Table of Contents

Introduction

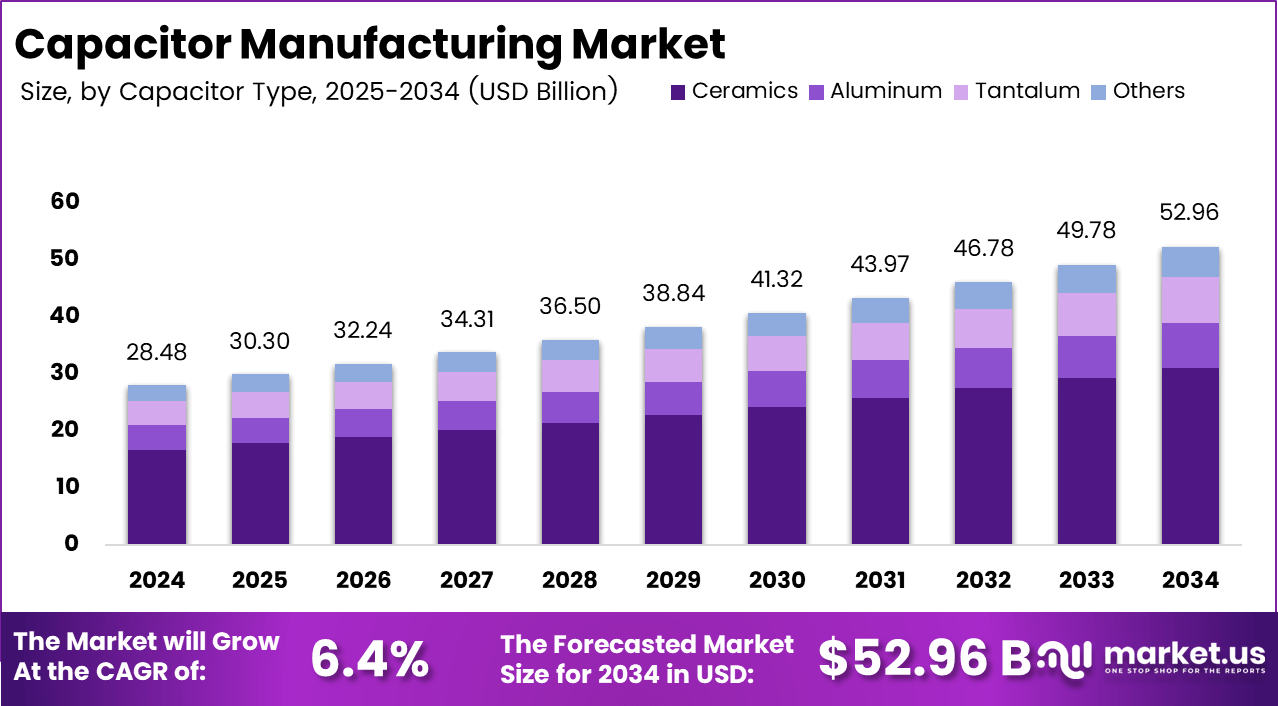

The Global Capacitor Manufacturing Market reached USD 28.4 billion in 2024 and is projected to grow from USD 30.3 billion in 2025 to USD 52.96 billion by 2034, registering a CAGR of 6.4%. Asia-Pacific dominated the market with a 58.6% share, generating USD 16.6 billion in revenue. This growth is fueled by rapid industrialization, expansion in consumer electronics, and rising adoption of electric vehicles. The integration of advanced materials and miniaturization technologies further accelerates capacitor demand across automotive, renewable energy, and telecommunication applications, making it one of the most vital components supporting global electrification and digitalization trends.

How Growth is Impacting the Economy

The capacitor manufacturing market’s steady 6.4% CAGR contributes significantly to the global economy by enhancing industrial output and supply chain resilience. Increased capacitor production drives semiconductor, automotive, and energy sectors, creating employment opportunities and boosting exports in countries such as China, Japan, and South Korea. The shift toward high-performance multilayer ceramic capacitors and energy storage solutions supports the renewable energy transition, improving economic sustainability.

This growth strengthens global trade balances by fostering domestic manufacturing ecosystems and reducing dependency on imported electronic components. As industries integrate capacitors into IoT systems, robotics, and power grids, economic productivity rises through efficient power management and reduced energy losses, directly contributing to GDP growth and national technology competitiveness.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/capacitor-manufacturing-market/free-sample/

Impact on Global Businesses

Rising Costs and Supply Chain Shifts: Businesses face increased raw material costs for tantalum, aluminum, and nickel, pushing manufacturers to secure long-term supply contracts. Geopolitical tensions and logistics constraints have shifted supply chains toward localized and vertically integrated production in Asia-Pacific and North America.

Sector-Specific Impacts: In automotive, capacitor demand is surging due to EV expansion and autonomous vehicle technologies. In electronics, miniaturized and high-capacity capacitors enable faster, more efficient devices. The energy sector is adopting supercapacitors for grid stabilization and renewable energy integration, while industrial automation relies on durable capacitors to enhance operational stability and reduce downtime.

Strategies for Businesses

- Invest in automation and precision manufacturing to improve production efficiency.

- Develop eco-friendly capacitors with recyclable materials to meet sustainability mandates.

- Strengthen regional supply networks to mitigate geopolitical risks.

- Focus on R&D for high-voltage and solid-state capacitors.

- Collaborate with OEMs for long-term supply partnerships in EV and renewable segments.

Key Takeaways

- Market projected to reach USD 52.96 billion by 2034 at 6.4% CAGR.

- Asia-Pacific leads with a 58.6% market share in 2024.

- Growing demand from EVs, 5G, and renewable energy industries.

- Rising material costs reshaping global supply strategies.

- Innovation in solid-state and hybrid capacitors driving future growth.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=160927

Analyst Viewpoint

The capacitor manufacturing market is undergoing rapid transformation driven by electrification, sustainability goals, and digital expansion. Presently, Asia-Pacific dominates production due to high-scale manufacturing and strong supplier ecosystems. Future growth will be fueled by AI-based design optimization, automation in fabrication, and innovations in dielectric materials. The analyst outlook remains optimistic as technological advancements and localized production models continue to shape a resilient and sustainable global capacitor industry.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Electric Vehicles | Rising adoption of EVs and hybrid systems requiring power stabilization |

| Consumer Electronics | Miniaturization and high-frequency performance in smartphones and wearables |

| Renewable Energy Systems | Integration of capacitors for energy storage and grid reliability |

| Industrial Automation | Increased automation and power regulation in manufacturing processes |

| Telecommunications | Expansion of 5G infrastructure and data transmission efficiency |

Regional Analysis

Asia-Pacific leads with a 58.6% share in 2024, driven by massive manufacturing bases in China, Japan, and South Korea. North America is growing steadily with advancements in EV and aerospace applications. Europe emphasizes sustainable capacitor technologies and renewable integration. Emerging economies in Latin America and the Middle East are expanding capacitor imports to support growing power and communication infrastructures.

➤ More data, more decisions! see what’s next –

Business Opportunities

Opportunities lie in the development of eco-efficient capacitors tailored for electric vehicles and renewable grids. Companies can leverage growth in energy storage and high-frequency 5G networks. Emerging markets in Southeast Asia and Africa offer potential for local assembly plants. Digitalization and Industry 4.0 initiatives open opportunities for smart manufacturing, predictive maintenance, and AI-driven product quality enhancement, expanding profitability across the global capacitor value chain.

Key Segmentation

The market is segmented by Product Type (Ceramic, Electrolytic, Film, Supercapacitors, Others), Application (Automotive, Consumer Electronics, Industrial, Energy, Telecommunications), Material (Aluminum, Tantalum, Plastic Film, Ceramic Oxide), and Region (APAC, North America, Europe, Latin America, Middle East & Africa). Ceramic and electrolytic capacitors dominate due to widespread use in electronics and automotive systems, while supercapacitors show the highest growth potential in renewable energy and EV applications.

Key Player Analysis

Industry participants emphasize product miniaturization, durability, and eco-friendly design. Companies are adopting automation, AI-based inspection systems, and precision material coating to improve yield and reduce waste. Strategic mergers and partnerships enhance access to raw materials and R&D expertise. The competitive landscape is increasingly defined by innovation in nanocomposite dielectrics, reliability in extreme environments, and faster response times for high-frequency circuits, securing long-term relevance in diverse electronic applications.

- Murata Manufacturing Company Ltd.

- Maxwell Technologies, Inc.

- Samsung Electro-Mechanics

- Nippon Chemi-Con Corporation

- TDK Corporation

- AVX Corporation

- Kyocera Corporation

- Taiyo Yuden Co., Ltd.

- Panasonic Corporation

- Yageo Corporation

- KEMET Corporation

- Vishay Intertechnology, Inc.

- Darfon Electronics

- Others

Recent Developments

- March 2025: Launch of ultra-thin ceramic capacitors for high-density circuit boards.

- February 2025: Partnership to co-develop high-voltage capacitors for EV inverters.

- January 2025: Investment in an automated capacitor assembly line in South Korea.

- November 2024: Introduction of lead-free film capacitors meeting RoHS compliance.

- September 2024: Expansion of production facility for supercapacitors in Japan.

Conclusion

The capacitor manufacturing market is accelerating with electrification, 5G deployment, and renewable integration. Continuous material innovation and automation are shaping a sustainable, high-efficiency industry poised for strong global growth.