Table of Contents

Introduction

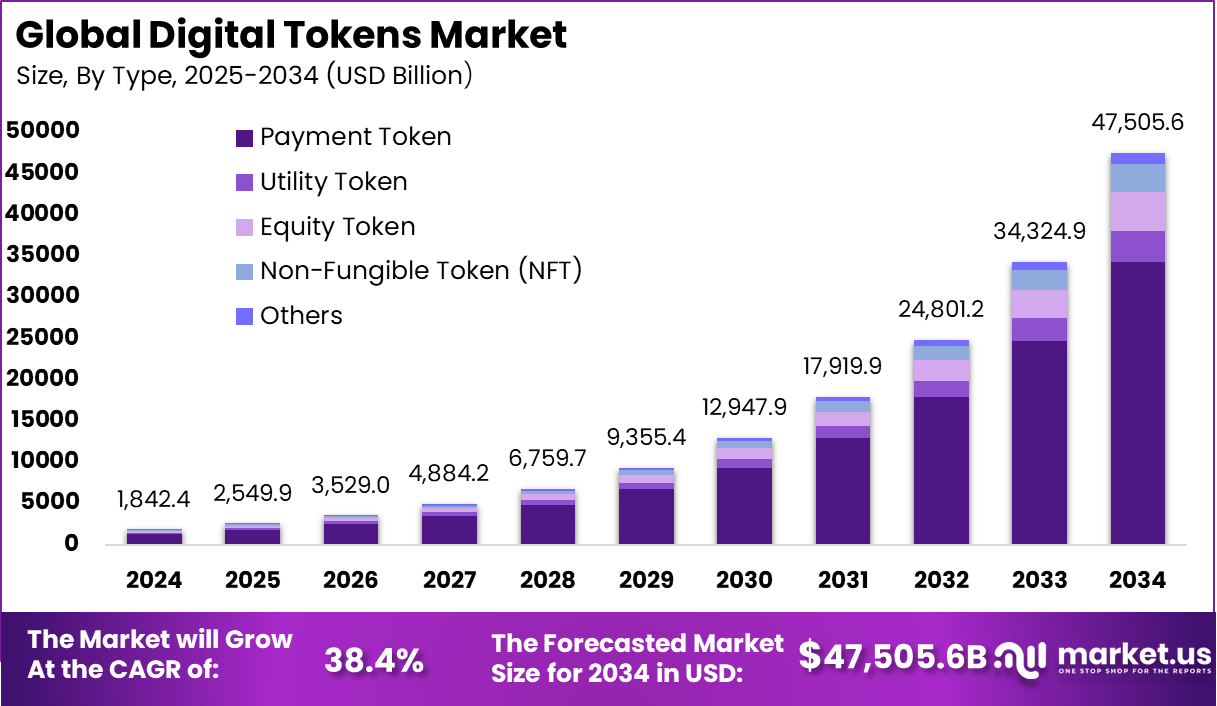

The Global Digital Tokens Market generated USD 1,842.4 billion in 2024 and is forecast to rise from USD 2,549.9 billion in 2025 to USD 47,505.6 billion by 2034, expanding at a CAGR of 5.94%. Growth is fueled by rising adoption of tokenized assets, expanding blockchain infrastructure, digital payments, and institutional interest in regulated token ecosystems. North America led the market in 2024 with a 43.2% share, generating USD 795.9 billion in revenue. Increasing digitalization, cross-border payment modernization, and token-based financial instruments are accelerating global market expansion.

How Growth Is Impacting the Economy

The rapid growth of digital tokens is reshaping global economic dynamics by strengthening digital finance ecosystems, expanding financial inclusion, and stimulating innovation in decentralized infrastructure. Tokenized assets enable fractional ownership, accelerating capital flow into real estate, commodities, and securities. This boosts economic liquidity and opens investment pathways for both institutional and retail participants.

Governments benefit from improved tax traceability and more transparent financial systems as regulated blockchain frameworks evolve. Digital tokens also support global commerce by reducing settlement delays, lowering transaction costs, and enabling instant cross-border transfers. As tokenization platforms expand, demand rises for cybersecurity services, blockchain developers, cloud processing, and digital identity verification, fueling job creation and supporting technology-driven GDP growth across developed and emerging markets.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/digital-tokens-market/free-sample/

Impact on Global Businesses

Businesses face rising costs due to compliance requirements, cybersecurity investments, and integration of blockchain-based payment rails. Supply chains are shifting as companies adopt tokenized tracking systems for logistics, procurement, and asset verification. Sector-specific impacts include faster settlements in banking, improved transparency in supply chains, enhanced risk management in insurance, and new monetization models for media and gaming through NFTs and utility tokens. Enterprises adopting tokenized finance gain operational efficiency but must adapt to fluctuating regulations and evolving customer expectations.

Strategies for Businesses

Businesses should implement secure blockchain platforms, strengthen compliance with digital asset regulations, and diversify token-based payment options. Investing in cybersecurity, smart contract audits, and multi-chain compatibility enhances operational resilience. Building partnerships with fintech ecosystems, training staff in blockchain literacy, and integrating real-time analytics will improve competitive positioning. Prioritizing user privacy, digital identity solutions, and scalable blockchain architecture supports long-term growth.

Key Takeaways

- The market is expected to reach USD 47,505.6 billion by 2034

- Steady CAGR of 5.94% driven by tokenized finance and digital payments

- North America leads with strong institutional adoption

- Blockchain enhances transparency, settlement speed, and global liquidity

- High growth potential in fintech, supply chain, gaming, and asset tokenization

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161792

Analyst Viewpoint

The digital tokens market is transitioning from speculative use to regulated utility-based adoption. Current growth is driven by tokenized real-world assets, stablecoins, and enterprise blockchain deployments. Over the next decade, expansion will be strengthened by regulatory clarity, institutional tokenization of assets, and scalable multi-chain networks. The long-term outlook remains positive as decentralized finance merges with traditional financial systems, enabling widespread token adoption across industries.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Cross-border payments | Need for faster, low-cost global transactions |

| Tokenized real-world assets | Rising institutional demand and improved liquidity |

| Supply chain verification | Blockchain transparency and traceability benefits |

| Gaming & NFTs | Growth of digital ownership and metaverse ecosystems |

| Decentralized finance (DeFi) | Demand for automated lending, staking, and smart contracts |

Regional Analysis

North America dominates due to institutional participation, regulatory advancements, and early adoption of blockchain infrastructure. Europe follows with a strong focus on digital finance frameworks and tokenized securities. Asia Pacific is the fastest-growing region driven by rapid fintech innovation, high mobile adoption, and government-backed blockchain initiatives. Latin America is expanding due to reliance on digital tokens for inflation protection and remittances. The Middle East and Africa are leveraging tokenization for digital transformation and trade modernization.

➤ Want more market wisdom? Browse reports –

Business Opportunities

High-growth opportunities exist in tokenized securities, stablecoin ecosystems, digital identity solutions, Web3 payments, and enterprise blockchain platforms. Businesses can capitalize on demand for compliant token issuance systems, cross-chain interoperability tools, and asset-backed digital tokens. Tokenization of real estate, carbon credits, supply chains, and luxury goods creates lucrative revenue pathways. Fintech firms entering regulated token markets have strong prospects for long-term expansion.

Key Segmentation

The market includes cryptocurrency tokens, utility tokens, security tokens, stablecoins, asset-backed tokens, and non-fungible tokens (NFTs). Core applications span payments, decentralized finance, supply chain management, gaming, digital identity, and investment platforms. Technology segments include public blockchain networks, private blockchain systems, cross-chain interoperability, smart contracts, and AI-driven token analytics. Distribution channels include exchanges, digital wallets, fintech platforms, and institutional custodial services.

Key Player Analysis

Key participants focus on improving blockchain scalability, enhancing token security, and building institutional-grade custody solutions. Strategies include expanding multi-chain interoperability, partnering with financial institutions, and offering regulatory-compliant tokenization platforms. Companies are integrating AI analytics, strengthening AML/KYC frameworks, and improving transaction throughput. Market competitiveness is defined by ecosystem strength, transaction speed, security reliability, and cross-industry applicability of token solutions.

- Binance Holdings Ltd.

- Coinbase Global, Inc.

- Ripple Labs, Inc.

- Block, Inc.

- Circle Internet Financial, LLC

- Payward, Inc.

- Gemini Trust Company, LLC

- Bullish, Inc.

- Universal Navigation Inc.

- iFinex Inc.

- KuCoin Global

- Tether Limited

- ConsenSys Software Inc.

- Aux Cayes Fintech Co. Ltd.

- Others

Recent Developments

- April 2024: Major upgrades introduced for regulated tokenized asset platforms.

- July 2024: Rollout of new stablecoin frameworks for global settlements.

- October 2024: Expansion of NFT utility tokens across gaming ecosystems.

- January 2025: Launch of institutional-grade custody solutions for tokenized securities.

- March 2025: Partnerships formed to enhance cross-chain token interoperability.

Conclusion

The Digital Tokens Market is evolving into a foundational pillar of the global digital economy. With rising adoption, regulatory improvements, and expanding real-world applications, digital tokens are set to drive long-term transformation in finance, commerce, and enterprise operations worldwide.