Table of Contents

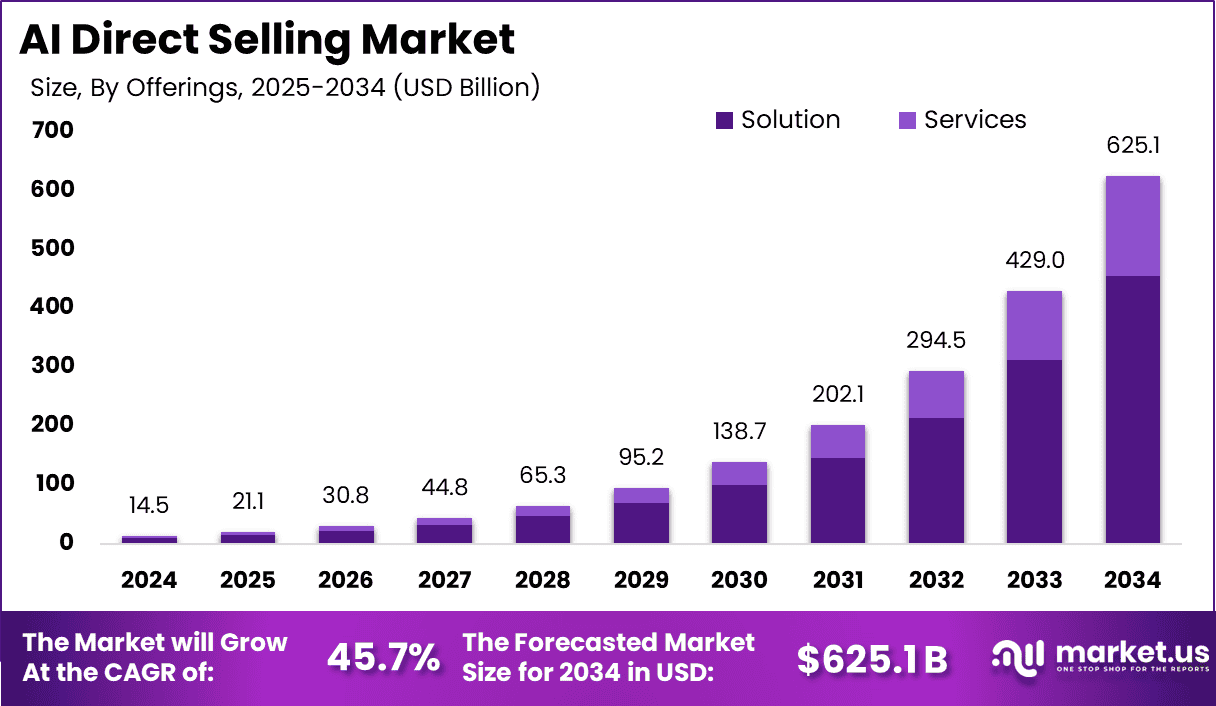

In 2024, the Global AI Direct Selling Market was valued at approximately US$ 14.5 billion and is projected to soar to around US$ 625.1 billion by 2034, expanding at an impressive CAGR of 45.7% during the forecast period. North America held the largest share at 34.7%, with revenue totaling US$ 5.03 billion.

This exponential growth is driven by AI-powered automation in customer engagement, real-time analytics, and personalized product offerings that are transforming traditional direct selling models. As macroeconomic variables such as tariffs continue to shift the global trade landscape, the AI direct selling industry is navigating complex economic and operational implications.

How Tariffs are Impacting the Economy

Tariffs imposed by major economies, including the U.S., are significantly reshaping global economic flows. In 2024, increased tariffs on electronics, semiconductor chips, and AI hardware components inflated import costs, placing pressure on downstream industries. These cost escalations contribute to inflationary trends, limiting consumer purchasing power and curbing capital expenditures in innovation-centric sectors.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/ai-direct-selling-market/free-sample/

Furthermore, retaliatory tariffs from trade partners intensify global uncertainty, resulting in reduced foreign investment. The AI direct selling sector, which relies on cross-border digital infrastructure and smart devices, faces challenges related to increased costs and delayed access to critical components. Domestic manufacturers also struggle with sourcing parts at competitive rates, affecting scalability and R&D. As global supply chains remain vulnerable to geopolitical shifts, tariffs are forcing companies to rethink procurement strategies, realign operations, and absorb financial shocks that compromise market agility and growth momentum.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs are causing a noticeable surge in procurement and manufacturing costs for businesses operating in the AI direct selling space. Increased duties on smart devices, chips, and digital infrastructure are reducing profit margins. In response, companies are moving supply chains from traditional hubs like China to emerging economies in Southeast Asia and Eastern Europe to minimize risk.

Sector-Specific Impacts

AI-based direct selling platforms depend heavily on data centers, real-time analytics engines, and cloud infrastructure. Tariffs on server components, GPUs, and telecom hardware have delayed deployments and increased operational costs. Sectors such as health & wellness, personal care, and home appliances, which form core segments of direct selling, face bottlenecks in AI integration due to equipment delays and cost surges.

Strategies for Businesses

To combat tariff-driven volatility, businesses are implementing strategic adaptations:

- Supplier Diversification: Shifting sourcing to low-tariff regions.

- Digital Transformation: Investing in virtual AI platforms to reduce dependency on physical imports.

- Local Manufacturing: Building regional production hubs to bypass tariffs.

- Cost Engineering: Redesigning products using less tariff-sensitive components.

- Trade Advisory Integration: Aligning operations with up-to-date policy monitoring and scenario planning.

Key Takeaways

- Market to reach US$ 625.1 billion by 2034 at 45.7% CAGR.

- North America led in 2024 with a 34.7% share, totaling US$ 5.03 billion.

- Tariffs inflating AI hardware and software deployment costs.

- Supply chains shifting to Southeast Asia and Eastern Europe.

- Digital innovation and local production offer resilience against trade uncertainties.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148265

Analyst Viewpoint

The AI direct selling market is undergoing rapid transformation amid trade and tariff disruptions. While short-term challenges like rising costs and supply bottlenecks exist, long-term growth remains highly promising. Companies embracing automation, real-time personalization, and virtual selling tools are well-positioned to thrive. Analysts foresee sustained momentum driven by evolving consumer behavior, expansion into untapped regions, and robust digital infrastructure. With the integration of AI-enhanced tools, businesses can streamline operations, boost engagement, and scale globally despite geopolitical friction, making this sector one of the most resilient and high-potential in the evolving tech-driven economy.

Regional Analysis

North America leads the AI direct selling market, propelled by advanced infrastructure, high AI adoption, and supportive regulatory frameworks. Europe follows with growing investment in digital ecosystems and expanding gig economy participation. The Asia-Pacific region is witnessing the fastest growth due to mobile-first consumer behavior, rapid digitalization, and emerging startups in India, China, and Southeast Asia. Latin America and the Middle East are gaining traction through localized AI applications and increased internet penetration. Regional growth patterns reflect a blend of tech readiness, economic policy, and cross-border trade facilitation, shaping strategic expansion opportunities for businesses worldwide.

➤ Discover More Trending Research

Business Opportunities

Significant opportunities are emerging across AI-powered CRM platforms, virtual assistants for sellers, voice-enabled sales tools, and hyper-personalized consumer targeting. As mobile commerce and influencer-driven marketing gain momentum, businesses integrating AI into social selling ecosystems stand to gain a competitive edge. Markets in Africa, Southeast Asia, and Latin America are especially ripe for disruption, offering large untapped consumer bases and favorable policy incentives for digital ventures. Additionally, the integration of AI with blockchain, augmented reality (AR), and decentralized applications presents avenues for innovation in both B2B and B2C direct selling models, fueling next-gen commerce expansion.

Key Segmentation

The AI Direct Selling Market is segmented based on Component (Software, Services, Hardware), Deployment Mode (Cloud-Based, On-Premise), Application (Customer Engagement, Sales Forecasting, Inventory Management, Lead Generation), End-User (Individual Sellers, Enterprises, SMEs), and Region (North America, Europe, Asia-Pacific, Latin America, and MEA). Software dominates due to the rising demand for intelligent CRM tools, while cloud deployment remains preferred for scalability and low infrastructure requirements. Customer engagement and lead generation applications are leading due to the AI-driven personalization trend. SMEs are increasingly adopting AI to enhance outreach and efficiency.

Key Player Analysis

Key players in the AI direct selling space are focusing on integrating advanced analytics, NLP, and machine learning into digital platforms to enhance user experience. These firms are leveraging strategic alliances, regional partnerships, and investment in proprietary AI algorithms to expand their reach. Emphasis is placed on developing scalable solutions, enhancing security protocols, and ensuring compliance with data protection regulations. Market leaders prioritize user-friendly interfaces and omnichannel presence to attract diverse consumer segments. Sustainable growth is pursued through continuous innovation, localization strategies, and customer-centric business models in both mature and emerging markets.

Top Key Players in the Market

- Epixel Solutions Pvt. Ltd.

- eXalt Solutions, Inc.

- CodeXoro

- Salesforce, Inc.

- Convin.ai

- Penny AI Technologies Inc.

- SW Direct Sales, LLC.

- Prime MLM Software

- SAP SE

- Lead MLM Software

- Others

Recent Developments

Recent innovations include AI-powered virtual sales assistants, predictive behavior tracking tools, and new partnerships between platform providers and telecom networks to enable faster global reach.

Conclusion

Despite trade hurdles and tariff challenges, the AI direct selling market is on a transformative growth path. Technological innovation, supply chain resilience, and regional expansion will drive long-term success for agile, forward-looking businesses.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)