Table of Contents

Introduction

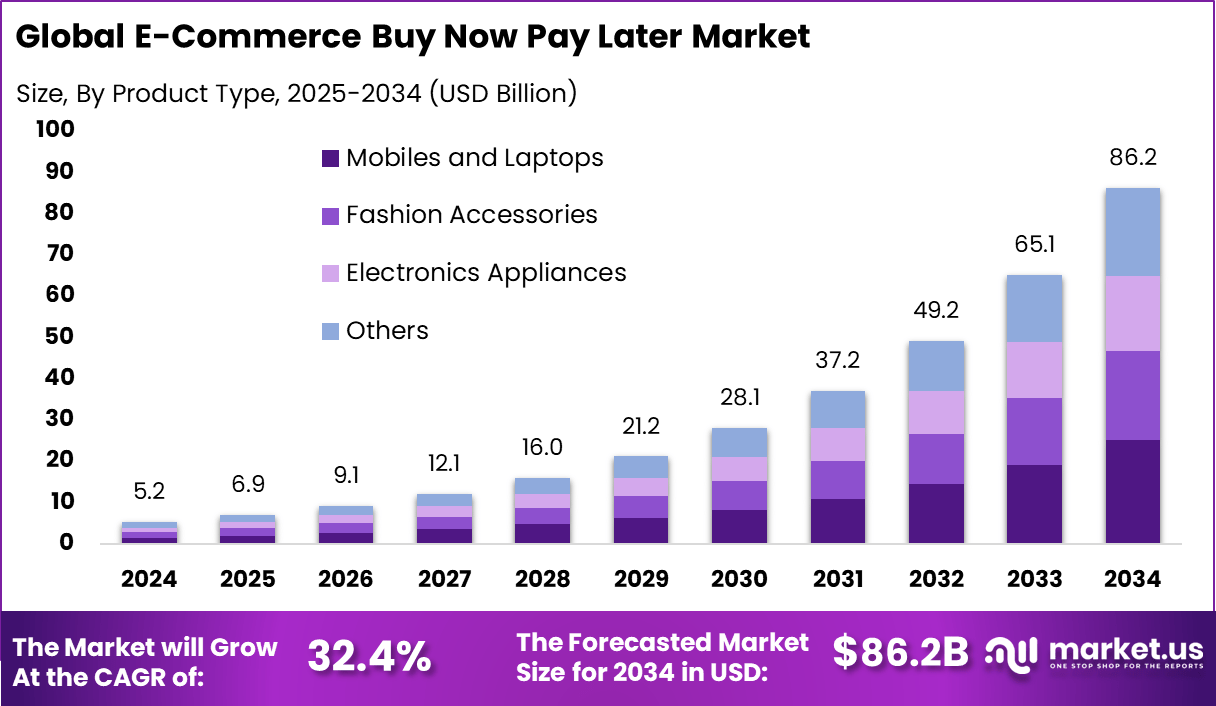

The global e-commerce “buy now, pay later” (BNPL) market generated USD 5.2 billion in 2024 and is predicted to escalate from USD 6.9 billion in 2025 to about USD 86.2 billion by 2034, recording a CAGR of 32.4%. North America held a dominant market position in 2024 with more than 34.6% share and revenues of USD 1.7 billion. The rapid growth is underpinned by rising digital commerce, increased consumer demand for flexible payment options, and the expansion of fintech platforms into alternative credit services.

How Growth is Impacting the Economy

The increased penetration of BNPL is contributing positively to consumer spending and retail turnover by enabling purchases that may otherwise have been delayed or foregone, thus stimulating economic activity. It is expected to raise consumption levels, especially in younger demographics, thereby supporting GDP growth in mature and emerging markets.

On the supply side, merchants adopting BNPL are seeing higher order volumes and larger basket sizes, which amplifies inventory turnover and can drive employment in logistics and fintech services. The broader financial ecosystem is impacted as non-bank lenders expand operations, necessitating regulatory oversight and potentially altering credit-market dynamics. As more households utilise BNPL, personal expenditure patterns adjust, with deferred payment solutions becoming a mainstream part of consumer finance.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/e-commerce-buy-now-pay-later-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As BNPL becomes mainstream, businesses face increased cost pressures from fees charged by BNPL providers and integration/operational expenses. Retailers must absorb or pass on these costs, influencing pricing strategies and margin structures. Supply chains must adapt to faster turnaround of goods, tighter inventory management, and higher consumer expectations, meaning suppliers and logistics providers must shift to more agile models.

Sector-Specific Impacts

In the retail/e-commerce sector, BNPL is enabling higher conversion rates and average order values, prompting retailers to revise checkout flows and marketing mix. In the consumer electronics and apparel industries, deferred payment is helping raise demand for premium items. In travel and leisure, BNPL is lowering booking friction and enabling higher-ticket purchases. Financial services firms are responding by offering integrated BNPL lending products and modifying underwriting frameworks to manage new credit risks.

Strategies for Businesses

Businesses should adopt the following strategic approaches:

- Integrate BNPL options at checkout to capitalise on increased conversion and basket sizes

- Negotiate favourable provider fees and revenue share arrangements to preserve margins

- Strengthen data analytics capabilities to monitor repayment behaviour and credit risk tied to BNPL usage

- Rework supply chain logistics for faster fulfilment and returns management aligned with BNPL expectations

- Collaborate with fintech partners or develop in-house BNPL platforms to retain customer insights and reduce dependency

- Ensure compliance with regulatory changes impacting BNPL, particularly credit reporting, consumer disclosures, and underwriting standards

Key Takeaways

- The BNPL market is growing rapidly with a projected CAGR of ~32.4% to 2034

- North America currently dominates, but global adoption is spreading

- BNPL growth is boosting consumer spending and retail turnover

- Businesses must manage cost, supply chain, and integration challenges

- Strategic adoption of BNPL can yield higher conversion, larger ticket size,s and deeper customer engagement

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161935

Analyst Viewpoint

At present the BNPL market is in an acceleration phase, driven by consumer demand for payment flexibility and strong fintech-merchant partnerships. Looking ahead, continued innovation in underwriting, AI-based risk assessment and geographic expansion are anticipated to sustain positive momentum. Regulatory frameworks are expected to mature, providing stability and trust, which will further broaden adoption across demographics and geographies. Overall the outlook is favourable with the market projected to evolve into a mainstream component of digital commerce.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Consumer electronics purchase via BNPL at checkout | Increasing e-commerce penetration; consumer preference for interest-free instalments |

| Premium apparel purchase using BNPL option | Rising disposable income in younger demographics; marketing of deferred payment to elevate average order value |

| Travel/ticket booking with BNPL payment plan | Desire for experiential consumption; flexibility in cash-flow management for consumers |

| Retailer offering BNPL to enhance conversion | Competitive pressure to provide differentiated checkout; data insights via fintech partnerships |

| Fintech/lender providing BNPL platform | Digital payments growth; underserved credit segments; regulatory evolution enabling alternative credit |

Regional Analysis

North America currently leads with over 34.6% share of the BNPL market as of 2024, benefiting from strong consumer credit infrastructure and high e-commerce adoption. Europe and Asia Pacific are gaining traction: Asia Pacific in particular is anticipated to register rapid growth due to large digital-native populations, mobile commerce adoption and rising fintech penetration. Emerging markets in Latin America, Middle East & Africa are also beginning to adopt BNPL solutions as online shopping and digital wallets become more widely used. Regional regulatory maturity and infrastructure readiness remain key differentiators of growth pace.

➤ More data, more decisions! see what’s next –

- Database Management Analytics Market

- Interactive Display Market

- BYOD (Bring Your Own Device) Market

- Agriculture Analytics Market

Business Opportunities

The BNPL surge offers several business opportunities. Merchant platforms can partner with BNPL providers to increase checkout conversion rates and customer acquisition. Fintech firms can innovate risk modelling, underwriting platforms and embedded finance offerings to capture underserved consumer credit markets.

Retailers can leverage BNPL data to drive personalised marketing, loyalty programmes and higher-ticket upselling. Geographic expansion into markets with lower traditional credit penetration presents opportunity for first-mover advantage. Additionally, vertical-industry adoption (healthcare, education, travel) offers new pathways beyond retail to embed BNPL in varied spend categories.

Key Segmentation

Market segmentation is important to tailor strategies. The segments include payment model (interest-free instalments, longer-term instalments), end-use (retail/e-commerce, travel & leisure, healthcare, education), channel (online, POS/offline), and user demographic (Gen Z, millennials, older adults).

Each segment is projected to grow at different rates depending on consumer behaviour, technology adoption, and regulatory factors. Businesses should align growth strategies to these segments, for example, targeting Gen Z via mobile-first online channels in e-commerce, or exploring POS BNPL in offline retail to capture fragmented markets.

Key Player Analysis

Key players are focusing on expanding merchant networks, enhancing risk assessment algorithms, and geographic footprint to stay competitive. They are seeking to embed BNPL deeply into checkout flows, integrate value-added services like loyalty dashboards, and bundle financing options beyond short-term instalments. Competition is intensifying, pushing firms to innovate on pricing, underwriting flexibility, and partnerships with big retailers. Strategic alliances and technology investments are expected to be decisive for firms aspiring to scale globally and maintain margin discipline.

- Klarna Bank

- Splitit Payments Ltd

- Bread Financial

- Payright Limited

- Affirm Holdings Inc.

- Laybuy Holdings Limited

- PayPal

- Sezzle Inc.

- QuickFee Group LLC

- Zip Co Limited

- Others

Recent Developments

- Regulatory bodies in key markets are initiating consumer-protection rules for BNPL providers, enhancing transparency and dispute-resolution mechanisms.

- A leading fintech BNPL provider launched a broader consumer loan product expansion into new geographies.

- Partnerships between major e-commerce platforms and BNPL providers are increasing checkout integration and embedded financing offerings.

- Fintech firms are deploying AI-based credit-scoring and fraud detection tools tailored to BNPL usage patterns.

- Several BNPL firms are exploring embedded finance models, offering previously credit-card-only merchants flexible instalment plans and white-label solutions.

Conclusion

The global BNPL market is poised for strong expansion and offers significant upside for merchants, fintechs and service providers that align strategies to consumer payment flexibility, digital commerce growth and risk-management innovation.