Table of Contents

Introduction

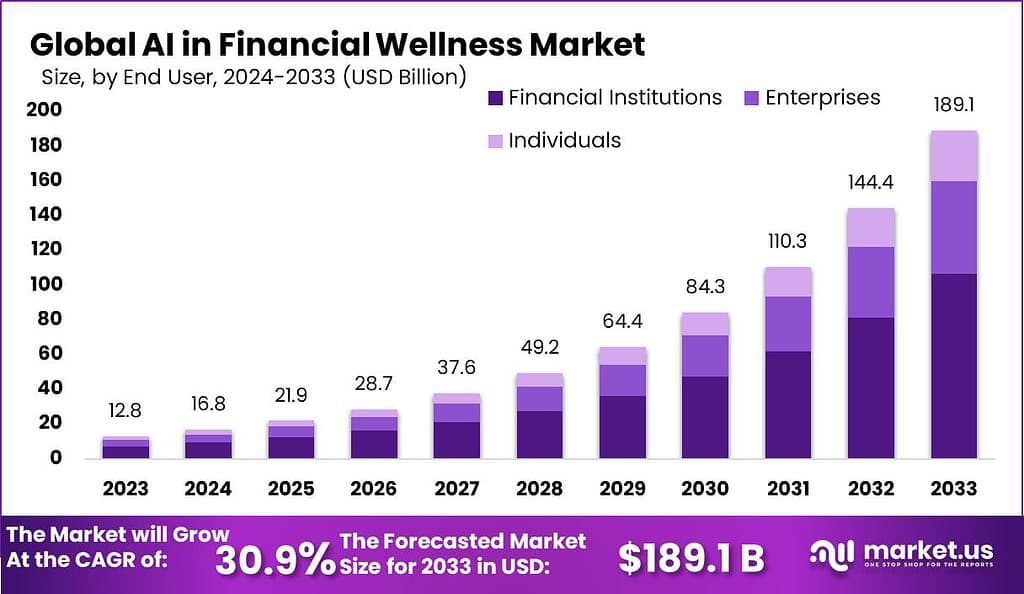

According to market.us, the global AI in Financial Wellness market is projected to expand significantly, reaching approximately USD 189.1 billion by 2033, up from USD 12.8 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 30.9% from 2024 to 2033.

The utilization of artificial intelligence (AI) in financial wellness signifies a transformative shift in how financial services are delivered and consumed. AI’s integration into financial wellness programs involves the use of algorithms and machine learning models to provide personalized financial advice and management solutions. This technology enables the analysis of large datasets to identify patterns and predict future financial behaviors, thus offering tailored recommendations to enhance an individual’s financial health.

The AI in Financial Wellness market is on a trajectory of significant growth, primarily driven by the widespread adoption of digital financial services and the increasing emphasis on personalized financial guidance. Artificial intelligence is proving to be instrumental in analyzing vast amounts of financial data to deliver customized advice, helping individuals enhance their financial stability and planning. This growth is also stimulated by advancements in AI technologies that enable more accurate predictions of financial trends and user behavior, making financial advice more accessible and reliable.

However, the integration of AI in financial wellness also presents notable challenges. Concerns regarding data privacy and security are paramount, as financial data is particularly sensitive. There is also the hurdle of building trust among users, who may be skeptical about receiving financial advice from AI systems. Additionally, the regulatory landscape surrounding the use of AI in financial services is still evolving, posing a potential challenge for compliance.

Despite these challenges, the market presents substantial opportunities. There is a growing demand for financial management tools that can provide real-time, actionable insights, especially among younger populations who prefer digital solutions for managing their finances. Furthermore, as financial literacy improves, more individuals are likely to seek out AI-enabled platforms that can offer personalized advice based on their specific financial situations, driving further adoption of such technologies. This evolving market landscape indicates a promising future for AI in enhancing financial wellness.

Key Takeaways

- The AI in financial wellness market is projected to grow significantly, expected to reach approximately USD 189.06 billion by 2033, up from USD 12.8 billion in 2023, marking a CAGR of 30.9% during the forecast period from 2024 to 2033.

- In terms of market segments, the software category dominated in 2023, holding a 62.7% share.

- In deployment types, cloud-based solutions led with a 75% market share. The wealth management application was the largest segment, accounting for 28.4% of the market in 2023, while financial institutions were the primary end-users, dominating with a 56.3% share.

- Regionally, North America was the leading market in 2023, holding over 36.7% of the global market. Despite the technological advancements in financial wellness, the economic stability of many remains a concern.

AI in Financial Wellness Statistics

- The Artificial Intelligence Market is projected to reach a valuation of approximately USD 2,745 billion by 2032, up from USD 177 billion in 2023. This represents a robust compound annual growth rate (CAGR) of 36.8% during the forecast period from 2024 to 2033.

- Recent reports indicate that 78% of adults live paycheck to paycheck, showing widespread financial instability. Additionally, two-thirds of families do not have an emergency fund, exposing a critical lack of financial preparedness.

- Credit card debt remains a prevalent issue, with 60% of adults accruing such debt in the past year. Financial stress is particularly high among certain groups, with 83% of government and university employees in the U.S. experiencing financial stress, whether physical, mental, or emotional.

- A November 2023 report by pymnts highlights the challenges faced by lower-income earners, with 77% of those earning under $50,000 annually living paycheck to paycheck, illustrating the severe financial strain on this demographic.

- 42% of surveyed participants, across various age groups and income levels, report feeling “somewhat” or “entirely” financially healthy.

- 70% of employees believe that financial wellness programs can significantly reduce stress and enhance the relationship between employer and employee.

- A significant 78% of adults report living paycheck to paycheck.

- Approximately two-thirds of all families lack an emergency fund.

- 60% of adults have experienced credit card debt in the past year.

- The most prevalent financial wellness benefits provided by employers are 401K matching (64%), health savings accounts (37%), and tuition reimbursement (32%).

- Personal finance issues most commonly impact mental health (34%) and sleep quality (33%) of individuals.

- 78% of individuals indicate that financial stress adversely affects their overall productivity

Emerging Trends

- Generative AI and Large Language Models (LLMs): Financial services are increasingly adopting generative AI and LLMs to automate tasks like report generation, investment research, and customer service interactions. This trend helps reduce manual work and improves efficiency in producing financial content and analyzing data.

- High Tech, High Touch Financial Wellness: There is a move towards blending digital tools with personalized human advice. Financial wellness programs are integrating technology with direct guidance from financial experts to meet the needs of users who seek both self-directed learning and expert validation for their financial decisions.

- Expansion into Emerging Markets: AI-driven financial wellness solutions are expanding rapidly into emerging markets, where there is a growing middle class and increasing access to digital technologies. This expansion is facilitated by the scalability of AI solutions, which can be adapted to different languages and cultural contexts, making financial services more accessible to a broader audience.

- Personalized Financial Guidance: AI is increasingly being used to provide personalized financial advice tailored to individual needs and circumstances. This trend is driven by the growing availability of data and sophisticated analytical tools that enable more accurate predictions and customized recommendations.

- Banking of Things (BoT): This refers to the integration of IoT technologies with financial services, facilitating more seamless and contactless transaction options. As consumer preferences shift towards contactless methods, financial services are adapting by incorporating NFC technology and QR codes, making financial transactions more convenient and accessible.

Top Use Cases of AI in Financial Wellness

- Personal Financial Management (PFM) Tools: AI-driven PFM tools like Digit and Wally utilize algorithms to analyze users’ financial data to provide actionable savings and budgeting advice, thus enhancing financial planning and decision-making capabilities.

- Conversational AI in Banking: AI-powered conversational interfaces, such as chatbots, are transforming customer interactions in banking, providing intuitive and personalized customer service, thereby improving satisfaction and engagement .

- Robo-Advisors: Platforms like Robinhood and Acorns leverage AI to offer personalized investment advice and portfolio management, significantly lowering the entry barrier for casual investors and enhancing user experience.

- Fraud Detection and Risk Management: AI algorithms are employed to detect fraudulent activities and manage risks by analyzing transaction patterns and flagging anomalies, thus safeguarding user assets and institutional integrity.

- Credit Scoring and Loan Underwriting: AI systems are increasingly used to automate the credit scoring process, providing more accurate risk assessments and enabling more nuanced loan underwriting processes.

Major Challenges

- Data Privacy and Security: The extensive use of personal and sensitive data in AI-driven financial services necessitates robust security measures to protect against breaches and ensure compliance with data protection regulations such as GDPR and CCPA.

- Explainability and Transparency: There is a pressing need for AI systems to be transparent and explainable, especially in sectors like finance where decisions affect personal finances. Users and regulators demand clear explanations of how AI models make their decisions, which is challenging with complex models.

- Ethical Use and Bias: AI systems must be developed and used ethically to prevent biases that could lead to discrimination in services such as credit scoring, hiring, or customer service. Ensuring fairness in AI algorithms and outputs is critical to maintaining trust and equity in AI applications.

- Integration and Implementation Challenges: Successfully implementing AI in existing financial systems involves overcoming technical and strategic hurdles. These include aligning AI goals with business objectives, ensuring infrastructure readiness, and managing stakeholder expectations through effective communication and engagement strategies.

- Data Security and Privacy Concerns: As financial services firms increase their use of AI, they face significant challenges in protecting sensitive and confidential information. Ensuring robust security measures and compliance with data protection regulations like GDPR and HIPAA is crucial to safeguard customer data from breaches and unauthorized access.

Market Opportunities

- Expansion into Emerging Markets: AI technologies offer unprecedented opportunities to penetrate emerging markets. These markets often lack extensive traditional banking infrastructure, which AI can circumvent by delivering financial services through mobile platforms and other digital channels. This not only broadens the customer base but also provides financial services to previously underserved populations.

- Enhancement of Customer Retention: AI-driven tools and systems can significantly boost customer retention rates for financial institutions. By personalizing customer interactions and providing tailored financial advice, AI can enhance customer satisfaction and loyalty, which are critical for competitive differentiation in the financial services industry.

- Development of New AI-Driven Financial Products: There’s a vast landscape for innovation in AI-driven financial products tailored to the needs of modern consumers. This includes everything from advanced wealth management tools to sophisticated budgeting and forecasting applications that can attract a broader user base and meet more specific consumer needs.

- Operational Efficiency and Cost Reduction: AI can streamline significant portions of financial operations, from customer service (via chatbots) to backend processing (through automation of routine tasks). This not only enhances service delivery but also reduces operational costs, making financial services more scalable and efficient.

- Strategic Decision-Making Enhancement: By leveraging the advanced analytics capabilities of AI, financial institutions can gain deeper insights into market trends and consumer behaviors. This data-driven approach can significantly enhance strategic decision-making, helping firms to better align their services with market demands and improve their overall competitiveness.

Recent Development

- New Product Launch: In March 2023, Aduro introduced a new AI-driven financial wellness platform that integrates physical and mental health tracking to provide a holistic view of employee wellness.

- Partnership: In January 2024, Beacon Health Options partnered with an AI company to incorporate predictive analytics into their mental health and financial wellness programs, aiming to provide more personalized support to users.

- Collaboration: In January 2024, Financial Fitness Group collaborated with a leading AI firm to integrate advanced analytics into their financial wellness programs, enhancing user engagement and outcomes.

- BrightDime: In May 2024, BrightDime released an update to their financial wellness platform, adding advanced machine learning algorithms to better predict and suggest financial behaviors that align with user goals. This update aims to enhance user experience and financial outcomes

- Enrich Financial Wellness: Enrich Financial Wellness launched a new feature in March 2024 that uses AI to create personalized financial wellness programs for users based on their financial behaviors and goals.

- Transamerica: Transamerica announced in January 2024 a new partnership with an AI company to enhance their financial wellness offerings with advanced predictive analytics and personalized financial planning tools.

Conclusion

In conclusion, the AI in financial wellness market is set to witness substantial growth, driven by advancements in technology, increased data availability, and the rising demand for personalized financial management tools. While the sector faces challenges such as data privacy concerns, the need for transparency, and the risk of biases in AI algorithms, the potential benefits are significant. AI can enhance financial decision-making, automate routine financial tasks, and provide personalized financial advice, thereby improving financial health for individuals and operational efficiency for businesses. The market’s expansion into emerging regions and its integration with IoT technologies further highlight its transformative potential. As the market evolves, continuous innovation and adherence to ethical standards will be crucial in leveraging AI’s full potential in financial wellness.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)