Table of Contents

AI Supercomputer Market Size

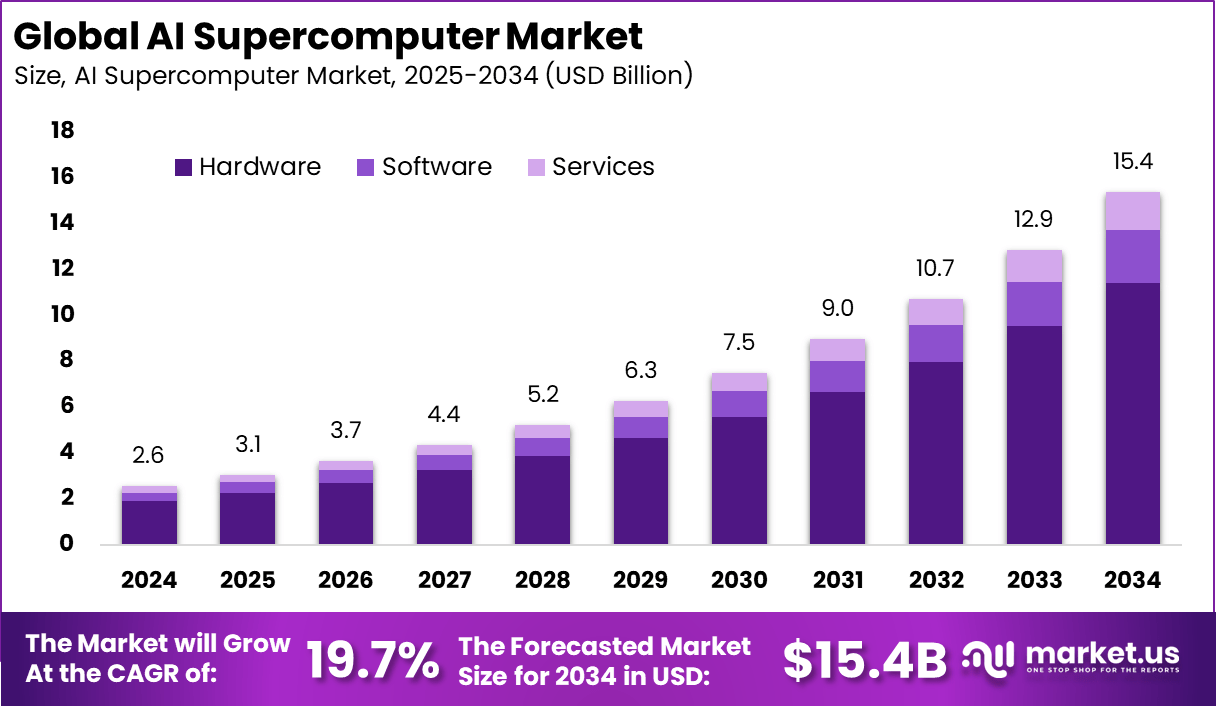

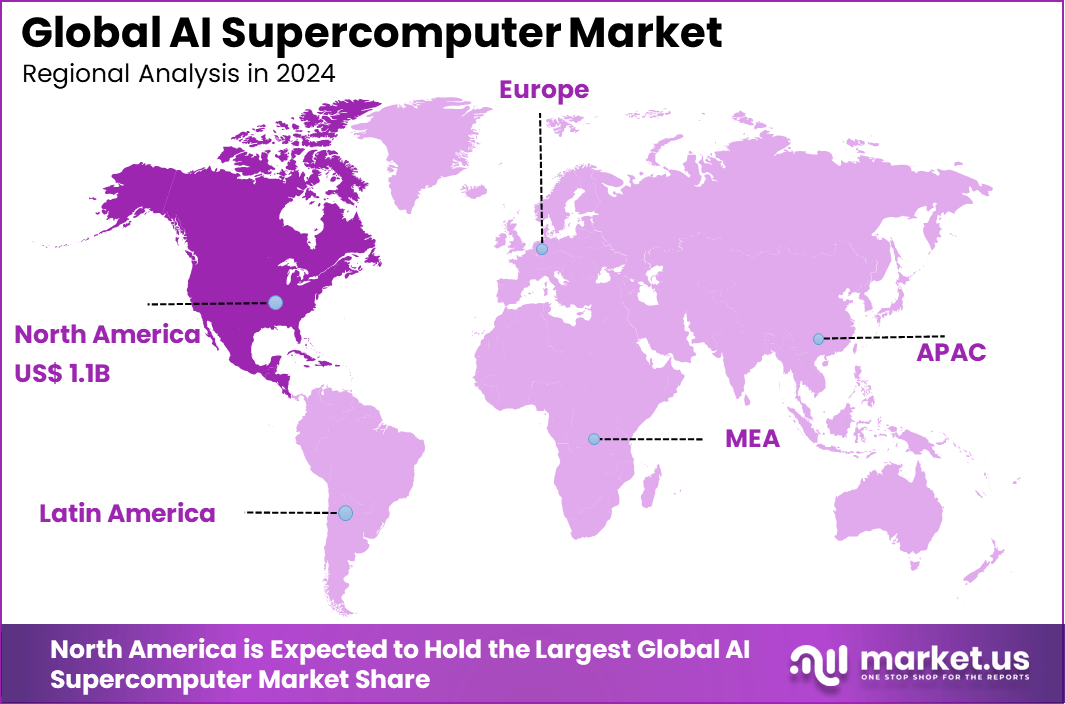

The global AI supercomputer market generated about 2.6 billion USD in 2024 and is expected to grow from nearly 3.1 billion USD in 2025 to approximately 15.4 billion USD by 2034, reflecting a CAGR of 19.7% across the forecast period. In 2024, North America held a dominant position with more than 42.5% of total revenue, accounting for nearly 1.1 billion USD, supported by strong adoption across advanced computing and enterprise AI workloads.

The AI supercomputer market has expanded as organisations build advanced computing systems capable of training large scale AI models and processing massive scientific datasets. Growth reflects increasing usage of generative AI, rising complexity of research workloads and the need for faster algorithm development. These systems combine accelerated processors, high bandwidth memory and specialised interconnects to deliver extremely high performance for data intensive tasks.

The push for quicker AI model training stands out as a main driver, since large models now require systems that handle trillions of operations per second, up from billions just a few years back. Hardware jumps, like better GPUs and custom chips, let these machines run more efficiently, cutting down on wait times for intensive jobs by factors of 10x or more. Sectors facing big data challenges, from finance to manufacturing, fuel this growth, with adoption rates in healthcare alone rising over 30% yearly due to needs in genomics and imaging.

Demand surges from real-world uses like autonomous vehicle testing and personalized medicine, where systems process petabytes of data daily across global networks. Cloud setups now make up about 60% of new deployments, letting firms scale without massive upfront builds, while on-site units serve sensitive government work. In regions like Asia-Pacific, industrial growth drives 40% higher uptake compared to mature markets, tied to rising AI experiments in smart cities and logistics.

Top Market Facts

- Hardware dominated in 2024 with 74.3% share, supported by strong demand for GPUs, TPUs, AI accelerators, and high-performance networking systems required for intensive model training.

- Cloud-based deployment accounted for 58.6%, showing broad adoption of remotely managed AI supercomputing capacity that allows scalable and flexible training workloads.

- Machine Learning and Deep Learning technologies led the market with 61.4%, driven by rising computational needs for large and complex AI models.

- AI Research and Model Training was the largest application segment with 48.2%, supported by rapid growth in foundation models and expanding enterprise AI workloads.

- Hyperscalers and Cloud Providers held 46.5%, as major technology companies continued to build large AI clusters to power commercial and research applications.

- North America captured 42.5% of global revenue. The US market reached USD 0.98 billion, posting 17.4% growth, supported by sustained investment in advanced AI infrastructure.

Driver Analysis

Rising Demand Across Industries

AI supercomputers see strong pull from sectors like healthcare, finance, and automotive that need heavy computing for tasks such as drug discovery and risk checks. These systems handle vast data sets quickly, cutting down research time and sharpening results for businesses chasing better outcomes. This demand grows as companies spot ways to use AI for real gains, from faster drug trials in health to spot-on fraud detection in banking. More firms now see these machines as key tools to stay ahead, pushing hardware makers to ramp up supply.

Restraint Analysis

Steep Upfront and Running Costs

High prices for parts like GPUs and TPUs hit hard, with added bills for cooling setups and power grids keeping many buyers away. Only big players with deep pockets can afford the initial outlay, leaving smaller outfits on the sidelines. Ongoing upgrades to match new AI needs pile on more expenses, making it tough for widespread use. This cost wall slows market spread, as firms weigh if the payoff justifies the spend year after year.

Opportunity Analysis

Push into New Markets and Cloud Links

Places like Asia-Pacific and Latin America open doors with fast industry growth and fresh AI builds in spots such as China and India. Local hubs for tech draw investments that favor powerful compute setups for local needs. Cloud tie-ins let any size firm tap supercomputing without big buys, scaling as workloads grow. This shift pulls in startups and mid-tier users, widening the buyer pool and fueling faster take-up.

Challenge Analysis

Power Use and Green Pressures

These machines gulp huge energy for nonstop runs, leaning on dirty sources that hike bills and harm the planet through big carbon output. Cooling alone adds to the strain, making ops pricey in high-power zones. Rules on emissions tighten as green goals rise, forcing tweaks for efficiency or cleaner power that cut speed or raise costs. Providers scramble to balance power with eco rules, or risk slower rollout.

Regional Insights

North America Market Size

In 2024, North America led the AI market with more than 42.5% share, supported by a strong base of technology innovation, skilled talent, and sustained capital investment. The region’s leadership is reinforced by the capabilities of the United States, where advanced digital infrastructure and extensive R&D activity accelerate AI development. Rapid adoption across industries is further supported by active venture capital funding and government programs that encourage broader AI commercialization.

Key Market Segments

By Component

- Hardware

- Processors/Compute

- Central Processing Units (CPU)

- Graphics Processing Units (GPU)

- Application-Specific Integrated Circuits (ASICS)

- Field-Programmable Gate Arrays (FPGAS)

- Memory & Storage

- Interconnect & Networking

- Processors/Compute

- Software

- AI Software Frameworks

- Cluster Management & Orchestration

- Developer Tools & Libraries

- Services

- Integration & Deployment

- Support & Maintenance

- Consulting

By Deployment Mode

- Cloud-based

- On-Premises

By Technology

- Machine Learning (ML)/Deep Learning (DL)

- Natural Language Processing (NLP)

- Computer Vision

By Application

- AI Research & Model Training

- Drug Discovery & Healthcare

- Autonomous Systems

- Financial Modeling

- Climate & Weather Research

- Others

By End-User

- Hyperscalers & Cloud Providers

- Government & Defense Labs

- Academic & Research Institutions

- Enterprises

- BFSI

- Healthcare

- Automotive

- Retail

- Others

Top Key Players in the Market

- Nvidia Corporation

- Intel Corporation

- Advanced Micro Devices Inc.

- Samsung Electronics

- Micron Technology Inc.

- IBM Corporation

- META

- Dell Inc.

- Huawei Technologies Co. Ltd.

- Microsoft

- Cerebras

- Hewlett Packard Enterprise Development LP

- Fujitsu

- Tesla

- Atos SE

- NEC Corporation

- Oracle

- Amazon Web Services Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.6 Bn |

| Forecast Revenue (2034) | USD 15.4 Bn |

| CAGR(2025-2034) | 19.7% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |