Table of Contents

Report Overview

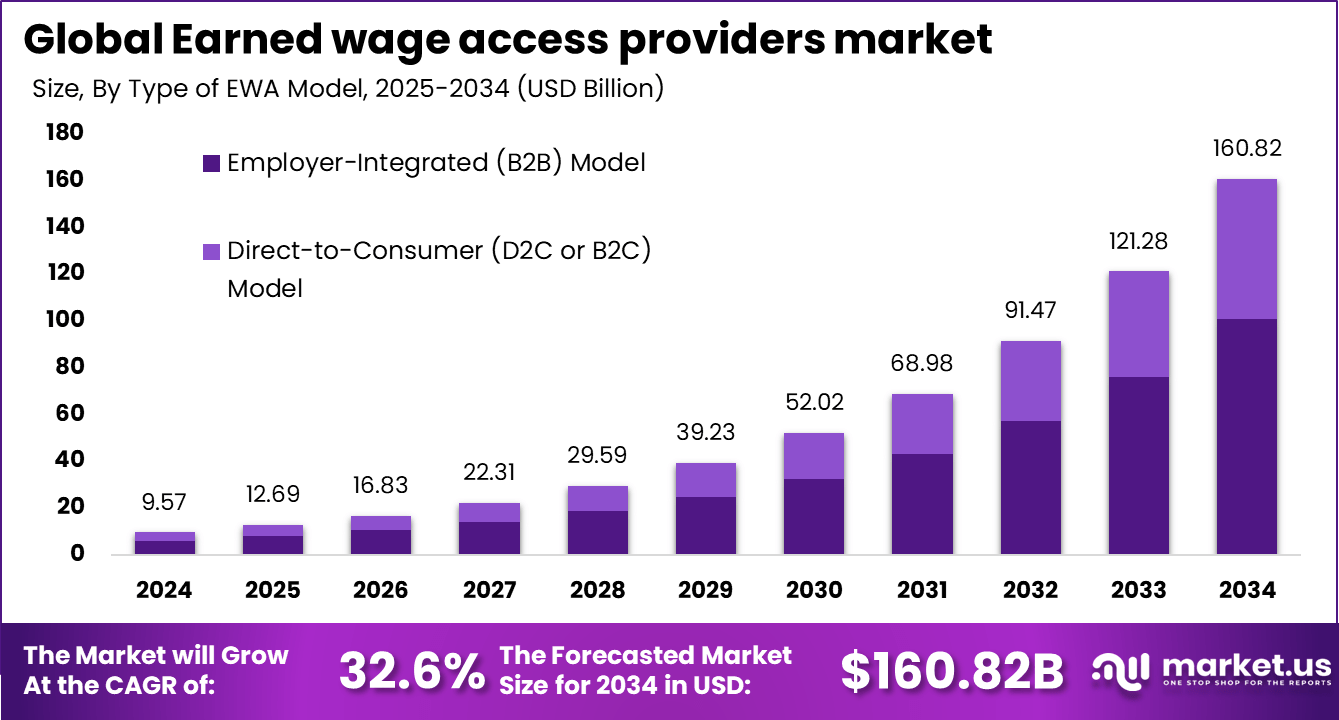

According to Market.us, The Global Earned Wage Access Providers Market is expected to reach USD 160.82 billion by 2034, rising from USD 9.57 billion in 2024 with a strong 32.6% CAGR projected from 2025 to 2034. In 2024, North America held a dominant position with more than a 40.6% share and revenue of USD 3.88 billion, reflecting widespread adoption of on-demand pay solutions across employers and financial platforms in the region.

The earned wage access providers market has expanded as employers and workers adopt on-demand pay services that allow employees to access a portion of their earned wages before payday. Growth reflects rising interest in financial flexibility, increased adoption of digital payroll systems and the shift toward employee centric benefits. EWA solutions have become a core component of modern workforce management, especially in industries with hourly or shift based work.

Top driving factors for this market include the increasing financial pressures on employees due to rising living costs and unexpected expenses. Demand is further fueled by a growing gig and hourly economy, which comprises freelancers and part-time workers needing flexible, early access to earned income. The convenience of mobile payment technologies and cloud-based payroll integrations has lowered barriers to adoption, making EWA solutions easy for employers to implement and users to access. Employer adoption is boosted by the positive impact of EWA on employee retention and absenteeism reduction, as workers feel more financially secure.

Demand analysis points to significant user growth, with more than 7 million workers using EWA services in 2022 and a near 93% increase in transaction volume year over year. The subscription-based revenue model has captured more than 70% of the provider market, favored for its predictable costs and scalable deployment. Mobile apps, preferred by about 42.6% of users, allow instant access and enhanced participant engagement. The retail and hospitality sectors hold a leading position, representing roughly 34.7% of the market, due to their large hourly wage workforces and the beneficial role EWA plays in reducing workforce turnover.

Key Takeaway

- The Employer Integrated (B2B) Model led the market in 2024 with a 62.8% share as more companies embedded EWA into payroll and HR platforms.

- Large Enterprises dominated adoption with 76.5%, showing strong interest in retention and financial wellness programs.

- The Subscription Based model accounted for 70.3%, supported by predictable pricing and scalability.

- Mobile Applications captured 42.6%, driven by user preference for instant access on smartphones.

- The Retail and Hospitality sector held 34.7%, reflecting high demand in hourly and high turnover industries.

- The U.S. market reached USD 3.30 billion in 2024 with 28.6% CAGR, supported by employer adoption and worker demand for flexible pay.

- North America maintained leadership with 40.6% share, driven by a mature fintech ecosystem and strong financial wellness initiatives.

User Statistics and Benefits

- User growth is rising, with more than 7 million workers using EWA services in 2022.

- Unique users increased from 1.9 million in 2021 to 2.8 million in 2022.

- Transaction volume increased by 93.2% between 2021 and 2022.

- Advanced funds rose by 94.7% over the same period.

- 77% of users reported lower financial stress.

- 82% felt less anxious about money.

- 72% gained better control and confidence in their financial decisions.

- 81% reported higher self esteem due to improved short term financial stability.

Sector Specific Adoption

- Retail and e commerce held 21% of the market in 2024, emerging as the leading adopter of EWA.

- Large enterprises accounted for nearly 60% of adoption in 2024, supported by retention and engagement benefits.

- Healthcare, logistics, and hospitality sectors recorded strong EWA uptake due to dependence on shift based and hourly employees.

Emerging Trends

Emerging trends in the earned wage access sector include the rapid adoption of mobile and cloud platforms that scale EWA services across industries such as healthcare, retail, and caregiving. Over 42% market share is held by North America, reflecting regional leadership driven by advanced technology use and high worker demand for pay flexibility. Integration of EWA with digital wallets and payment apps is also on the rise, providing seamless, instant wage access to employees.

Another notable trend is the increased regulatory clarity and compliance frameworks establishing trust in EWA offerings. This fosters sustainable adoption by employers aiming to improve workforce financial wellness and reduce turnover. Cloud-based scalable platforms remain a key innovation, enabling faster deployment and broader reach of on-demand pay solutions that address the needs of a growing gig economy workforce.

Growth Factor

The primary growth factor for earned wage access is rising financial stress among workers, with recent data indicating about 97% of full-time employees face financial stress, and 87% report it impacts daily life. This urgency for immediate wage access is intensified by inflation and increased living costs. Additionally, the gig and hourly workforce segments, where many live paycheck to paycheck, drive demand for flexible payroll solutions. These factors encourage employers to adopt EWA programs to improve employee satisfaction and retention.

Growth is further supported by technological advancements, including AI integration, cloud payroll systems, and mobile apps, which enhance the ease of use and accessibility of EWA. There is also growing awareness of employee financial wellness as a strategic priority, leading companies to offer these benefits as part of talent retention efforts. The dynamic labor market with evolving work arrangements continues to create favorable conditions for the rapid expansion of earned wage access services.

Driver

Rising Financial Stress Among Workers

The increasing financial pressure on workers, especially hourly and gig workers, is a major factor driving the earned wage access (EWA) market. Many employees experience cash flow gaps between pay cycles, which pushes the demand for early access to earned wages. This financial flexibility helps reduce reliance on costly payday loans and credit cards, offering a practical solution to manage unexpected expenses and living costs. Employers recognize that providing EWA improves employee satisfaction and retention, motivating adoption. The growing gig economy and expanded smartphone use also support the integration of EWA with digital payroll systems, facilitating easier, real-time wage access for workers.

Restraint

Regulatory and Compliance Challenges

The earned wage access market faces challenges related to regulatory uncertainties and compliance with labor laws. Different regions have varying rules on wage advances and financial products, complicating consistent implementation. Providers must navigate complex legal frameworks to avoid potential liabilities or regulatory penalties. These compliance hurdles may delay market entry or expansion for some providers and increase costs for maintaining legal adherence. Without clear, harmonized guidelines, widespread adoption by employers may be cautious, limiting rapid growth.

Opportunity

Integration with Workforce Financial Wellness Programs

A significant opportunity lies in embedding earned wage access into broader employer-sponsored financial wellness programs. Businesses are increasingly focused on improving employee well-being and reducing financial stress to boost productivity and reduce turnover. EWA solutions combined with education and budgeting tools create a holistic employee benefit.

Such integrated offerings attract large enterprises aiming to enhance workforce stability, making EWA a strategic part of human capital management. This trend broadens market potential beyond urgent cash needs to long-term financial health support.

Challenge

Balancing Access with Responsible Use

A key challenge is ensuring that earned wage access does not lead to employee over-reliance or financial harm. If used irresponsibly, frequent wage advances can create cycles of dependency or debt. Providers and employers must design safeguards to encourage responsible use, including controls on withdrawal limits and clear communication on fees. Building trust requires balancing ease of access with education and protections. Maintaining this balance is critical to sustaining consumer confidence and regulatory support in the evolving market.

Future Outlook

The future outlook for earned wage access providers is optimistic with expanding adoption across industries and geographies. Innovations in API-driven platforms allow customizable and scalable EWA offerings that integrate easily into employer systems. Growing emphasis on employee financial wellness and regulatory clarity supports wider deployment. Markets such as gig work and freelance labor present new opportunities to broaden reach beyond traditional employment environments. The increasing migration toward digital payroll and real-time payments infrastructure continues to enhance service reliability and ease of access.

Opportunities in the EWA market lie in extending beyond basic wage advances to integrated financial wellness platforms offering budgeting, saving, and credit-building tools. Providers that can embed their offerings into comprehensive HR technology stacks and partner with payroll and fintech companies are positioned to grow faster. International expansion, as seen by some providers entering UK, Canada, and Australia markets, opens additional avenues for growth. These trends collectively signal a shift towards more flexible, employee-focused payroll innovations, aimed at improving financial health and workforce stability.