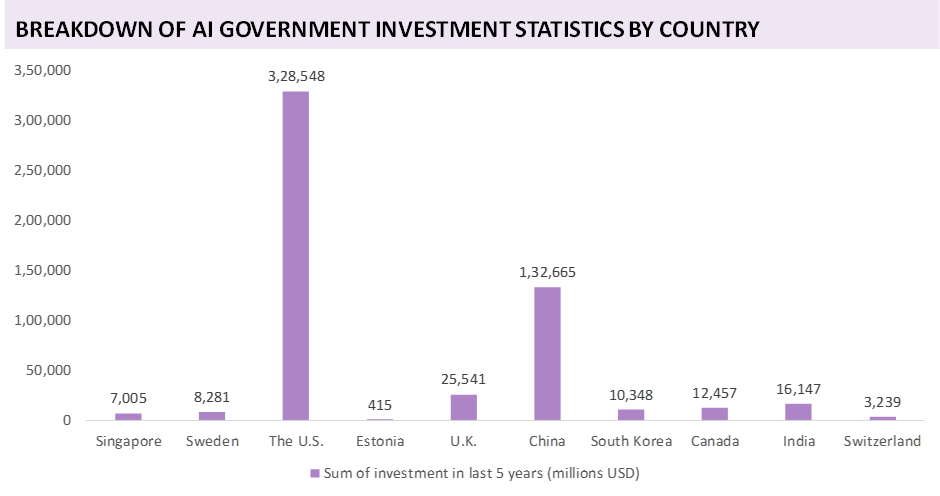

| Government and Corporate Investment | Significant R&D funding driving innovation and deployment of AI across sectors |

| Increasing Data Availability | Big data growth fuels machine learning model accuracy and expansion |

Key Trends and Innovations

| Trend / Innovation | Description |

|---|---|

| Generative AI Expansion | AI models for text, image, audio, and video generation revolutionize content creation |

| Foundation Models & Transfer Learning | Large pre-trained AI models enable fast domain adaptation and reduced development time |

| AI for Automation & Augmentation | AI automates knowledge work, customer interaction, and decision-making with AI assistants |

| AI-Driven Analytics & Insights | Predictive and prescriptive analytics power enterprise intelligence |

| AI Ethics & Governance Growth | Increasing focus on responsible and explainable AI principles |

| AI Hardware & Edge AI | Specialized chips and edge processing for faster, privacy-preserving AI computations |

Suggested Reading – Creator Economy Market Statistics

Driver

Increased Enterprise Adoption of AI Platforms

The AI market growth is strongly driven by enterprises rapidly integrating AI into core business processes. Cloud-delivered AI platforms have made AI accessible for organizations of all sizes, enabling firms to embed pre-trained models into applications without requiring large data science teams. This trend accelerates AI adoption across industries, from finance to healthcare, transforming AI from an experimental tech to a necessary operational tool. For example, many technology leaders report AI is already fully integrated into their business strategies, reflecting how widely it has become a competitive advantage.

This enterprise adoption is supported by the ease and scale of cloud infrastructure, which allows businesses to quickly deploy AI services and scale as needed while controlling costs. As more companies use AI for tasks such as customer support automation, fraud detection, and predictive maintenance, AI solutions become standardized business utilities. The strong investment flows from venture capital and corporate funds also sustain this driver, by funding AI startups and innovations that widen AI’s practical applications and appeal.

Restraint

Data Privacy and Security Concerns

One significant restraint slowing AI adoption relates to rising concerns around data privacy and security. As AI solutions become more widespread, the volume of sensitive data processed and stored in AI systems grows, raising fears about breaches, misuse, and regulatory non-compliance. Companies, especially in regulated industries like finance and healthcare, face challenges balancing AI innovation with maintaining strict data governance and user privacy protections.

These concerns sometimes lead organizations to delay or limit AI deployments until compliance frameworks mature or better safeguards are developed. Additionally, regulatory uncertainty around how AI can use personal and proprietary data creates hesitation among businesses wary of legal risks. Without clear standards and robust privacy solutions, these risks remain a barrier that restrains the speed and breadth of AI adoption in many markets.

Opportunity

AI for Industry-Specific Customization

A key opportunity lies in developing AI solutions tailored for specific industries and business needs. Unlike generic AI tools, customized AI can directly address unique operational challenges, from personalized customer experiences in retail to specialized predictive maintenance in manufacturing. This approach creates significant value by making AI more applicable, effective, and attractive to businesses seeking ROI from technology investments.

Innovation in conversational AI, predictive analytics, and domain-specific machine learning models is growing rapidly, opening new revenue streams for providers who can offer these niche solutions. As industries increasingly require AI systems that understand their distinct workflows and data, companies focusing on customized AI have the chance to differentiate themselves and capture dedicated market segments.

Challenge

AI Talent Shortage Slowing Implementation

A persistent challenge for AI market growth is the shortage of skilled talent required to develop, deploy, and maintain AI systems. Despite growing demand for AI-driven transformation, many organizations struggle to find or retain professionals experienced in AI, data science, and machine learning. This skills gap hampers the pace at which companies can roll out new AI projects or integrate AI into existing operations.

The high demand for AI talent has pushed salaries higher, especially in competitive hubs, increasing project costs for businesses. Moreover, timelines for AI initiatives often stretch due to a lack of qualified personnel, which can lead to missed opportunities or slower returns on investment. Until educational programs, reskilling efforts, and AI development platforms bridge this gap more effectively, talent scarcity will continue to be a critical implementation challenge.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- On-Premise

- Cloud-based

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Computer Vision

- Others

By Industry

- Healthcare

- BFSI

- Manufacturing

- Retail and eCommerce

- Media & Entertainment

- Transportation

- Automotive

- Education

- Others

Top Key Players in AI Market

- Alphabet Inc. (Google AI)

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services (AWS)

- NVIDIA Corporation

- Meta Platforms, Inc.

- Intel Corporation

- OpenAI

- Baidu, Inc.

- Tencent Holdings Ltd.

- Salesforce Inc.

- Oracle Corporation

- SAP SE

- Huawei Technologies Co., Ltd.

- Alibaba Group

- C3.ai

- SAS Institute Inc.

- Palantir Technologies

- Siemens AG

- Other Key Players

Explore More Trending Reports