Table of Contents

Introduction

The global zero-emission vehicles (ZEV) market is entering a transformative growth phase supported by clean energy transitions and policy-driven innovation. With global environmental targets accelerating, manufacturers and consumers alike are adopting zero-emission mobility solutions at a rapid pace. The market continues to gain momentum as awareness and affordability improve.

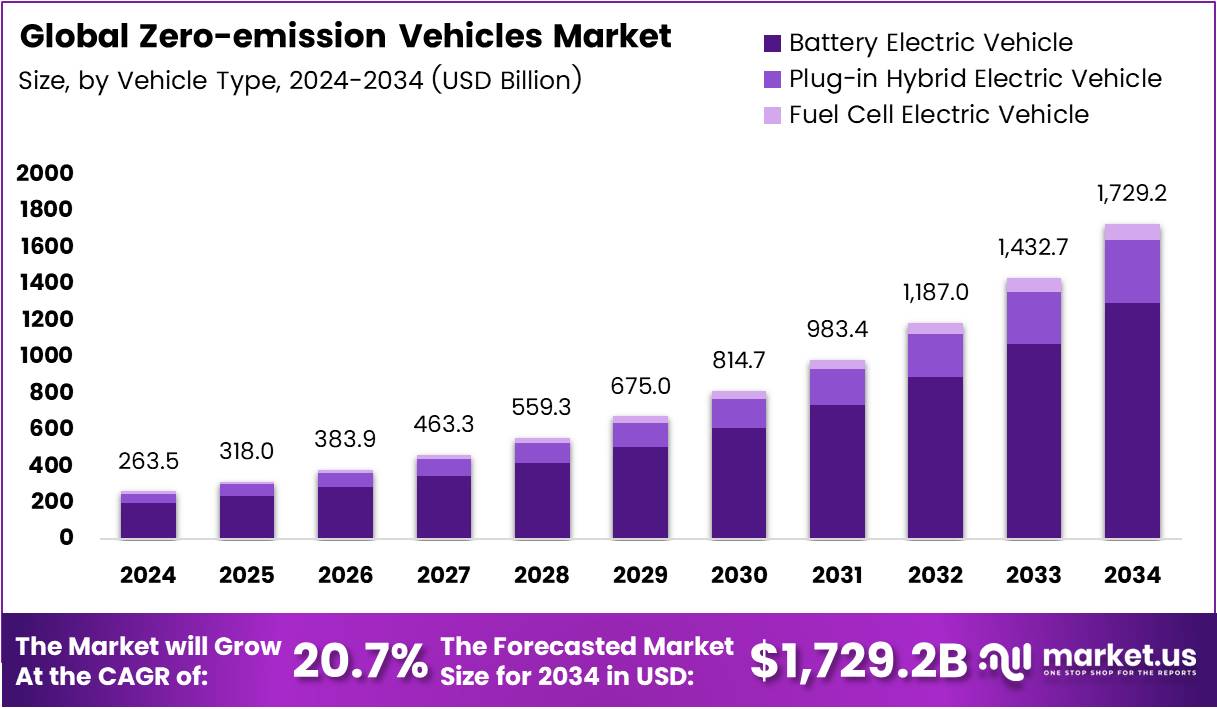

According to recent market insights, the Global Zero-emission Vehicles Market is projected to increase from USD 263.5 Billion in 2024 to approximately USD 1,729.2 Billion by 2034, representing a strong CAGR of 20.7% between 2025 and 2034. This upward trajectory reflects growing adoption of sustainable transportation solutions, driven by advancements in electric and hydrogen vehicle technologies.

In addition, supportive regulatory frameworks and large-scale infrastructure developments further stimulate market expansion. Governments across regions are introducing tax incentives, emission regulations, and funding initiatives to encourage industry investments and boost consumer confidence.

Key Takeaways

- The Global Zero-emission Vehicles Market is valued at USD 263.5 Billion in 2024 and projected to reach USD 1,729.2 Billion by 2034, growing at a CAGR of 20.7%.

- Battery Electric Vehicle (BEV) dominates the market with a 74.9% share in 2024 due to strong infrastructure and government incentives.

- Passenger Vehicle segment leads with a 65.3% share in 2024, driven by rising affordability and sustainability awareness.

- Front Wheel Drive (FWD) accounts for 48.7% of the market, supported by compact design and energy efficiency.

- North America leads regionally with a 43.9% market share valued at USD 115.6 Billion in 2024.

Market Segmentation Overview

The Battery Electric Vehicle (BEV) segment dominates the market due to rapid improvements in battery technology, cost-effective charging infrastructure, and government-backed purchase incentives. Widespread consumer acceptance continues to grow, making BEVs the primary choice for personal and commercial sustainable mobility solutions.

In the application segment, Passenger Vehicles hold the largest share because of rising consumer interest in environmentally conscious transportation. Increasing model availability, competitive pricing strategies, and enhanced driving ranges are supporting broader consumer adoption in urban and suburban areas.

By vehicle drive type, Front Wheel Drive (FWD) systems maintain the largest share owing to compact engineering and energy efficiency benefits. As manufacturers prioritize efficiency and urban driving performance, FWD configurations remain the most suitable choice for modern electric vehicle platforms.

Drivers

Government Incentives and Regulatory Support: Global policy frameworks promoting emissions reduction continue to propel ZEV adoption. Subsidies, tax credits, and fuel-efficiency standards are making ZEVs more accessible to consumers and encouraging automakers to expand electric and hydrogen vehicle production.

Technological Advancements in Battery Systems: Continued enhancements in battery chemistry, performance, and cost-efficiency are critical growth drivers. Higher energy density batteries enable longer driving ranges and shorter charging times, increasing practicality for everyday usage and commercial deployment.

Use Cases

Urban Personal Transportation: Cities are increasingly adopting zero-emission mobility solutions to reduce pollution and congestion. Electric cars and two-wheelers are becoming preferred choices for commuting, especially with growing availability of public charging stations and shared mobility platforms.

Commercial and Fleet Operations: Logistics providers and corporate fleets are transitioning to electric delivery vans and light-duty trucks to reduce fuel costs and align with sustainability goals. Zero-emission fleet operations help organizations meet corporate environmental responsibility targets while improving operational efficiency.

Major Challenges

High Upfront Cost of Zero-emission Vehicles: Although operating costs are lower, initial vehicle purchase prices remain comparatively high due to expensive battery components. This limits adoption among cost-sensitive consumers, especially in developing economies where government incentives may be limited.

Battery Disposal and Recycling Limitations: With rising EV adoption, the demand for effective battery end-of-life management is increasing. The current recycling ecosystem is underdeveloped and expensive, raising concerns around environmental sustainability and material recovery efficiency.

Business Opportunities

Growing Hydrogen Fuel Cell Vehicle Adoption: Expanding hydrogen production and refueling infrastructure presents a significant opportunity, particularly for heavy transportation. Fuel cell vehicles provide longer driving ranges and faster refueling, making them suitable for buses, trucks, and commercial fleets.

Vehicle-to-Grid (V2G) Integration: The rise of smart energy networks creates opportunities for EVs to serve as mobile power storage units. V2G systems allow surplus stored energy in EV batteries to be redistributed to electricity grids, enhancing grid stability and offering cost-saving benefits to owners.

Regional Analysis

North America: North America leads the global ZEV market, supported by government mandates, investment in smart charging infrastructure, and strong consumer demand. Policies designed to phase out internal combustion engines are driving rapid industry transformation across the region.

Asia Pacific: The Asia Pacific region is experiencing rapid ZEV adoption fueled by urbanization, government subsidies, and expanding domestic EV production capabilities. China remains the largest contributor, with strong market leadership in both EV manufacturing and battery technology innovation.

Recent Developments

- In March 2025, Rivian Automotive, Inc. formed Also Inc., raising US$ 105 million to enhance electric mobility initiatives.

- In October 2025, Toyota collaborated with the UK Government on a £30 million project to accelerate ZEV development and production.

- In September 2024, the UK Government allocated £88 million for next-generation zero-emission vehicle research and manufacturing.

- In December 2024, the U.S. EPA announced over $735 million in grants to support zero-emission heavy-duty vehicle replacements.

Conclusion

The global Zero-emission Vehicles Market is poised for sustained long-term expansion as governments, manufacturers, and consumers align around environmental sustainability goals. Technological innovation, supportive policies, and rising market awareness continue to fuel widespread adoption. As the industry transitions to cleaner mobility systems, the ZEV market is expected to drive significant economic, environmental, and social benefits across global transportation networks.