Table of Contents

Introduction

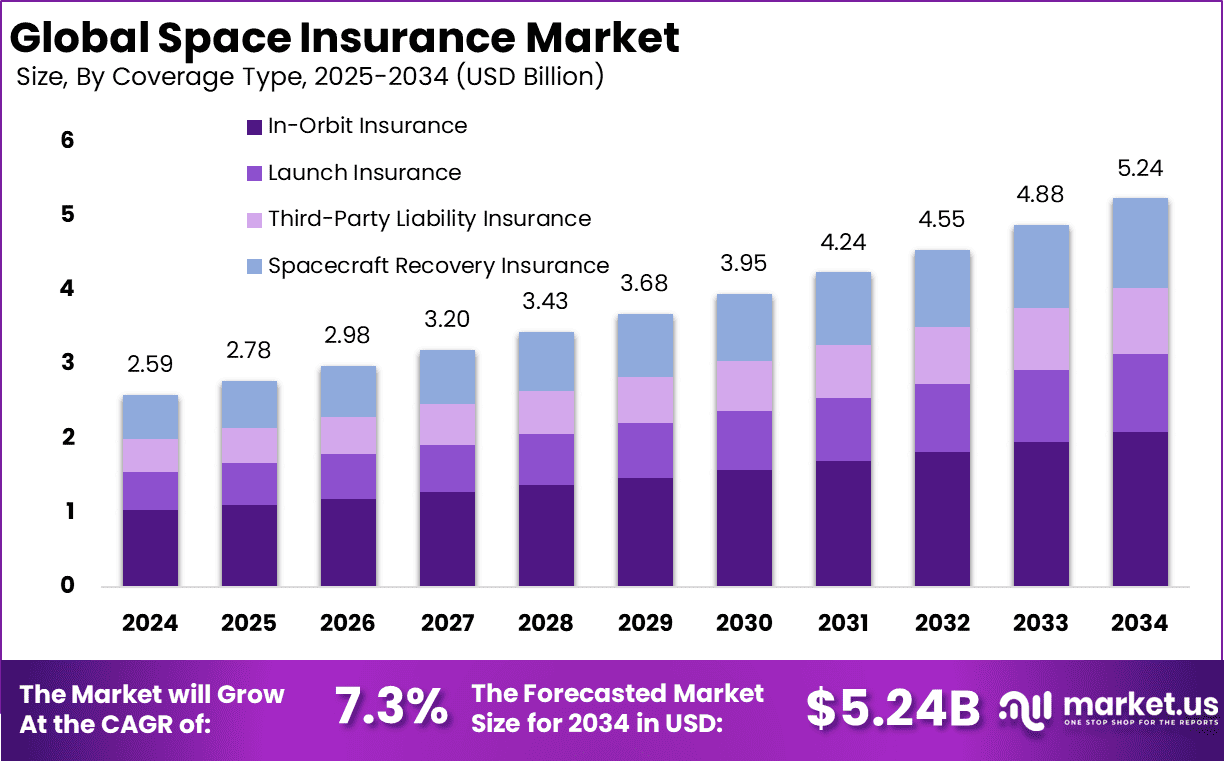

The Global Space Insurance Market, valued at USD 2.59 billion in 2024, is expected to grow to USD 5.24 billion by 2034, at a CAGR of 7.3% from 2025 to 2034. The market’s growth is driven by the increasing frequency of space launches, satellite deployment, and the rising importance of space-based infrastructure for communication, navigation, and weather forecasting. As the commercial space industry expands, both government and private sector players are increasingly seeking insurance solutions to mitigate the risks associated with space exploration, satellite operations, and space station ventures.

How Growth is Impacting the Economy

The growing space insurance market is having a positive impact on the global economy by fostering the expansion of space-related industries and enabling technological advancements in satellite communications, space exploration, and remote sensing. The market has led to the development of more specialized insurance products, including coverage for satellite launches, on-orbit insurance, and liability for collisions in space. These products are enabling space companies to manage risk more effectively, ensuring that investments in space infrastructure are protected. Additionally, the growth of this market is helping to create jobs in insurance underwriting, risk management, and space mission design.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/space-insurance-market/free-sample/

Impact on Global Businesses

The space insurance market is driving expansion in satellite manufacturing, launch services, and space-based data services. It is also influencing the broader insurance industry, with insurers innovating to offer tailored products that address the unique risks of space missions, including space debris collisions, radiation, and mechanical failures. Space operators, particularly those launching commercial satellites and space exploration missions, are increasingly relying on space insurance policies to mitigate their financial risks. As the private sector plays a larger role in space exploration, insurance providers are diversifying their portfolios to include not only satellite coverage but also liability for space tourism and asteroid mining ventures.

Strategies for Businesses

To capitalize on the growth of the space insurance market, companies should develop specialized insurance products targeting emerging space sectors, such as space tourism and asteroid mining. Insurers should invest in advanced risk assessment tools, using data analytics and artificial intelligence to improve pricing models and coverage options. Collaborating with space agencies and private space companies to offer bundled insurance packages for satellite deployment, launch services, and on-orbit operations is a strategic approach. Expanding into emerging markets where space infrastructure is developing, such as Asia-Pacific and Africa, will also help insurers tap into new revenue streams.

Key Takeaways

- Market expected to reach USD 5.24B by 2034, growing from USD 2.59B in 2024

- CAGR of 7.3% reflects strong growth driven by satellite launches and space exploration

- North America holds a 41% market share in 2024 with USD 1.06 billion in revenue

- Space tourism, satellite coverage, and space debris protection are key drivers

- Emerging markets in Asia-Pacific and Africa are opening new opportunities

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=160921

Analyst Viewpoint

The space insurance market is witnessing steady growth, driven by an expanding commercial space industry and increasing risks associated with satellite operations and space exploration missions. While the market is dominated by traditional space powers like the U.S. and Europe, Asia-Pacific, and other regions with growing space sectors will see increasing demand for specialized insurance products. The future of the space insurance market lies in addressing new risks, such as those related to private space stations, orbital tourism, and asteroid mining, with innovative and adaptive insurance solutions. The use of big data and predictive analytics will play a crucial role in shaping the future landscape of space insurance.

Use Case and Growth Factors

| Use Case | Growth Driver |

|---|---|

| Satellite launches and operations | Increased satellite demand in communications and defense |

| Space tourism and private space stations | Emergence of commercial space travel and private space stations |

| Space debris and collision liability | Rising concerns over space debris and satellite collisions |

| Exploration missions and space assets | Growth in government and private space exploration programs |

| Asteroid mining and resource extraction | New frontier for space commerce and insurance requirements |

Regional Analysis

North America is the largest space insurance market, holding over 41% of the global market share in 2024. The U.S. continues to lead due to the concentration of satellite operators, commercial space ventures, and the growing role of private companies like SpaceX and Blue Origin. Europe is also a key player, with strong governmental involvement through the European Space Agency (ESA) and private space startups. Asia-Pacific, particularly China and India, is rapidly expanding its space programs, driving demand for space insurance as these nations increase satellite launches and space exploration activities. The Middle East and Africa are emerging regions, with investments in space technology and infrastructure development creating new opportunities for space insurance.

Business Opportunities

The expanding market presents opportunities for insurers to tailor policies for a variety of emerging space sectors, such as satellite communications, space tourism, and asteroid mining. Companies can leverage partnerships with private space companies to offer bespoke insurance solutions for satellite launches, on-orbit operations, and space station activities. Furthermore, insurers can explore risk management services related to space debris, which is becoming a significant concern. There is also increasing demand for coverage in emerging space markets such as Asia-Pacific, Latin America, and Africa, where governments and private firms are investing in space infrastructure and exploration.

Key Segmentation

The space insurance market is segmented by Type (Launch Insurance, In-Orbit Insurance, Life-Cycle Insurance, and Space Tourism Insurance), Application (Commercial Satellites, Space Exploration, Space Tourism, and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa). Launch insurance is the dominant segment due to its essential coverage of satellite deployment risks. Space exploration and tourism segments are growing rapidly due to the increasing number of private space companies and international collaborations. In-orbit insurance is also seeing a surge as satellites become a vital component of global communication and data systems.

Key Player Analysis

The market is led by a mix of established insurance providers and newer, specialized firms focusing on space-related risks. Traditional insurance giants are expanding their space portfolios, while niche players are entering the market with innovative products aimed at satellite operators, space tourists, and space station ventures. Companies are also focusing on the integration of advanced risk modeling tools to better predict and price space risks. Strategic partnerships with space agencies and private space companies are becoming crucial to gaining a competitive edge. Cybersecurity and liability for space debris are expected to become increasingly important in future offerings.

- AXA XL

- Munich Re

- Swiss Re

- Lloyd’s of London

- Global Aerospace

- Atrium Underwriters

- AIG (American International Group)

- Allianz Global Corporate & Specialty (AGCS)

- Marsh McLennan (Insurance Broker)

- Willis Towers Watson (WTW)

- BRIT Insurance

- Others

Recent Developments

- August 2025: Partnership between a major insurance provider and a private space company to offer customized insurance for commercial space tourism ventures.

- June 2025: A new policy introduced by an insurer to cover space debris risks and satellite collision liability.

- April 2025: Space exploration company expands its satellite launch coverage with added in-orbit insurance for multi-year missions.

- February 2025: A collaborative insurance package launched to support small satellite operators, offering both launch and in-orbit coverage.

- January 2025: Introduction of blockchain-based risk management tools for space insurance policies, enhancing transparency and security.

Conclusion

The space insurance market is positioned for robust growth, driven by expanding commercial space activities and increasing risks associated with space missions. As new space industries emerge, insurers must innovate and adapt to provide coverage for a wider range of space-related risks, including satellite launches, space tourism, and space debris. This evolving market offers substantial opportunities for businesses to expand their offerings and tap into the growing demand for specialized insurance solutions.