Table of Contents

Introduction

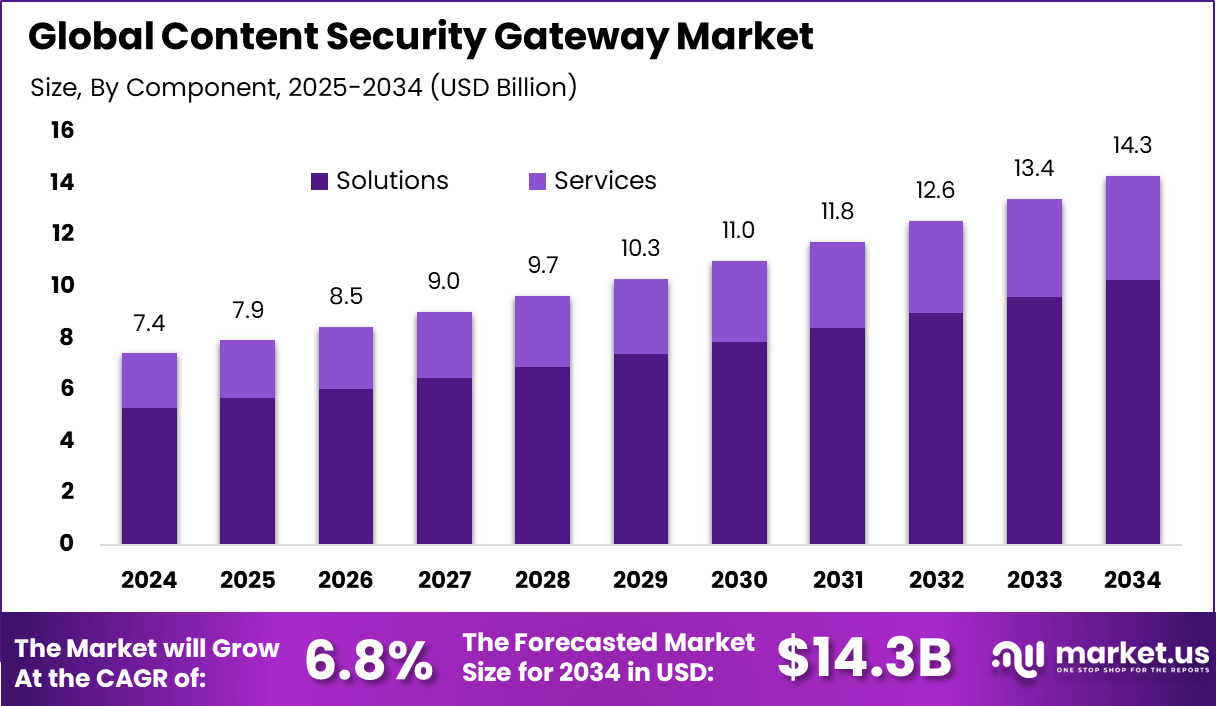

The Global Content Security Gateway Market reached USD 7.4 billion in 2024 and is projected to grow from USD 7.9 billion in 2025 to USD 14.3 billion by 2034, reflecting a CAGR of 6.8%. North America dominated with a 39.4% share, generating USD 2.9 billion in revenue in 2024.

The market’s expansion is fueled by increasing cyber threats, the rise in enterprise cloud adoption, and stringent data compliance regulations. The demand for real-time monitoring, encryption, and threat intelligence continues to strengthen the role of content security gateways in safeguarding enterprise communication networks and protecting confidential digital assets.

How Growth is Impacting the Economy

The expanding content security gateway market is reshaping the global digital economy by enhancing cybersecurity resilience and driving innovation in IT infrastructure. The steady 6.8% CAGR signifies growing investments in secure digital transformation and cloud governance frameworks. Countries with advanced digital ecosystems, such as the US, Canada, Germany, and Japan, are witnessing increased productivity and cost savings due to automation and AI-enhanced filtering solutions.

This growth fosters new job creation in cybersecurity engineering and boosts demand for cloud-based security consulting services. Furthermore, as businesses reduce losses from phishing, ransomware, and insider threats, national economies benefit from improved data protection, regulatory compliance, and uninterrupted digital trade flow, strengthening their GDP contributions from the IT services and security segments.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/global-content-security-gateway-market/free-sample/

Impact on Global Businesses

Rising Costs and Supply Chain Shifts: Businesses face higher costs as data privacy laws tighten and security certification requirements escalate. Vendors are moving toward subscription-based, cloud-integrated models, shifting production from hardware-heavy gateways to scalable, software-defined systems.

Sector-Specific Impacts: The financial sector is experiencing rapid compliance adaptation to GDPR, PCI DSS, and SOX frameworks. The healthcare sector is adopting these gateways to secure patient data and comply with HIPAA standards. The manufacturing and retail sectors leverage gateway systems to counter data leaks from IoT devices and supply chain applications, ensuring end-to-end protection against data manipulation and ransomware threats.

Strategies for Businesses

- Adopt multi-layered content filtering and sandboxing technologies.

- Integrate AI-driven anomaly detection and predictive analytics to identify zero-day threats.

- Shift to scalable cloud-native architectures for faster policy updates and deployment.

- Collaborate with national cybersecurity agencies to align with evolving regulations.

- Invest in employee awareness programs to mitigate risks from social engineering and phishing attacks.

Key Takeaways

- The market is projected to grow from USD 7.9 billion in 2025 to USD 14.3 billion by 2034.

- North America dominates with a 39.4% revenue share in 2024.

- AI and ML integration enhances predictive threat intelligence.

- Compliance with data protection laws is a major growth catalyst.

- Cloud-based deployment is overtaking on-premise security solutions globally.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162439

Analyst Viewpoint

The market is witnessing accelerated adoption of AI-enhanced content filtering and policy automation. Cloud migration across enterprises is expected to keep security gateway demand strong. Over the next decade, integrating blockchain and zero-trust network architectures will revolutionize gateway operations, improving transparency and reducing breach risks. The analyst outlook remains positive as government investments in cyber resilience and digital infrastructure continue to strengthen long-term growth.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Email and Web Traffic Filtering | Rising phishing and ransomware attacks in enterprise communication |

| Cloud Data Security | Rapid cloud migration and SaaS adoption |

| Data Leakage Prevention | Increasing insider threat and compliance mandates |

| IoT Network Protection | Expanding connected device ecosystem and edge computing |

| Regulatory Compliance Automation | Growing global data privacy laws and audits |

Regional Analysis

North America leads due to strong regulatory enforcement and cloud adoption among large enterprises, holding a 39.4% share in 2024. Europe follows with a stringent GDPR-driven implementation, while Asia-Pacific exhibits the fastest growth, driven by increasing digitization in India, Japan, and South Korea. Latin America and the Middle East are gradually embracing secure cloud solutions, supported by national cybersecurity strategies and investments in digital infrastructure resilience.

➤ More data, more decisions! see what’s next –

Business Opportunities

Significant business opportunities lie in cloud-native gateways that integrate AI and zero-trust models for real-time threat response. Emerging economies are opening markets for localized compliance-based solutions. Startups specializing in API security, threat sandboxing, and encrypted traffic inspection are gaining traction. Partnerships with telecom and managed service providers present new revenue streams, while hybrid solutions combining web, email, and application security appeal to mid-sized enterprises transitioning to cloud ecosystems.

Key Segmentation

The market is segmented by Component (Solutions, Services), Deployment (Cloud-based, On-premise, Hybrid), Enterprise Size (Large Enterprises, SMEs), End-User (BFSI, Healthcare, IT & Telecom, Government, Retail, Manufacturing), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). The cloud-based deployment and BFSI end-user segments are anticipated to dominate the market share through 2034 due to increasing security automation and compliance adoption.

Key Player Analysis

Market participants focus on R&D investments to integrate AI and machine learning capabilities into their gateway offerings. Vendors are prioritizing real-time threat detection, encrypted traffic inspection, and zero-trust frameworks. Strategic collaborations with cloud service providers and expansion in emerging markets are shaping competitive strategies. Product differentiation based on regulatory compliance, multi-vector threat detection, and ease of scalability remains crucial to sustaining leadership in this evolving cybersecurity segment.

- Barracuda Networks Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- F5 Inc.

- FirstWave Cloud Technology Limited

- McAfee Corp.

- Planet Technology Corporation

- Proofpoint Inc.

- Trustwave Holdings Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Fortinet Inc.

- Trend Micro Inc.

- Zscaler Inc.

- Fortra LLC

- AO Kaspersky Lab

- Cato Networks Ltd.

- Mimecast Services Limited

- SonicWall Inc.

- Comodo Security Solutions Inc.

- WatchGuard Technologies Inc.

- Sophos Group PLC

- iboss Inc.

- Cyren Inc.

- Smoothwall Limited

- Menlo Security Inc.

- Others

Recent Developments

- March 2025: Launch of AI-powered cloud security gateway with real-time anomaly tracking.

- February 2025: Partnership announced for zero-trust network integration across hybrid systems.

- January 2025: Expansion into Asia-Pacific via localized compliance-focused gateway deployment.

- December 2024: Release of next-gen API security gateway targeting enterprise SaaS users.

- October 2024: Acquisition of a cybersecurity startup specializing in encrypted data flow analysis.

Conclusion

The Content Security Gateway Market is on a robust growth trajectory, propelled by cloud transformation, data protection mandates, and AI-driven innovation, creating sustainable economic and digital security benefits worldwide.