Table of Contents

Introduction

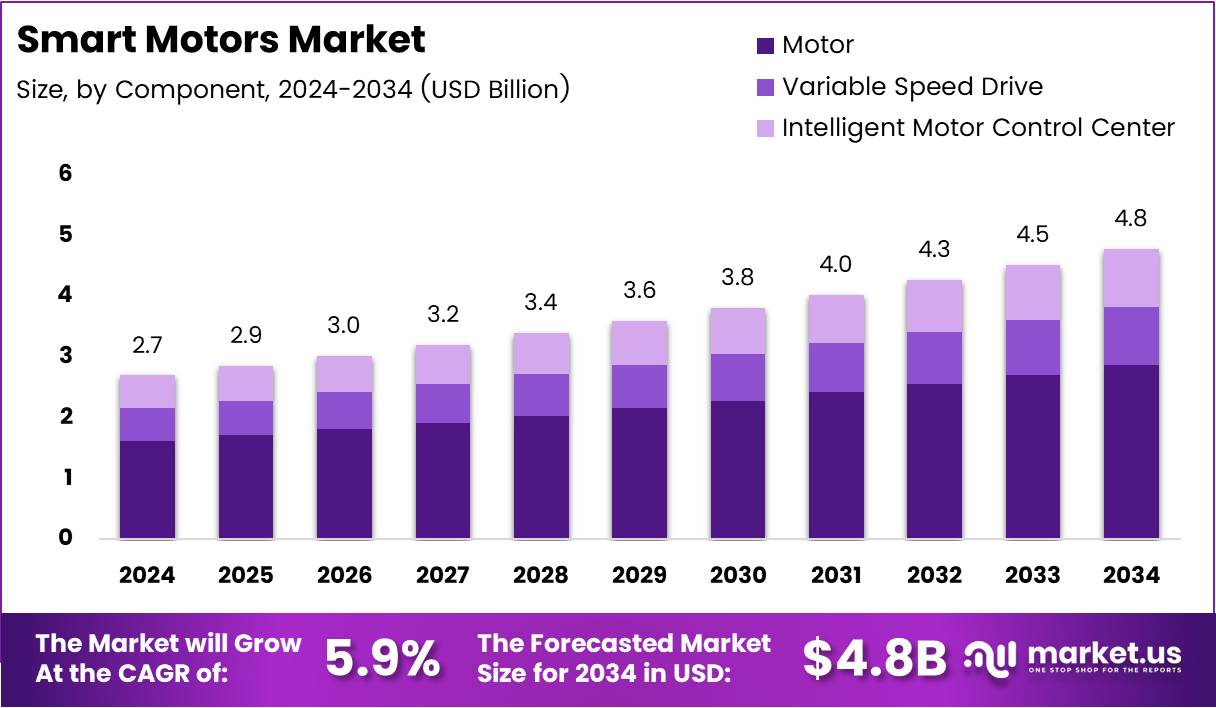

The Global Smart Motors Market is poised for substantial growth, projected to reach USD 4.8 Billion by 2034 from USD 2.7 Billion in 2024, registering a CAGR of 5.9% between 2025 and 2034. The market’s expansion is primarily driven by rising automation and the global emphasis on energy-efficient technologies.

Furthermore, as industries increasingly adopt smart systems for real-time monitoring and predictive maintenance, the integration of smart motors into industrial, automotive, and robotics applications continues to accelerate. Their built-in intelligence enables optimized performance, reduced energy usage, and improved reliability, aligning with the global sustainability agenda.

Additionally, government incentives promoting eco-friendly manufacturing practices and smart energy utilization are fueling adoption across key sectors. This convergence of regulatory support, technological innovation, and rising demand for efficient systems marks a pivotal phase in the smart motors industry.

Key Takeaways

- The Global Smart Motors Market is expected to be worth USD 4.8 Billion by 2034, growing at a CAGR of 5.9% from 2025 to 2034.

- Motor holds a dominant position in the By Component Analysis segment, with a 45.9% share in 2024.

- 24V is the dominant product type in the market, accounting for 36.3% of the share in 2024.

- Automotive is the leading application segment, holding a 32.5% share in 2024, driven by the rise of electric vehicles.

- North America holds a dominant market share of 37.8%, valued at USD 1.0 Billion in 2024.

Market Segmentation Overview

By Component

In 2024, the Motor segment dominated with a 45.9% share due to its extensive use across manufacturing, automotive, and consumer electronics. Smart motors provide precise control and high efficiency, essential for automation. Meanwhile, variable speed drives and intelligent motor control centers complement this ecosystem, enhancing performance and reliability.

By Product

The 24V product type leads the market with a 36.3% share, thanks to its compact size and low energy consumption. This voltage is ideal for robotics, automotive, and portable devices. 36V and 48V systems serve higher-power applications like EVs, while 18V caters to cost-sensitive, small-scale tools.

By Application

The Automotive sector holds a 32.5% share, driven by the rising adoption of electric and hybrid vehicles. Smart motors enable efficient power management and performance optimization. Additionally, sectors such as aerospace, oil & gas, and water treatment are increasingly embracing smart motors for automation and energy savings.

Drivers

Surge in Demand for Energy-Efficient Solutions

As sustainability becomes a business imperative, industries are rapidly transitioning toward energy-efficient systems. Smart motors significantly reduce electricity consumption while improving operational output. This efficiency not only aligns with global climate initiatives but also translates to reduced operational costs, encouraging widespread adoption across industrial and commercial applications.

Advancements in Automation and Robotics

Automation is revolutionizing industrial operations, and smart motors serve as a cornerstone in this transformation. With precise control and adaptive performance capabilities, they enable smooth operation in robotic systems and automated production lines. Their ability to adjust speed and torque dynamically enhances productivity and reduces energy waste.

Use Cases

Automotive and Electric Vehicles

Smart motors are critical in electric drivetrains, offering precise control, energy optimization, and regenerative braking capabilities. In EVs, these motors enable longer driving ranges and better performance monitoring. The automotive industry’s pivot toward electric mobility continues to be a major growth catalyst for smart motor adoption.

Industrial Automation and Manufacturing

In manufacturing environments, smart motors facilitate predictive maintenance, process optimization, and real-time control. By integrating with industrial IoT systems, they allow manufacturers to monitor equipment health and prevent unplanned downtime. This not only improves efficiency but also extends the life cycle of expensive machinery.

Major Challenges

Shortage of Skilled Workforce

A significant obstacle to market expansion is the lack of skilled professionals adept at installing and managing smart motor systems. Specialized training is required to handle configuration and integration processes, which can deter smaller enterprises from adoption due to additional resource costs.

Lack of Standardization

The absence of global standards for smart motor designs and communication protocols creates interoperability challenges. Different suppliers use varied interfaces, complicating integration into existing systems. This fragmentation increases deployment complexity and costs, slowing down broader implementation across industries.

Business Opportunities

Smart Cities and Infrastructure Projects

The rapid rise of smart cities presents lucrative opportunities for smart motor integration in sectors like traffic control, HVAC systems, and automated utilities. These motors enhance energy management and sustainability, supporting urban planners in achieving net-zero and intelligent infrastructure goals.

Renewable Energy and Clean Technology

Smart motors play a crucial role in renewable energy systems, including solar trackers and wind turbines. Their ability to deliver precise motion control and real-time performance data optimizes energy generation. With global investments in renewables soaring, this segment offers long-term expansion potential for manufacturers.

Regional Analysis

North America Leads Global Market

North America dominates the market with a 37.8% share, valued at USD 1.0 Billion in 2024. The region’s growth is fueled by strong automation adoption, expanding EV infrastructure, and supportive government energy policies. Continuous investments in smart manufacturing and advanced robotics bolster market momentum.

Asia Pacific Emerges as a High-Growth Region

The Asia Pacific region is witnessing rapid industrialization, particularly in China and India. Government initiatives promoting smart factories and sustainable mobility are driving adoption. Additionally, the growing presence of OEMs and component manufacturers is positioning APAC as a future hub for smart motor production and innovation.

Recent Developments

- In Jul 2025, Matter Motors announced plans to raise $200 million to accelerate expansion and pursue a public listing within 3-4 years.

- In Sep 2025, Blue Energy Motors secured USD 30 million in funding from Nikhil Kamath and Omnitex Industries for growth initiatives.

Conclusion

The Global Smart Motors Market is entering a transformative era, driven by digitalization, sustainability goals, and automation advancements. With strong regulatory support and technological integration of AI and IoT, smart motors are set to become essential across industries. As businesses pursue efficiency and sustainability, the market’s outlook through 2034 remains exceptionally promising.