Table of Contents

Introduction

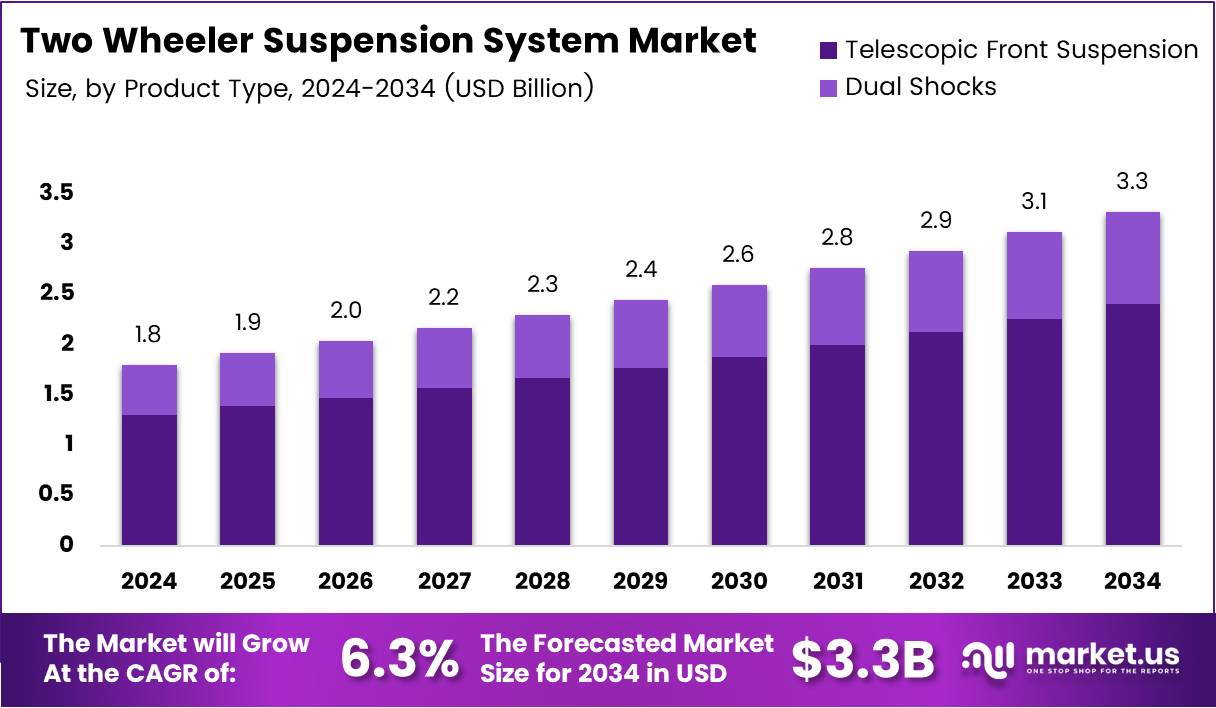

The Global Two Wheeler Suspension System Market is poised for significant growth, reaching USD 3.3 Billion by 2034, up from USD 1.8 Billion in 2024. Driven by rising motorcycle adoption across emerging economies, the market is expanding rapidly as consumers seek smoother and safer riding experiences.

Furthermore, advancements in suspension technologies and the shift toward eco-friendly materials are transforming the industry. Manufacturers are increasingly focusing on lightweight, durable, and sustainable designs that enhance fuel efficiency and comfort, aligning with evolving rider expectations and regulatory mandates.

Additionally, as urbanization accelerates, two-wheelers remain a preferred mode of transport due to their affordability and convenience. Governments’ infrastructure investments and growing emphasis on safety standards further amplify demand for innovative suspension systems globally.

Key Takeaways

- The Global Two Wheeler Suspension System Market is expected to reach USD 3.3 Billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034.

- Telescopic Front Suspension held a 72.4% share in 2024, dominating the By Product Type segment.

- ICE powered vehicles dominated with an 87.7% share in the By Propulsion Type segment in 2024.

- Motorcycles held a 58.9% share in 2024, leading the By Vehicle Type segment.

- The OEM channel dominated with a 78.3% share in the By Sales Channel segment in 2024.

- Asia-Pacific led the market with a 47.7% global share in 2024.

Market Segmentation Overview

By Product Type

Telescopic Front Suspension dominated with 72.4% share in 2024, driven by its affordability, simplicity, and wide adoption in both motorcycles and scooters. Mono shocks are increasingly used in high-performance bikes, while dual shocks maintain niche appeal. Rear suspension systems remain vital for improved ride comfort and stability.

By Propulsion Type

The ICE segment accounted for 87.7% of the market in 2024, supported by robust infrastructure and affordability. Electric two-wheelers are gradually emerging, gaining momentum due to sustainability trends and expanding charging networks, but remain a smaller portion compared to traditional combustion engines.

By Vehicle Type

Motorcycles held a 58.9% market share in 2024 due to their versatility and efficiency. Scooters follow closely, popular in urban areas for convenience. Mopeds, though limited in capability, cater to low-speed commuters in select markets, contributing modestly to the overall segment growth.

By Sales Channel

OEM sales led with 78.3% market share in 2024, driven by integration into new vehicles and growing production volumes. Meanwhile, the Aftermarket segment serves as a key area for upgrades and replacements, particularly among performance and off-road riders seeking enhanced suspension solutions.

Drivers

Increasing Demand for Enhanced Comfort and Safety

Consumers are prioritizing comfort and safety, pushing manufacturers to design advanced suspension systems that improve shock absorption, stability, and braking. The growing awareness of suspension’s role in road handling has made it a crucial factor in purchase decisions, especially for premium two-wheelers.

Technological Advancements Expanding Accessibility

Ongoing innovation in suspension materials, electronics, and manufacturing has lowered costs, making advanced systems accessible across segments. Features like adjustable damping and lightweight alloys, once exclusive to high-end bikes, are now entering commuter and mid-range models, broadening the market base.

Use Cases

Urban Commuting Solutions

In densely populated cities, suspension systems ensure rider comfort amid uneven roads and traffic conditions. Enhanced shock absorption improves daily commuting experiences, making motorcycles and scooters viable, long-term transportation options for millions of urban commuters.

Performance and Adventure Riding

High-performance and adventure motorcycles demand superior suspension systems for challenging terrains and long-distance rides. Advanced mono-shock and adaptive suspensions deliver improved handling, stability, and control, elevating performance for both enthusiasts and professionals.

Major Challenges

Lack of Standardization Across Manufacturers

The absence of unified suspension standards complicates production and aftermarket compatibility. Manufacturers must tailor designs for specific brands, increasing inventory costs and limiting consumer options, especially in developing markets with fragmented supply chains.

Environmental and Regulatory Constraints

Stricter environmental regulations are restricting material choices and processes, forcing redesigns and increasing development costs. Complying with diverse regional standards also prolongs time-to-market and adds complexity to global operations.

Business Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes across Asia, Africa, and Latin America are driving demand for quality motorcycles equipped with premium suspension systems. Manufacturers investing locally stand to benefit from strong growth and evolving consumer preferences.

Smart and Adaptive Suspension Technologies

The emergence of electronically controlled adaptive suspension systems offers significant potential. These intelligent systems adjust automatically to road conditions, delivering optimized performance and comfort. Integration with IoT for predictive maintenance further enhances their value proposition.

Regional Analysis

Asia-Pacific Leading the Global Market

Asia-Pacific captured 47.7% of the global share in 2024, led by high two-wheeler sales in China, India, and Japan. Affordable mobility solutions, coupled with rising middle-class demand and OEM expansions, continue to reinforce the region’s dominance in the suspension market.

Europe and North America Seeing Steady Growth

In Europe, the shift toward electric mobility and stringent safety standards are fueling adoption of lightweight and efficient suspension systems. Meanwhile, North America is experiencing growth from recreational biking and the rising popularity of high-performance motorcycles.

Recent Developments

- In July 2025, SRAM acquired an Italian component manufacturer, strengthening its position in global cycling components.

- In October 2024, Brembo acquired Öhlins, enhancing its portfolio in high-performance suspension systems.

- In July 2024, Simple Energy raised USD 20 million in Series A funding to scale electric vehicle production.

- In February 2024, Lit Motors launched a USD 5 million crowdfunding campaign to develop its electric vehicles.

Conclusion

The Global Two Wheeler Suspension System Market is on a strong growth trajectory, expected to reach USD 3.3 Billion by 2034. Rising demand for comfort, safety, and sustainability, coupled with technological innovation, is redefining the industry landscape.

With Asia-Pacific leading and new opportunities emerging in adaptive systems, manufacturers focusing on smart, lightweight, and eco-friendly designs are best positioned to thrive. The next decade will witness a blend of innovation, performance, and sustainability shaping the future of two-wheeler mobility worldwide.