Table of Contents

AI Shoes Market Size

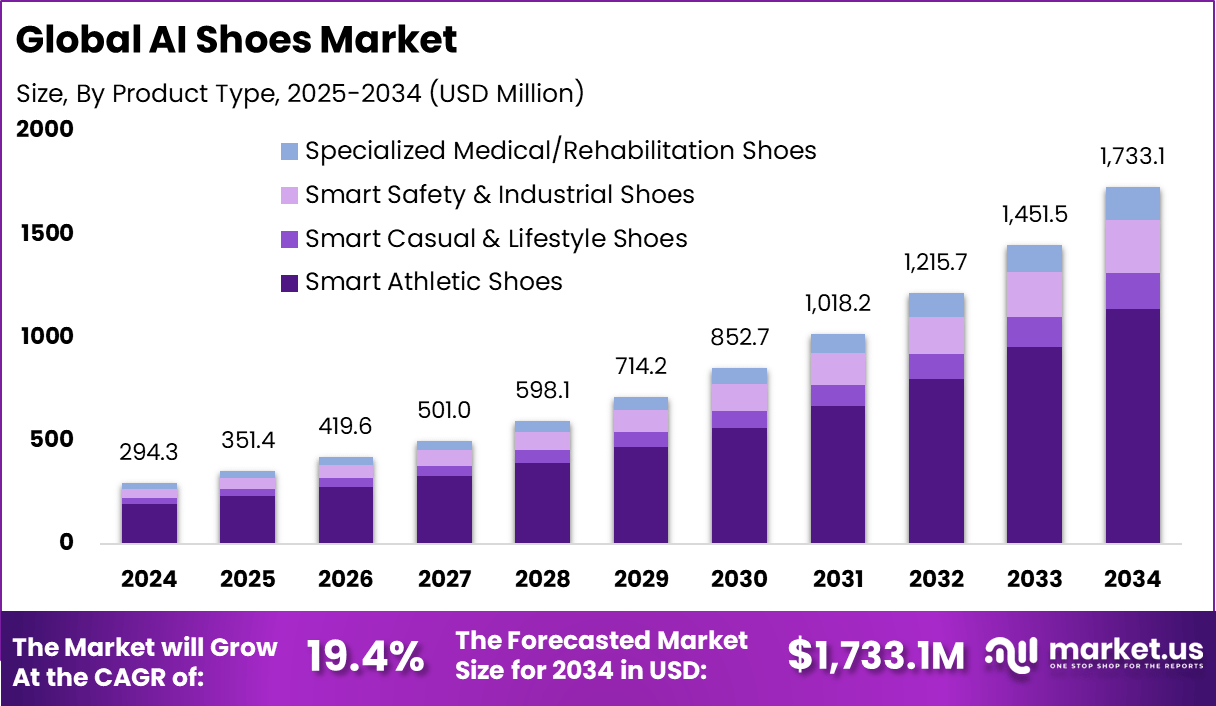

The Global AI Shoes Market generated USD 294.3 million in 2024 and is expected to grow from USD 351.4 million in 2025 to nearly USD 1,733.1 million by 2034, supported by a 19.4% CAGR across the forecast period. In 2024, North America held a leading position with more than a 42.6% share and revenue of USD 125.3 million, reflecting strong adoption of sensor-enabled and AI-driven footwear solutions in the region.

The AI shoes market has expanded as footwear manufacturers integrate intelligent sensors, motion analytics and adaptive algorithms into everyday and athletic footwear. Growth reflects rising consumer interest in personalised comfort, performance optimisation and health monitoring. AI powered shoes now support real time gait analysis, pressure mapping and activity insights, turning footwear into smart wearable devices.

Top driving factors for the AI shoes market include personalized fit and performance enhancement. AI shoes utilize advanced sensors and machine learning to tailor fit and provide real-time corrections on gait and posture, helping reduce injury risk. The ability to dynamically adjust shoe features like lacing and cushioning during use makes these products appealing both for sports and casual users. Additionally, the rising global interest in health monitoring and fitness tracking is fueling demand, with about 70% of fitness-conscious users willing to pay a premium for shoes offering personalized support and data insights.

Top Market Takeaways

- Smart athletic shoes hold 65.7%, reflecting strong demand for AI-enabled footwear that supports training and performance tracking.

- Sensor technology accounts for 40.3%, showing its importance in gait analysis, motion tracking, and injury prevention.

- Online channels represent 60.6%, supported by digital buying habits and interest in customizable smart footwear.

- Athletes and fitness enthusiasts make up 55.1% of the user base, driven by performance benefits and health insights.

- North America captures 42.6%, supported by early technology adoption and strong fitness spending.

- The U.S. leads regional growth with rising interest in smart footwear for sports, wellness, and lifestyle use.

- Growth at 17.5% CAGR reflects increasing awareness of AI-supported training optimization and personalized performance insights.

AI Adoption by Industry

High-Adoption Sectors

- Technology sector leads with 88% of companies using generative AI.

- Professional services, media, and telecom show strong adoption, with 80% in professional services and 79% in media and telecom.

- Financial services adoption stands at 65%, with AI expected to add USD 1 billion in banking revenue by 2027.

- Consumer goods and retail show 68% adoption, supported by personalization and operational efficiency.

- Industrial and automotive sectors in India show fast adoption, with automotive recording a 48% rise in machine learning use.

Low-Adoption Sectors

- Energy and materials record 59% adoption, the slowest among major industries.

- Construction and agriculture show the lowest usage at 1.4%, indicating large untapped potential.

Common Reasons for AI Adoption

- Internal process automation is the top driver, identified by 36% of executives.

- Data analysis and analytics remain core uses for supporting decisions and predictive insights.

- Marketing and sales adopt AI widely for content generation, lead qualification, and personalized outreach.

- Research and development uses AI in 44% of companies, especially within information and communication industries.

- ICT security adoption is high in electricity, gas, and water supply, where AI strengthens cybersecurity and operational resilience.

Future Outlook

The future outlook for the AI shoes market is optimistic, with continuous advances in sensor technology, AI algorithms, and materials science enabling smarter and more comfortable footwear. The market sees rising investment in eco-friendly materials and AI-driven design tools that speed up product development while personalization capabilities expand. There is a growing opportunity in medical and therapeutic applications such as gait rehabilitation and posture correction, extending the use beyond sports to healthcare. Regions like Asia-Pacific, showing increased disposable income and consumer awareness, present promising growth avenues.

Opportunity lies in leveraging health insights combined with connectivity features, allowing shoes to integrate with broader digital health ecosystems. AI-powered shoes can offer personalized coaching and long-term fitness and health monitoring, building strong consumer loyalty. Companies that innovate in these areas, including augmented reality virtual try-ons and sustainable manufacturing, are likely to capture new customer segments. This convergence of footwear, AI, and digital health continues to drive expansion, especially as consumers focus more on wellness and personalized experiences.

Emerging Trends

Among emerging trends in the AI shoes market, the integration of smart sensors stands out. Around 45% of new AI shoe models launched in 2025 include embedded sensors that track gait, posture, and health metrics. These sensors offer real-time feedback for injury prevention and performance optimization, aligning with the growing demand for health-focused smart footwear. Additionally, Bluetooth connectivity and AI-driven health tracking are becoming common features, boosting consumer interest in smart and connected shoes.

In 2025, smart athletic shoes dominate the market with a significant share of 65.7%. These shoes not only provide data on foot pressure and movement but also adapt dynamically with features such as auto-tightening and adaptive cushioning. This development fits well with the rise of data-driven fitness routines and has created a product category that appeals broadly to athletes and health-conscious consumers looking for footwear that acts as a wearable performance coach.

Key Growth Factors

Key growth factors for the AI shoes market include increasing consumer demand for personalized fitness tracking and enhanced comfort. Around 70% of fitness-focused consumers are willing to pay a premium for AI-enabled shoes that offer customized support and activity monitoring. Advances in AI algorithms and smaller electronics are enabling smarter data collection and analysis, which lowers production costs by approximately 20%, making advanced footwear more accessible. These factors create positive momentum for market expansion.

Another major growth factor is the surge in fitness culture and adoption of smart devices, particularly in North America where digital buying habits and fitness tech ecosystems are strong. This region captures nearly 43% of the market share. The combination of rising health awareness and technological innovation is fueling demand for AI shoes that blend comfort with intelligent features, driving continuous innovation and consumer adoption in the footwear industry.

Market Dynamics

Driver: Personalized Fit and Performance

AI shoes use advanced sensors and machine learning to capture detailed data about an individual’s foot shape, gait, and movement patterns. This allows for the creation of footwear that fits perfectly and offers real-time feedback to improve comfort and reduce the risk of injury. Such tailored performance enhancements strongly attract athletes and fitness enthusiasts who seek both comfort and injury prevention benefits. This growing demand for personalized, data-driven footwear is a key growth driver.

Additionally, AI shoes can dynamically adjust features like lacing or cushioning during use, enhancing the wearer’s experience throughout various activities. The capability to fuse health tracking with footwear enhances the appeal beyond traditional shoe options, driving broader market adoption across sports and everyday usage contexts.

Restraint: High Production Costs

One major challenge limiting AI shoes’ mass adoption is their high production cost. Incorporating sensors, AI chips, and connectivity components significantly increases manufacturing expenses. This results in higher retail prices that many consumers find prohibitive, especially in price-sensitive and emerging markets.

The expense barrier overly restricts broader market penetration, confining early growth mostly to premium and athletic segments where consumers prioritize advanced technology for performance gains. Until production costs decrease, affordability remains a key restraint preventing AI shoes from reaching a wider audience.

Opportunity: Growing Demand for Health Insights

There is a rising global trend toward health monitoring and smart wearable technology, creating a significant opportunity for AI shoes. These shoes offer users valuable health data such as step count, running speed, calories burned, and gait analysis. This insight helps users optimize fitness and avoid injuries through data-driven adjustments.

Consumers focused on health and fitness appreciate footwear that integrates AI-driven analytics for real-time coaching and preventive injury management. Market growth is expected to benefit greatly as more health-conscious individuals adopt smart footwear that supports personalized wellness goals.

Challenge: Consumer Trust and Data Privacy

Ensuring trust in AI shoes involves addressing consumer concerns about data privacy and technological reliability. AI shoes collect sensitive biomechanical and health-related data, raising fears about how this information is stored, used, and protected.

Moreover, technological malfunctions or sensor failures could undermine user experience and reduce confidence. Overcoming these challenges requires robust privacy safeguards, transparent data handling policies, and durable hardware capable of consistent performance to encourage wider acceptance.

Key Market Segments

By Product Type

- Smart Athletic Shoes

- Running Shoes

- Training & Gym Shoes

- Basketball Shoes

- Smart Casual & Lifestyle Shoes

- Smart Safety & Industrial Shoes

- Specialized Medical/Rehabilitation Shoes

By Technology

- Sensor Technology

- Machine Learning and Artificial Intelligence

- Algorithms

- Connectivity

By Sales Channel

- Online Channel

- Offline Channel

By End-User

- Athletes & Fitness Enthusiasts

- Tech-Savvy Consumers

- Healthcare & Rehabilitation Patients

- Industrial Workers

- Elderly Population

Top Key Players in the Market

- Nike Inc.

- Adidas AG

- Puma SE

- Under Armour Inc.

- Asics Corp.

- Deckers Outdoor Corporation

- Wolverine World Wide Inc.

- Reebok International Ltd.

- Mizuno Corporation

- Brooks Sports Inc.

- Salomon SAS

- Patagonia Inc.

- Vivobarefoot Limited

- Ajanta Shoe Private Limited

- Orpyx Medical Technologies Inc.

- Scott Sports SA

- La Sportiva NA Inc.

- Shift Robotics

- Digitsole

- Sensoria Health Inc.

- ShiftWear

- Wiivv Wearables Inc.

- Altra Torin IQ

- Salted Venture

- Lumo

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 294.3 Mn |

| Forecast Revenue (2034) | USD 1,733.1 Mn |

| CAGR(2025-2034) | 19.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |