Table of Contents

Introduction

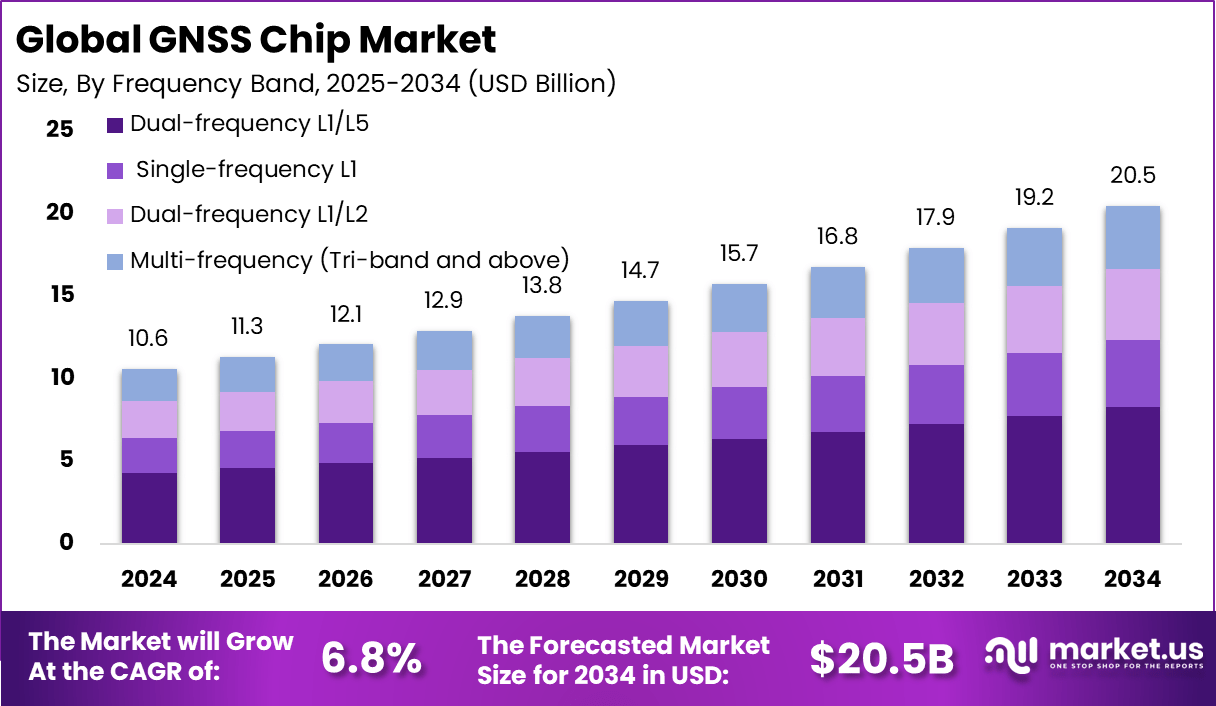

The Global GNSS Chip Market reached USD 10.6 billion in 2024 and is expected to grow from USD 11.3 billion in 2025 to nearly USD 20.5 billion by 2034, advancing at a CAGR of 6.80%. Rising demand for navigation-enabled smartphones, autonomous systems, precision agriculture, and connected mobility continues to accelerate adoption. Asia Pacific dominated the market with a 39.2% revenue share in 2024, driven by strong manufacturing capacity and rapid technology penetration.

How Growth Is Impacting the Economy

Expanding GNSS chip adoption is strengthening digital infrastructure, enabling more accurate logistics, transportation management, and fleet monitoring. The growth is also boosting semiconductor production and stimulating investment in advanced fabrication technologies. Higher demand for real-time navigation platforms is improving productivity across agriculture, construction, and mobility sectors.

The expansion of automated systems and location-based services is generating new revenue opportunities for startups, hardware makers, and software developers. Government-backed satellite modernization programs are creating jobs, enhancing industrial capabilities, and improving national positioning networks that contribute to overall economic resilience.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/global-gnss-chip-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Growing GNSS chip demand is reshaping global supply chains, pushing manufacturers to diversify sourcing beyond traditional hubs. Semiconductor shortages and rising raw material costs have led businesses to reassess suppliers, optimize inventories, and explore nearshoring strategies.

Sector-Specific Impacts

Industries such as automotive, drones, IoT, and precision farming face increasing dependence on reliable GNSS modules. Firms integrating navigation capabilities benefit from improved efficiency yet must navigate evolving standards, compatibility needs, and tighter quality requirements.

Strategies for Businesses

• Strengthen supplier diversification and build multi-region sourcing networks

• Invest in R&D for high-precision, low-power GNSS modules

• Collaborate with satellite service providers for enhanced positioning performance

• Adopt predictive demand planning to reduce supply bottlenecks

• Focus on application-specific GNSS product portfolios for automotive, IoT, and UAV segments

Key Takeaways

• Market heading toward USD 20.5 billion by 2034

• Asia Pacific remains the leading manufacturing and consumption region

• IoT, autonomous mobility, and smart agriculture drive demand

• Supply chain modernization is accelerating across semiconductor ecosystems

• Precision navigation is becoming a mission-critical capability

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165705

Analyst Viewpoint

The GNSS chip landscape is expected to maintain strong momentum due to robust integration across mobility, smart devices, and industrial automation. Growing investments in satellite constellations and advanced positioning technologies will reinforce performance standards. Market prospects remain positive as businesses adopt multi-band, low-power GNSS solutions and emerging applications extend into robotics, drones, and smart infrastructure.

Use Cases & Growth Factors

| Use Case | Description | Growth Factors |

|---|---|---|

| Autonomous Vehicles | Navigation, lane accuracy, sensor fusion | Rise of ADAS, stricter safety norms |

| Precision Agriculture | Flight stabilization, mapping, and security operations | Food security focus, smart farming adoption |

| IoT Devices | Asset tracking, wearables, smart utilities | Expansion of connected ecosystems |

| Drones & UAVs | Flight stabilization, mapping, security operations | Commercial drone regulations, delivery applications |

| Industrial Automation | Robotics, logistics, fleet optimization | Factory modernization, Industry 4.0 |

Regional Analysis

Asia Pacific leads the market with a 39.2% share, driven by large-scale semiconductor manufacturing and high adoption of navigation-enabled devices. North America benefits from strong automotive and aerospace applications, while Europe focuses on precision technologies linked to industrial automation. Regions such as the Middle East, Africa, and Latin America show rising adoption through expanding telecom networks and smart mobility initiatives.

➤ Want more market wisdom? Browse reports –

- AI in Mining and Natural Resources Market

- Employer-Sponsored EWA Market

- API-based Payroll Tech Market

- Direct-to-Consumer EWA Market

Business Opportunities

Increasing demand for high-accuracy multi-frequency GNSS chips presents strong opportunities in automotive autonomy, drone logistics, smart farming, and defense modernization. Emerging markets seek affordable yet precise location solutions, opening doors for mid-tier manufacturers. Growth in satellite constellations and 5G-driven applications also fosters opportunities in chip miniaturization, ultra-low power solutions, and integrated navigation technologies.

Key Segmentation

The market spans applications across automotive, consumer electronics, industrial IoT, aerospace, defense, and smart agriculture. Device categories include multi-band GNSS chips, low-power IoT GNSS modules, and high-precision surveying chips. These segments collectively support navigation, tracking, timing, and automation requirements across global industries.

Key Player Analysis

Leading companies focus on expanding product portfolios, enhancing chip accuracy, and reducing power consumption. They invest in multi-frequency GNSS technologies and collaborate with satellite operators to improve positioning capabilities. Their strategies emphasize R&D expansion, design innovation, and regional supply chain optimization to meet rising demand across automotive, IoT, and industrial sectors.

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- MediaTek Inc.

- STMicroelectronics N.V.

- u-blox Holding AG

- Samsung Electronics Co., Ltd. (System LSI)

- Skyworks Solutions, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Sony Semiconductor Solutions Corporation

- Intel Corporation

- Thales Group

- Trimble Inc.

- Hemisphere GNSS, Inc.

- Septentrio N.V.

- Furuno Electric Co., Ltd.

- Allystar Technology Co., Ltd.

- Hexagon AB (NovAtel Inc.)

- Orolia (Safran Electronics & Defense)

- HiSilicon (Shanghai) Technologies Co., Ltd.

- Topcon Positioning Systems, Inc.

- Other Major Players

Recent Developments

• January 2024: Launch of next-generation low-power GNSS modules for IoT tracking

• March 2024: Introduction of multi-band GNSS chips optimized for autonomous mobility

• July 2024: Partnerships announced to integrate advanced positioning into commercial drones

• February 2025: Expansion of fabrication facilities for high-precision GNSS chip production

• May 2025: Release of miniaturized GNSS chips for wearable and health devices

Conclusion

The GNSS chip market continues accelerating with strong multi-industry demand, regional expansion, and rapid technological innovation. Its long-term growth trajectory remains solid through rising automation, mobility, and IoT adoption worldwide.