Table of Contents

Introduction

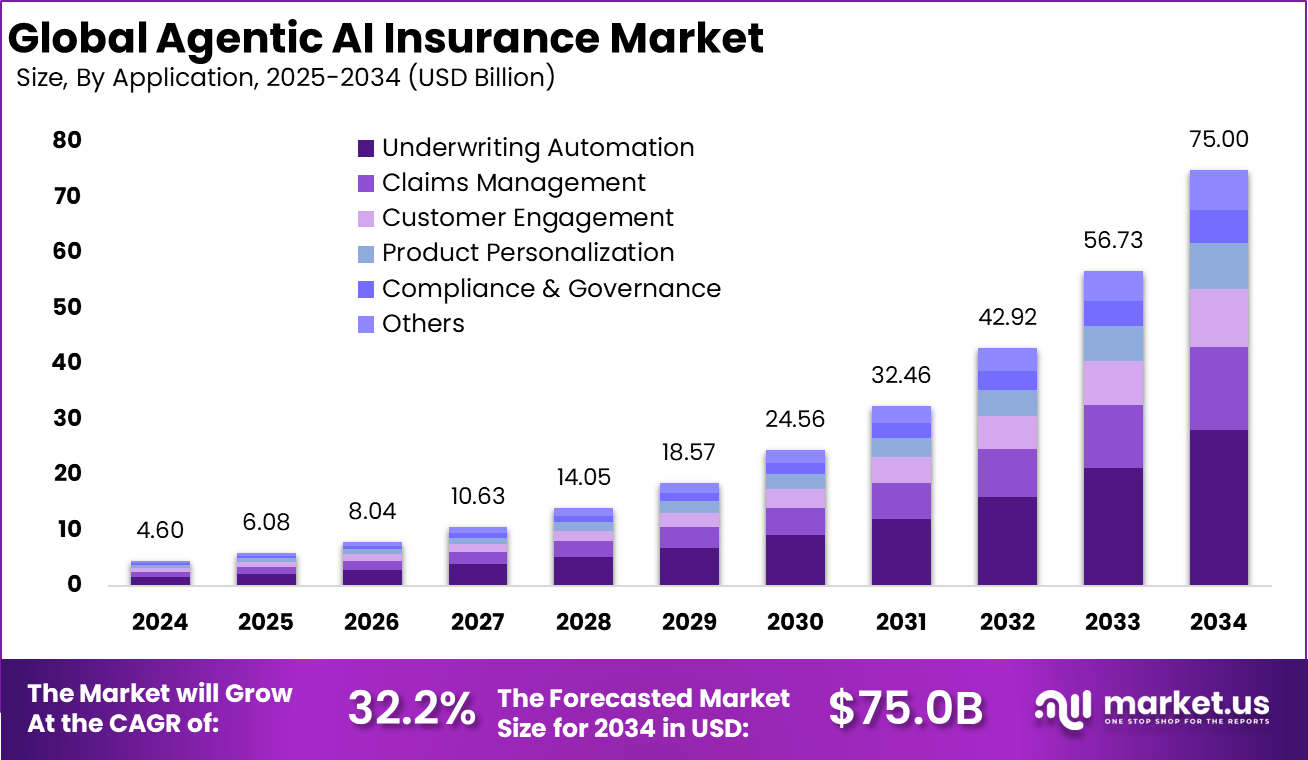

The global Agentic AI insurance market is projected to reach USD 75.00 billion by 2034, rising from USD 4.60 billion in 2024, at an impressive CAGR of 32.2%. North America leads the market with a 39.3% share, generating USD 1.80 billion in 2024. Growth is fueled by the adoption of generative and agentic AI systems that autonomously process claims, assess risks, and personalize premiums.

Insurance companies are increasingly leveraging predictive models and digital assistants to enhance underwriting accuracy and customer experience. The convergence of AI, big data, and automation is driving significant transformation in the global insurance landscape.

How Growth is Impacting the Economy

The rapid growth of the agentic AI insurance industry is reshaping financial ecosystems by enhancing productivity, minimizing human error, and optimizing capital allocation. As insurance firms automate claims and fraud detection, operational costs decline, improving profitability and investor confidence. This digital acceleration contributes to GDP expansion by spurring innovation, regulatory technology development, and AI-based employment opportunities.

Economies benefit from improved consumer trust and faster policy delivery, which, in turn, strengthen financial inclusion. Startups and fintechs gain opportunities to collaborate with insurers through API-driven ecosystems. Moreover, the market’s exponential CAGR reflects how AI adoption supports long-term economic resilience by reducing risk exposure and increasing insurance penetration across both developed and emerging economies.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/agentic-ai-insurance-market/free-sample/

Impact on Global Businesses

Rising implementation costs linked to AI model training, data governance, and cybersecurity are challenging global insurers. However, decentralized and cloud-based infrastructures are improving supply chain efficiency and operational transparency. In the technology sector, agentic AI enhances predictive analytics and risk modeling.

Healthcare insurers utilize it for claims optimization, while auto insurance providers employ AI for behavior-based pricing. The financial sector benefits from automation in fraud detection and compliance monitoring. Despite higher setup expenses, agentic AI fosters cost reductions over time through automation, scalability, and precision-driven decision-making, fundamentally altering how insurance operations and value chains are structured worldwide.

Strategies for Businesses

- Invest in explainable AI systems for transparent decision-making.

- Partner with AI-driven data analytics firms for advanced risk modeling.

- Implement secure, compliant cloud infrastructure for scalability.

- Leverage predictive automation to enhance underwriting and claims management.

- Train the workforce on hybrid AI-human collaboration to improve operational adaptability.

Key Takeaways

- The market is growing at a 32.2% CAGR through 2034.

- North America leads with a 39.3% revenue share.

- AI-driven automation reduces fraud and enhances policy efficiency.

- Predictive models improve underwriting precision and customer satisfaction.

- Data privacy and compliance remain critical to market sustainability.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=164897

Analyst Viewpoint

The agentic AI insurance market shows exceptional promise as insurers accelerate automation to reduce inefficiencies and enhance customer engagement. Currently, the adoption of AI-powered underwriting and dynamic pricing models is driving competitiveness. Looking ahead, self-learning AI agents are expected to autonomously handle policy management and claims, significantly cutting administrative costs. With evolving regulatory clarity and increasing trust in digital ecosystems, the sector’s trajectory is strongly positive, positioning AI as a cornerstone of next-generation insurance innovation and global financial stability.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Automated Claims Processing | Reduction in fraud and faster claim settlements through AI validation |

| Dynamic Premium Pricing | Real-time risk assessment using behavioral and environmental data |

| Risk Prediction Models | Integration of big data analytics and machine learning |

| Fraud Detection | Enhanced accuracy through deep learning and pattern recognition |

| Customer Assistance Bots | 24/7 support powered by natural language processing and generative AI |

Regional Analysis

North America dominates the agentic AI insurance market due to high adoption of AI-driven automation and favorable regulatory frameworks supporting insurtech innovation. Europe follows closely, driven by GDPR-aligned AI applications and growing investment in insurance digitalization. Asia-Pacific is the fastest-growing region, supported by rising insurance penetration, expanding fintech ecosystems, and government-led digital initiatives. Latin America and the Middle East are witnessing steady adoption as insurers modernize legacy systems and integrate AI to streamline operations and enhance profitability.

➤ More data, more decisions! see what’s next –

- AI-Powered Tutoring Bots Market

- Subscription-Based Drone Security Market

- AI Tablet Market

- AI Legal Drafting Tools Market

Business Opportunities

The market presents substantial opportunities for insurers adopting personalized policy recommendations, automated underwriting, and real-time analytics. Startups focusing on ethical AI, fraud detection, and risk mitigation have strong potential for partnerships with large carriers. Additionally, the integration of agentic AI with blockchain can unlock transparency and trust in contract execution. Cloud-native insurance platforms, API-based collaboration, and embedded insurance solutions will offer scalable business models, enabling players to expand their digital footprint and tap into underserved markets with intelligent automation.

Key Segmentation

The market is segmented by Component (Solutions, Services), Deployment (Cloud, On-Premise), Application (Claims Processing, Risk Assessment, Underwriting, Fraud Detection, Customer Support), and End-User (Health, Automotive, Life, Property & Casualty, Travel). Cloud deployment dominates due to flexibility and cost-efficiency, while claims processing and fraud detection lead application segments owing to rising automation. The health and auto insurance sectors exhibit the highest AI adoption, driven by massive data volumes and demand for real-time decision-making.

Key Player Analysis

Leading players are focusing on developing intelligent insurance ecosystems integrating automation, predictive analytics, and customer personalization. Their R&D investments aim to advance adaptive AI capable of real-time learning and regulatory compliance. Strategic collaborations with cloud providers and data analytics firms are driving innovation, while partnerships with insurtech startups enhance digital agility. These companies are also prioritizing explainable AI to maintain transparency and trust, enabling the creation of highly efficient, data-driven insurance frameworks tailored to global and regional market needs.

- Allianz SE

- Simplifai

- Salesforce, Inc.

- Roots Automation

- LTIMindtree Limited

- Hexaware Technologies Limited

- Rishabh Software

- Cognizant

- Virtusa Corp

- UiPath

- Newgen Software Technologies Limited

- Others

Recent Developments

- October 2025: A leading insurtech company introduced an AI-powered platform for automated underwriting and dynamic pricing.

- September 2025: A global insurer launched a generative AI assistant for instant policy customization.

- August 2025: A cloud AI firm integrated blockchain for tamper-proof claims verification.

- June 2025: A financial AI lab unveiled an adaptive fraud detection model using multi-agent frameworks.

- May 2025: An insurance startup collaborated with a cloud provider to scale its AI claims processing system.

Conclusion

The agentic AI insurance market is redefining global insurance operations through automation, intelligence, and personalization. With rapid adoption across industries, it is poised to enhance transparency, reduce costs, and drive the future of digital insurance ecosystems worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)