Table of Contents

Introduction

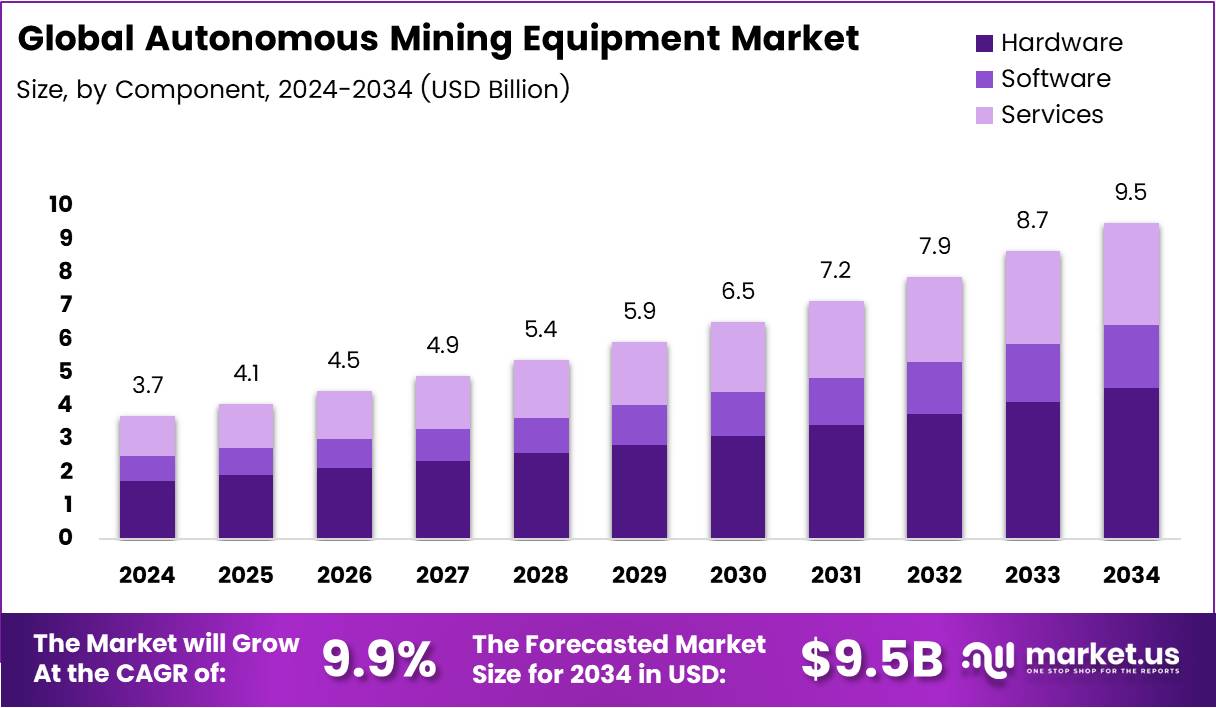

The Global Autonomous Mining Equipment Market is undergoing a major transformation as automation reshapes traditional mining operations. Valued at USD 3.7 Billion in 2024, it is projected to reach USD 9.5 Billion by 2034, growing at a CAGR of 9.9%. This surge is fueled by technological innovation and the pursuit of operational efficiency.

Moreover, as the mining industry faces challenges like labor shortages, safety concerns, and sustainability mandates, companies are turning to automation for improved productivity and risk reduction. Governments across key mining regions are introducing favorable policies, further driving adoption.

Additionally, advancements in AI, machine learning, and IoT are revolutionizing the sector, enabling precise control, real-time monitoring, and predictive maintenance. These developments position autonomous mining equipment as a cornerstone of next-generation mining.

Key Takeaways

- The Global Autonomous Mining Equipment Market size is expected to be worth around USD 9.5 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 9.9%.

- In 2024, Hardware held a dominant market position in the By Component Analysis segment, with a 47.8% share.

- In 2024, Surface Mining held a dominant market position in the By Mining Analysis segment, with a 69.3% share.

- In 2024, Metal held a dominant market position in the By Application Analysis segment, with a 49.2% share.

- In 2024, Asia Pacific held the dominant position, with a share of 42.8%, amounting to USD 1.5 Billion.

Market Segmentation Overview

In 2024, Hardware dominated the market with a 47.8% share, driven by rising demand for excavators, robotic trucks, and load haul dumps. These components form the backbone of automation, enabling enhanced precision, safety, and output across large-scale mining operations worldwide.

By mining type, Surface Mining led with a 69.3% share, as open-pit operations increasingly rely on autonomous haul trucks and drills for efficiency. The segment benefits from streamlined extraction processes and improved resource utilization, particularly in large industrial mines.

By application, Metal Mining accounted for 49.2%, reflecting strong demand from construction, electronics, and automotive industries. Automation helps operators meet growing demand while ensuring safety, consistency, and optimized production cycles in metal-rich regions.

Regionally, Asia Pacific dominated with 42.8% share (USD 1.5 Billion), fueled by industrial expansion, government support, and integration of AI-driven mining fleets. North America and Europe follow, leveraging innovation and strict safety regulations to scale adoption.

Drivers

1. Increasing Demand for Safety and Risk Reduction

Mining remains one of the world’s most hazardous industries. Autonomous systems mitigate risks by operating remotely in harsh environments, reducing exposure to accidents. These technologies enhance worker safety while maintaining operational efficiency, making them a top priority for modern mining operations.

2. Rising Labor Costs and Technological Advancements

Global labor shortages and escalating wages push companies toward automation. With AI and machine learning integration, autonomous equipment operates continuously, optimizes resource allocation, and delivers real-time insights, significantly lowering operational costs and improving productivity.

Use Cases

1. Autonomous Haulage Systems in Surface Mines

Leading mining companies deploy autonomous haul trucks for material transport in large open-pit mines. These vehicles operate 24/7 with precision, enhancing productivity and minimizing human error, while improving overall safety and energy efficiency.

2. Automated Drilling for Resource Extraction

Autonomous drills equipped with advanced sensors and AI algorithms improve accuracy and reduce waste during resource extraction. They allow consistent performance in difficult terrains, boosting recovery rates and operational consistency across mining sites.

Major Challenges

1. Integration with Existing Infrastructure

Many legacy mining operations struggle to retrofit autonomous systems into outdated infrastructure. Compatibility issues, high setup costs, and the need for skilled technicians slow down implementation, especially in remote or resource-constrained regions.

2. Social and Regulatory Concerns

Automation’s impact on employment raises community and labor union resistance. Governments must balance innovation with workforce protection, creating regulatory uncertainty that can delay project approvals and technology rollouts.

Business Opportunities

1. Expansion in Emerging Markets

Emerging economies with rich mineral reserves are embracing automation to compete globally. Countries in Asia, Africa, and Latin America are investing in smart mining infrastructure, creating untapped opportunities for autonomous equipment manufacturers and solution providers.

2. Sustainable and Energy-Efficient Solutions

The shift toward eco-friendly mining aligns with global ESG goals. Autonomous systems reduce fuel use and emissions through optimized operations, offering opportunities for green innovation and partnerships focused on sustainable mining practices.

Regional Analysis

1. Asia Pacific Leads with 42.8% Share

Asia Pacific, valued at USD 1.5 Billion, remains the largest market due to rapid industrialization, high mineral demand, and robust government incentives. Countries like China and Australia are pioneering large-scale adoption of autonomous fleets to enhance competitiveness.

2. North America and Europe Drive Technological Adoption

North America’s strong R&D ecosystem fosters innovation in AI and robotics, while Europe’s strict safety and sustainability mandates accelerate automation uptake. These regions focus on precision technologies that meet environmental and operational compliance standards.

Recent Developments

- Jun 2025 – EACON Mining Technology secures over $55 million in funding to advance autonomous mining technologies, improving operational efficiency.

- May 2025 – Sensmore raises $7.3 million to convert traditional mining machines into intelligent robots, enhancing automation.

- Apr 2025 – Epiroc records a $350 million autonomous equipment sale, marking its largest transaction to date.

- Jul 2025 – Mesabi Metallics invests $110 million in ultra-class haul trucks to expand mining operations.

- Jul 2025 – Bedrock Robotics emerges from stealth, securing $80 million to develop autonomous construction technology for mining.

Conclusion

The Autonomous Mining Equipment Market stands at the forefront of the mining industry’s digital revolution. With strong government backing, safety-driven adoption, and expanding AI capabilities, it is set for robust growth through 2034. Emerging markets and sustainability-focused innovations will further accelerate its trajectory, shaping the future of mining worldwide.