Table of Contents

Introduction

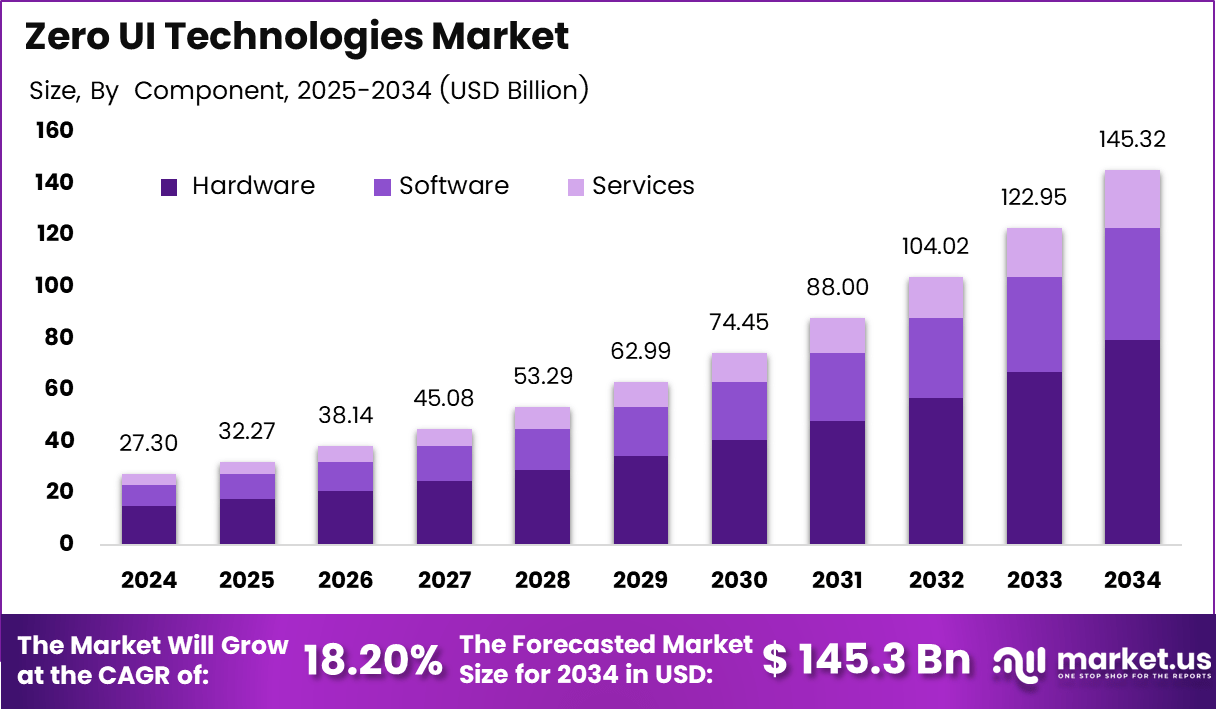

The global Zero UI Technologies Market was valued at USD 27.3 billion in 2024 and is projected to reach USD 145.3 billion by 2034, expanding at a compound annual growth rate (CAGR) of 18.2%. This growth is driven by the rising adoption of intuitive, touchless, multimodal user-interfaces integrating voice, gesture and gaze-based interactions.

The push for hands-free, ambient computing experiences across smart homes, wearables, automotive and enterprise systems has elevated the importance of Zero UI technologies. Increased investment in artificial intelligence (AI), sensor technology and edge-computing platforms further supports the market’s expansion.

How Growth is Impacting the Economy

The rapid growth of the Zero UI market is expected to stimulate broader economic activity, particularly within high-tech manufacturing, software development and services sectors. As demand rises for sensors, cameras, microphones and edge-chips, upstream manufacturing industries are projected to scale production, thereby creating jobs and boosting capital investment. Simultaneously, the rollout of connected devices and voice/gesture interfaces in consumer electronics is projected to increase household spending on smart-home ecosystems and wearables, generating increased consumer spending and supporting GDP growth in advanced economies.

The service sector—especially integration, customization and UX design—is anticipated to benefit substantially, with firms expanding to provide Zero UI solutions for enterprises and public infrastructure. The ripple effect extends to supporting industries such as telecommunications and cloud/edge computing, where enhanced infrastructure deployment is required to handle the data and latency demands of touchless interfaces. Economies that embrace this shift effectively may improve productivity by reducing friction in human-machine interactions, thereby improving operational efficiency and potentially reducing labour costs in certain segments.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/zero-ui-technologies-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses engaged in manufacturing Zero UI hardware components face rising costs for high-precision sensors, cameras, microphones and edge modules. Supply chain constraints—especially for specialised components such as gestural sensors and gaze-tracking modules—are pushing firms to diversify sourcing, relocate manufacturing closer to demand centres and invest in shorter, more resilient supply-chains. Firms integrating Zero UI capabilities must also account for increased R&D and integration costs, as software, firmware and hardware must be tightly coupled for seamless experiences.

Sector-Specific Impacts

In consumer electronics, manufacturers of smart speakers, wearables and smart-home appliances are adopting voice and gesture controls rapidly, shifting away from traditional UI models. In automotive, Zero UI technologies enable interactive cockpit controls and driver-assist systems that reduce reliance on physical buttons, affecting suppliers of traditional infotainment modules.

In healthcare, touchless interfaces enhance sterile environments and patient monitoring, which opens opportunities for medical device manufacturers but also demands compliance and specialised sensors. Retail and public spaces are leveraging gesture and gaze-based kiosks for contactless interaction, altering the solutions landscape for kiosks, digital signage and interactive environments. Each of these sectors must adapt business models, supplier relationships and product architectures to capitalise on the Zero UI shift.

Strategies for Businesses

To capitalise on the Zero UI market opportunity, businesses should pursue the following strategies:

- Invest in modular sensor and edge-processing architectures to enable scalable gesture/voice/gaze control integration.

- Form strategic partnerships with AI and NLP-platform providers to enhance voice and ambient intelligence capabilities.

- Diversify supply-chain sourcing by locating manufacturing or assembly closer to major demand regions (e.g., Asia-Pacific) to reduce latency and logistic risk.

- Focus on vertical-specific solutions (such as automotive or healthcare) rather than only horizontal consumer devices, to leverage higher margins and specialised requirements.

- Ensure compliance with privacy/security frameworks, especially where voice, gesture and biometrics are used, thereby increasing user trust and reducing regulatory risk.

- Build ecosystems with third-party developers and device manufacturers to accelerate adoption and create network effects for Zero UI interfaces.

Key Takeaways

- Market size (2024): USD 27.3 billion; projected (2034): USD 145.3 billion; CAGR ~18.2%.

- Zero UI technologies eliminate traditional screens/buttons via voice, gesture, gaze and ambient interaction.

- Growth drives hardware manufacturing, software/services expansion and ecosystem development.

- Supply-chain complexity and component costs are key business challenges.

- Strategic focus on verticals, partnerships and compliance will differentiate winners.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162901

Analyst Viewpoint

The present outlook for the Zero UI Technologies Market is positive, underscored by robust adoption in consumer electronics, automotive and smart-infrastructure segments. As voice and gesture interfaces mature, enterprises are expected to shift from novelty to mainstream deployment. Looking ahead, the future is promising: ambient computing and multimodal interaction are projected to become standard in everyday devices, leading to higher system integration, further cost-reductions in sensors and expanded opportunities across emerging markets. Businesses that adapt early to this paradigm are likely to capture significant value and remain competitive in the digital-interaction era.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Smart-home voice/gesture control | Rising consumer demand for convenience and hands-free interaction |

| Automotive cockpit interfaces | Growth of connected/ autonomous vehicles and need for intuitive HMI |

| Healthcare hands-free monitoring | Sterile environments, patient comfort, touchless device operation |

| Retail & kiosks gesture/gaze | Demand for contactless interaction and enhanced customer experience |

| Wearables & AR/VR platforms | Multi-modal interaction and immersive experiences |

Regional Analysis

North America dominated the market in 2024, capturing approximately 40-43 % of global share due to strong AI ecosystems, high smart-speaker penetration and early adoption of connected devices. Asia-Pacific is anticipated to grow at the fastest pace over the forecast period, driven by large smartphone/user base, rapid deployment of 5G networks, smart-home expansion and rising demand in automotive and consumer electronics in countries such as China, India, Japan and South Korea. Europe, Latin America and Middle East & Africa offer moderate growth opportunities supported by smart city infrastructure and IoT adoption.

➤ More data, more decisions! see what’s next –

- Digital Health Insurance Market

- Fintech Paas Platforms Market

- Unit Linked Insurance Market

- AI Ring Market

Business Opportunities

Business opportunities abound for firms willing to innovate within the Zero UI domain. Suppliers of advanced sensors, edge-processing modules and cameras stand to benefit from increased demand. Software developers specialising in voice/NLP engines, gesture recognition SDKs and gaze-tracking frameworks can capture high-value contracts.

Enterprises can also differentiate by delivering turnkey industry-specific Zero UI solutions—such as smart-cockpit modules in vehicles or voice/gesture controls in healthcare devices. Service providers offering integration, UX-design and managed services for Zero UI deployments will find growing demand. In emerging markets, localisation of voice and gesture modalities presents additional opportunities for growth.

Key Segmentation

The market segments encompass technology type (such as voice user interface systems, gesture recognition & motion control, brain-computer interface, ambient computing & IoT integration, haptic & tactile feedback systems, eye-tracking & gaze control, biometric authentication & predictive interfaces), interaction modality (voice & audio commands, hand & body gestures, facial expression recognition, neural signal processing, environmental context sensing, proximity & presence detection, emotional state recognition, behavioural pattern analysis) and deployment environment (consumer electronics, enterprise & corporate solutions, public spaces & smart cities, vehicle-integrated systems, cloud-based infrastructure, edge computing platforms). These segments together define where and how Zero UI technologies are used, and growth is anticipated to vary by segment based on adoption and investment trends.

Key Player Analysis

The competitive landscape comprises leading global technology firms delivering hardware (sensors, cameras, edge-chips), software (voice platforms, gesture SDKs, gaze analytics) and services/integration-solutions for Zero UI deployments. Companies are investing heavily in R&D to strengthen algorithms for natural-language understanding (NLU), computer vision, gaze-tracking, sensor-fusion and edge-AI optimisation.

Strategic moves include partnerships, acquisitions and ecosystem development to accelerate time-to-market and secure end-to-end capabilities. With rising demand across multiple verticals, competitive differentiation is increasingly based on solution completeness, latency/performance, ease of integration and compliance with privacy/security standards.

- Amazon (Alexa Voice Service)

- Google (Assistant & Nest)

- Apple Inc. (Siri & HomeKit)

- Microsoft Corporation (Cortana & HoloLens)

- Meta Platforms Inc. (Oculus & AR/VR)

- Samsung Electronics Co. Ltd Company Profile

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- IBM Corporation

- Baidu Inc.

- SenseTime Group

- Nuance Communications

- Leap Motion

- Tobii AB

- Neurable Inc.

- Emotiv Inc.

- Cogito Corporation

- Affectiva

- Brain Products GmbH

- Others

Recent Developments

- A review noted that during the COVID-19 pandemic the demand for touchless technologies surged, reinforcing Zero UI adoption in service industries.

- A design blog emphasised the shift from graphical user interfaces (GUIs) to voice, gesture, and ambient interfaces and their implications for customer experience.

- A recent market summary noted that the hardware segment will dominate the Zero UI market in 2024, driven by sensors, cameras, and microphones.

- Technology-blog outlined key benefits of Zero UI for enterprise mobile applications, including reduced cognitive load and improved engagement.

- A market-report pointed to Asia-Pacific as the fastest-growing region and North America as the largest in 2024, underlying regional dynamics.

Conclusion

The Zero UI Technologies Market presents compelling growth potential, driven by rising demand for seamless, touchless interactions across consumer, automotive, healthcare and enterprise sectors. Businesses that invest in sensors, AI, edge computing and vertical-specific solutions stand to benefit significantly in the screen-less future of human-machine interfaces.