Table of Contents

Life Insurance Market Size

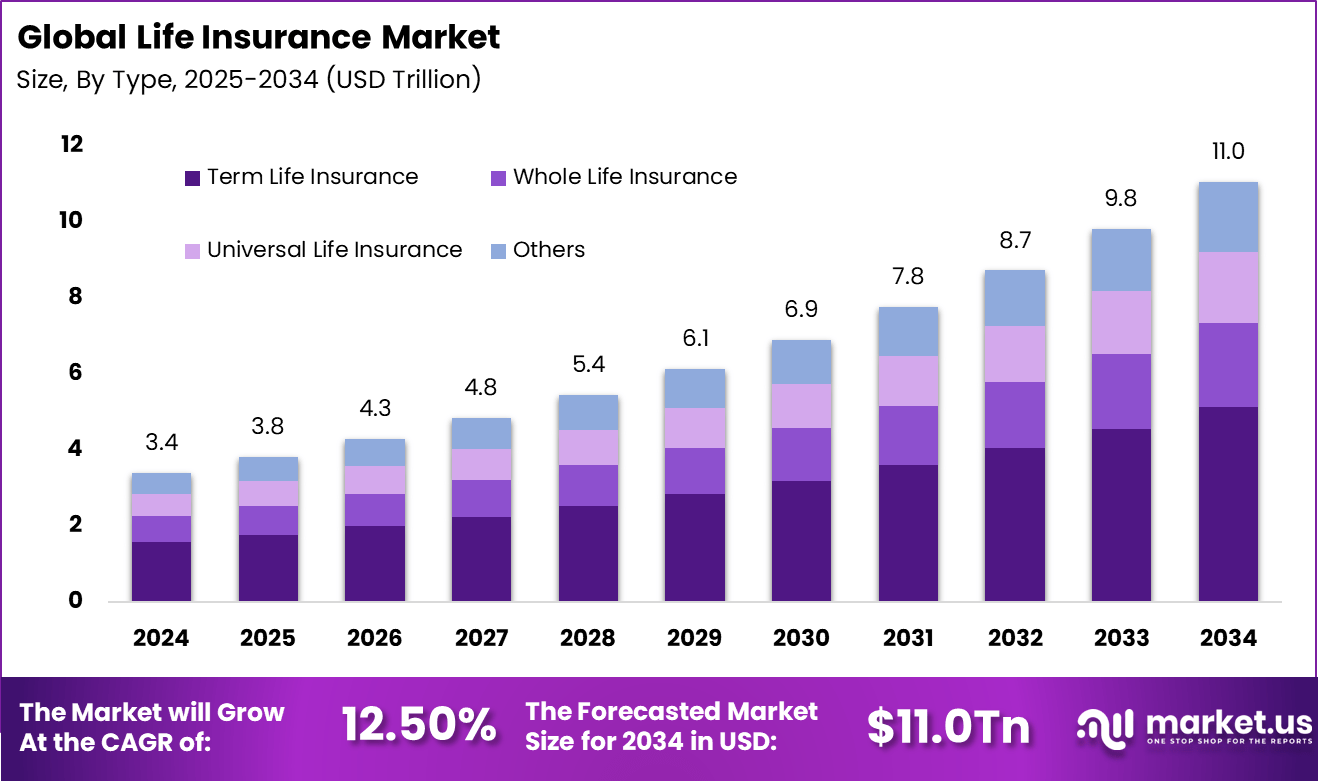

The Global Life Insurance Market is expected to reach USD 11.0 trillion by 2034, rising from USD 3.4 trillion in 2024 with a strong 12.50% CAGR projected from 2025 to 2034. In 2024, North America maintained a leading position with more than a 34.6% share and revenue of about USD 1.17 trillion, reflecting sustained demand for protection-focused financial products across the region.

The life insurance market has expanded as individuals and families prioritise long term financial protection, income replacement and legacy planning. Growth reflects rising awareness of financial vulnerability, increasing life expectancy and the need for structured coverage across diverse income groups. The market includes term life, whole life, universal life and group life policies designed to support financial security throughout different life stages.

The growth of the market can be attributed to increasing health risks, higher household debt, population ageing and broader financial literacy. Economic uncertainty encourages more individuals to secure stable protection for dependents. Employers also contribute to growth by offering life insurance as part of employee benefits. Digital platforms have made policy comparisons and applications easier, supporting more widespread adoption.

According to Market.us, the use of generative AI in life insurance is shifting from early testing to real deployment. The market is expected to reach USD 1,739.9 million by 2033, rising from USD 138.8 million in 2023. This expansion reflects a strong 28.77% CAGR from 2024 to 2033. Growth is being supported by insurers adopting AI to speed up underwriting, reduce fraud, personalise coverage, and strengthen customer engagement.

Economic growth contributes positively, as improving incomes enable more people to afford life insurance. Additionally, rising incidence of chronic and lifestyle diseases like cancer and heart disease boosts demand, as individuals seek to mitigate medical and long-term care costs through insurance. For instance, in the United States, approximately 1.9 million new cancer cases were diagnosed in 2022, increasing the urgency for life coverage to ease financial burdens.

Key Takeaways

- In 2024, the Term Life Insurance segment held a leading position with 46.4% of the Global Life Insurance Market.

- In 2024, the Medium segment dominated with a 41.3% share of the market.

- In 2024, the Insurance Companies segment accounted for 38% of the total market share.

- The U.S. Life Insurance Market reached USD 298.7 Trillion in 2024 and recorded a strong 29.6% CAGR.

- In 2024, North America maintained a dominant position with 34.6% of the global market.

Ownership and Need

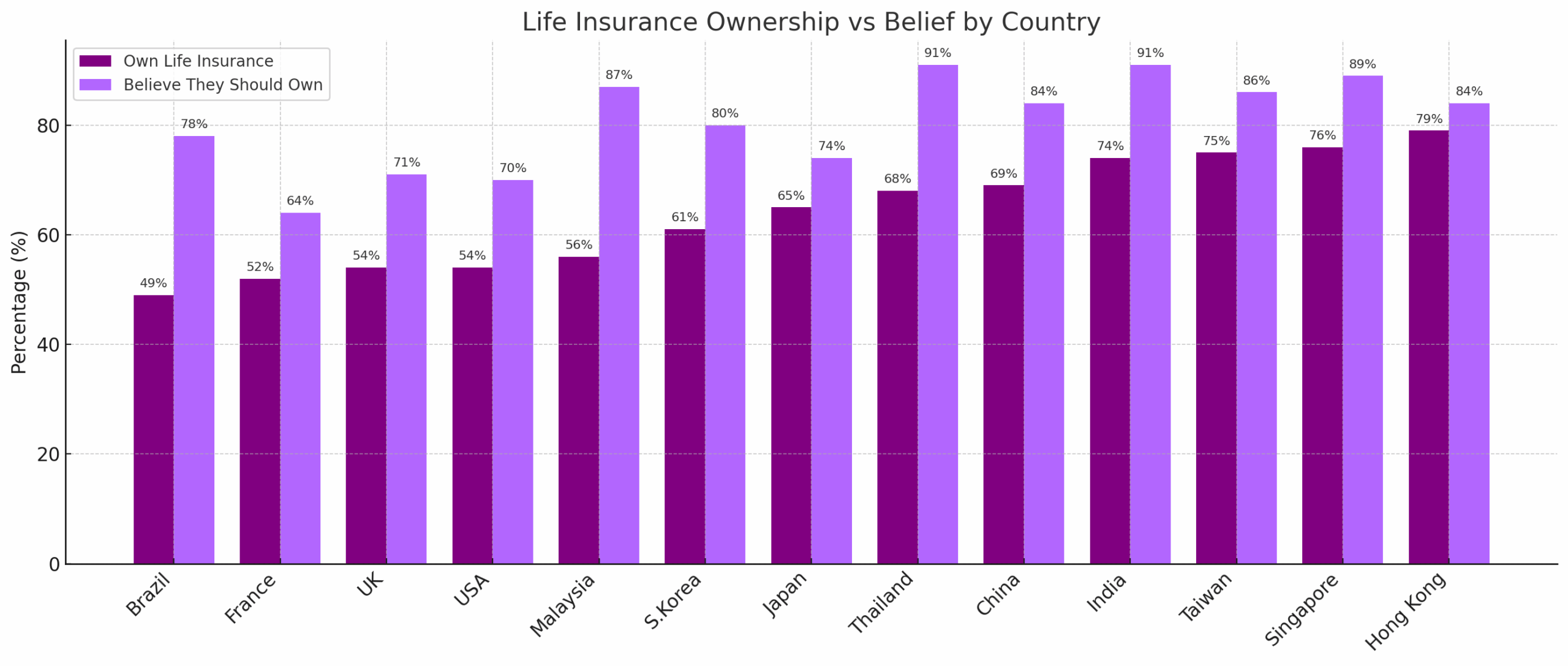

- 51% of American adults currently own a life insurance policy.

- 42% of adults report that they either lack life insurance or need additional coverage.

- The largest coverage gap is seen among single mothers, with 59% indicating they need protection.

- Purchase intent is strong among younger adults, with 44% of Gen Z and 50% of Millennials planning to buy coverage within a year.

Policy and Market Trends

- Total premiums for individual life insurance reached USD 15.9 billion in 2024, rising 3% from 2023 and marking the fourth record year.

- New individual policy sales remained flat compared with 2023.

- Annuities continued to strengthen their market position, accounting for 55.8% of life and annuity direct premiums in 2024.

Digital and Social Media Influence

- 25% of Americans prefer researching and purchasing life insurance online, although Gen Z is least likely to choose this method.

- More than 60% of Gen Z and Millennial adults trust social media influencers for insurance information.

- Around 50% of younger adults follow a financial advisor on social platforms, and over one-third follow an insurance company for product updates and guidance.

Driver Analysis

Growing Awareness of Financial Security

The increasing awareness among individuals about the importance of financial security is a key driver for the life insurance market. People are more conscious about securing their family’s future and managing risks related to unexpected events. This awareness has led to a rising demand for various life insurance products, notably term insurance and personalized policies tailored to specific needs. As financial education improves globally, more people see life insurance as a fundamental tool for long-term financial planning and protection.

Technological advancements also support this driver, making policies easier to buy and manage digitally, which attracts younger demographics. The convenience of online platforms and personalized options encourages more people to invest in life insurance policies, thus propelling overall market growth.

Restraint Analysis

Low Insurance Penetration and Product Complexity

Despite growth, low penetration rates, especially in rural and underdeveloped areas, restrict the life insurance market expansion in many regions. This limitation is due to financial literacy gaps and challenges in reaching remote locations. Many consumers find life insurance products complex and not clearly understood, which creates hesitation in policy adoption.

The variety and technical nature of insurance can overwhelm potential customers, limiting their willingness to purchase policies. Additionally, competition from informal savings and investment options like chit funds often divert interest away from formal insurance products. Companies face difficulties in simplifying offerings and enhancing trust with customers, which restrains the market’s full potential.

Opportunity Analysis

Digital Transformation and Product Innovation

The shift towards digital channels presents a significant opportunity for the life insurance market. Digital platforms enable insurers to reach a broader audience more efficiently and reduce operational costs. Innovations such as AI-driven underwriting and personalized insurance solutions are creating more customer-centric experiences. These new approaches allow for quicker policy issuance and claims processing, which enhances customer satisfaction.

Moreover, government initiatives and regulatory support for digital finance and financial inclusion are expanding access, especially in developing markets. This digital push combined with product innovation enables insurers to tap into previously underserved segments, including younger and middle-class populations seeking flexible and affordable coverage.

Challenge Analysis

Agent Retention and Distribution Channel Evolution

One of the major challenges in the life insurance industry is maintaining a stable and successful distribution network. Many life insurance agents leave the profession within the first few years, leading to high turnover and recruitment costs. Agent retention is difficult due to the demanding nature of the job, evolving customer expectations, and competition from digital channels.

Furthermore, traditional agency models are being disrupted as direct sales and bancassurance grow, requiring insurers to adapt their distribution strategies. Balancing the integration of digital tools while sustaining human interaction remains a critical challenge. Insurers must develop diverse and flexible distribution channels to stay competitive while managing costs effectively.

Key Market Segments

By Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Others

By Premium Range

- Low

- Medium

- High

By Provider

- Insurance Companies

- Insurance Agents/Brokers

- Insurtech Companies

- Others

Top Key Players in the Market

- American International Group (AIG)

- Allianz SE

- AXA Group

- The Prudential Insurance Company of America

- MetLife, Inc.

- Berkshire Hathaway Life

- China Life Insurance (Overseas) Company Limited

- Ping An Insurance (Group) Company of China, Ltd.

- China Ping An Insurance (Group) Co., Ltd.

- AIA Group Limited

- Assicurazioni Generali S.p.A.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.4 Bn |

| Forecast Revenue (2034) | USD 11.0 Bn |

| CAGR(2025-2034) | 12.5% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |