Table of Contents

Introduction

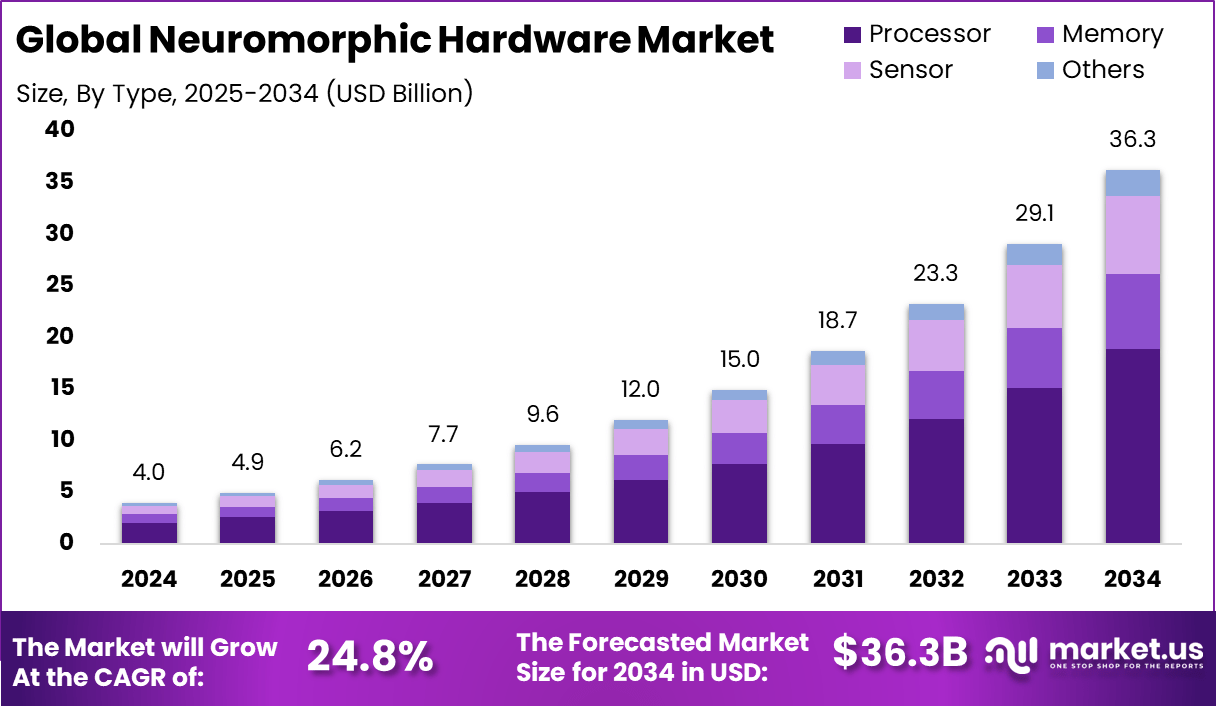

The global neuromorphic hardware market reached USD 4.0 billion in 2024 and is projected to grow to about USD 36.3 billion by 2034, representing a compound annual growth rate (CAGR) of 24.8% throughout the forecast period. In 2024, North America accounted for more than a 38.4% share of market revenue, generating USD 1.53 billion.

This expansion is underpinned by the increasing adoption of brain-inspired computing architectures, the proliferation of artificial intelligence (AI) and edge computing applications, and significant advances in low-power, event-driven neuromorphic hardware. Governments and private players are ramping up investments in neuromorphic R&D as part of next-generation computing strategy.

How Growth is Impacting the Economy

The robust growth of the neuromorphic hardware market is generating considerable economic impact across multiple layers. First, increased demand for specialized hardware is driving capital investment in semiconductor manufacturing, R&D, and high-tech equipment, which supports job creation and regional economic development in chip-design hubs and manufacturing clusters.

Second, the deployment of neuromorphic systems in sectors such as automotive, healthcare and defence is expected to enhance productivity and enable new business models, thereby contributing to economic output gains.

Third, as global economies push toward digital transformation and sustainable computing, the shift to energy-efficient neuromorphic hardware helps reduce operational costs and environmental footprint, aligning with regulatory objectives and encouraging further investment. Finally, the ripple effect through supply chains—from raw materials to system integrators—supports ancillary industries and fosters ecosystem growth, leading to broader economic multiplier effects.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/neuromorphic-hardware-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

With the rising demand for neuromorphic hardware, component and semiconductor costs are increasing, prompting businesses to revise cost structures and sourcing strategies. Global companies are shifting supply chains to regions with favourable incentives or closer proximity to key markets to mitigate logistics and geopolitical risks. Increased demand for advanced materials and fabrication processes also places pressure on suppliers, requiring strategic partnerships and vertical integration to secure stable supply.

Sector-Specific Impacts

In automotive and transportation, neuromorphic hardware is enabling more advanced driver-assistance systems and autonomous capabilities, compelling OEMs to invest in new computing platforms. By healthcare and life sciences, the technology supports edge-based diagnostics and brain-inspired medical devices, pushing device manufacturers to adopt new architectures and ecosystem partnerships. In industrial automation, manufacturers are integrating neuromorphic processors for real-time sensor fusion and predictive maintenance, altering production lines and data-processing models. Consumer electronics firms are leveraging neuromorphic chips to deliver smarter, low-power devices, changing product roadmaps and value chains.

Strategies for Businesses

Businesses operating in or entering the neuromorphic hardware ecosystem should adopt the following strategies:

- Invest early in research and development partnerships or alliances to gain access to neuromorphic architectures and software stacks.

- Implement supply-chain diversification strategies, including sourcing key components from multiple geographies and securing fabrication capacity through long-term agreements.

- Focus on value creation through energy-efficient solutions and edge-deployment use cases, as these offer differentiation in cost and performance.

- Adapt business models to subscription- and service-based hardware deployment, thereby integrating hardware, software and analytics.

- Monitor regulation and standardisation developments in neuromorphic computing and align product design and market entry accordingly.

Key Takeaways

- The global neuromorphic hardware market is projected to grow from USD 4.0 billion in 2024 to about USD 36.3 billion by 2034 at a CAGR of 24.8%.

- North America held over a 38.4% share in 2024, highlighting regional leadership in this domain.

- Growth is driven by demands in AI, edge computing and autonomous systems, and by the need for energy-efficient, brain-inspired processing.

- Rising hardware costs and supply-chain constraints are key challenges for businesses.

- Strategic investment in partnerships, diversification and service-oriented models will be critical for market success.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161521

Analyst Viewpoint

Presently, the neuromorphic hardware market is in a phase of rapid development, with abundant innovation and strong demand signals from major sectors such as automotive, healthcare and edge computing. Over the forecast horizon, the market is projected to mature further, with increasing standardisation, cost-reductions in hardware manufacturing, and broader commercial deployment of neuromorphic systems. This creates a positive outlook for both hardware vendors and ecosystem participants, with opportunities to capture value across design, system integration and software services.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Real-time vision and sensor fusion in autonomous vehicles | Increasing production of advanced driver-assistance systems and autonomous vehicles provides a major use-case for neuromorphic hardware. |

| Edge healthcare diagnostics | Demand for low-power, real-time processing at the edge (e.g., wearable devices, imaging) supports hardware adoption. |

| Smart consumer electronics | Growth in AI-enabled and ultralow-power smart devices drives integration of neuromorphic chips in consumer segments. |

| Industrial and robotics automation | Requirement for real-time decision-making and efficient computing in industrial robotics and automation encourages neuromorphic deployments. |

Regional Analysis

North America dominates the market, with over a 38.4% share in 2024 and strong investments in neuromorphic R&D and manufacturing infrastructure. The region’s dominant position is supported by leading semiconductor firms and government initiatives. Asia-Pacific is expected to exhibit the fastest growth over the forecast period due to growing electronics manufacturing, rising AI adoption and policy support for advanced computing. Europe and rest of world regions are gradually improving their foothold, though they lag North America in terms of scale and ecosystem maturity.

➤ More data, more decisions! See what’s next – https://market.us/purchase-report/?report_id=161521

Business Opportunities

There are strong business opportunities across the neuromorphic hardware ecosystem. Hardware vendors can capitalise on demand for specialised neuromorphic processors and memory architectures. Systems integrators and semiconductor foundries can capture value by providing design-to-manufacture services for neuromorphic devices. Edge-computing solution providers can develop end-to-end neuromorphic platforms tailored to automotive, robotics or healthcare applications. Additionally, software developers and algorithm providers have the opportunity to supply spiking-neural-network frameworks, development tools and middleware that enable adoption of neuromorphic hardware. Strategic cross-industry partnerships present further value creation possibilities.

Key Segmentation

The market can be segmented by offering (hardware, software), deployment (edge, cloud) and application across sectors such as automotive, healthcare, consumer electronics and industrial automation. Hardware remains the dominant segment given the value-intensive nature of neuromorphic processors. Edge deployment is expected to grow rapidly due to the need for low-latency, local processing. Automotive and autonomous systems represent major application clusters, followed by healthcare diagnostics and smart devices. Each segment presents distinct growth pathways depending on technology maturity, industry adoption and regulatory context.

Key Player Analysis

The competitive landscape is characterised by a handful of established semiconductor and computing companies along with emerging niche players focusing exclusively on neuromorphic architecture. These firms are investing heavily in hardware platforms, software ecosystems and partnerships with device manufacturers. Their strategic moves include launching neuromorphic processor families, establishing alliances with automobile OEMs and healthcare device makers, and advancing fabrication capabilities tailored to spiking-neural-network workloads. As the market expands, differentiation through energy efficiency, scalability and ecosystem support will be critical in gaining leadership positions.

- aiCTX AG

- Applied Brain Research Inc.

- BrainChip Holdings Ltd.

- General Vision Inc.

- GrAI Matter Labs

- Hewlett Packard Enterprise (HPE)

- HRL Laboratories, LLC

- IBM Corporation

- Innatera Nanosystems B.V.

- Intel Corporation

- Knowm Inc.

- Micron Technology, Inc.

- Nepes Corporation

- Numenta, Inc.

- Prophesee SA

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- SynSense AG

- Others

Recent Developments

- A brain-inspired supercomputer system was revealed that mimics over 1.15 billion artificial neurons and 128 billion synapses, marking a significant milestone in neuromorphic architecture.

- Researchers in China developed a neuromorphic AI server of mini-fridge size claiming 90% power reduction compared to traditional datacentre servers.

- Advances in neuromorphic chip designs have incorporated on-chip learning architectures and novel instruction sets, allowing millions of neurons per chip.

- The neuromorphic computing market report announced projected values reaching USD 1,325.2 million by 2030, highlighting an 89.7% CAGR and strong uptake across automotive and space applications.

- Studies show increased adoption of neuromorphic chips in automotive ADAS and consumer electronics sectors, driven by demand for energy-efficient, real-time perception systems.

Conclusion

The neuromorphic hardware market is experiencing significant growth, driven by rising AI demand, edge-computing needs and energy-efficient architectures. Businesses that strategically align with this trend stand to benefit from vast economic and technological opportunities.