Table of Contents

Introduction

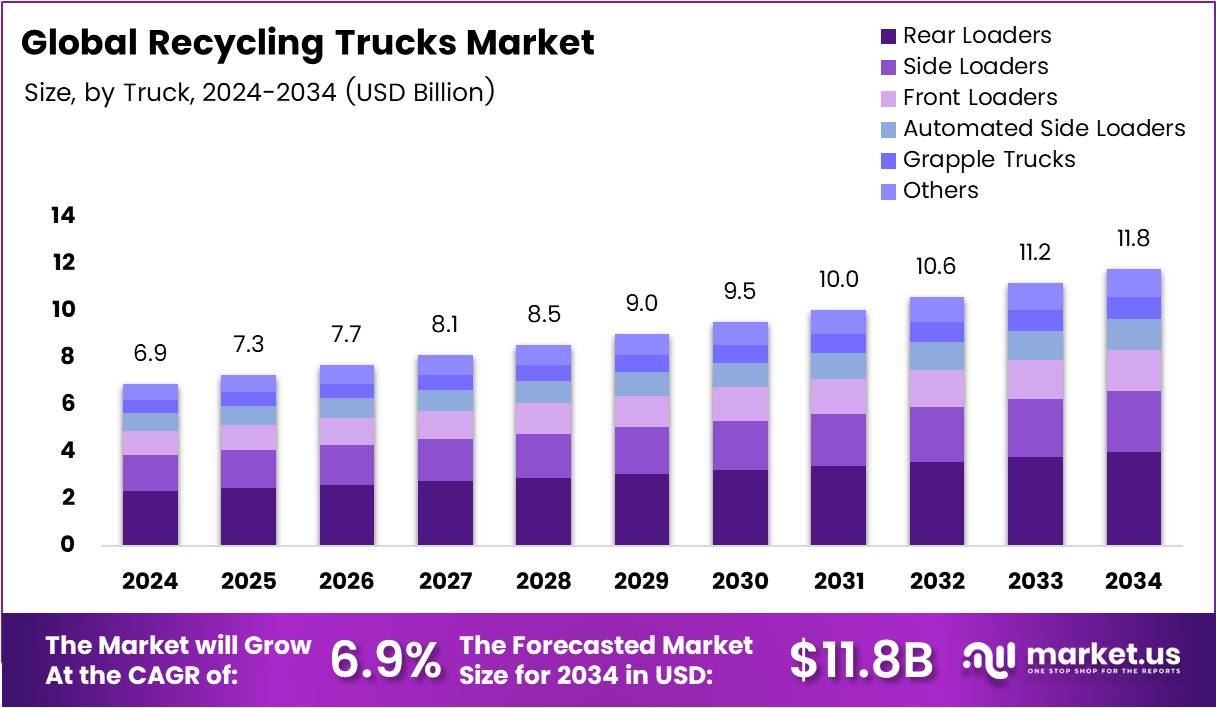

The Global Recycling Trucks Market is projected to reach USD 11.8 Billion by 2034, rising from USD 6.9 Billion in 2024, at a CAGR of 5.5% from 2025 to 2034. The growing push toward sustainability and waste reduction is reshaping how municipalities and private operators manage recyclable materials. Recycling trucks have become central to efficient waste diversion systems, supporting both environmental goals and regulatory compliance.

As awareness of circular economy practices increases, governments and organizations are investing in advanced recycling fleet technologies. These include automation, improved waste compaction, and reduced-emission propulsion systems. With cities expanding and recycling requirements becoming stricter, demand for specialized recycling trucks is expected to rise steadily across global markets.

Additionally, supportive policy frameworks, funding programs, and infrastructure modernization initiatives are accelerating adoption. Industries are emphasizing environmentally responsible waste handling, and recycling trucks play an essential role in enabling streamlined collection and processing. This market continues to evolve as manufacturers introduce innovative equipment designed for efficiency, durability, and reduced operational impact.

Key Takeaways

- The Global Recycling Trucks Market is projected to reach USD 11.8 Billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034.

- Rear Loaders dominate the By Truck Analysis segment in 2024 with a 33.8% market share.

- Compactor Trucks lead the By Body Type Analysis segment in 2024 with a 44.7% market share.

- Trucks with a 10 to 20 tons capacity dominate the By Capacity Analysis segment in 2024 with a 51.9% market share.

- ICE (Internal Combustion Engine) trucks dominate the By Propulsion Analysis segment in 2024 with an 89.3% market share.

- North America holds a 39.4% share of the Recycling Trucks market in 2024, valued at USD 2.7 Billion.

Market Segmentation Overview

In the By Truck segment, Rear Loaders remain the most widely used due to their effectiveness in residential curbside collection. Their simple handling, compatibility with small containers, and ease of integration into existing routes make them highly preferred. Meanwhile, Side Loaders and Automated Side Loaders are gaining traction in urban zones focused on reducing labor dependency and boosting operational efficiency.

In the By Body Type segment, Compactor Trucks dominate because of their ability to compress waste materials, maximizing load capacity and reducing transportation cycles. These trucks support efficient recycling workflows, especially in high-density cities. Transfer Trucks and Roll-Off Trucks serve specific industrial and large-scale operations, contributing to targeted waste movement efficiency.

In the By Capacity segment, the 10 to 20 tons category leads with its flexibility and suitability across multiple applications. These trucks can navigate both urban and industrial environments, offering a balance of maneuverability and payload capability. Smaller fleets used for residential pickups and larger models used for industrial waste collection make up the secondary demand groups.

In the By Propulsion segment, ICE-powered recycling trucks dominate due to well-established fueling infrastructure and proven durability. However, electric recycling trucks are emerging as governments enforce emissions regulations and municipalities adopt fleet electrification strategies. Future growth is expected to shift gradually toward zero-emission vehicles.

Drivers

Increasing Demand for Waste Management Solutions: Rapid urbanization and population growth have significantly increased waste generation, driving the need for efficient recycling systems. Municipal authorities are investing in modern waste collection fleets to ensure environmental compliance and reduce landfill dependency.

Government Sustainability Initiatives: Many national and regional governments are implementing recycling mandates and circular economy policies. Incentives, grants, and regulatory frameworks encourage organizations to adopt advanced recycling fleet technologies, accelerating market expansion.

Use Cases

Municipal Waste Collection: Cities use recycling trucks for scheduled collection programs across residential areas. These vehicles support organized recycling initiatives, ensuring recyclable materials are properly sorted, collected, and transported to processing centers.

Industrial and Commercial Waste Handling: Large facilities rely on specialized recycling trucks for bulk waste movement. Transfer Trucks and Roll-Off Trucks play critical roles in handling large, recyclable loads from manufacturing plants, retail warehouses, and disposal facilities.

Major Challenges

High Cost of Fleet Modernization: Advanced recycling trucks require significant upfront investment for purchase, maintenance, and operation. Smaller waste management firms may struggle to adopt modern vehicles due to budget limitations.

Limited Sorting Infrastructure: In many developing regions, recycling infrastructure remains insufficient. Without proper sorting facilities, collected materials may not be efficiently processed, reducing the overall benefit of recycling investments.

Business Opportunities

Growing Demand for Electric and Hybrid Trucks: As governments push for low-emission fleets, manufacturers offering electric-powered and hybrid recycling trucks can expect strong growth. Advancements in battery technology will further support market scaling.

Smart Fleet Management Technologies: IoT integration, real-time monitoring, and automated routing systems represent opportunities for fleet operators. These solutions enhance operational efficiency and reduce fuel expenditure.

Regional Analysis

North America: With a market value of USD 2.7 Billion and 39.4% share in 2024, North America leads due to strong recycling infrastructure, municipal funding, and sustainability policies. Active fleet modernization and emissions-reduction initiatives support ongoing growth.

Europe: Europe follows closely, supported by stringent environmental regulations and high recycling rates. The EU’s push toward circular economy models boosts demand for modern waste collection vehicles, especially those focusing on automation and eco-efficiency.

Recent Developments

- In July 2024, Eureka Recycling secured over USD 10 Million in financing to upgrade its Materials Recovery Facility, increasing recycling efficiency.

- In July 2025, Mack Trucks launched an electric refuse truck in the Bronx to support urban emissions reduction programs.

- In December 2024, the EPA awarded over USD 735 Million in grants to encourage adoption of clean heavy-duty recycling and waste handling vehicles.

Conclusion

The Recycling Trucks Market is positioned for sustained expansion as cities, governments, and industries prioritize sustainable waste management. With evolving regulations, technological advancements, and increasing public awareness, demand for efficient and environmentally friendly recycling vehicles will continue to rise. Manufacturers investing in electrification, automation, and smart fleet technologies are expected to gain strong competitive advantages in the coming decade.