Table of Contents

Introduction

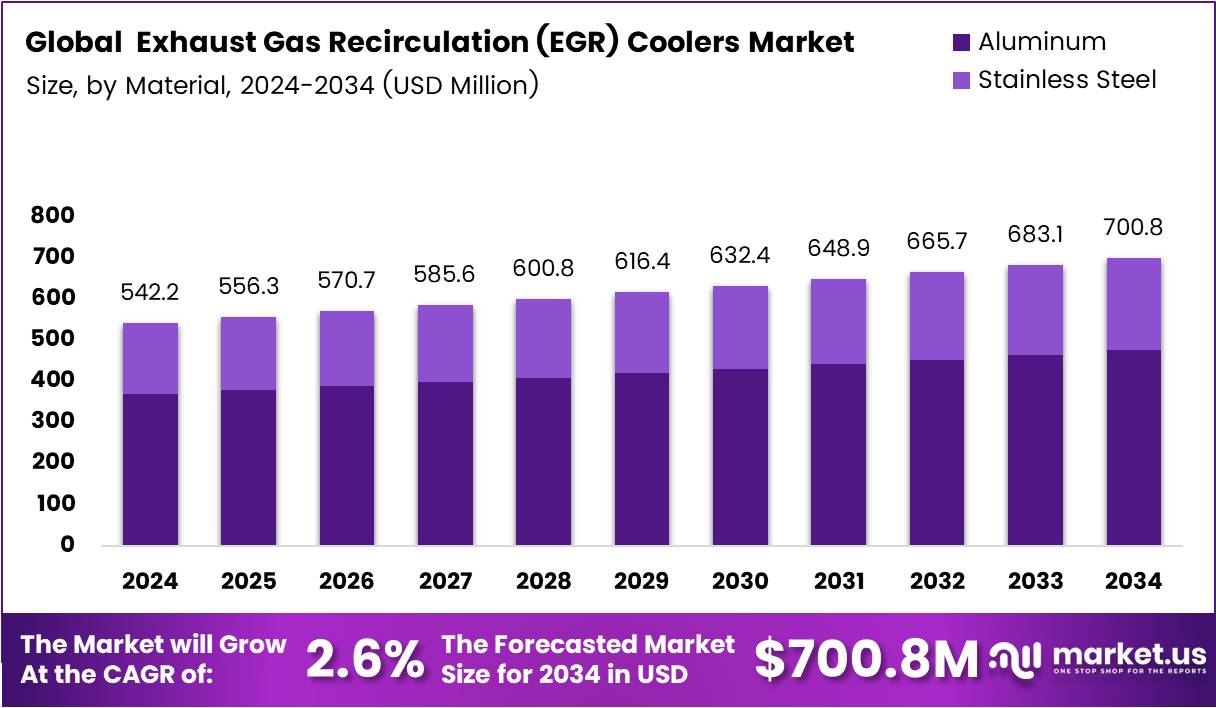

The Global Exhaust Gas Recirculation (EGR) Coolers Market is projected to reach USD 700.8 Million by 2034, growing from USD 542.1 Million in 2024 at a CAGR of 2.6%. This steady expansion highlights the industry’s crucial role in reducing nitrogen oxide emissions and meeting global environmental standards.

As stricter emission norms emerge worldwide, automakers are increasingly integrating EGR systems in diesel and gasoline vehicles. The growing demand for efficient, low-emission engines, alongside regulatory compliance mandates such as Euro 6 and EPA Tier 4, continues to drive innovation among EGR cooler manufacturers.

Furthermore, advancements in materials and design, including the use of aluminum and stainless steel, are improving thermal performance and product reliability. These developments ensure that EGR coolers remain an essential component in sustainable engine technologies across passenger and commercial vehicles.

Key Takeaways

- The Exhaust Gas Recirculation (EGR) Coolers market is projected to reach USD 700.8 Million by 2034, growing from USD 542.1 Million in 2024 at a CAGR of 2.6%.

- Aluminum dominates the Material segment with a 68.4% share, favored for lightweight design and superior heat dissipation.

- Tube EGR Coolers lead the Type segment with a 59.2% share, driven by design simplicity and emission control efficiency.

- Diesel vehicles account for a 78.8% share in the Fuel Type segment, owing to high NOx emissions and regulatory compliance needs.

- Passenger Vehicles hold a 66.1% share under Vehicle Type, supported by emission norms in Europe and Asia-Pacific.

- OEMs dominate the Sales Channel with an 82.3% share, ensuring compatibility, precision, and warranty-backed reliability.

- Asia Pacific leads globally with a 41.7% market share, valued at USD 226.0 Million, fueled by stringent emission rules and automotive expansion.

Market Segmentation Overview

By Material: Aluminum dominates with 68.4% due to its lightweight design and high thermal conductivity. The material’s superior heat dissipation makes it ideal for modern vehicles focused on fuel efficiency. Stainless steel also remains significant for heavy-duty applications, valued for its durability and corrosion resistance.

By Type: Tube EGR Coolers lead the market with 59.2% share, attributed to their simplicity and proven efficiency in emission control. Finned EGR Coolers are gaining traction for their compact design and enhanced heat exchange capabilities, offering a strong alternative for modern engine systems.

By Fuel Type: Diesel holds a commanding 78.8% share due to higher nitrogen oxide emissions requiring strict control. However, the petrol segment is gradually expanding as automakers integrate EGR technologies into gasoline engines to improve combustion efficiency and meet rising CO₂ reduction targets.

By Vehicle Type: Passenger Vehicles dominate with 66.1% share, driven by increasing production and stringent emission policies. Commercial Vehicles continue to rely on EGR systems to ensure durability and performance in heavy-duty transport operations and industrial fleets worldwide.

By Sales Channel: OEMs capture 82.3% of the market share, emphasizing quality assurance and precision engineering. The Aftermarket segment is expanding steadily as fleet owners replace or upgrade aging EGR systems, particularly in developing regions with large diesel vehicle fleets.

Drivers

1. Adoption of Strict Emission Regulations: Growing enforcement of emission control laws worldwide is driving the integration of EGR systems in both passenger and commercial vehicles. Governments are mandating NOx reduction, compelling automakers to adopt advanced EGR coolers to comply with evolving environmental standards.

2. Technological Advancements in EGR Design: Innovations in heat transfer materials and EGR configuration have improved durability, efficiency, and engine performance. These advancements reduce energy losses, extend service life, and align with global sustainability goals, significantly propelling market growth.

Use Cases

1. Heavy-Duty Diesel Vehicles: EGR coolers are essential in trucks, buses, and off-highway machinery to control NOx emissions. Their use ensures compliance with regional emission norms and enhances thermal stability, making them indispensable for logistics and construction industries worldwide.

2. Passenger Car Efficiency Enhancement: In smaller vehicles, EGR systems contribute to improved fuel economy and reduced emissions. Automakers are integrating compact EGR coolers in turbocharged gasoline engines to optimize combustion, promoting cleaner mobility and compliance with Euro and EPA standards.

Major Challenges

1. Shift Toward Electric Vehicles (EVs): The rising adoption of EVs, which eliminate exhaust systems altogether, poses a long-term challenge to the EGR coolers market. As electrification accelerates, especially in passenger vehicles, demand for traditional EGR solutions may gradually decline.

2. Maintenance and Durability Concerns: EGR coolers often face performance degradation due to soot accumulation and thermal fatigue. This leads to increased maintenance costs, operational downtime, and potential system failures, particularly in heavy-duty applications exposed to extreme conditions.

Business Opportunities

1. Expansion of Low-Temperature EGR Systems: Modern turbocharged engines increasingly rely on low-temperature EGR coolers to achieve better efficiency and emission reduction. This trend opens opportunities for manufacturers to innovate and offer next-generation thermal management solutions.

2. Growing Aftermarket Demand: With aging vehicle fleets worldwide, replacement demand for EGR coolers is surging. Aftermarket suppliers can capitalize by offering cost-effective, high-performance solutions for diesel and hybrid vehicles, particularly in Asia-Pacific and Latin America.

Regional Analysis

1. Asia Pacific: Asia Pacific leads the global market with 41.7% share, valued at USD 226.0 Million. The region’s growth stems from rapid vehicle production, stringent emission laws, and expanding infrastructure investments in China, India, and Japan. Increasing adoption of advanced emission control systems reinforces this leadership.

2. Europe and North America: Europe remains a crucial market due to Euro 6 standards, while North America continues to enforce strict EPA regulations. Both regions exhibit strong demand for high-performance EGR systems across passenger and commercial vehicles, supported by advanced R&D and a mature automotive manufacturing base.

Recent Developments

- In May 2025, BorgWarner extended four EGR system contracts with a major North American OEM, strengthening its position in emission control technology.

- In May 2025, Senior PLC secured new contracts to supply fluid conveyance assemblies for EGR coolers to a heavy-duty truck manufacturer, expanding its commercial vehicle presence.

- In August 2025, BMW issued a warranty extension for its N47T diesel EGR cooler and intake manifold, improving reliability and consumer confidence.

- In August 2025, a class-action settlement involving the Ram 1500 EcoDiesel EGR cooler was finalized, addressing thermal failure risks and establishing compensation measures.

Conclusion

The Global Exhaust Gas Recirculation (EGR) Coolers Market continues to play a pivotal role in advancing sustainable automotive engineering. Despite challenges from electrification trends, the ongoing enforcement of emission regulations and innovation in cooling materials will sustain market momentum. Asia Pacific’s dominance, coupled with Europe’s regulatory leadership, ensures that EGR coolers remain integral to global emission control strategies. As technology evolves, manufacturers focusing on lightweight materials, enhanced durability, and hybrid-compatible designs are expected to lead the next decade of growth and transformation.