Table of Contents

Introduction

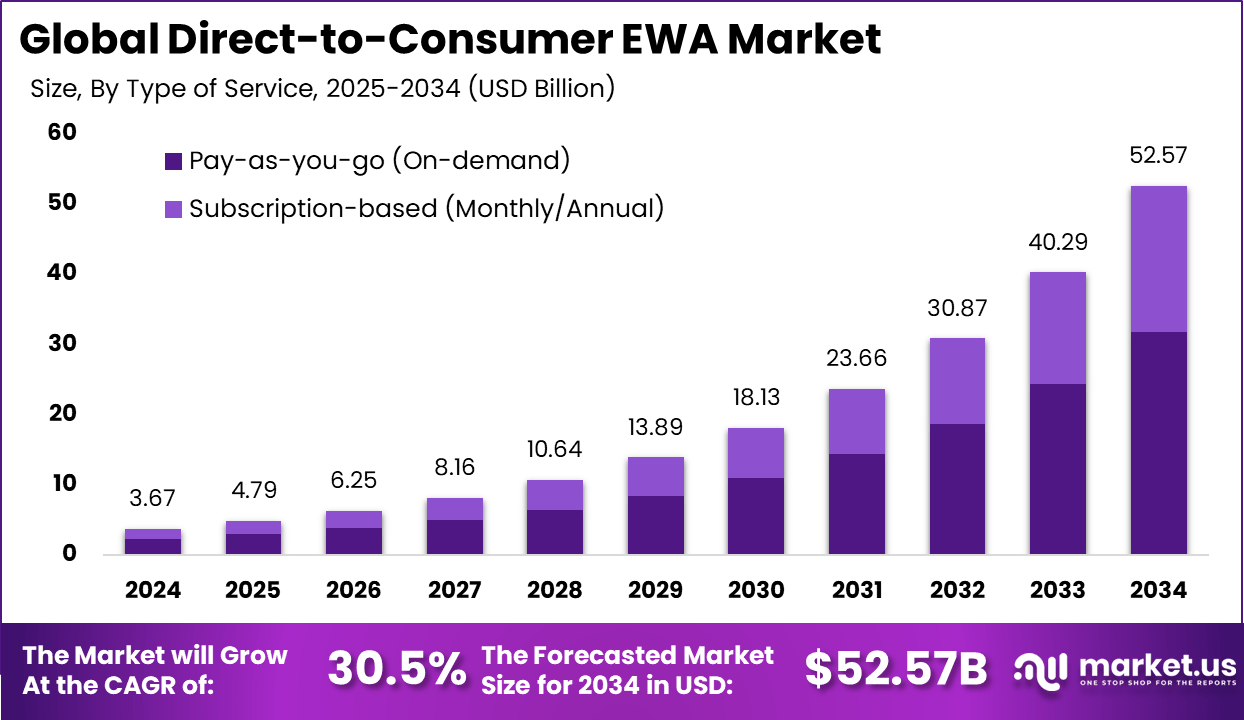

The Global Direct-to-Consumer Earned Wage Access (EWA) Market was valued at USD 3.67 billion in 2024 and is expected to reach USD 52.57 billion by 2034, expanding at a CAGR of 30.5%. North America dominated the market with a 37.1% share worth USD 1.36 billion. Growth is driven by rising financial stress among workers, increasing mobile banking adoption, and high demand for flexible income solutions. Consumers increasingly prefer real-time access to wages, fueling D2C EWA app usage and strengthening the digital financial services ecosystem.

How Growth is Impacting the Economy

The growing adoption of direct-to-consumer EWA services significantly influences the global economy by improving cash flow for millions of workers and reducing reliance on high-interest loans. This leads to healthier consumer spending, enhanced workforce productivity, and greater financial stability across low- and middle-income groups. The expansion of D2C EWA platforms also accelerates digital payment adoption, encourages fintech innovation, and strengthens competitive dynamics in global financial services.

As EWA platforms scale, they stimulate job creation in app development, financial analytics, compliance, and customer support. Increased liquidity among consumers supports economic activity at retail, utilities, and essential services. The broader shift toward instant wage access contributes to financial inclusion, reduces economic inequality, and encourages governments to modernize regulatory frameworks around real-time financial services, promoting a resilient and future-ready digital economy.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/direct-to-consumer-ewa-market/free-sample/

Impact on Global Businesses

Businesses face rising integration and compliance costs as employees adopt wage access tools independently. Supply chains shift as fintech companies partner with neobanks, digital wallets, and payment processors. Sector-specific implications include reduced employee turnover in retail and hospitality, enhanced financial stability for gig workers, increased usage of instant pay in delivery and rideshare services, and growing reliance on predictive analytics for wage disbursement systems.

Strategies for Businesses

Companies should partner with reputable D2C EWA providers to integrate wage access into employee financial wellness programs. Emphasizing transparent fee structures, data security, and regulatory compliance strengthens trust. Businesses should analyze workforce financial behavior to optimize benefit offerings, invest in digital payroll systems, and collaborate with fintech ecosystems to streamline disbursement processes.

Key Takeaways

- Market is expected to reach USD 52.57 billion by 2034

- Strong CAGR of 30.5% driven by financial inclusion trends

- North America leads with 37.1% share

- D2C models reduce reliance on high-interest loans

- Rising demand for flexible wage access in gig and hourly workforces

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166081

Analyst Viewpoint

The direct-to-consumer EWA market is experiencing rapid momentum as financial flexibility becomes essential for modern workers. Currently, adoption is driven by gig platforms, hourly wage earners, and millennials seeking instant liquidity. Looking ahead, advancements in real-time payments, open banking, and AI-driven financial insights will further strengthen D2C ecosystem scalability. Regulatory clarity and improved data governance will boost consumer trust and expand adoption across emerging markets. The long-term outlook remains highly positive, with EWA evolving into a core financial wellness tool globally.

Use Case and Growth Factors

Use Cases Table

| Use Case | Description |

|---|---|

| Instant Access to Earned Wages | Users withdraw a portion of earned income before payday. |

| Gig Worker Micro-Payments | Real-time payouts for rideshare, delivery, and freelance workers. |

| Emergency Financial Support | Immediate liquidity for urgent bills or unexpected expenses. |

| Mobile Banking Integration | Seamless transfers into digital wallets or bank accounts. |

Growth Factors Table

| Growth Factor | Description |

|---|---|

| Rising Financial Stress | Drives demand for early wage access solutions. |

| Growth of Gig Economy | Expands real-time wage access needs. |

| Mobile-First Banking | Supports higher D2C adoption rates. |

| Regulatory Evolution | Enables safer and more transparent EWA services. |

Regional Analysis

North America leads due to early fintech adoption, strong digital banking infrastructure, and a large base of gig and hourly workers. Europe sees rapid expansion driven by open banking and responsible lending regulations. Asia Pacific is experiencing high growth due to smartphone penetration, youth workforce populations, and digital payment ecosystem expansion. Latin America benefits from increasing financial inclusion initiatives, while the Middle East and Africa adopt D2C EWA through mobile money platforms and emerging digital banking networks.

➤ Want more market wisdom? Browse reports –

- Border Security Drone Market

- AI in Mining and Natural Resources Market

- Employer-Sponsored EWA Market

- API-based Payroll Tech Market

Business Opportunities

Opportunities exist in mobile-first EWA solutions, AI-powered financial planning tools, open banking integrations, and fee-transparent subscription models. Growing gig workforces create demand for embedded wage access within marketplace apps. Partnerships with neobanks, telecom providers, and digital wallets offer strong monetization potential. Expanding into emerging markets presents opportunities where traditional credit access is limited, strengthening EWA’s role in financial inclusion and everyday liquidity.

Key Segmentation

The market is segmented by type, business model, end-user, platform, and distribution channel. Types include instant-withdrawal EWA and scheduled withdrawal EWA. Business models include subscription-based, fee-per-withdrawal, and interest-free employer-funded structures. End-users include gig workers, salaried employees, freelancers, and independent contractors. Platforms cover mobile apps, digital wallets, and open banking APIs. Distribution channels include app stores, fintech partners, and embedded finance platforms.

Key Player Analysis

Market players focus on enhancing user experience through instant transfers, transparent pricing, and AI-driven financial guidance. They strengthen partnerships with gig platforms, neobanks, and digital banking networks to expand adoption. Key strategies include diversifying revenue models, improving fraud detection systems, and increasing regulatory compliance. Continuous innovation in instant payments, data analytics, and embedded finance capabilities boosts market competitiveness and consumer trust.

- DailyPay

- Earnin

- PayActiv

- Rain Technologies, Inc.

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Branch

- ZayZoon

- Earnipay

- Strovia

- Others

Recent Developments

- Expansion of D2C EWA platforms into emerging markets

- Launch of AI-based budgeting and financial coaching features

- Partnerships between gig platforms and EWA providers

- Integration of instant payment rails via open banking

- Regulatory consultations improving consumer protection guidelines

Conclusion

The direct-to-consumer EWA market is rapidly scaling due to rising financial pressures, ongoing fintech innovation, and global movement toward real-time wage access. With expanding use cases and strong digital adoption, the sector is poised for long-term global growth.