Table of Contents

- Report Overview

- Key Takeaways

- Impact Of AI

- Regional Analysis

- Market Segmentation

- Component Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Industry Vertical Analysis

- Emerging Trends

- Top Use Cases

- Major Challenges

- Attractive Opportunities

- Key Players In AI for Debt Collection

- Opportunities for Key Players

- Recent Developments

- Conclusion

Report Overview

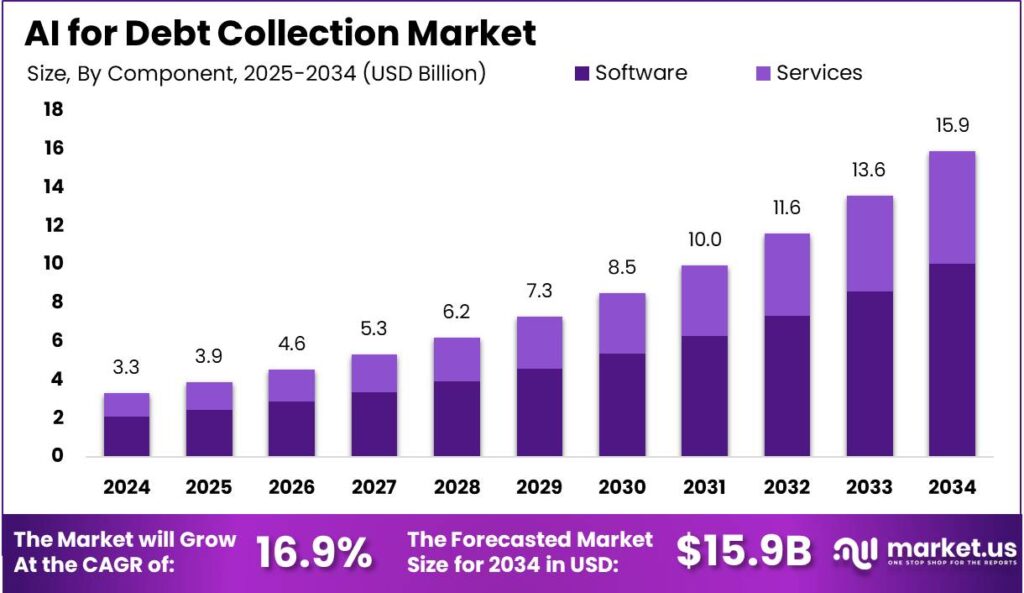

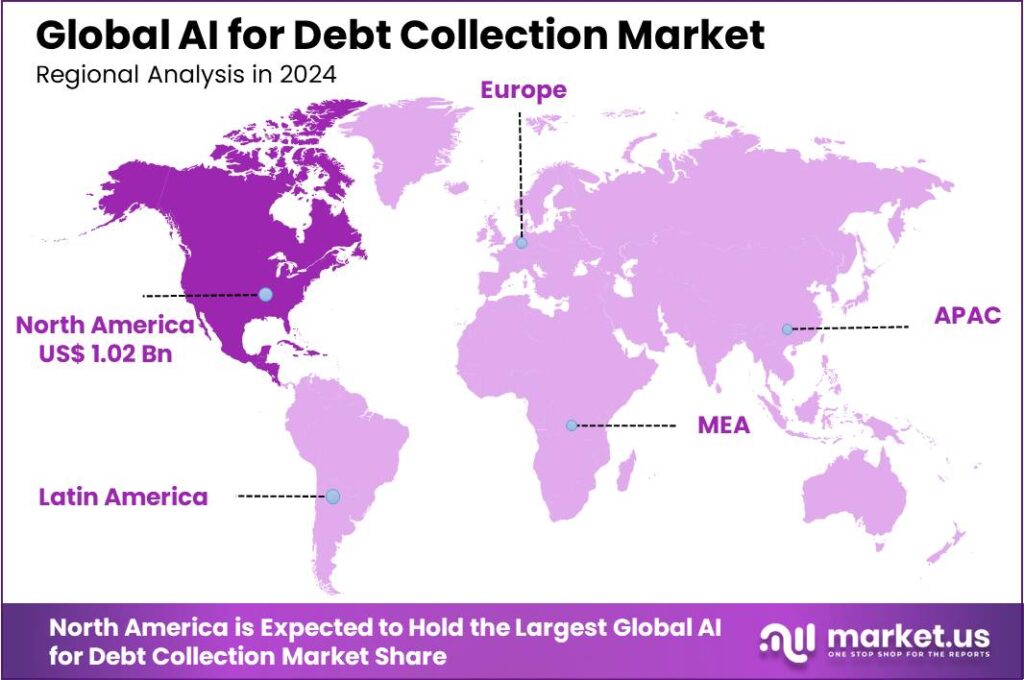

According to Market.us, The AI for Debt Collection Market is set to grow significantly in the coming years. By 2034, the market size is projected to reach an impressive USD 15.9 billion, up from USD 3.34 billion in 2024. This translates to a robust compound annual growth rate (CAGR) of 16.90% from 2025 to 2034. North America currently leads the market, accounting for more than 30.7% of the global share in 2024, with revenues of approximately USD 1.02 billion.

Artificial Intelligence (AI) for debt collection is a transformative technology that leverages machine learning and data analytics to streamline and enhance the debt recovery process. AI systems in this sector automate routine tasks such as sending personalized payment reminders and handling debtor responses across various channels. These systems not only reduce the manual effort involved in debt collection but also enhance compliance by ensuring that all activities adhere to legal requirements.

The AI for debt collection market is experiencing robust growth driven by the need for more efficient collection processes and reduced operational costs. As traditional collection methods are labor-intensive and often less effective, AI offers a compelling alternative that can handle large volumes of data and interactions with greater precision and lower cost. The market is further supported by the increasing regulatory requirements which demand higher compliance and data security standards, areas where AI systems excel due to their automated and error-reducing nature.

The major driving factors for the adoption of AI in debt collection include the need for cost reduction, increased efficiency, and improved customer experience. AI significantly lowers operational costs by automating communications and data processing, thus reducing the need for extensive human labor. Enhanced efficiency is achieved through AI’s ability to analyze vast amounts of data quickly and accurately, enabling targeted collection efforts based on debtor profiles and behaviors.

Moreover, AI improves the debtor experience by providing more personalized and respectful communication approaches, aligning with modern standards of customer service. Market demand for AI in debt collection is primarily driven by the financial services industry, which faces constant pressure to maximize recovery rates while minimizing costs and maintaining customer relationships.

Opportunities in this market are expanding into sectors such as healthcare, telecommunications, and utilities, where organizations are looking to leverage AI to handle their growing volumes of receivables more effectively. The integration of AI helps these industries not only in enhancing their collection rates but also in maintaining compliance with industry-specific regulations.

Technological advancements are continuously shaping the AI for debt collection landscape. Innovations include the use of predictive analytics to forecast debtor payment behavior, natural language processing for enhancing communication with debtors, and machine learning algorithms that improve over time, increasing their effectiveness in debt recovery strategies. These technologies enable more sophisticated segmentation of debtors and personalization of outreach efforts, thereby increasing the likelihood of successful collections.

Key Takeaways

- In 2024, the Software segment dominated the market, holding more than 63.3% of the share.

- The Cloud-Based segment led the market in 2024, capturing over 42.7% of the share.

- The Large Enterprise segment held the largest market share in 2024, with more than 72.3% of the market.

- The Banking, Financial Services, and Insurance (BFSI) segment had a dominant position in the market, accounting for over 31.6% of the share in 2024.

- North America was the leading region, holding more than 30.7% of the market, with revenues reaching approximately USD 1.02 billion in 2024.

Impact Of AI

- Improved Efficiency in Collections: AI-powered tools can analyze customer data and predict which accounts are most likely to pay, allowing collection teams to prioritize their efforts more effectively. This reduces the time spent on each case, enabling quicker resolutions and freeing up resources for other tasks. Automation also streamlines communication with debtors, using pre-written messages or calls that are sent automatically based on triggers, such as missed payments.

- Personalized Customer Interactions: AI systems can gather and process a large amount of customer data to create personalized, human-like interactions. These systems understand debtor behavior and tailor communication to individual needs, making it more likely for customers to respond positively. For example, reminders can be sent in a friendly tone or at times that align with a debtor’s payment habits, improving the chances of recovery.

- Cost Reduction: With AI automation handling repetitive tasks, such as sending payment reminders or generating reports, businesses can reduce their reliance on human agents. This can significantly lower operational costs, which is especially beneficial for small and medium-sized businesses. It allows collection teams to focus on more complex cases that require human judgment, while AI manages routine tasks.

- Enhanced Predictive Analytics: AI algorithms use historical data to predict which customers are more likely to repay, helping to identify the most promising cases. This predictive capability improves decision-making, as businesses can focus their efforts on customers who are likely to respond, resulting in higher recovery rates. AI also helps in analyzing customer preferences and behavior patterns, optimizing collection strategies.

- Better Consumer Experience: Traditionally, debt collection can be a stressful and negative experience for consumers. AI has made this process more respectful and less intrusive. For instance, AI can offer flexible payment options, remind debtors gently, and provide personalized payment plans that fit their financial situation. This shift leads to higher customer satisfaction, encouraging cooperation and reducing the potential for disputes.

Regional Analysis

In 2024, North America emerged as the leading region in the AI-driven debt collection market, securing a significant market share of over 30.7%. This dominance translated to substantial revenue, with the region generating approximately USD 1.02 billion in sales. Several factors contributed to this strong market position, including the widespread adoption of artificial intelligence technologies across financial institutions, debt collection agencies, and other relevant sectors.

North America’s advanced infrastructure, coupled with a high level of investment in AI and machine learning technologies, has facilitated the rapid growth of AI solutions in debt recovery processes. These solutions offer efficiency improvements, cost reduction, and enhanced customer experience, all of which have been instrumental in driving demand across the region. Consequently, North America is expected to maintain its leading role in the global AI for debt collection market, with continued innovation and integration of AI technologies enhancing operational efficiencies in the years to come.

Market Segmentation

Component Analysis

In 2024, the software segment emerged as the dominant player in the market, capturing over 63.3% of the total market share. This significant share highlights the increasing importance of software solutions in various industries. Software forms the core of many technological transformations, powering innovations in areas such as automation, artificial intelligence, data management, and cloud computing. The growing reliance on software applications to streamline business operations, enhance efficiency, and support digital transformation initiatives across sectors has fueled this dominance.

Deployment Analysis

The cloud-based segment was a key leader in 2024, holding a dominant share of more than 42.7% in the market. This reflects the rapid and widespread adoption of cloud technologies across industries. Cloud-based solutions offer businesses enhanced flexibility, scalability, and cost efficiency, making them an attractive option for organizations of all sizes. Cloud computing allows companies to scale resources according to demand, eliminate the need for expensive infrastructure, and promote collaboration among distributed teams.

Enterprise Size Analysis

In 2024, the large enterprise segment maintained a commanding position in the market, holding over 72.3% of the market share. This dominance is primarily attributed to the extensive resources, infrastructure, and capabilities of large enterprises to invest in advanced technologies. These organizations typically have the financial and operational capacity to adopt complex solutions, including enterprise-level software and cloud-based infrastructure, to support their vast operations. Additionally, large enterprises tend to have diverse and specialized needs that can be met by a wide range of software and technology solutions.

Industry Vertical Analysis

The Banking, Financial Services, and Insurance (BFSI) sector held a dominant market position in 2024, accounting for over 31.6% of the total market share. This significant share reflects the critical role that the BFSI sector plays in the global economy, driving demand for technology solutions to improve operational efficiency, security, and customer experience.

In recent years, the BFSI industry has undergone a digital transformation, adopting technologies such as cloud computing, artificial intelligence, and data analytics to streamline operations, manage risk, and enhance customer service. With the increasing reliance on digital platforms for banking, investing, and insurance services, the BFSI sector’s demand for advanced software and cloud-based solutions is growing.

Emerging Trends

- Empathetic AI Communications: AI technology is revolutionizing debt collection by enabling agencies to craft empathetic and personalized communications. This approach reduces conflicts and improves resolution rates by handling conversations with compassion and understanding, which are key to maintaining positive debtor relations.

- Enhanced Data Security: With AI’s heavy reliance on consumer data, there is a rising emphasis on robust data security measures. Agencies are now investing more in advanced encryption and secure data storage solutions to protect sensitive information and ensure privacy.

- Omnichannel Engagement: AI-driven tools are supporting seamless customer interactions across various platforms – SMS, email, social media, and phone calls – ensuring that communication aligns with customers’ preferred channels, thereby increasing the effectiveness of collection efforts.

- Real-Time Analytics: Leveraging AI for real-time reporting and analytics allows debt collection agencies to instantly assess key performance indicators and adjust strategies dynamically. This real-time data processing helps in making informed decisions quickly to optimize recovery rates.

- Ethical AI Adoption: There is a growing trend towards the ethical use of AI in debt collections. This involves implementing AI solutions that are transparent, unbiased, and respect debtor rights, aligning with fair practice principles to enhance the credibility and effectiveness of debt collection processes.

Top Use Cases

- Automated Interaction Management: AI automates routine tasks such as sending payment reminders and following up on outstanding debts. This not only enhances efficiency but also ensures consistency and coverage across all accounts, helping to prevent any account from being neglected.

- Predictive Customer Insights: By analyzing vast amounts of data, AI can predict debtor behavior and identify high-risk accounts. This allows agencies to prioritize efforts on debtors most likely to settle their dues, thereby maximizing recovery rates.

- Customized Repayment Solutions: AI algorithms assess individual debtor situations to offer tailored repayment plans. This personalized approach not only improves debtor engagement but also increases the likelihood of repayment by providing manageable solutions that fit debtors’ financial capabilities.

- Fraud Detection and Risk Assessment: AI tools enhance the ability to detect fraudulent activities and assess credit risks by analyzing historical data and recognizing patterns that may indicate potential risks.

- Regulatory Compliance: AI-driven systems help ensure that debt collection practices comply with legal and regulatory requirements. Automated systems maintain consistent adherence to protocols, reducing the risk of legal issues and enhancing trust with debtors.

Major Challenges

- Data Privacy and Security Concerns: As AI systems rely heavily on personal data, ensuring robust data protection is paramount. Agencies must navigate complex regulations and invest in secure technologies to safeguard sensitive information from breaches, which remains a significant challenge.

- High Implementation Costs: The initial investment required for implementing AI solutions can be prohibitive for many organizations. This includes costs associated with acquiring the technology, integrating it into existing systems, and ongoing maintenance and updates.

- Resistance to Technological Change: Introducing AI into traditional debt collection processes can meet resistance from staff who are accustomed to conventional methods. Overcoming this requires significant change management efforts and training to ensure smooth adoption.

- Ensuring Ethical AI Use: There’s a critical need to implement AI systems that are not only effective but also ethical. This includes designing systems that avoid biases and are transparent in their operations, which can be difficult to achieve and regulate.

- Accuracy and Reliability of AI Predictions: While AI offers the ability to predict debtor behavior and optimize collection strategies, the accuracy of these predictions is crucial. Inaccurate data or poorly designed models can lead to ineffective collection efforts and potential reputational damage.

Attractive Opportunities

- Enhanced Customer Segmentation: AI enables more precise segmentation of debtors based on their behavior, financial status, and communication preferences. This allows for more targeted and effective collection strategies that are likely to increase recovery rates.

- Automated Real-Time Decision Making: AI can process large volumes of data in real-time, providing debt collection agencies with the ability to make quick and informed decisions. This helps in adapting strategies promptly to changing debtor circumstances or market conditions.

- Scalability and Flexibility: AI technologies allow debt collection agencies to scale operations efficiently without proportionally increasing the workforce. This flexibility is crucial in managing fluctuating volumes of debt recovery tasks.

- Improved Compliance and Risk Management: AI systems can be programmed to comply with evolving regulations and standards automatically. This reduces the risk of legal penalties and enhances the trustworthiness of collection agencies.

- Customer-Centric Collection Approaches: By leveraging AI for personalized communication and empathetic engagement, agencies can improve debtor relations and increase the likelihood of successful collections. This focus on customer experience is becoming a significant differentiator in the industry.

Key Players In AI for Debt Collection

- TrueAccord is a standout in the AI-driven debt collection sector, leveraging machine learning to personalize the debt recovery process. Their platform, powered by behavioral analytics, tailors communication strategies to individual debtors, enhancing response rates and customer satisfaction. TrueAccord’s approach not only boosts recovery rates but also maintains a positive relationship with customers.

- CollectAI, another major player, integrates artificial intelligence to streamline the debt collection process. Their technology focuses on digital communication methods, using smart algorithms to determine the optimal time and messaging for contacting debtors. CollectAI’s solutions prioritize user-friendly interactions and have been praised for increasing efficiency while reducing the operational costs associated with traditional debt collection methods.

- PRA Group harnesses data analytics and AI to optimize its collection strategies. With a vast database of debt recovery scenarios, PRA Group’s AI systems predict debtor behavior and recommend tailored strategies to their agents. This targeted approach helps in achieving higher recovery rates and in complying with the regulatory standards, safeguarding consumer rights.

- Experian, traditionally known for credit scoring, has also ventured into AI for debt collection. Their advanced analytics and decisioning tools help organizations improve their collection strategies by predicting debtor payment behavior and identifying the most effective recovery channels. Experian’s integration of AI into debt collection underscores the potential for technology to enhance accuracy and efficiency in the financial sector.

Opportunities for Key Players

- Increased Mergers and Acquisitions (M&A) Activity: As operational complexities and regulatory demands increase, smaller debt collection agencies are finding it challenging to compete. This environment is prompting a rise in M&A activities, allowing larger, well-capitalized firms to acquire smaller players, thus expanding their market reach and service offerings.

- Specialization in Niche Sectors: The debt collection landscape is witnessing the rise of agencies specializing in specific sectors such as Buy Now, Pay Later (BNPL). These sectors require unique collection strategies tailored to their regulatory and consumer behavior specifics, presenting a growing market for specialized debt collection services.

- Advanced Data Analytics and Prediction Models: AI systems use machine learning algorithms to predict payment outcomes and debtor behavior. This allows for better strategic planning and resource allocation, leading to higher recovery rates and more efficient operations. AI can also provide real-time insights and continuous monitoring to adapt strategies promptly based on debtor responses.

- Operational Efficiency through Automation: AI technologies are transforming debt collection by automating routine tasks, improving key performance indicators like recovery rates and days sales outstanding (DSO), and reducing operational costs. This not only streamlines operations but also allows agencies to handle higher volumes of accounts more efficiently.

- User-Friendly AI Interfaces: The development of intuitive AI platforms that require minimal training is becoming a strategic advantage. These platforms facilitate the easy analysis of debtor information and customization of collection strategies, thereby improving both the efficiency of operations and the effectiveness of debt recovery efforts.

Recent Developments

- In September 2024, InDebted, an AI-focused debt collection firm, secured $60 million in a Series C funding round. This investment aims to support the company’s mergers and acquisitions strategy and enhance its product offerings.

- In November 2024, PAIR Finance introduced a new generative AI technology based on Llama 3 to revolutionize customer service in debt collection. This innovation aims to improve communication during the debt collection process.

- In November 2024, AI Unlimited Group acquired the Resolve Debt Platform, marking its entry into the B2B market. This strategic move positions the company to capture a significant share of the $21 billion U.S. debt collection market and the growing accounts receivable automation sector.

Conclusion

In summary, the AI for debt collection market is witnessing significant growth as businesses seek efficient, cost-effective, and automated solutions to manage and recover debts. AI technologies, such as natural language processing, machine learning, and predictive analytics, are increasingly being integrated into debt collection strategies to enhance customer interaction, improve decision-making, and optimize recovery rates. By automating repetitive tasks and analyzing large datasets, AI tools can forecast payment behaviors, personalize communication, and streamline the overall collection process, reducing the need for manual intervention.

The adoption of AI in debt collection presents a transformative opportunity for companies to enhance operational efficiency while improving customer experience. As AI continues to evolve, it is expected that debt collection processes will become even more sophisticated, leading to faster recovery times and greater financial outcomes. However, businesses must balance automation with ethical considerations and compliance to maintain trust and regulatory adherence in this critical area.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)