Table of Contents

Introduction

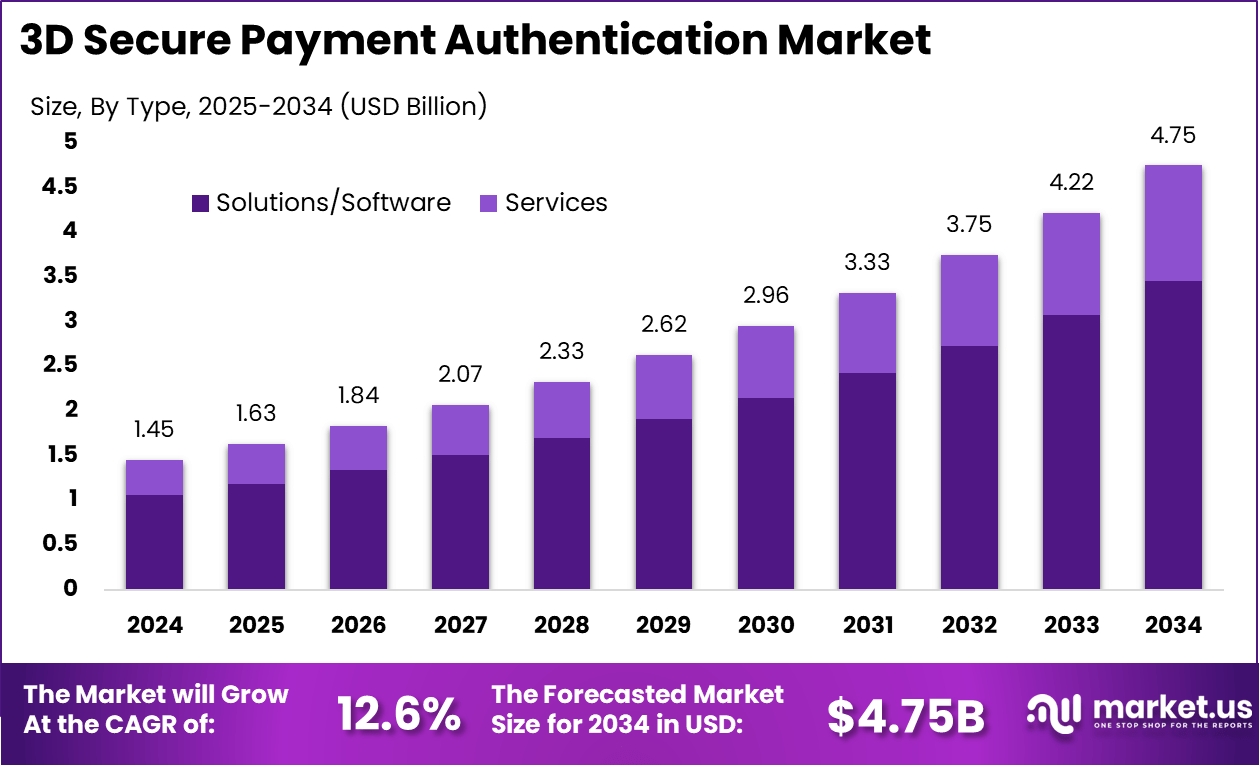

The Global 3D Secure Payment Authentication Market was valued at USD 1.45 billion in 2024 and is projected to reach USD 4.75 billion by 2034, expanding at a CAGR of 12.6%. This growth is driven by rising online transactions, increasing digital fraud cases, and mandatory authentication regulations across major economies. In 2024, North America dominated the market with a 38.3% share, contributing USD 0.5 billion in revenue due to strong e-commerce penetration, advanced banking infrastructure, and early adoption of secure payment technologies.

How Growth Is Impacting the Economy

The accelerating adoption of 3D secure payment authentication significantly strengthens the digital economy by enhancing trust in online transactions. As global e-commerce expands, secure authentication tools reduce fraud losses, encourage higher online spending, and promote financial inclusion. This growth boosts banking modernization, cybersecurity investment, and digital payment innovation across industries.

The increasing need for secure authentication drives demand for cloud services, AI-based fraud detection, and regulatory compliance frameworks, creating new job opportunities and strengthening financial system resilience. The market’s expansion also supports small and medium businesses by reducing chargebacks, increasing consumer confidence, and enabling more seamless cross-border commerce. As governments implement stronger digital payment regulations, overall economic stability improves, fostering long-term growth in the global digital payments ecosystem.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/3d-secure-payment-authentication-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses face rising costs associated with security infrastructure upgrades, compliance solutions, cloud authentication systems, and fraud prevention tools. To mitigate risk, companies are shifting toward scalable cloud-based authentication, decentralizing transaction verification, and partnering with payment security vendors to reduce operational burdens.

Sector-Specific Impacts

E-commerce, BFSI, travel, retail, and fintech platforms benefit the most from 3D Secure authentication. These sectors experience reduced fraud, improved customer trust, and smoother digital transaction flows. However, they must continuously adapt to evolving regulatory standards, browser-based integration requirements, and user-experience challenges.

Strategies for Businesses

• Invest in AI-enabled fraud detection and risk-based authentication

• Adopt cloud-based 3DS servers for scalability and compliance

• Improve user experience with frictionless authentication flows

• Strengthen partnerships with payment gateways and cybersecurity firms

• Regularly update systems to align with global digital payment regulations

Key Takeaways

• Market projected to reach USD 4.75 billion by 2034

• North America leads with 38.3% market share

• Fraud reduction and regulatory compliance drive adoption

• AI-based risk scoring enhances authentication accuracy

• Cloud-based 3DS platforms are gaining strong traction

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162249

Analyst Viewpoint

The 3D Secure Payment Authentication Market is experiencing strong momentum as businesses prioritize fraud reduction and regulatory compliance. The current landscape is shaped by the rapid digitalization of payments, increasing consumer trust requirements, and the need for frictionless transaction experiences. Future market growth remains highly favorable due to advancements in AI-based behavioral analytics, biometric authentication, and cloud-native payment security. As digital commerce expands globally, 3DS adoption will continue to rise, making secure authentication essential for businesses of all sizes.

Use Cases & Growth Factors

| Use Case | Description | Growth Factors |

|---|---|---|

| E-commerce | Fraud prevention in online shopping | Rising digital payments, higher fraud attempts |

| Banking & Fintech | Secure customer authentication | Regulatory compliance (PSD2, RBI norms) |

| Travel & Booking | Protecting high-value transactions | Growth in digital ticketing |

| Retail | Secure card-not-present payments | Expansion of omnichannel retail |

| Digital Wallets | Verification of mobile transactions | Increasing mobile payment adoption |

Regional Analysis

North America leads the market due to advanced payment ecosystems, strong enforcement of digital security standards, and high e-commerce spending. Europe follows with strict regulations such as PSD2, driving widespread adoption of 3D Secure 2. Asia Pacific is emerging rapidly as digital wallets, mobile banking, and cross-border e-commerce expand. Regions such as Latin America and the Middle East show rising adoption driven by fintech growth, cybersecurity investments, and increasing preference for secure online transactions.

➤ Want more market wisdom? Browse reports –

- Capacitor Manufacturing Market

- Semiconductor Lens Market

- Smart Language Model Market

- Data Center Logical Security Market

Business Opportunities

The market offers strong opportunities in cloud-based authentication, biometric-integrated verification, AI-driven risk scoring, and frictionless checkout solutions. Growing digital payment usage in emerging markets creates demand for lightweight and cost-effective 3DS platforms. Fintech growth, regulatory reforms, and cross-border e-commerce expansion further open avenues for solution providers to deliver scalable, API-driven authentication frameworks across industries.

Key Segmentation

The market is segmented by component (3DS servers, access control servers, SDKs, integration tools), application (e-commerce, banking, retail, travel, fintech), and authentication type (frictionless flow, challenge flow). End users include banks, merchants, payment gateways, and digital wallet providers. These segments reflect widespread implementation across industries seeking secure digital transaction experiences.

Key Player Analysis

Leading market participants focus on enhancing authentication speed, minimizing customer friction, and improving fraud detection accuracy. Their strategies include deploying cloud-native platforms, integrating AI-driven behavioral analytics, and strengthening risk-based authentication models. Continuous product upgrades, compliance alignment, and global expansion help them maintain a competitive edge while supporting the rising demand for secure digital transactions.

- GPayments Pty Ltd.

- Broadcom Inc.

- Mastercard Incorporated

- RSA Security LLC

- Modirum

- Visa Inc.

- Bluefin Payment Systems LLC

- DECTA Limited

- American Express Company

- JCB Co., Ltd

- American Express

- Thales Group

- Entrust Corporation

- Netcetera

- SISA Information Security

- Stripe

- Fiserv Incorporation

- Marqeta, Inc.

- Entersekt

- Others

Recent Developments

• January 2024: Launch of upgraded 3DS 2.3 platforms supporting biometric authentication.

• April 2024: Partnerships formed to integrate AI-driven fraud scoring into 3DS servers.

• August 2024: Expansion of cloud-based 3DS infrastructure across APAC.

• February 2025: Introduction of frictionless checkout solutions for merchants.

• May 2025: Rollout of enhanced multi-factor authentication for mobile banking.

Conclusion

The 3D secure payment authentication market is expanding rapidly as digital transactions surge and fraud risks rise. With robust technological innovation and global regulatory support, the market is positioned for strong and sustained long-term growth.