Table of Contents

Introduction

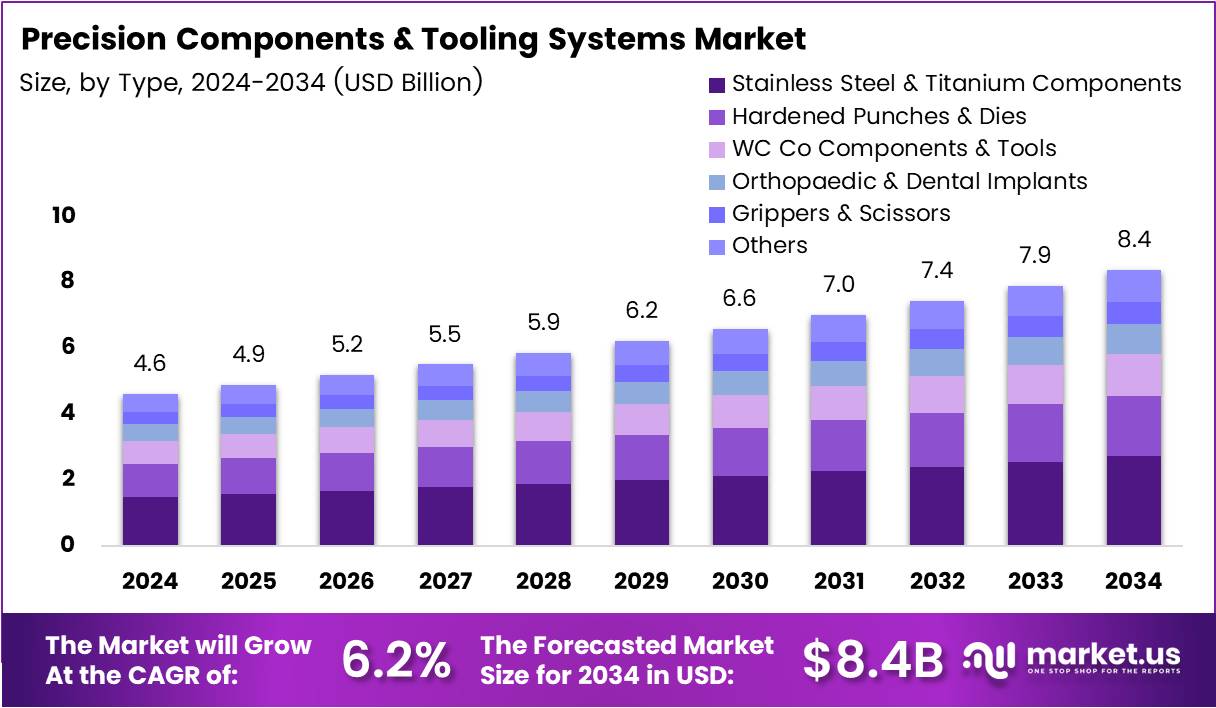

The Global Precision Components and Tooling Systems Market is projected to reach USD 8.4 Billion by 2034, rising from USD 4.6 Billion in 2024 at a CAGR of 6.2%. The market plays a crucial role in modern manufacturing, supporting industries such as aerospace, automotive, and electronics with precision-engineered components.

Driven by rapid industrial automation and digital transformation, the demand for precision tooling has surged. As companies adopt smart manufacturing technologies and advanced CNC machining, precision tools are becoming essential for ensuring product consistency, reliability, and high-quality performance across production lines.

Additionally, increasing investments in domestic manufacturing initiatives, coupled with the rise of Industry 4.0 technologies, are propelling the market forward. Real-time data integration, predictive maintenance, and IoT-enabled tooling are redefining operational efficiency and driving a new era of intelligent manufacturing globally.

Key Takeaways

- The Global Precision Components and Tooling Systems Market is projected to reach USD 8.4 Billion by 2034, up from USD 4.6 Billion in 2024.

- The market is expected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, Stainless Steel & Titanium Components dominated the By Type segment with a 32.3% share.

- In 2024, Defence & Aerospace led the By Application segment with a 38.5% share.

- North America held the largest regional share at 42.6%, valued at USD 1.9 Billion in 2024.

Market Segmentation Overview

By Type, Stainless Steel & Titanium Components held a commanding 32.3% market share in 2024 due to their strength, corrosion resistance, and broad applicability across aerospace, medical, and industrial sectors. Their superior material properties ensure durability and performance in demanding environments, sustaining global demand.

Hardened Punches & Dies are gaining momentum for their exceptional wear resistance and long operational life. As manufacturing scales toward automation and high-volume production, these components enhance efficiency, ensuring precision and reliability in mass manufacturing systems worldwide.

WC Co Components & Tools continue to expand due to their unmatched hardness and superior cutting capabilities. They play a pivotal role in precision machining and heavy-duty operations, delivering consistent accuracy and extended tool life in complex industrial applications.

Orthopaedic & Dental Implants are rapidly growing as medical advancements increase demand for biocompatible, precise, and durable components. With aging populations and rising surgical procedures, the medical sector continues to drive innovation in precision tooling and materials.

Grippers & Scissors are showing steady growth in robotic automation and assembly lines. Their contribution to high-precision handling and cutting applications aligns with global trends toward industrial robotics and automation-enhanced productivity.

By Application, Defence & Aerospace dominate with a 38.5% market share. High safety and performance standards require precision tooling for components that operate under extreme conditions, reinforcing the industry’s reliance on ultra-accurate systems and engineering expertise.

Drivers

Rising Adoption of High-Precision Machining in Aerospace and Automotive Sectors: The growing demand for high-quality components with tight tolerances has accelerated the adoption of precision machining. Aerospace and automotive industries increasingly rely on advanced cutting tools and CNC machines to deliver superior performance and operational safety, driving steady market growth.

Integration of Automation and IoT in Tooling Operations: Automation combined with IoT technologies is revolutionizing production efficiency. Smart tooling systems enable predictive maintenance, real-time performance monitoring, and optimized tool life, reducing downtime and enhancing overall production reliability in industrial operations.

Use Cases

Aerospace Manufacturing: Precision components are vital in aircraft production, ensuring that engines, turbines, and structural parts meet stringent safety standards. The use of precision tooling minimizes errors, supports complex geometries, and guarantees performance reliability under extreme operating conditions.

Medical Device Production: In the healthcare industry, precision tooling enables the creation of high-accuracy surgical instruments, implants, and diagnostic equipment. These tools ensure biocompatibility and durability, improving patient outcomes and supporting innovation in minimally invasive medical procedures.

Major Challenges

High Initial Investment Costs: Establishing precision manufacturing facilities requires substantial capital for advanced CNC machinery, automation systems, and quality inspection tools. This high entry barrier limits smaller firms from adopting cutting-edge technologies, slowing overall market penetration.

Shortage of Skilled Workforce: Operating and maintaining complex tooling systems demands specialized technical expertise. The global shortage of trained engineers and machinists presents a significant challenge, hindering efficiency, innovation, and scalability in precision manufacturing.

Business Opportunities

Expansion of Additive and Hybrid Manufacturing: The adoption of additive manufacturing and hybrid machining creates new growth pathways. These technologies enable rapid prototyping, intricate designs, and improved material utilization, appealing to industries demanding flexibility and design innovation.

Development of Sustainable Tooling Materials: The industry is increasingly shifting toward eco-friendly materials and coatings that enhance durability while reducing waste and energy use. This trend supports global sustainability goals and offers long-term cost advantages to manufacturers adopting green technologies.

Regional Analysis

North America: Holding a 42.6% market share worth USD 1.9 Billion, North America leads the market due to its strong aerospace and automotive sectors. The region’s focus on advanced manufacturing, automation, and R&D investment continues to fuel market dominance and drive technological progress.

Asia Pacific: Rapid industrialization and increased investment in high-precision machining have made Asia Pacific one of the fastest-growing regions. Countries like China, Japan, and India are investing in manufacturing infrastructure and automation, creating lucrative opportunities for precision tooling manufacturers.

Recent Developments

- In April 2024, Sandvik increased its ownership stake to 72.4% through a strategic €189 million deal, enhancing its control in precision engineering and tooling segments.

- In May 2024, Precision Aerospace (Dallas) acquired Owens (Lewisville, TX), expanding its machining capabilities across U.S. aerospace and defense markets.

- In July 2024, JK Tool, part of Weiss-Aug Group, acquired Precise Tool & Die (Leechburg, PA), strengthening its advanced die-making capabilities.

- In July 2024, OSG Corporation acquired Precision Tools Holding B.V. (Contour / Technodiamant), expanding its portfolio in high-precision diamond tool solutions.

Conclusion

The Global Precision Components and Tooling Systems Market is entering a transformative decade marked by innovation, automation, and digital integration. As industries adopt smarter and more sustainable manufacturing solutions, the demand for precision tooling will continue to grow. Supported by technological advancements and government initiatives, market players are poised to capitalize on emerging opportunities and drive long-term global competitiveness.