Table of Contents

Introduction

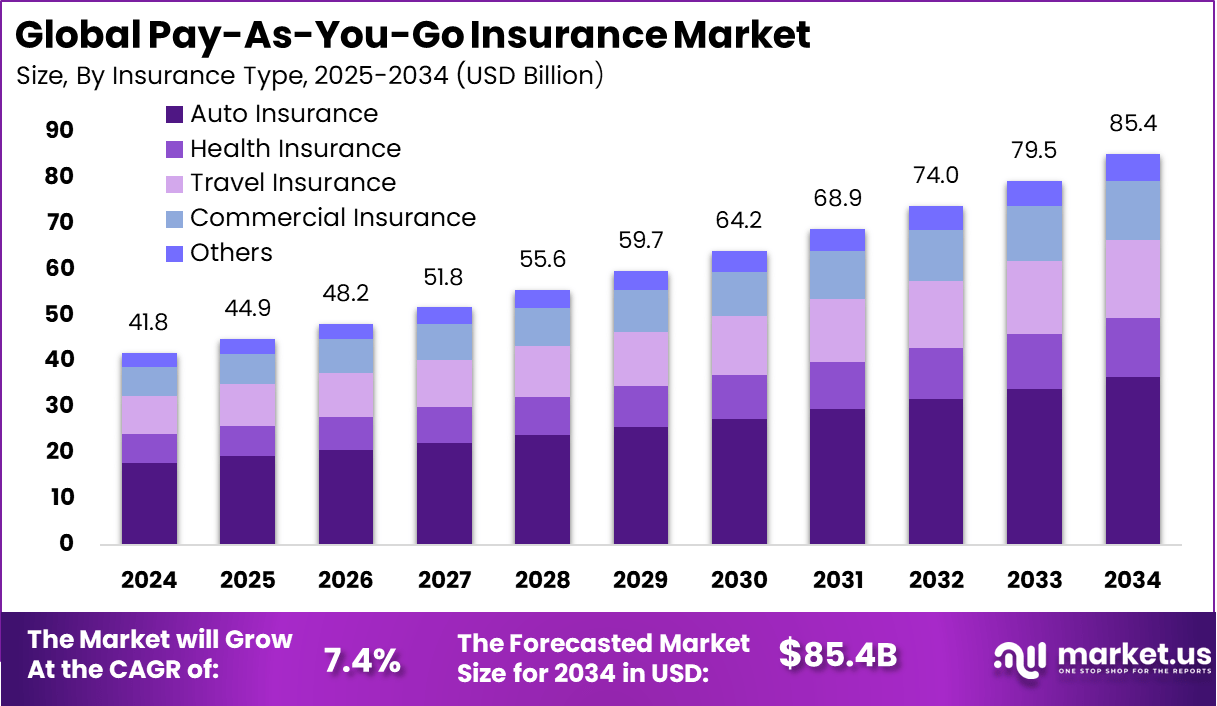

The Global Pay-As-You-Go Insurance Market generated USD 41.8 billion in 2024 and is projected to increase to USD 85.4 billion by 2034, rising at a CAGR of 7.4%. Revenue is expected to reach USD 44.9 billion in 2025. North America dominated the landscape in 2024 with a 38.0% share valued at USD 15.8 billion. Market growth is driven by telematics adoption, personalized risk pricing, expansion of usage-based auto and travel insurance, and increased demand for flexible, data-driven policy models supported by IoT and real-time analytics.

How Growth is Impacting the Economy

The expansion of pay-as-you-go insurance is reshaping the global economy by shifting traditional premium models toward personalized, data-backed pricing structures. As consumers increasingly demand affordability and flexibility, insurers benefit from greater market penetration, especially across younger demographics and low-mileage drivers. The shift to telematics-driven policies stimulates growth in IoT devices, connected vehicle ecosystems, and mobility infrastructure.

Real-time analytics reduces claim variability, helping insurers maintain profitability and allocate resources more efficiently. Economic impact is also evident in improved road safety, as telematics encourages behavioral monitoring and safe-driving incentives. The trend supports digital transformation across the insurance sector, generating new employment opportunities in data science, mobile engineering, cloud platforms, and actuarial technologies.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/pay-as-you-go-insurance-market/free-sample/

Impact on Global Businesses

Businesses face rising operational costs due to connected device integration, telematics data management, and compliance requirements. Supply chains shift as insurers collaborate with automotive OEMs, IoT device manufacturers, and mobility service providers. Sector-specific impacts include reduced fleet insurance costs, enhanced driver monitoring in logistics, personalized premium structures for rideshare companies, greater fraud prevention in claims management, and increasing use of predictive analytics in commercial insurance underwriting.

Strategies for Businesses

Companies should adopt advanced analytics platforms, invest in telematics integrations, and build partnerships with mobility providers. Expanding customer education on usage-based insurance increases adoption. Developing transparent data policies enhances consumer trust. Diversifying pay-as-you-go products across auto, travel, health, and gig-economy insurance widens market reach. Leveraging AI for pricing optimization and fraud detection strengthens competitiveness.

Key Takeaways

- Market to reach USD 85.4 billion by 2034

- CAGR of 7.4% during 2025–2034

- North America leads with a 38% revenue share

- Telematics and IoT adoption drive usage-based models

- Demand rises for flexible, personalized policy pricing

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166185

Analyst Viewpoint

The pay-as-you-go insurance market is gaining strong momentum as shifting consumer behavior prioritizes flexibility, transparency, and digital engagement. Present growth is fueled by telematics adoption, data-driven underwriting, and usage-based models across automotive, travel, and mobility sectors. Looking ahead, adoption will accelerate through autonomous vehicles, connected mobility platforms, and AI-driven risk scoring. As regulatory frameworks mature and insurers gain access to higher-quality driving and behavioral data, the market is expected to expand rapidly with improved profitability and broader policy innovation.

Use Case and Growth Factors

Use Cases Table

| Use Case | Description |

|---|---|

| Usage-Based Auto Insurance | Premiums based on driving behavior, mileage, and telematics insights. |

| Fleet & Logistics Monitoring | Real-time tracking improves safety and reduces operational insurance costs. |

| Travel & On-Demand Coverage | Users activate policies only when traveling or using services. |

| Gig-Economy Worker Insurance | Flexible coverage for rideshare, delivery, and freelance workers. |

Growth Factors Table

| Growth Factor | Description |

|---|---|

| Telematics Adoption | Connected vehicles and IoT drive data-rich pricing models. |

| Digital Insurance Platforms | Online onboarding accelerates user acquisition. |

| Mobility-as-a-Service Growth | Expands demand for micro-duration insurance. |

| Regulatory Push for Transparency | Encourages personalized, data-driven coverage. |

Regional Analysis

North America leads due to strong telematics integration, high vehicle connectivity, and early adoption of usage-based auto insurance. Europe follows with rapid regulatory support, EV adoption, and fleet digitalization. Asia Pacific is expanding quickly as mobility platforms, two-wheeler telematics, and urban gig-economy services accelerate demand. Latin America and the Middle East show growing adoption driven by smartphone penetration and emerging insurtech ecosystems. Africa remains in early adoption stages with rising interest in micro-insurance models.

➤ Want more market wisdom? Browse reports –

Business Opportunities

Significant opportunities arise in telematics ecosystems, connected-car analytics, gig-economy insurance products, and micro-duration coverage for on-demand mobility. Insurers can expand offerings across auto, travel, health, and commercial fleet sectors. Partnerships with OEMs, EV manufacturers, ride-hailing platforms, and logistics companies create recurring high-value revenue streams. The rise of AI, behavior-based scoring, and claims automation further enhances underwriting accuracy and operational efficiency.

Key Segmentation

The market is segmented by insurance type, technology, distribution channel, and end-user. Insurance types include usage-based auto insurance, pay-per-mile, on-demand travel insurance, gig-worker insurance, and short-term health coverage. Technologies include telematics, IoT devices, connected-car systems, mobile apps, and AI analytics. Distribution channels span digital platforms, brokers, insurers, and mobility partners. End-users include personal drivers, commercial fleets, gig-economy workers, travelers, and corporate mobility providers.

Key Player Analysis

Key market participants focus on scaling telematics capabilities, enhancing mobile app ecosystems, and building data-sharing collaborations with automakers and mobility platforms. Their strategies include expanding digital onboarding, developing real-time risk scoring algorithms, and leveraging AI for claims automation and behavioral insights. Emphasis is placed on improving transparency, reducing fraud, expanding flexible policy types, and strengthening customer retention through personalized experiences and safe-driving incentive programs.

- Progressive

- Allstate

- Liberty Mutual

- State Farm

- Nationwide

- AXA

- Generali

- Zurich

- Root Insurance

- Metromile

- Lemonade

- Cuvva

- By Miles

- Trov

- Slice Labs

- Others

Recent Developments

- Launch of AI telematics scoring models for personalized premiums

- Integrations between insurers and connected-vehicle OEM platforms

- Expansion of micro-duration insurance for rideshare drivers

- Partnerships between insurtech firms and mobility-as-a-service providers

- Development of IoT-based claim verification and fraud-reduction tools

Conclusion

The Pay-As-You-Go Insurance Market is expanding rapidly due to telematics adoption, digital transformation, and consumer demand for flexible premiums. With strong growth outlook and rising global investment, the sector is poised for long-term innovation and market diversification.