Table of Contents

Introduction

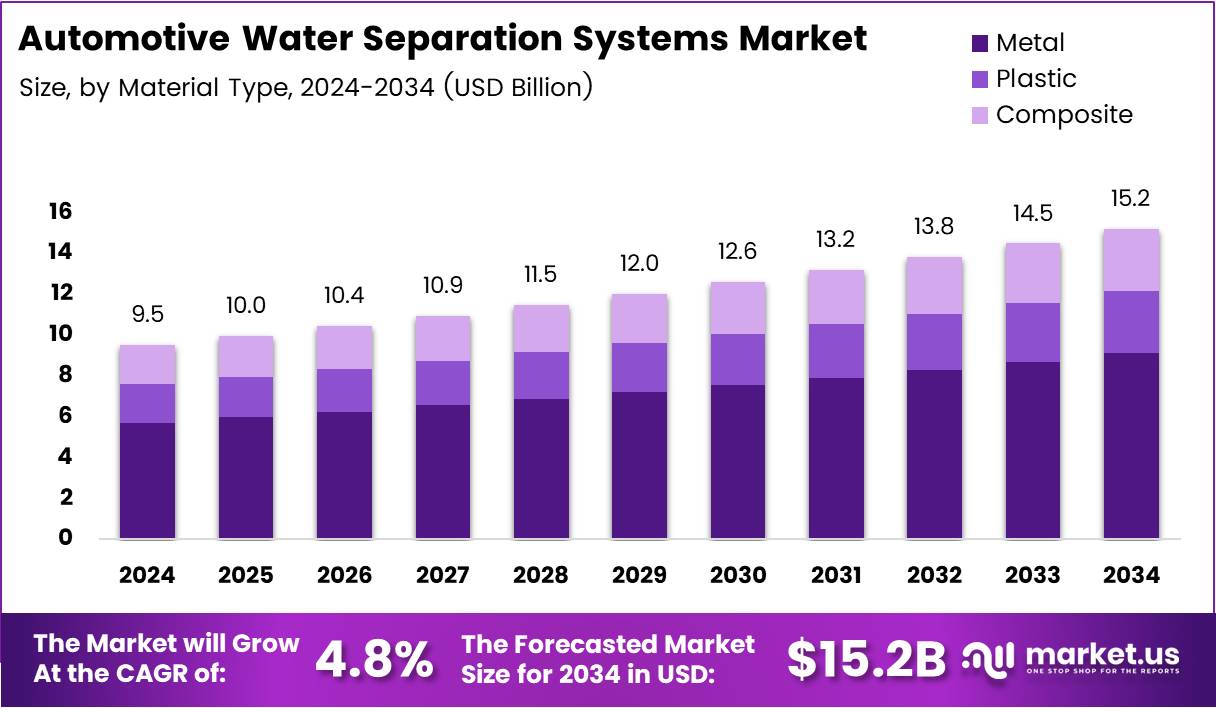

The Global Automotive Water Separation Systems Market is projected to reach USD 15.2 Billion by 2034, up from USD 9.5 Billion in 2024, expanding at a CAGR of 4.8% during 2025–2034. These systems are essential for ensuring cleaner fuel delivery and enhancing vehicle performance across diesel and hybrid vehicle platforms.

With increasing demand for high-efficiency engines and emission-compliant vehicles, water separation technologies have become critical. They effectively eliminate moisture and contaminants, thereby improving combustion quality and extending engine lifespan. Manufacturers are rapidly integrating intelligent filtration and real-time monitoring technologies to meet evolving fuel standards globally.

Additionally, the industry is witnessing a shift toward lightweight and compact filtration modules. The adoption of sustainable materials such as composites and advanced polymers supports automotive decarbonization goals, enabling automakers to enhance efficiency and comply with environmental regulations.

Key Takeaways

- The global market is expected to reach USD 15.2 Billion by 2034, up from USD 9.5 Billion in 2024, growing at a 4.8% CAGR (2025–2034).

- Metal held a 48.9% share in 2024 (By Material Type), driven by its durability and strength.

- Coalescing Filtration led Technology segment (44.2%) for precise fine-particle separation.

- Fuel Filtration dominated Application segment (52.7%) owing to clean-fuel initiatives.

- Passenger Vehicles accounted for 49.3% of the market (By End-User).

- Asia Pacific led globally with a 38.6% market share, valued at USD 3.6 Billion in 2024.

Market Segmentation Overview

By Material Type: The segment is led by metal with a 48.9% share, owing to its pressure endurance and long operational life. Plastic and composite systems are gaining traction due to their lightweight nature, corrosion resistance, and compatibility with next-gen compact engines.

By Technology: Coalescing Filtration dominates with a 44.2% share, offering superior performance in separating fine water droplets. Centrifugal and Hydrocyclone technologies are also expanding their footprint due to maintenance-free operation and eco-friendly designs.

By Application: Fuel Filtration leads the market with a 52.7% share, protecting engines from water-induced damage. Oil and Air Filtration segments are growing rapidly to support extended oil intervals and clean combustion across modern vehicle platforms.

By End-User: Passenger Vehicles dominate with a 49.3% share, driven by rising automotive production and urban mobility trends. Meanwhile, Commercial and Heavy-Duty Vehicles are expanding due to fleet modernization and fuel efficiency targets.

Drivers

High-performance fuel filtration demand in commercial fleets: Logistics, construction, and transport sectors rely on diesel platforms with long duty cycles. Robust water-fuel separation preserves injector life, stabilizes combustion, and minimizes downtime, directly improving total cost of ownership for fleet operators.

Escalating emission compliance requirements: Tightening EURO 6/VI and EPA norms are accelerating adoption of advanced separation modules that improve fuel cleanliness, enhance aftertreatment performance, and contribute to measurable gains in fuel economy across vehicle classes.

Use Cases

Long-haul commercial trucks and buses: Continuous operation in varying climates exposes fuel to condensation. Integrated separators maintain water thresholds below critical limits, reducing corrosion, misfire events, and unplanned service stops on cross-regional routes.

Off-highway and agricultural equipment: Heavy-duty engines operating in dusty, humid sites need stable fuel quality. High-capacity coalescers sustain performance under load, supporting uptime targets during seasonal peaks in mining, construction, and farming.

Major Challenges

Upfront cost and lifecycle maintenance burden: Premium filters, sensors, and housings increase BOM costs and service complexity. In price-sensitive segments, buyers defer adoption, limiting penetration of advanced systems in entry and mid-range trims.

Compatibility with alternative and biofuel blends: Varying water content, surfactants, and fuel chemistries can degrade separation efficiency. Without tailored media and design, performance swings risk injector wear and warranty claims.

Business Opportunities

Smart, sensor-equipped filtration with predictive maintenance: Inline water-in-fuel sensors, differential-pressure monitoring, and connected dashboards enable condition-based service. Fleets can cut unplanned maintenance and optimize filter replacement intervals.

OEM–supplier co-development for compact, lightweight modules: Co-engineering composite housings, nanofiber media, and quick-connect architectures can shrink packaging volume, reduce mass, and streamline assembly for next-gen ICE and hybrid platforms.

Regional Analysis

Asia Pacific leadership: With a 38.6% share and USD 3.6 Billion value in 2024, China, Japan, and emerging ASEAN bases drive volume. Investments in fuel-efficient technologies and expanding commercial fleets sustain multi-year demand.

North America and Europe resilience: Large in-service diesel parc and strict fuel quality protocols underpin replacement and retrofit demand. Technology leadership in coalescing media, hydrophobic coatings, and electronics accelerates innovation cycles.

Recent Developments

- In 2024, Pacific Avenue Capital acquired Sogefi’s Filtration Business Unit for an enterprise value of about €374 Million (~USD 400 Million), expanding its global filtration footprint.

- In January 2024, Vance Street Capital and Micronics acquired Solaft Filtration Solutions, strengthening industrial and automotive filtration coverage across key markets.

- In September 2024, Axius Water acquired MITA Water Technologies, broadening water and wastewater separation capabilities with sustainable solutions.

Conclusion

The Automotive Water Separation Systems Market is set for steady expansion, powered by emission mandates, diesel fleet retention, and a shift to intelligent, lightweight modules. Advances in nanofiber media, hydrophobic coatings, and IoT monitoring are raising performance baselines. As OEMs and suppliers co-innovate, compact, cost-effective, and connected systems will define competitive advantage through 2025–2034.