Table of Contents

Introduction

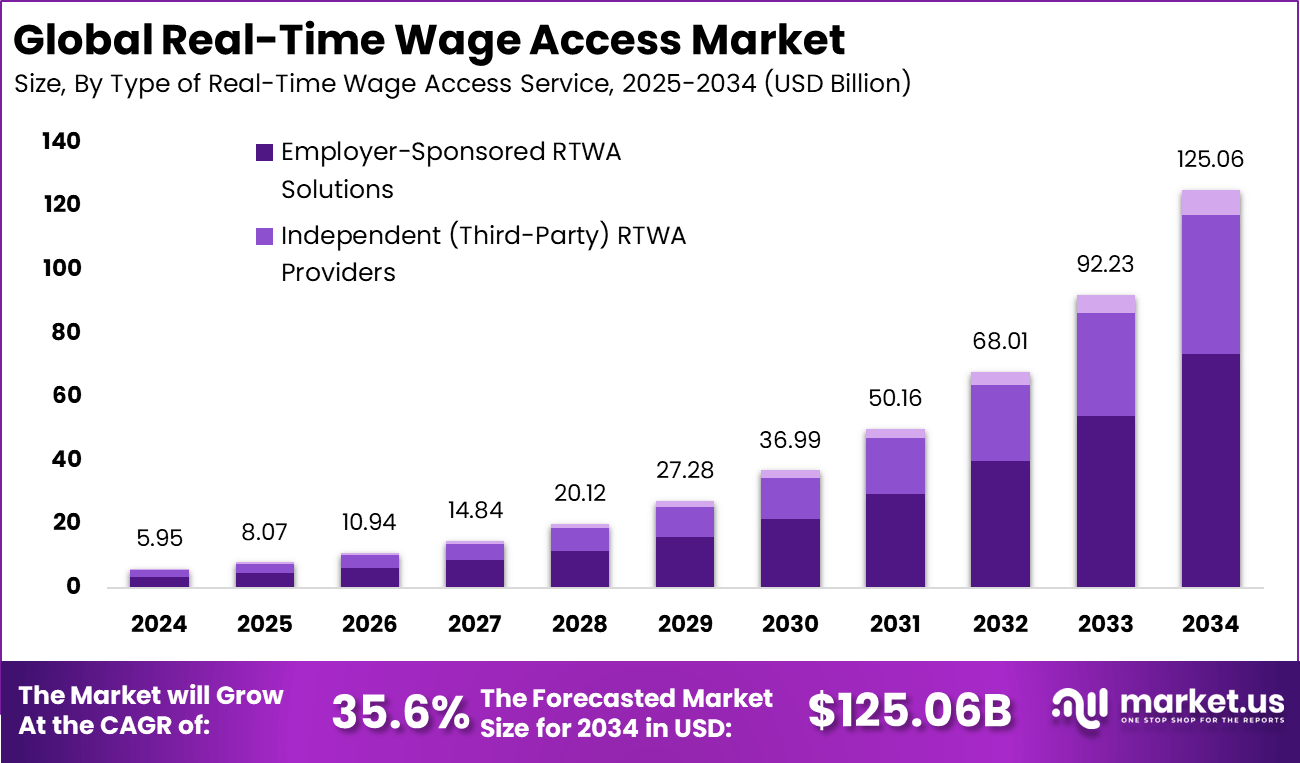

The Global Real-Time Wage Access Market is projected to surge from USD 5.95 billion in 2024 to USD 125.06 billion by 2034, expanding at a CAGR of 35.6%. Growth accelerates as employers adopt on-demand pay platforms to improve workforce financial stability. With North America holding a 35.6% share and USD 2.11 billion revenue in 2024, the market advances rapidly due to rising digital payroll adoption, fintech expansion, and increasing demand for flexible earning models.

How Growth is Impacting the Economy

The expansion of real-time wage access solutions is reshaping labor economics by strengthening employee liquidity, reducing financial stress, and lowering reliance on high-interest loans. This contributes to increased consumer spending, improved job retention, and higher workforce productivity across service and labor-intensive sectors.

The proliferation of digital payroll systems boosts fintech innovation, creating new employment opportunities in software development, cybersecurity, and API-based financial platforms. As more workers gain immediate access to earned wages, regional economies benefit from faster money circulation, stronger household financial resilience, and improved participation in digital payments. Businesses adopting real-time wage access also contribute to economic modernization through payroll automation, enhanced tax accuracy, and reduced administrative overhead.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/real-time-wage-access-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Organizations are experiencing higher operational expenses tied to fintech integrations, cloud-based payroll processing, and regulatory compliance. Shifts toward digital payment ecosystems require restructured vendor partnerships, API dependencies, and enhanced data governance. Companies also adjust supply chain labor models to include financial-wellness features that improve retention.

Sector-Specific Impacts

Retail, hospitality, logistics, and gig platforms witness stronger workforce availability and lower absenteeism as employees access wages instantly. Manufacturing improves shift fulfillment, while healthcare benefits from reduced staffing turnover. Financial institutions see new revenue prospects through embedded payroll services and earned-wage access APIs.

Strategies for Businesses

Businesses should adopt secure payroll APIs, partner with fintech platforms, and deploy compliant pay-on-demand models. Integrating financial-wellness tools, enhancing cybersecurity, offering flexible payout options, and optimizing workflows through automated payroll systems will strengthen retention and operational efficiency. Investing in multi-region compliance frameworks accelerates global scalability.

Key Takeaways

- The market is expected to reach USD 125.06 billion by 2034

- CAGR projected at 35.6%

- North America leads with 35.6% and USD 2.11 billion in revenue

- Rising demand for flexible wage models

- Digital payroll and fintech infrastructure are accelerating adoption

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165702

Analyst Viewpoint

The market is currently driven by financial-wellness initiatives and rapid adoption of digital payroll frameworks, enabling companies to reduce turnover and improve worker satisfaction. Over the next decade, developments in AI fraud monitoring, instant settlement rails, and embedded financial ecosystems are expected to propel strong future growth. Real-time wage access platforms will increasingly integrate with HR systems and neobanking tools, creating a more resilient and efficient global payroll ecosystem that supports flexible earnings, boosts productivity, and strengthens financial inclusion.

Use Case & Growth Factors

| Category | Details |

|---|---|

| Key Use Cases | On-demand wage withdrawal, gig-worker payouts, payroll automation, financial wellness programs, shift-based wage access |

| Growth Factors | Expansion of digital payment infrastructure, surge in gig economy, rising worker demand for liquidity, fintech innovation, mobile payroll adoption |

Regional Analysis

North America maintains dominance owing to rapid fintech integration, employer adoption, and strong digital payroll infrastructure. Europe shows momentum driven by labor-welfare regulations and increasing financial-wellness initiatives. Asia-Pacific is poised for the fastest growth due to mobile-first economies, gig expansion, and rising demand for instant payouts among contract workers. Latin America and the Middle East & Africa benefit from growing digital banking penetration and employer shifts toward workforce-retention tools.

➤ Want more market wisdom? Browse reports –

- Data Conversion Services Market

- Home Security Consulting Market

- Political Risk Insurance Market

- eSports Betting Software Market

Business Opportunities

Key opportunities arise in API-based payout platforms, embedded fintech services, instant settlement rails, and mobile payroll ecosystems. Strong growth exists in SME-focused wage access solutions, cross-border payout systems, and compliance-ready payroll integrations. Financial institutions can enter new revenue streams through white-label on-demand pay solutions, while HR-tech providers gain traction by bundling payroll automation with real-time wage features.

Key Segmentation

The market is segmented by service type, including employer-integrated earned wage access, third-party on-demand pay platforms, and instant payroll settlement tools. Deployment models span cloud-based, hybrid, and API-integrated solutions. End-users include large enterprises, SMEs, gig-economy platforms, and staffing agencies. Each segment experiences accelerated adoption due to rising digital payroll transformation, labor retention needs, and increasing demand for flexible cash-flow access.

Key Player Analysis

Leading participants focus on enhancing instant payout speeds, expanding geographic coverage, and improving compliance-layer technology. Many invest in real-time fraud detection, advanced risk scoring, and AI-powered payroll automation. Strategic partnerships with HR platforms, payment processors, and financial institutions help strengthen distribution. Continuous innovation in mobile UX, flexible withdrawal structures, and multilayer data security further differentiates major providers.

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- Launch of AI-driven wage-access fraud monitoring tools.

- Introduction of real-time payout rails integrated with employer HR systems.

- Expansion of mobile-first EWA apps across emerging markets.

- Development of embedded payroll APIs enabling instant settlements.

- New financial-wellness dashboards added to employee benefit platforms.

Conclusion

The Real-Time Wage Access Market is set for strong, transformative growth, driven by fintech modernization, digital payroll expansion, and rising demand for flexible earnings. Businesses embracing on-demand pay will enhance workforce stability and gain long-term competitive advantages.