Table of Contents

Introduction

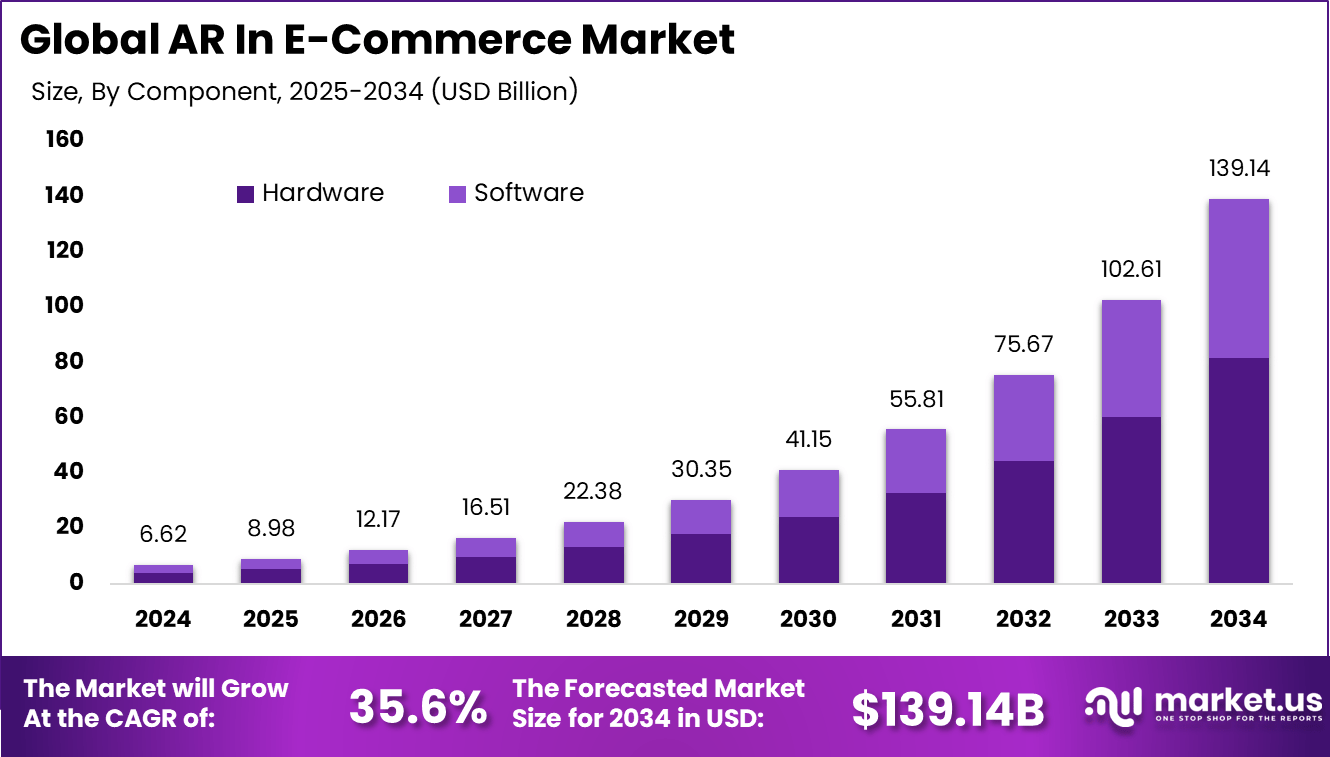

The global AR in e-commerce market size is expected to grow from USD 6.62 billion in 2024 to approximately USD 139.14 billion by 2034 at a projected CAGR of 35.6%. In 2024, North America held a dominant share of more than 41.6% of the market, with revenues of around USD 2.75 billion.

The adoption of augmented reality (AR) technologies in online retail is being driven by rising smartphone penetration, improved mobile connectivity, and web-based AR experiences that reduce reliance on apps. Studies indicate that conversion rates for AR-enabled shopping can be up to 94% higher than those for non-AR approaches, enabling a compelling value proposition.

How Growth is Impacting the Economy

The dominant segment of investment is flowing into immersive retail experiences, which is expected to generate new economic activity through hardware, software, content creation, and user-interaction services. This growth is anticipated to stimulate job creation in AR development, digital content design, and mobile application services, while accelerating demand for high-speed connectivity and 5G infrastructure.

The expansion of AR in e-commerce fosters greater consumer spending by increasing online purchase frequency and reducing return rates — this improvement in retail efficiency contributes to higher margins, taxation, and productivity in the retail sector. As AR technology becomes more accessible, smaller retailers and regional markets are projected to benefit, thereby supporting regional economic development and reducing disparities. The broader effect is a strengthening of the digital economy, as AR-driven e-commerce sits at the intersection of tech, retail, and services.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/ar-in-e-commerce-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses are facing increased upfront costs for AR integration — including hardware procurement, 3D asset creation, software licensing, and mobile-app enhancements. However, these investments are offset by reductions in product returns (which AR helps reduce), improved customer engagement, and higher conversion rates.

Supply chains are shifting toward more digital and flexible models: retailers are sourcing AR-ready content, engaging virtual try-on service,s and collaborating with tech providers rather than relying purely on traditional manufacturing and logistics. This forces global businesses to adapt supplier relationships, training, and fulfilment operations.

Sector-Specific Impacts

In the fashion and beauty sectors, AR is enabling virtual try-ons, which is projected to shrink return-rates by up to 25% and raise online sales significantly. In furniture and home decor e-commerce AR allows consumers to visualise items in their space, driving deeper engagement and conversion lifts of circa 100% in some cases. In electronics and accessories, AR helps customers confirm size, fit, and function virtually, reducing post-purchase dissatisfaction. Each sector is being redefined by immersive consumer interactions, compelling businesses to remodel digital-first strategies.

Strategies for Businesses

Businesses should prioritise scalable AR solutions that work across devices (web-based AR, smartphones) to minimise friction. They should partner with AR tool providers and integrate analytics to monitor user engagement, conversion uplift, and return-rate changes. Developing rich 3D content libraries, investing in virtual try-on modules, and embedding AR experiences into social-commerce platforms can drive competitive differentiation.

Omni-channel integration is key — linking online AR previews with in-store QR or mobile experiences allows seamless transitions. Additionally, training internal teams, aligning marketing and IT functions, and selecting KPIs (such as time spent in AR, conversion lift, and return-reduction) will help capture ROI effectively.

Key Takeaways

- The market is projected to grow to USD 139.14 billion by 2034 at a 35.6% CAGR

- North America currently leads with over 41.6% share in 2024

- AR can boost conversion rates by up to 94% and reduce returns by up to 25%

- Rising AR adoption is reshaping supply chains, increasing upfront costs but improving retail efficiency

- Sector-specific benefits vary: fashion, home goods, and electronics are key beneficiaries

- Strategic investment, content development, and analytics-driven deployment are essential for businesses

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162244

Analyst Viewpoint

At present, the AR in the e-commerce market is in a phase of rapid expansion, driven by consumer demand for immersive and interactive online shopping and by the roll-out of enabling technologies such as 5G and AR-cloud frameworks. Looking ahead, the future is positive: as AR becomes mainstream and cost barriers decline, adoption is expected to spread beyond leading brands into mid-tier and regional retailers. Margins will improve, user experience will evolve, and the competitive advantage of immersive commerce will become a standard expectation rather than a differentiator. The long-term trajectory suggests a transformation of online retail and sustained growth for AR-enabled platforms.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Virtual try-on for fashion/beauty | Rising smartphone AR support; consumer desire for virtual fitting; higher conversion and lower returns (30-40 % uplift) |

| Home-furnishing visualisation (place item in room) | Increase in mobile commerce; improved spatial-computing; consumer preference for visual confirmation before purchase |

| Interactive product visualisation for electronics/accessories | Need for customer confidence in size/fit; reduction in post-purchase dissatisfaction; AR engagement data driving decisions |

| Social-commerce AR campaigns | Rising influencer/social-commerce adoption; younger demographics willing to use AR (90 % of Gen Z) |

Regional Analysis

In North America the market held about 41.6 % share in 2024 and remains the largest region thanks to strong digital infrastructure, high consumer willingness to adopt AR and presence of major technology platforms. Asia Pacific is projected to achieve the highest growth rate during the forecast period, driven by rapid mobile internet adoption, large e-commerce penetration and aggressive technology roll-out. Europe is adopting AR comparatively steadily, with consumer demand for immersive retail experiences and growing emphasis on omni-channel strategies. Emerging markets in Latin America and Middle East & Africa present opportunities as smartphone penetration and internet connectivity improve.

➤ More data, more decisions! see what’s next –

- Quantum-Safe Messaging Apps Market

- Corporate Volunteering Platform Market

- North America Earned Wage Access Market

- AI Task Manager App Market

Business Opportunities

The advancing AR in the e-commerce landscape offers multiple business opportunities. Service providers can develop plug-and-play AR modules targeting small and mid-sized retailers to democratise interactive shopping. Content creation agencies specialising in 3D modelling and AR asset management can capitalise on the demand.

Brands can exploit AR for personalisation and loyalty programmes — for example, by enabling custom virtual product visualisation or social-AR experiences. Integration of AR with AI-driven recommendations and user-behaviour analytics opens monetisation avenues through targeted advertising and upselling. Software platforms that simplify AR deployment, reduce cost and streamline measurement will capture significant value.

Key Segmentation

The market can be segmented by component (hardware, software), display type (HMD, smart glass, HUD, handheld devices), application (virtual try-on solutions, product visualisation, AR advertising & marketing, personalised shopping experience, virtual showrooms), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa). Each segment is projected to grow, with the software component and handheld device display type showing particularly strong momentum owing to smartphone-driven adoption.

Key Player Analysis

Major industry players are focusing on strategic partnerships, acquisitions and product innovations to enhance their AR capabilities and to address the rapidly evolving e-commerce ecosystem. They are investing in platforms that integrate AR into existing retail systems, focusing on scalability, user-friendliness and cross-device experience. The competitive landscape is shifting from pure hardware to service-oriented AR ecosystems as companies race to offer end-to-end solutions including 3D asset creation, analytics and omnichannel deployment. Firms that leverage strong developer tools, global reach and retail partnerships are expected to lead future growth.

- Google LLC

- Inter IKEA Systems B.V.

- Apple Inc.

- Meta Platforms, Inc.

- Amazon.com, Inc.

- Snap Inc.

- Microsoft Corporation

- Houzz Inc.

- L’Oréal Paris

- Shopify Inc.

- Perfect Corp.

- Others

Recent Developments (Jan-Sept)

- A major social-media platform released free AR-try-on tools for brands to embed into e-commerce interfaces.

- A leading furniture retailer updated its mobile app with advanced AR functionality allowing room-scale placement and interactive product demos.

- A fashion brand reported a conversion rate triples when customers engaged with its AR virtual try-on feature.

- A smartphone manufacturer launched new hardware with enhanced AR-specific processors and sensors to boost AR shopping experiences.

- An analytics firm published data showing AR-enabled product pages reduced return rates by up to a quarter compared to standard pages.

Conclusion

The AR in e-commerce market is set for exponential growth, underpinned by strong consumer adoption and technological advances. Businesses that act now by embedding immersive experiences, measuring impact and scaling AR solutions stand to gain significant competitive advantage and long-term value.