Table of Contents

Introduction

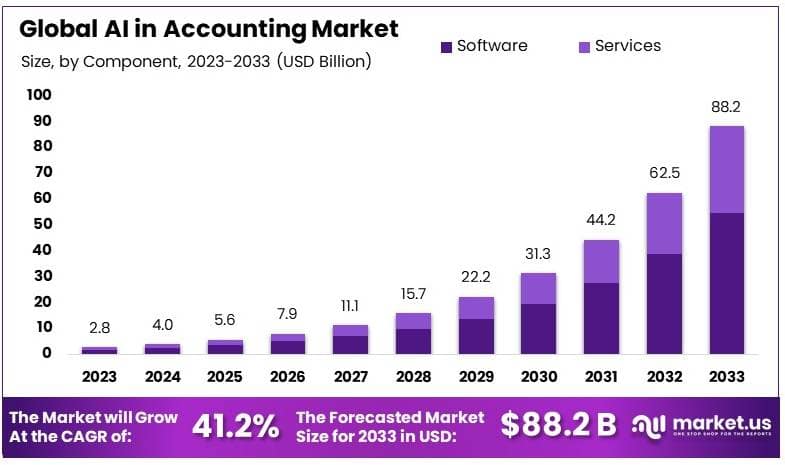

According to Market.us, The global AI in accounting market size is projected to expand significantly, from USD 2.8 Billion in 2023 to an estimated USD 88.2 Billion by 2033. This represents a robust compound annual growth rate (CAGR) of 41.2% over the forecast period from 2024 to 2033.

Artificial Intelligence (AI) in accounting involves the integration of AI technologies, such as machine learning and natural language processing, into financial functions. AI systems in this field automate routine tasks, increase accuracy, and provide insightful analytics. By doing so, they help accountants manage vast amounts of data, perform audits, and make predictions based on historical information, leading to more informed business decisions.

The AI in accounting market is expanding as companies adopt innovative technologies to enhance efficiency and effectiveness in their financial operations. This market encompasses a range of applications designed to support financial bookkeeping, transaction coding, payroll processing, compliance checks, and more. As businesses increasingly rely on data-driven strategies, AI tools that offer real-time insights and improve financial reporting are becoming essential.

The growth of the AI in accounting market is driven by several key factors. The need for greater accuracy and speed in accounting tasks is a major driver, as AI can process transactions and data faster than humans with fewer errors. Additionally, the increasing volume of financial data requires advanced tools for effective management and analysis, pushing companies toward AI solutions. The pressure to reduce operational costs and the growing demand for real-time accounting are also significant contributors to the adoption of AI in this field.

The integration of AI in accounting opens up top opportunities for both technology providers and businesses. For technology firms, there is significant potential in developing AI applications that can be tailored to specific accounting needs, such as tax preparation, payroll, or compliance reporting. For businesses, AI offers the chance to enhance the strategic role of finance teams by freeing up resources from routine tasks, allowing a focus on analysis and decision support. Additionally, as AI technology evolves, its ability to detect financial anomalies and prevent fraud presents a critical opportunity for companies to safeguard their operations.

Key Takeaways

- The AI in Accounting Market was valued at USD 2.8 billion in 2023 and is projected to reach USD 88.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 41.2%.

- Software components command a significant share of the market, accounting for 62%. This dominance is attributed to their critical role in automating accounting tasks and enhancing accuracy.

- Cloud deployment is the preferred mode, holding a 65.3% market share. This trend is driven by the ongoing demand for secure, scalable, and easily accessible accounting solutions.

- Within the application segment, Invoice Processing leads with a 25% share, propelled by the need to automate invoice management and minimize processing errors.

- Small and Medium-sized Enterprises (SMEs) are the leading adopters in the organization size segment, with a 58% share. This reflects their growing reliance on AI to optimize accounting processes.

- North America holds the largest market share at 32%, underpinned by a robust presence of AI technology providers and pioneering adoption in the accounting industry.

Key Factors Influencing the AI in Accounting Market Growth

The growth of the Artificial Intelligence (AI) in Accounting market is influenced by several key factors that are reshaping the industry landscape:

- Technological Advancements: The integration of advanced technologies like Natural Language Processing (NLP), Machine Learning, and Deep Learning is pivotal. These technologies enhance the efficiency and accuracy of accounting processes by automating tasks such as data entry, analysis, and compliance reporting, thus driving market growth.

- Increasing Demand for Automation: There is a growing need for automation to reduce the labor-intensive aspects of accounting and to streamline operations. Automation helps in reducing errors and improving the speed of accounting processes which is crucial for financial decision-making and compliance.

- Regulatory and Compliance Requirements: Tightening regulations and the need for compliance in financial reporting are prompting businesses to adopt AI-driven solutions that ensure accuracy and adherence to legal standards. AI helps in managing and mitigating risks associated with financial reporting and audits.

- Geographical Expansion and Economic Growth: The AI in Accounting market is experiencing robust growth in regions like North America due to the presence of major tech companies and startups innovating in the AI space. Meanwhile, Asia-Pacific is witnessing rapid growth due to increasing technology adoption and economic development, which fuels demand for efficient accounting solutions.

- Strategic Alliances and Investments: Major players in the market are continuously engaging in strategic alliances, mergers, and acquisitions to enhance their product offerings and expand their geographical reach. These activities not only help in market expansion but also in integrating diverse technological capabilities, thus fostering growth in the sector.

AI in Accounting Statistics

- The market size is expected to grow from USD 177 billion in 2023 to USD 2,745 billion by 2032, achieving a Compound Annual Growth Rate (CAGR) of 36.8% during the forecast period from 2024 to 2033.

- Recent research by KPMG indicates that over 70% of companies are currently employing AI technologies in some form within their financial operations.

- According to an AI maturity framework survey, 33% of the U.S. companies are considered AI finance leaders, while another 39% are categorized as solid implementers.

- From a global survey, 595 accounting professionals participated, providing extensive data on AI’s role in accounting.

- 59% of these professionals utilize AI for composing emails.

- 36% leverage AI for task automation.

- 31% use AI tools for enhancing their research capabilities.

- 54% of respondents believe a firm’s value decreases without AI integration.

- 66% view AI as a competitive advantage.

- 46% believe AI can attract and retain more talent within the accounting sector.

- Data security concerns are significant, with 76% of professionals wary about this aspect when evaluating AI tools.

- 56% worry about the reduction in human interaction due to AI.

- Ethical dilemmas and biases are a concern for 49% of the survey participants.

- Keeping up with rapid advancements in AI technology poses a challenge for 46% of accounting professionals.

- Currently, the AI adoption rate within U.S. accounting stands at 16%.

- Comfort with AI integration is high, with 64% of accountants open to using AI in their professional activities.

- AI has been credited with improving accuracy by up to 66%, reducing accounting errors significantly, and increasing data processing speeds by 75%.

- AI could potentially automate approximately 39% of accounting processes.

Emerging Trends in AI in Accounting

- Generative AI Advancements: The rapid evolution of generative AI is setting a transformative path, with more than three-quarters of business leaders considering it one of the top emerging technologies impacting the sector in the next year. This AI form is reshaping various business functions including finance and accounting, enhancing analytical capabilities and decision-making processes.

- Real-Time Financial Reporting: Many organizations are transitioning from traditional periodic financial updates to real-time reporting systems, enhancing transparency and allowing stakeholders to make well-informed decisions swiftly. This shift is largely facilitated by advanced ERP systems that integrate multiple business processes and enable seamless real-time analytics.

- Enhanced Data Analytics and Forecasting: As the accounting landscape becomes more data-driven, the importance of sophisticated data analytics and forecasting tools is growing. These technologies are pivotal in transitioning accounting roles from traditional number crunching to strategic advisory by enabling real-time insights and forward-looking analysis.

- Increased Emphasis on Compliance and Regulation: With significant regulatory changes on the horizon, including those due to economic disruptions from global events, accounting professionals must be agile and well-informed to ensure compliance. Continuous adaptation to these changes is necessary to minimize risks and capitalize on new regulatory landscapes.

- Blockchain Integration: The adoption of blockchain technology in accounting is enhancing the security and efficiency of financial transactions. By introducing a transparent and tamper-proof system, blockchain is poised to revolutionize aspects like double-entry bookkeeping and broader financial reporting and compliance.

Top Use Cases

Here are the top use cases of AI in accounting:

- Financial Data Analysis and Reporting: AI is extensively used to enhance the accuracy and speed of financial reporting. It automates the analysis of financial data, identifying trends and anomalies which can improve financial decision-making and reporting accuracy.

- Fraud Detection and Compliance: Through pattern recognition capabilities, AI can monitor transactions and detect irregular patterns that may indicate fraudulent activities. This is crucial for maintaining financial integrity and regulatory compliance.

- Invoice and Transaction Processing: AI streamlines the processing of invoices by automating data extraction, coding, and approval workflows, which not only speeds up the process but also reduces human error, enhancing overall operational efficiency.

- Auditing: AI supports auditing by automating the preparation of audit schedules, analyzing financial information, and detecting anomalies for investigation. This technology enables auditors to focus on more strategic aspects of the audit process, thereby enhancing the effectiveness of audits.

- Tax Preparation and Research: AI aids in tax research and preparation by automating data extraction and analysis, which helps in preparing accurate tax returns and supporting documentation more efficiently. This application of AI is particularly useful in managing and leveraging large volumes of tax-related data.

Top Opportunities in AI for Accounting

- Automation of Routine Tasks: AI is revolutionizing the accounting field by automating time-consuming tasks like data entry, invoicing, and reconciliations, allowing professionals to focus on more strategic activities. This shift not only boosts productivity but also enhances the accuracy of financial reporting.

- Advanced Analytics and Decision Support: Utilizing AI for predictive analytics and financial forecasting offers significant advantages. AI algorithms analyze vast amounts of data to identify trends and make accurate predictions, thus supporting strategic decision-making across financial operations.

- Compliance and Risk Management: AI improves compliance by automating the monitoring of regulatory changes and analyzing financial data to identify potential risks. This proactive approach helps in maintaining compliance and mitigating risks effectively.

- Enhanced Client Services: AI enables accountants to offer more personalized and efficient services. For instance, generative AI tools can handle complex data analyses and generate insightful financial reports, thereby helping clients make informed decisions.

- Integration of AI with Emerging Technologies: The convergence of AI with other technologies like IoT and blockchain offers new ways to enhance the efficiency and security of accounting processes. For example, integrating ERP systems with IoT sensors aids in real-time operational monitoring and maintenance, which can lead to significant cost savings.

Major Challenges in AI in Accounting

- Regulatory Compliance: Keeping pace with evolving tax laws and regulations poses a significant challenge for AI in accounting. The dynamic nature of tax regulations requires constant updates and adaptations in AI systems to ensure compliance and mitigate risks of non-compliance.

- Cybersecurity Risks: With the increasing use of AI, cybersecurity is a major concern. The average time to identify and contain a data breach is notably lengthy and costly, complicating the responsibilities of accounting professionals in safeguarding sensitive financial data.

- Talent Acquisition and Training: The integration of AI in accounting demands a workforce that is not only proficient in traditional accounting practices but also skilled in AI and data analytics. The challenge extends to attracting, training, and retaining such talent.

- Cost of Implementation: Adopting AI in accounting involves significant initial investments in technology and infrastructure. Additionally, there are ongoing costs associated with training personnel and updating systems.

- Ethical and Privacy Concerns: The use of AI in accounting raises ethical questions and privacy issues, especially regarding the handling of confidential financial data. Ensuring the ethical use of AI and maintaining privacy standards are critical to gaining trust and acceptance.

Recent Developments

- Microsoft – In October 2023, Microsoft introduced significant updates to its cloud computing services, including AI-driven tools designed to enhance financial operations like accounting. These updates were part of Microsoft’s broader initiative to leverage AI across business functions.

- Amazon Web Services (AWS) – AWS continued its expansion into AI services tailored for financial analytics throughout 2023, with notable updates in July and August 2023. These services are designed to automate complex accounting tasks such as fraud detection, significantly improving accuracy and efficiency.

- Deloitte – In November 2023, Deloitte launched new AI-driven solutions aimed at improving financial reporting and auditing processes. This initiative is in response to increasing demands for accuracy and transparency in financial operations.

Conclusion

The integration of artificial intelligence in accounting is paving the way for a transformative shift in the profession. By automating routine tasks, enhancing data analytics capabilities, and improving compliance and risk management, AI is setting a new standard for efficiency and precision in financial reporting. Moreover, its ability to provide deep insights and support complex decision-making processes makes it an invaluable tool for accounting professionals aiming to add strategic value to their organizations.

As these technologies continue to evolve, they will undoubtedly open up further opportunities for innovation and improvement in the accounting sector. Thus, staying updated with the latest AI advancements and integrating them into accounting practices is crucial for maintaining competitiveness and achieving long-term success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)