Table of Contents

Introduction

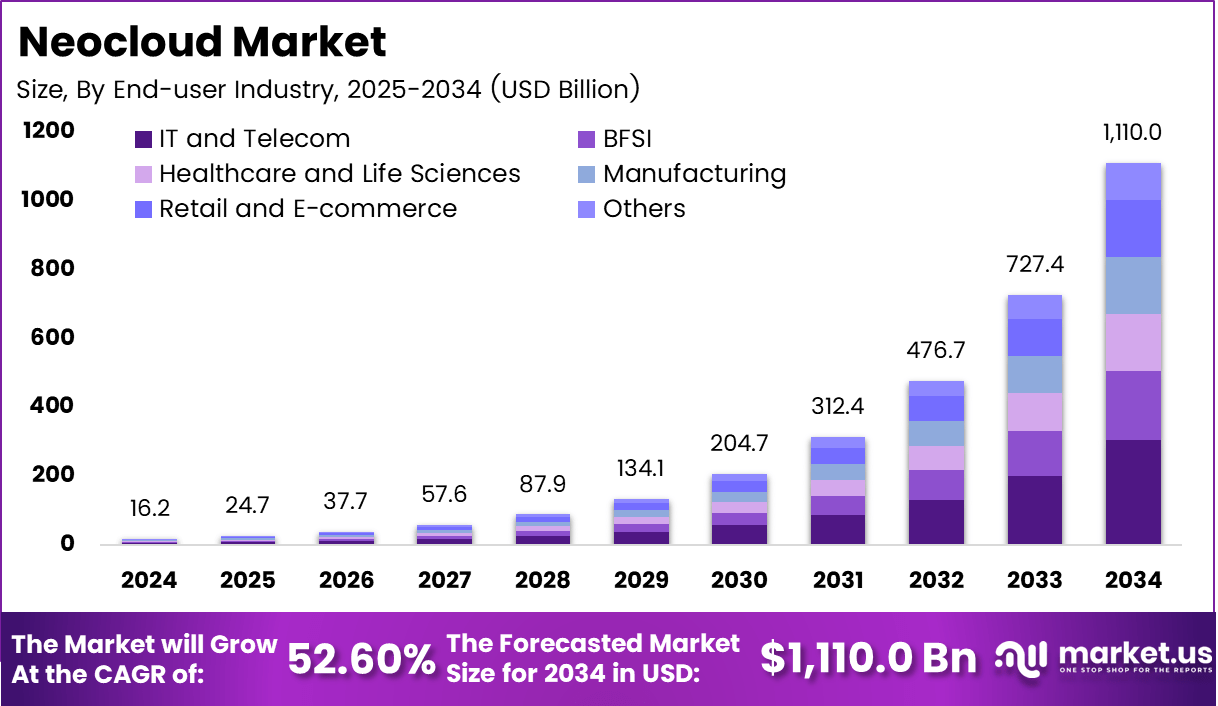

The global neocloud market is projected to jump from USD 16.21 billion in 2024 to USD 1,110 billion by 2034, expanding at a CAGR of approximately 52.6%. North America alone holds a value of USD 6.69 billion in 2024, leading the adoption curve owing to rapid enterprise migration toward cloud-native infrastructures and DevOps automation.

The term “neocloud” refers to specialised cloud providers built from the ground up for GPU-centric workloads and AI/ML training rather than general-purpose cloud services. This surge reflects dramatic shifts in infrastructure demand, driven by generative-AI compute hunger, evolving enterprise workloads, and new cloud economics.

How Growth is Impacting the Economy

The neocloud market growth is anticipated to have multiplier effects across macroeconomic indicators and industrial capacity. As enterprises invest heavily in GPU-optimized infrastructure, capital expenditure in data centres and chip production expands, stimulating manufacturing, construction, and semiconductor ecosystems. Labour markets are impacted via demand for AI infrastructure engineers, data-centre technicians, and cloud operations specialists, thereby driving wage growth and employment in high-tech hubs.

National-scale infrastructures — including edge-data-centres and sovereign AI-cloud facilities — attract government-initiated subsidies and regulatory frameworks, boosting digital-infrastructure investment and supporting broader technology-driven productivity growth. The scale of growth also influences energy markets and raw-material supply chains (such as high-end GPUs, cooling systems, and networking fabric), embedding neocloud economics in industrial supply chains and regional development strategies globally.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/neocloud-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As demand for high-performance GPUs and related hardware soars, component and semiconductor pricing experience upward pressure. This directly raises infrastructure costs for business users of Neocloud services. Equipment lead-times and supply constraints push companies to rethink procurement and inventory strategies. Global businesses face supply-chain shifts as GPU vendors, data-centre operators, and cloud-infrastructure firms reorient toward specialised AI workloads, moving away from standard general-purpose cloud hardware.

Sector-Specific Impacts

In the healthcare sector, neocloud-based platforms enable faster genomic sequencing, medical image analysis and AI-driven diagnostics but require higher compute budgets and robust regional Data-sovereignty compliance. Financial services benefit from model retraining and real-time risk analytics but contend with increased infrastructure cost and latency demands when moving compute deeper to edge or regional hubs. Manufacturing and automotive firms using simulation, digital twins and autonomous-vehicle development demand massive GPU clusters, aligning with neocloud offerings but also facing escalation of capital intensity and cooling/infrastructure costs.

Strategies for Businesses

Businesses seeking to harness neocloud growth should adopt the following strategic approaches:

- Evaluate hybrid-cloud frameworks that integrate neocloud providers for AI-specific workloads while retaining traditional cloud for general-purpose services.

- Negotiate long-term GPU-compute contracts or reserved capacity to lock in infrastructure cost and mitigate price escalation risk.

- Optimise workload placement: identify AI-training and inference workloads that benefit from neocloud environments (e.g., high GPU-utilisation, low-latency applications) and migrate accordingly.

- Invest in underlying data-preparation, model orchestration, and DevOps for AI to maximise ROI from neocloud capacity rather than simply scaling compute.

- Monitor regional regulation, data-residency, energy-cost, and cooling-infrastructure factors when selecting neocloud partners, especially for distributed or edge deployments.

Key Takeaways

- The neocloud market is entering hyper-growth, moving from billions to over a trillion-dollar opportunity in the next decade.

- Growth is driving economic investment in infrastructure, semiconductors, and high-tech employment globally.

- Global enterprises face rising procurement and operational costs as infrastructure demands shift to GPU-centric environments.

- Sector-specific use-cases (healthcare, finance, manufacturing) benefit significantly but must manage higher capital and complexity.

- Businesses should adopt hybrid placement strategies, secure reserved capacity, and focus on workload migration and DevOps maturity.

- Regional factors such as data sovereignty, cooling/infrastructure cost, and energy supply become decisive in selecting neocloud partnerships.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163175

Analyst Viewpoint

At present, the neocloud market offers a compelling growth trajectory as enterprises accelerate AI deployment and infrastructure vendors pivot to GPU-first models. The economy is aligning behind this structural shift in cloud computing fundamentals. Looking ahead, the future remains positive: as GPU pricing stabilises, regional edge deployments proliferate and enterprises mature their AI workflows, neoclouds are projected to become foundational infrastructure for AI-driven business transformation. Companies that position ahead of the curve may gain a competitive advantage through cost-optimised performance and reduced time-to-market for AI initiatives.

Use-Case & Growth Factors

| Use-Case | Growth Factor |

|---|---|

| Training large language models and generative-AI workflows | Rising demand for GPU compute and model complexity is driving the purpose-built infrastructure |

| Real-time AI inference at the edge (healthcare diagnostics, autonomous systems) | Need for low latency, distributed compute beyond centralised hyperscale clouds |

| High-performance simulation and digital-twin deployments in automotive/manufacturing | Advances in GPUs, networking and data-fabric enabling larger simulation workloads |

| Cloud-native DevOps/ML-ops platforms for enterprises | Shift from general-purpose cloud to workload-optimised environments and DevOps automation |

| Data-sovereign and regional AI-cloud deployments | Regulatory, latency and data-residency pressures driving localised neocloud infrastructure |

Regional Analysis

North America currently leads the neocloud adoption with a market value of USD 6.69 billion in 2024, driven by strong enterprise migration to cloud-native architectures, DevOps acceleration and early infrastructure investment. Europe and Asia Pacific are expected to grow rapidly as regional governments and industries prioritise AI infrastructure build-out, data-residency compliance and edge compute deployment. Latin America, Middle East & Africa will gradually follow, although their growth may be constrained by energy/infrastructure cost and latency limitations. Regional variations in energy cost, data-centre cooling, chip supply, and regulation will influence adoption pace and partner selection in different markets.

➤ More data, more decisions! see what’s next –

- Quantum-Safe Messaging Apps Market

- Corporate Volunteering Platform Market

- North America Earned Wage Access Market

- AI Task Manager App Market

Business Opportunities

The rapid expansion of the neocloud market presents numerous business opportunities. Infrastructure-builders (data-centre operators, GPU/IP vendors, cooling and power-solutions providers) can capitalise on accelerating demand for purpose-built GPU clusters and edge hubs. Application vendors and AI-services firms can design optimised engine-hosting, inference, and training services tailored for neocloud environments. Enterprises could partner with neocloud providers to deploy private AI environments and monetise internal data assets. Regional players can establish sovereign neocloud ecosystems to meet local compliance and latency needs, creating differentiated service offerings. Overall, the growth trajectory enables new value-chains, partnerships, and monetisation models across technology, infrastructure, and service domains.

Key Segmentation

In mapping the neocloud market, segmentation can be organised across key dimensions:

- By Infrastructure Type: GPU-cluster as a service, bare-metal AI compute, managed inference platforms.

- By Deployment Model: Public neocloud, private neocloud, hybrid neocloud.

- By End-Use Sector: Enterprise AI & ML workflows, HPC/simulation, edge/5G workloads, data-sovereign/regional cloud services.

- By Region: North America, Europe, Asia Pacific, Rest of World.

Each segment exhibits distinct growth drivers: for example, managed inference platforms benefit from operational simplicity, while bare-metal AI compute appeals to large-scale model-builders.

Key Player Analysis

The leading firms in the neocloud ecosystem demonstrate rapid revenue expansion, significant capital spending for GPU infrastructure, and aggressive scaling of data-centre capacity. These players specialise in AI-first cloud services, leverage partnerships with major GPU vendors, and often secure take-or-pay contracts with large enterprise and AI-model clients.

Their business models focus on high utilisation of GPU clusters, cost advantage over hyperscalers, and niche positioning in infrastructure for AI workloads. Competitive differentiation hinges on hardware efficiency, specialised networking fabric, regional deployment agility, and the ability to serve low-latency, high-throughput AI applications.

- CoreWeave, Inc.

- Nebius International B.V.

- Lambda Labs, Inc.

- Genesis Cloud GmbH

- Vast.ai, Inc.

- RunPod, Inc.

- G-Core Labs S.A.

- Crusoe Cloud (Crusoe Energy Systems LLC)

- The Constant Company, LLC (Vultr)

- Paperspace, Inc.

- LeptonTogether AI

- Amazon Web Services Inc.

- Microsoft Azure (Microsoft Corporation)

- Google Cloud Platform (Google LLC)

- Oracle Cloud (Oracle Corporation)

- Sustainable Metal Cloud (Firmus Metal International Pte. Ltd.)

- Together AI (Together Computer Inc,)

- Hyperstack (NexGen Cloud Limited)

- Scaleway (Scaleway SAS)

- DataCrunch (DataCrunch Oy)

- Whitefiber, Inc.

- Others

Recent Developments

- A major neocloud provider announced the purchase of roughly USD 400 million worth of MI355X chips to build a dedicated AI data-centre facility in the US.

- Analysts published a report showing Neocloud revenue exceeded USD 5 billion in Q2 and is on pace to hit USD 23 billion globally in 2025.

- Industry commentary highlighted that pricing per-GPU-hour in Neoclouds can reach up to 66 % lower than hyperscaler equivalents for the same hardware.

- Observers suggest neoclouds may take more than one-third of total GPU demand in AI infrastructure going forward.

- Regulatory and data-sovereignty pressures are causing telecom and cloud operators to explore neocloud architectures deployed closer to the edge.