Table of Contents

Introduction

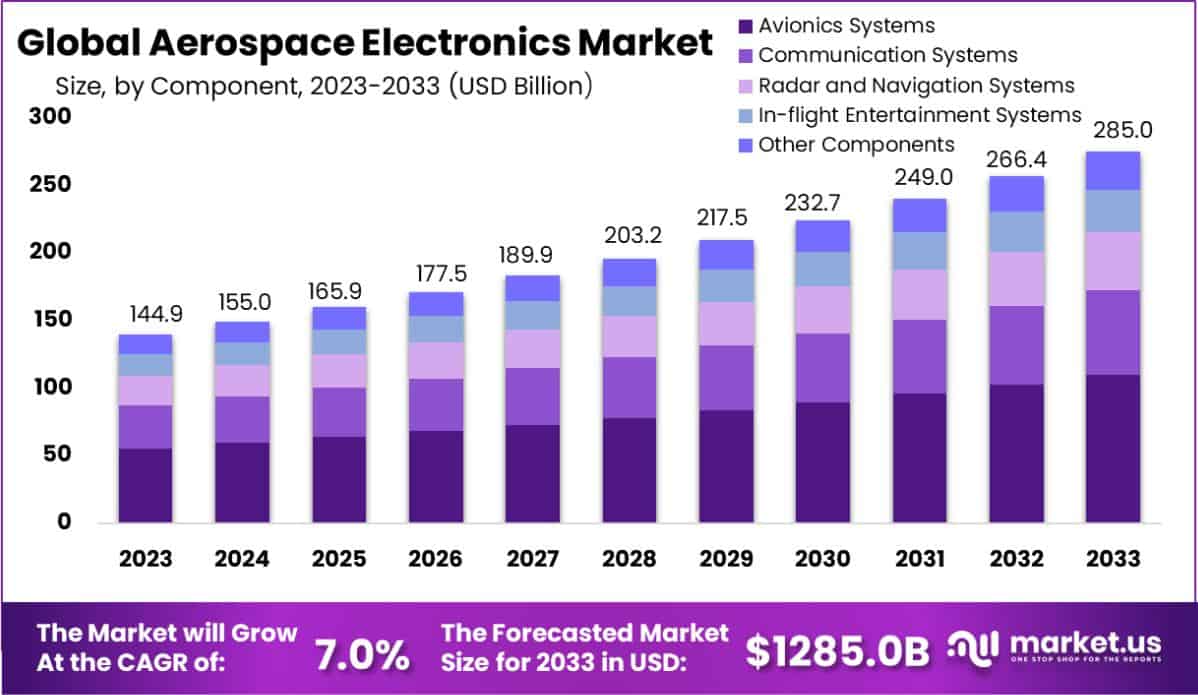

According to Market.us, The Global Aerospace Electronics Market is anticipated to expand from USD 144.9 Billion in 2023 to approximately USD 285.0 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 7.0%. This projection underscores the sector’s vigorous expansion driven by technological advancements and increased investments in aerospace applications. In terms of regional dominance, North America stands out in 2023, capturing a significant 37.4% of the global market share, valued at USD 54.19 Billion.

Aerospace electronics are integral to the functioning and advancement of modern aircraft, encompassing a broad array of systems such as navigation, communication, and radar. These electronics are critical for the safe and efficient operation of both military and commercial aircraft. The components include flight control systems, data recorders, and cockpit displays, each designed to withstand the unique pressures and environmental challenges associated with aerospace environments. Innovation in this sector is highly dependent on advancements in technology and materials science, aiming to improve the reliability, functionality, and safety of airborne electronics.

The global market for aerospace electronics is experiencing significant growth, driven by increasing demands for advanced avionic systems and the rising number of air travel passengers. Modernization of existing aircraft fleets and heightened defense spending in several countries further catalyze market expansion. The incorporation of new technologies such as artificial intelligence (AI) and the Internet of Things (IoT) into aerospace electronics is transforming the industry, enhancing everything from navigation precision to in-flight entertainment systems.

Demand in the aerospace electronics market is primarily driven by the growth of both commercial aviation and space exploration sectors. In commercial aviation, the increasing number of air passengers globally and the subsequent need for more aircraft are significant demand drivers. Additionally, the push for more fuel-efficient and environmentally friendly aircraft accelerates the adoption of advanced electronics that optimize aircraft performance and reduce emissions. In the space sector, the rise of commercial space travel and satellite deployment for communication and earth observation purposes further bolsters demand for cutting-edge aerospace electronics.

Several factors are catalyzing the growth of the aerospace electronics market. The ongoing modernization of aircraft fleets, driven by older aircraft replacements and the demand for next-generation avionic systems, is a significant growth driver. Additionally, the defense sector’s consistent demand for enhanced aircraft capabilities supports robust investments in military aviation electronics. The increasing governmental and private investment in space exploration and satellite technology also propels the market forward. Regulatory changes that promote aviation safety and technological upgrades further stimulate the development and integration of advanced electronics in the aerospace industry.

Opportunities within the aerospace electronics market are vast, particularly in light of emerging technologies that promise to revolutionize aerospace capabilities. Innovations in fields such as artificial intelligence, machine learning, and robotics are increasingly being integrated into aerospace systems. These technologies enhance the autonomy and efficiency of aerospace vehicles, from unmanned aerial vehicles (UAVs) to commercial airliners and beyond. Moreover, the growing trend of miniaturization allows for lighter and more energy-efficient systems, opening up possibilities for new aerospace applications and improvements in existing systems.

Aerospace Electronics Statistics

- The Global Aerospace Electronics Market is projected to escalate from USD 144.9 Billion in 2023 to approximately USD 285.0 Billion by 2033, registering a Compound Annual Growth Rate (CAGR) of 7.0% over the forecast period from 2024 to 2033. This growth is indicative of robust advancements and an increasing adoption rate in aerospace technologies.

- In the component segmentation of the Aerospace Electronics Market, Avionics Systems emerged as the leading category in 2023, securing a substantial market share of over 38.5%. This segment’s dominance underscores its critical role in modern aerospace applications, driven by the increasing complexity and functionality of avionics in enhancing flight operations and safety.

- Regarding the end-use landscape, the Commercial sector accounted for a significant majority, holding more than 59.1% of the market share in 2023. This dominance is attributed to the escalating demand for commercial aviation driven by global economic growth and increasing air travel.

- Geographically, North America proved to be the most influential region within the Aerospace Electronics Market, holding a dominant share of 37.4%, which translated to a revenue of USD 54.19 Billion in 2023. This leading position is supported by advanced technological infrastructure and substantial investments in aerospace and defense sectors in the region.

- The Global Aerospace Market is projected to double in value over the next decade, with estimations suggesting a growth from USD 330.5 Billion in 2023 to USD 662.4 Billion by 2033. This reflects a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2024 to 2033. Such expansion is indicative of robust sectoral advancements and escalating demand for aerospace services and technologies.

- Simultaneously, the Global Aerospace AI Market is poised for a dramatic surge, anticipated to escalate from USD 1.2 Billion in 2023 to USD 34.2 Billion by 2033. This market is expected to grow at an unprecedented CAGR of 39.8%, driven by the increasing integration of artificial intelligence in aerospace applications for enhanced efficiency and safety.

- Further complementing the aerospace sector’s growth is the global space economy, which encompasses various activities related to the research, exploration, and utilization of space. This segment is estimated to exceed revenues of over $1 trillion by 2040, reflecting the increasing commercial and governmental investment in space technologies.

- Additionally, the Global Aerospace Coating Market is also on a growth trajectory, set to increase from USD 2.5 Billion in 2023 to USD 4.6 Billion by 2033. The market is projected to grow at a CAGR of 6.4%, underpinned by the rising demand for advanced, durable, and environmentally friendly coatings.

- In 2023, Boeing led the aerospace and defense manufacturing sector, posting revenues of approximately USD 77.9 billion. This dominance underscores its significant role in shaping industry dynamics and driving technological innovations across the global aerospace market.

Emerging Trends

- Sustainable Aviation: Aerospace industries are aggressively adopting sustainable practices, focusing on electric and hybrid-electric propulsion systems and the integration of Sustainable Aviation Fuels (SAFs) derived from renewable sources. This trend is driven by a global push towards reducing the carbon footprint of air travel.

- Autonomous and Unmanned Systems: Advances in artificial intelligence and machine learning are enhancing the capabilities of unmanned aerial vehicles (UAVs) and autonomous flight systems. These technologies allow for greater precision and autonomy in operations ranging from civilian to military applications.

- Advanced Propulsion Systems: The development of supersonic and hypersonic aircraft, along with innovative space propulsion technologies like reusable rockets and ion thrusters, marks a significant trend. These advancements aim to reduce travel times and expand the possibilities of space exploration.

- Digital Transformation and Industry 4.0: The aerospace sector is experiencing a digital overhaul with the widespread adoption of additive manufacturing (3D printing), digital twins, and enhanced cybersecurity measures to protect interconnected aerospace systems.

- Space Tourism and Exploration: Initiatives by both private companies and governmental agencies are pushing the boundaries of space travel and exploration. Commercial spaceflight and ambitious missions to outer space bodies are being planned and executed, aiming to open new frontiers for human activities beyond Earth.

Top Use Cases

- Enhanced Safety and Efficiency in Aviation: AI-enabled co-pilot systems and autonomous navigation technologies are improving flight safety and operational efficiency, reducing human errors and optimizing resource utilization during flights.

- Precision in Manufacturing: Aerospace companies are utilizing advanced 3D printing technologies to create complex components that are lighter and stronger, thereby enhancing the performance and reducing the environmental impact of aerospace vehicles.

- Improved Communication Systems: Advanced communication technologies that utilize lasers and radio frequencies are revolutionizing how ground teams interact with satellites and spacecraft, enhancing the robustness and reliability of space missions.

- Remote Sensing and Earth Observation: Autonomous high-altitude pseudo satellites (HAPS) and advanced satellite technologies are being developed to provide continuous and cost-effective Earth observation, critical for environmental monitoring, disaster response, and military surveillance.

- Sustainable Practices in Aerospace Operations: From the adoption of SAFs to the development of zero-emission hydrogen aircraft, the aerospace industry is investing in technologies that support sustainable operations to meet global environmental targets.

Major Challenges

- Supply Chain Complexity: Aerospace and defense (A&D) industries are grappling with intricate supply chains that lack transparency, which makes it difficult to plan and mitigate disruptions. This complexity is compounded by part shortages that delay production and delivery schedules.

- Talent Shortage: The A&D sector is facing significant challenges in attracting and retaining skilled workers. This talent shortage is exacerbated by evolving workforce expectations and a highly competitive job market, making it difficult for companies to scale operations to meet increasing demands.

- Technological Disruption: Rapid advancements in technologies like AI and automation are continuously reshaping the industry landscape. While these innovations present opportunities, they also challenge existing business models and require companies to continually adapt and integrate new capabilities.

- Economic Uncertainty and Inflation: Fluctuating economic conditions and rising inflation are impacting the purchasing power of defense budgets and increasing the costs of raw materials. This economic pressure affects everything from innovation to day-to-day operations.

- Environmental Regulations and Sustainability Pressures: The push towards sustainability is urging A&D companies to innovate greener technologies and practices. Compliance with stringent environmental regulations adds another layer of complexity to the production and operational processes.

Top Opportunities

- Digital Transformation: There is a significant opportunity for growth through the adoption of digital technologies. These technologies can enhance operational efficiency, improve product development, and offer better customer solutions.

- Innovation in Product and Services: The introduction of new technologies and materials, along with the evolution of additive manufacturing, opens up avenues for innovative products and services that can meet changing industry demands and standards.

- Expansion into New Markets: Decreasing costs for space payloads and advancements in infrastructure are making it feasible for smaller and mid-size companies to enter the A&D market, thereby expanding the industry ecosystem.

- Partnerships and Collaborations: Strategic partnerships, like those seen with major companies enhancing their capabilities through alliances, are crucial. These collaborations can lead to better resource sharing, enhanced innovation capacities, and access to new markets.

- Adapting to New Regulatory Environments: Companies that can quickly adapt to new regulations and environmental standards are likely to gain a competitive edge. This adaptability is essential not just for compliance but also for pioneering sustainable aerospace solutions.

Recent News

- RTX Corporation’s AI Integration in Avionics: In July 2024, RTX Corporation unveiled a strategic partnership aimed at advancing avionic systems through the integration of artificial intelligence. This collaboration is designed to refine navigation solutions, thereby modernizing aircraft operations and elevating safety standards within the aerospace electronics sector.

- L3Harris Technologies and U.S. Navy Agreement: In November 2023, L3Harris Technologies secured a significant contract valued at $80 million from the U.S. Navy. The contract is focused on enhancing electronic warfare capabilities aboard F/A-18 aircraft. This development aims to equip pilots with advanced systems to counteract evolving threats, underscoring a strategic move to bolster defense mechanisms through cutting-edge technology.

- BAE Systems Acquisition of Ball Aerospace: In February 2024, BAE Systems completed its acquisition of Ball Aerospace, leading to the formation of a new division termed Space & Mission Systems. This acquisition is anticipated to harness BAE’s extensive capabilities across various aerospace technologies, strategically positioning the company for expanded growth in both defense and civil systems arenas.

- GE’s Launch of Energy-Efficient Power Electronics: In June 2024, General Electric (GE) introduced a new line of energy-efficient power electronics. These innovations are engineered to reduce aircraft carbon emissions by up to 30%. This launch is part of the broader industry initiative towards sustainability, aimed at minimizing the environmental footprint of aerospace operations.

Conclusion

The aerospace electronics market is poised for robust growth, propelled by advancements in technology and an increasing emphasis on aircraft safety and efficiency. As airlines continue to modernize fleets and military expenditures remain high, the demand for sophisticated aerospace electronics will likely escalate.

Furthermore, emerging trends such as UAVs, UAM, and electric propulsion systems present new challenges and opportunities, requiring continuous innovation in electronic technologies. Navigating these developments successfully will be crucial for stakeholders aiming to capitalize on the potential of the aerospace electronics industry, ensuring sustained growth and adaptation in a rapidly evolving global market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)