Table of Contents

Introduction

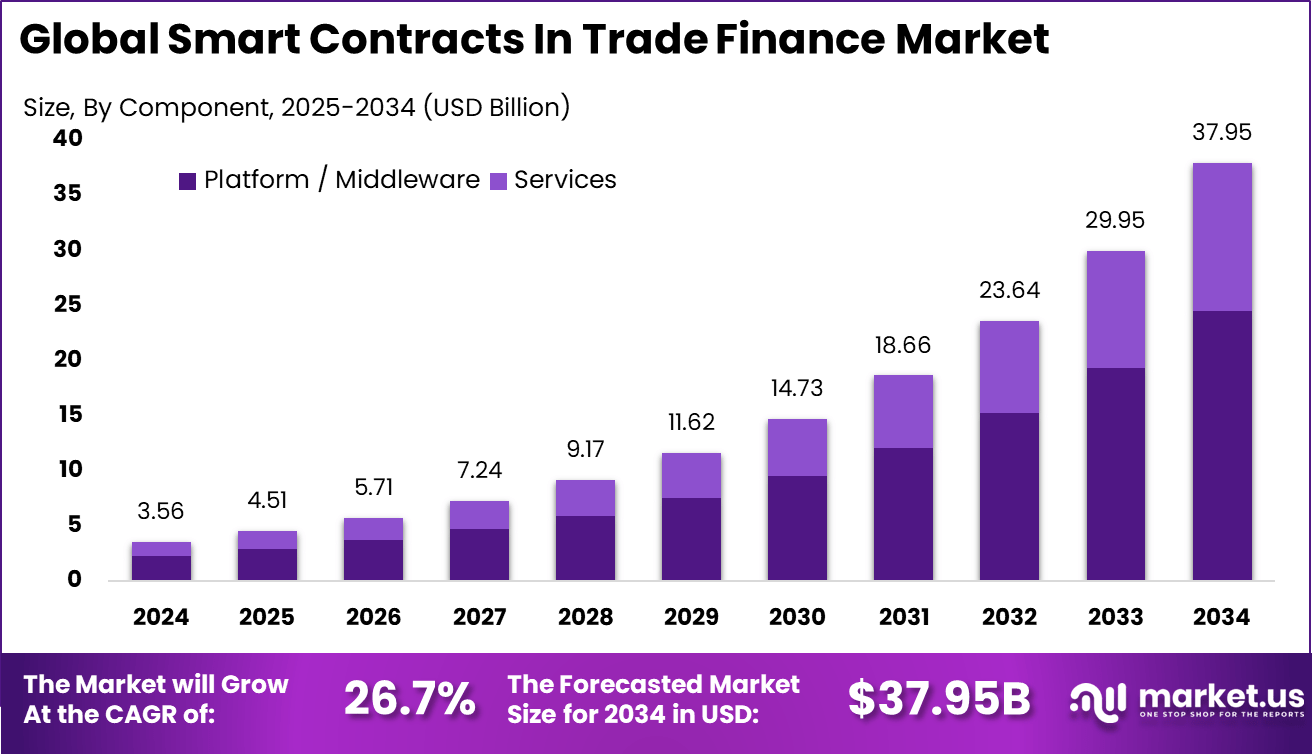

The Global Smart Contracts in Trade Finance Market was valued at USD 3.56 billion in 2024 and is projected to reach USD 37.95 billion by 2034, growing at a strong 26.7% CAGR. Adoption is driven by rising digitalization of trade processes, demand for automated settlements, and enhanced transparency across global supply chains. North America dominated in 2024 with a 36.4% share, contributing USD 1.29 billion. The rapid shift toward blockchain-backed documentation, fraud reduction systems, and smart compliance frameworks is accelerating the modernization of international trade flows.

How Growth Is Impacting the Economy

The expansion of smart contracts in trade finance is reshaping global economic activity by reducing transaction friction, lowering operational costs, and accelerating cross-border settlements. Automated contracts eliminate manual verification, shorten documentation timelines, and enhance trust among trading partners, improving liquidity across supply chains. As digital trade ecosystems expand, businesses benefit from improved access to working capital, reduced fraud exposure, and faster financing approvals.

This shift encourages greater participation from SMEs, strengthening global trade diversity and resilience. In addition, governments and financial institutions increasingly endorse blockchain-based systems to enhance compliance accuracy, reduce regulatory burdens, and modernize trade ecosystems. The economic impact extends across logistics, shipping, banking, and manufacturing, fostering a more efficient and digitally connected global trading environment.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/smart-contracts-in-trade-finance-market/free-sample/

Impact on Global Businesses

Rising implementation costs, platform integration challenges, and blockchain infrastructure expenses are increasing the financial burden on enterprises. Supply chain shifts are emerging as companies transition to digital documentation, automated verification, and decentralized financing ecosystems. Financial institutions adopt smart contracts to streamline credit issuance, while logistics companies benefit from real-time tracking and automated settlement triggers. Manufacturing and export-oriented industries experience improved cash flow cycles, whereas SMEs gain faster access to trade credit. However, sectors with legacy systems face delays due to interoperability gaps, regulatory uncertainties, and skills shortages.

Strategies for Businesses

- Invest in blockchain-ready digital infrastructure and workflow automation.

- Partner with fintech providers to implement scalable smart contract platforms.

- Strengthen compliance frameworks for transparent and traceable transactions.

- Modernize legacy systems to ensure interoperability with distributed ledgers.

- Train employees in digital trade processes and smart contract management.

Key Takeaways

- Market expected to reach USD 37.95 billion by 2034.

- Strong adoption driven by digital trade transformation.

- Automated settlements enhance accuracy and reduce fraud.

- North America leads with advanced fintech and regulatory frameworks.

- SMEs gain improved access to trade credit via smart contracts.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165500

Analyst Viewpoint

The market presents strong momentum as financial institutions accelerate blockchain adoption to modernize global trade workflows. Current growth is supported by rising demand for automation, risk reduction, and compliance accuracy. The future outlook remains highly positive, driven by greater interoperability between platforms, adoption of real-time trade visibility tools, and integration of AI with smart contracts. As global trade digitalization deepens, smart contract ecosystems are expected to become foundational to banking, logistics, and export operations, enabling faster, more reliable, and secure transactions worldwide.

Use Case and Growth Factors

| Category | Details |

|---|---|

| Use Case | Automated letters of credit and payment settlement |

| Use Case | Digital document verification for exports and imports |

| Use Case | Smart contract–based supply chain financing |

| Growth Factor | Rising digitalization of trade processes |

| Growth Factor | Increasing adoption of blockchain and DLT platforms |

| Growth Factor | Need for fraud prevention and transparent documentation |

| Growth Factor | Expansion of SME-focused trade financing models |

Regional Analysis

North America leads the market with a 36.4% share, supported by advanced financial ecosystems, strong fintech presence, and blockchain-friendly regulatory frameworks. Europe follows with high adoption in banking and logistics as part of its digital trade modernization initiatives. Asia Pacific is experiencing rapid growth driven by export-led economies, cross-border e-commerce expansion, and government-backed digital trade programs. The Middle East and Latin America are emerging markets focusing on enhancing supply chain transparency and improving trade-financing efficiency to reduce delays and fraud.

➤ Want more market wisdom? Browse reports –

- Enterprise Conversational AI Platform Market

- Underwater Transducer Market

- AI Store Manager Tools Market

- AI Interactive Display Market

Business Opportunities

Smart contract platforms offer significant opportunities in automated settlement engines, digital compliance systems, blockchain-based documentation, and decentralized financing models. Banks and fintech innovators can capitalize on rising demand for digital letters of credit, asset tokenization, and cross-border payment automation. Logistics and manufacturing industries can integrate smart contracts for shipment tracking, invoice validation, and end-to-end visibility. With SMEs expanding global participation, scalable digital trade solutions remain a major growth area for technology providers.

Key Segmentation

The market covers smart contract platforms, blockchain-based trade finance solutions, digital document management systems, automated payment engines, and decentralized trade-financing frameworks. Major applications include letters of credit, invoice financing, supply chain financing, customs documentation, and real-time shipment verification. End-users include banks, fintech companies, trading firms, logistics operators, manufacturers, and SMEs. The strongest uptake is seen in automated credit issuance, transparent documentation, and cross-border payment workflows.

Key Player Analysis

Leading players focus on developing secure, scalable blockchain architectures that support high-volume trade transactions. Their strategies revolve around enhancing smart contract automation, strengthening interoperability with banking systems, and integrating AI-driven verification tools. These companies invest heavily in compliance technology, risk-scoring engines, and digital identity frameworks to support global trade regulations. They also expand partnerships with banks, logistics providers, and fintech innovators to accelerate adoption and deliver robust end-to-end digital trade solutions.

- CargoX

- International Business Machines Corporation

- Wipro

- XDC Network

- R3 Corda

- DP World

- Debut Infotech

- PerfectionGeeks Technologies

- Spydra

- Other Major Players

Recent Developments

- January 2025: New blockchain-based trade documentation platform launched for banks.

- March 2025: Fintech provider introduced an AI-enabled smart contract verification module.

- June 2025: Major export association adopted smart contract–powered invoice financing.

- August 2025: Cross-border trade network integrated decentralized settlement infrastructure.

- October 2025: New interoperability protocol released for multi-ledger trade systems.

Conclusion

Smart contracts are transforming trade finance through automation, transparency, and fraud reduction. With strong regional momentum and expanding digital trade ecosystems, the market is set for sustained long-term growth driven by efficiency, security, and global connectivity.