Table of Contents

Introduction

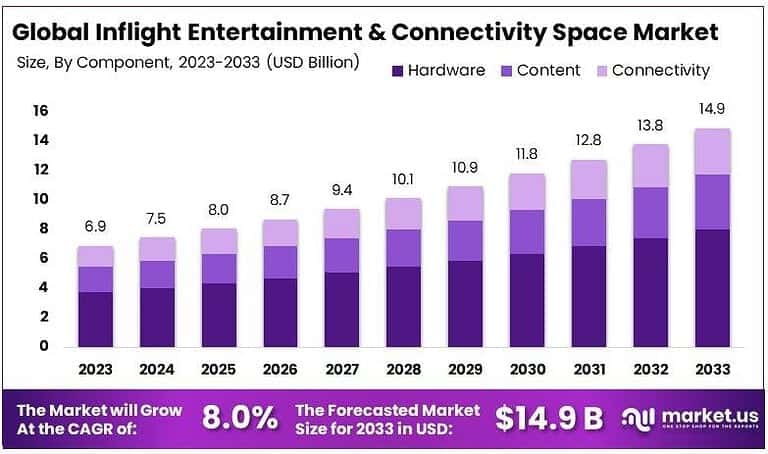

The global inflight entertainment and connectivity (IFEC) space market reached USD 6.9 billion in 2023 and is projected to grow at a CAGR of 8.0%, attaining approximately USD 14.9 billion by 2033. The growth is fueled by rising air passenger volumes, increasing demand for high-speed internet onboard, and the expansion of satellite-based connectivity solutions. Airlines are investing heavily in advanced Wi-Fi systems, seatback entertainment, and content streaming platforms to enhance passenger experience and differentiate services. The proliferation of low-Earth orbit (LEO) satellites and 5G integration is further accelerating market transformation.

How Growth is Impacting the Economy

The expansion of the IFEC market is contributing to global economic development through increased innovation, aviation infrastructure enhancement, and digital transformation. According to the International Air Transport Association (IATA), global air traffic is expected to exceed 4.7 billion passengers by 2026, creating massive demand for onboard connectivity and entertainment systems. This growth drives investment in aerospace engineering, satellite communication, and software integration.

Economically, the IFEC sector stimulates employment in avionics manufacturing, ground infrastructure, and satellite network operations. It also boosts tourism and e-commerce revenue by enabling real-time inflight transactions and advertising opportunities. The rise in data-driven services, such as personalized streaming and connected cabin solutions, is creating a new digital revenue stream for airlines and technology providers, making IFEC a key economic enabler in the aviation industry.

➤ Unlock growth! Get your sample now! – https://market.us/report/inflight-entertainment-and-connectivity-space-market/free-sample/

Impact on Global Businesses

Rising component costs, bandwidth pricing, and certification requirements are increasing operational expenditures for airlines and IFEC suppliers. Supply chain delays in electronics and satellite hardware have affected installation schedules for retrofitted fleets. Sector-specific effects are evident: commercial airlines are focusing on high-speed broadband and personalized passenger interfaces, while business jets are adopting luxury-grade entertainment suites. Meanwhile, low-cost carriers are introducing bring-your-own-device (BYOD) solutions to minimize hardware costs. Despite these challenges, IFEC systems are enhancing brand loyalty and ancillary revenue through advertising, gaming, and shopping platforms, positioning connectivity as a key differentiator in competitive aviation markets.

Strategies for Businesses

To gain a competitive advantage, businesses in the IFEC space market are implementing key strategies:

- Investing in LEO and 5G satellite integration for uninterrupted global coverage.

- Adopting modular, lightweight systems to reduce aircraft fuel consumption.

- Partnering with content and streaming providers to deliver personalized entertainment.

- Expanding retrofit programs for older aircraft fleets.

- Leveraging data analytics for passenger behavior insights and targeted marketing.

Key Takeaways

- Market expected to reach USD 14.9 billion by 2033, growing at 8.0% CAGR.

- Driven by passenger demand for high-speed, personalized in-flight experiences.

- LEO satellites and 5G integration are transforming connectivity performance.

- Airlines are focusing on digital monetization through entertainment and e-commerce.

- Asia Pacific and North America remain key growth regions.

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=129264

Analyst Viewpoint

The IFEC market is entering a new growth phase as digital aviation becomes central to passenger experience strategies. Currently, airlines are transitioning from traditional seatback systems to hybrid streaming models powered by high-bandwidth satellite networks. Over the next decade, AI-driven content personalization, cloud-based platforms, and next-gen communication constellations will redefine inflight digital services. Analysts anticipate significant collaboration between telecom providers and aircraft OEMs, leading to enhanced revenue models, lower latency, and better passenger engagement. The future outlook remains highly positive with rapid technological innovation and global fleet expansion.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Commercial Airline Wi-Fi Integration | Rising passenger demand for real-time connectivity |

| Business Jet Entertainment Systems | Increasing luxury travel and premium onboard experiences |

| Satellite-Based Broadband Solutions | Expansion of LEO constellations for global coverage |

| Cloud Content Streaming Platforms | Growing adoption of BYOD entertainment systems |

| Cabin Crew Digital Tools | Integration of data analytics and communication systems |

Regional Analysis

North America leads the IFEC market due to the presence of major aircraft manufacturers, technology providers, and high passenger connectivity expectations. Europe follows, driven by sustainability and passenger experience mandates among major airlines. Asia Pacific is expected to witness the fastest growth, supported by increasing air travel in China and India, alongside the expansion of low-cost carriers. The Middle East remains a strategic hub due to premium fleet modernization and long-haul network connectivity initiatives. Latin America and Africa are gradually adopting satellite-based IFEC systems as air traffic and fleet expansion increase.

Business Opportunities

The IFEC market offers substantial opportunities in satellite broadband integration, AI-based passenger personalization, and cloud-based content delivery. Companies providing hybrid connectivity (combining satellite and air-to-ground systems) are expected to gain traction. The rise of digital marketplaces, virtual reality inflight experiences, and cybersecurity solutions for connected cabins opens additional revenue channels. Emerging markets with increasing air travel demand present lucrative opportunities for new installations and retrofit programs. Partnerships between airlines, telecom operators, and entertainment providers will be key to capitalizing on this digital evolution in aviation.

Key Segmentation

The market can be segmented as follows:

- By Component: Hardware, Connectivity, Content, Services

- By Type: Seatback Systems, Portable Systems, BYOD (Bring Your Own Device)

- By Connectivity Type: Satellite-Based, Air-to-Ground

- By Class: Economy, Business, First Class

- By End-User: Commercial Aviation, Business Aviation, Military

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading IFEC providers are focusing on expanding satellite coverage, enhancing bandwidth efficiency, and delivering seamless passenger experiences. Their innovation strategies include hybrid connectivity solutions, AI-driven entertainment personalization, and partnerships with content creators. Companies are also emphasizing fuel-efficient lightweight systems and cybersecurity compliance. Strategic alliances with telecom operators, cloud service providers, and aircraft OEMs are enhancing deployment speed and global service reliability. Continuous R&D in high-speed Ka-band and LEO satellite technologies is expected to strengthen competitive positioning and support next-generation inflight experiences.

- Panasonic Avionics Corporation

- Thales Group

- Honeywell International Inc.

- RTX Corporation

- Gogo Business Aviation LLC

- Anuvu

- Viasat, Inc.

- Kontron AG

- Iridium Communications Inc.

- Telesat

- Other Key Players

Recent Developments

- April 2025: Introduction of a new AI-based content management system for personalized inflight entertainment.

- February 2025: Partnership between a leading satellite operator and airline group to enhance broadband coverage.

- November 2024: Launch of lightweight modular IFEC hardware to reduce installation time.

- August 2024: Collaboration between telecom and aviation firms to enable 5G inflight connectivity.

- June 2024: Major airline initiated retrofit program to upgrade older fleets with next-gen IFEC systems.

Conclusion

The global inflight entertainment and connectivity market is poised for strong, sustained growth, driven by rising passenger expectations, rapid digitalization, and advancements in satellite communication. As airlines increasingly focus on personalized experiences and ancillary revenue models, IFEC will remain central to the next generation of connected aviation ecosystems.