Table of Contents

Introduction

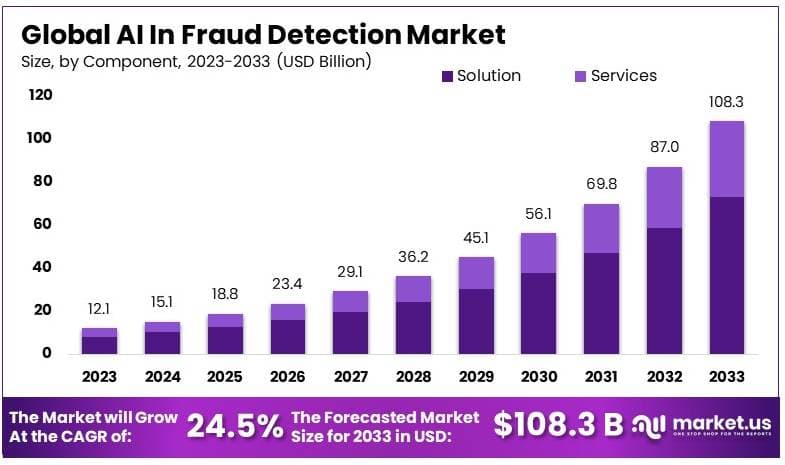

According to Market.us, The AI in Fraud Detection Market was valued at USD 12.1 billion in 2023 and is projected to reach USD 108.3 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 24.50%.

Artificial Intelligence (AI) is revolutionizing the approach to fraud detection by enhancing the accuracy and efficiency of monitoring and preventative measures. AI technologies, including machine learning algorithms and neural networks, analyze vast amounts of data to identify patterns and anomalies that may indicate fraudulent activities.

These systems learn from historical data, enabling them to adapt and respond to new fraudulent strategies dynamically. AI-driven fraud detection tools are crucial for sectors where large-scale transaction processing occurs, such as banking, insurance, and e-commerce, providing real-time analysis that helps minimize financial losses and safeguard consumer trust.

The market for AI in fraud detection is experiencing robust growth, driven by the increasing need for advanced security solutions across various industries. This growth is further propelled by the rising incidences of cybercrimes and the growing sophistication of fraud techniques. Financial institutions and online retailers are among the key adopters, utilizing AI to enhance their security frameworks and improve customer service by reducing false positives in fraud detection.

As regulatory requirements become more stringent, the demand for AI-powered fraud detection systems is expected to surge, offering significant opportunities for technology providers to innovate and expand their solutions. Market analysts predict a continued expansion of this sector, emphasizing the critical role of AI in combating fraud in an increasingly digital world.

The demand for AI in fraud detection is surging as organizations seek to combat the escalating frequency and sophistication of financial fraud. Industries such as finance, healthcare, and retail are particularly keen on adopting these technologies to safeguard their operations.

The shift towards digital transactions, intensified by the global increase in online banking and e-commerce due to the pandemic, has made traditional fraud detection methods inadequate. Consequently, companies are investing in AI solutions that can process large datasets and detect anomalies more efficiently, driving substantial demand in the market.

The growth of the AI in fraud detection market is propelled by technological advancements and the increasing digitization of financial services. AI technologies not only enhance the speed and accuracy of fraud detection but also enable proactive prevention strategies, making them indispensable tools for modern businesses. This growth is supported by continuous innovations in AI and machine learning, as well as the integration of AI with other emerging technologies like blockchain and the Internet of Things (IoT).

Opportunities in the AI in fraud detection market are vast and varied. As AI technology evolves, there is potential for the development of more sophisticated, context-aware systems that can predict and adapt to new fraud tactics before they become widespread. There is also significant potential for expansion into emerging markets, where digital financial services are growing rapidly but infrastructure for fraud prevention remains underdeveloped.

Furthermore, partnerships between AI technology providers and regulatory bodies could foster the creation of industry-wide standards and solutions, enhancing security measures across sectors and regions. These opportunities underscore the strategic importance of AI in shaping the future landscape of fraud prevention.

Key Takeaways

- The AI in Fraud Detection Market was valued at USD 12.1 billion in 2023 and is projected to reach USD 108.3 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 24.50%.

- In 2023, the Solution component dominated the market, accounting for 67.2% of the sector, underscoring the critical role of AI-based tools in fraud detection efforts.

- The Payment Fraud category led the application segment with a share of 49.4%, driven by the escalating need to counteract increasing payment-related fraud incidents.

- Large Enterprises held a dominant position in the organization size segment, comprising 68.0% of the market, highlighting their significant investment in advanced fraud detection solutions.

- In the industry verticals, BFSI (Banking, Financial Services, and Insurance) led with 26.5%, indicating a high adoption rate of fraud detection technologies within the financial sector.

- Regionally, North America was the leading market in 2023, capturing 38.9% of the global share, reflecting its advanced artificial intelligence infrastructure for fraud detection.

AI in Fraud Detection Statistics

- The Artificial Intelligence Market size is projected to reach approximately USD 2,745 billion by 2032, up from USD 177 billion in 2023, with a compound annual growth rate (CAGR) of 36.8% from 2024 to 2033.

- A study by the ACFE revealed that organizations employing data analytics for fraud detection have cut the duration of fraud instances by 50% and reduced financial losses by 40%.

- 50% of companies identify data quality and availability as a significant challenge in their AI initiatives.

- The estimated global economic impact of fraud totals a staggering USD 10 trillion annually.

- Banks utilizing real-time generative AI for fraud detection report improvements in fraud detection rates between 60% and 99%, a reduction in false positives by 80% to 90%, and annual fraud prevention savings ranging from USD 3 million to USD 15 million.

- Currently, 73% of organizations are utilizing AI specifically for fraud detection, indicating a significant trend towards automated solutions in financial crime prevention.

- Among surveyed financial institutions, 49% have already integrated AI into their systems, while 93% are planning to invest in AI technologies within the next 2 to 5 years, demonstrating a strong commitment to enhancing fraud detection capabilities.

- Organizations employing AI for fraud detection report a 98% success rate in identifying fraudulent activities, underscoring the effectiveness of AI technologies in this area.

- AI systems are capable of processing vast amounts of data significantly faster than traditional methods, drastically reducing the time required for fraud detection and response.

- 63% of financial institutions cite “increased fraud detection” as the primary motivation behind their investment in AI technologies, highlighting AI’s crucial role in advancing security measures.

- The global cost of cybercrime is estimated at USD 600 billion annually, representing 0.8% of global GDP, emphasizing the critical need for robust fraud detection solutions.

- In 2023, organizations reported spending between USD 5 million and USD 25 million on operational costs associated with investigating and combating financial crime.

- Over 50% of organizations have suffered losses due to AI-driven threats, with many acknowledging that criminals are increasingly sophisticated in their use of AI, outpacing the defensive capabilities of banks.

- 61% of financial institutions anticipate an increase in financial crime activities in 2024, signaling ongoing challenges in fraud prevention despite technological advancements.

- The value of fraudulent transactions is expected to escalate, with projections indicating that the global value of card fraud alone could rise to USD 38.5 billion by 2027.

Emerging Trends in AI in Fraud Detection

- Generative AI in Fraud Creation: The rise of generative AI has enabled fraudsters to enhance their techniques, particularly in creating realistic synthetic identities and deepfake content for scams. These tools allow the creation of fraudulent documents and media that are increasingly difficult to distinguish from authentic materials.

- Sophistication in Social Engineering: AI tools like chatbots have been refined to conduct sophisticated social engineering attacks. These attacks are becoming more convincing, leveraging deepfake technology to mimic human interactions in scams that target both individuals and businesses.

- AI-Powered Real-Time Detection: Financial institutions and businesses are increasingly adopting AI-driven systems that can analyze transaction data in real-time to detect and prevent fraud more effectively. This technology helps in identifying anomalous behavior swiftly, thereby minimizing potential losses.

- Increased Adoption of AI by Small and Medium Enterprises (SMEs): As AI technology becomes more accessible and affordable, even small to medium-sized enterprises are starting to implement AI solutions for fraud detection, driven by the need to safeguard their growing online transactions.

- AI in Regulatory Compliance and Risk Management: With regulatory pressures mounting, companies are leveraging AI not only to combat fraud but also to ensure compliance with evolving regulations. This trend is particularly prevalent in sectors like finance and healthcare, where data sensitivity is paramount.

Top Use Cases

- Transaction Monitoring: AI systems are widely used to monitor transactions in real-time, identifying patterns and anomalies that may indicate fraudulent activities. This is especially crucial in high-volume sectors like banking and e-commerce.

- Identity Verification: Leveraging AI to analyze biometric data, such as facial recognition and voice patterns, helps verify identities during transactions and access requests, reducing the risk of identity theft.

- Risk Assessment for Loans and Credits: AI models are employed to assess the risk levels of loan applicants, analyzing a vast array of data points to detect potential fraud or default risks.

- Fraudulent Claim Detection in Insurance: AI algorithms are used to scrutinize insurance claims, spotting inconsistencies and patterns that may suggest fraudulent claims, thus protecting against losses in the insurance sector.

- Behavioral Analytics in Gaming and Gambling: In the iGaming industry, AI is utilized to monitor player behaviors and wagering patterns, flagging actions that deviate from normal activities which could indicate fraudulent behavior.

Benefits of AI Implementation in Fraud Detection

The implementation of AI in fraud detection offers several substantial benefits. AI systems enhance accuracy and efficiency by analyzing vast amounts of data at speeds far exceeding human capabilities. This leads to more accurate and timely detection of fraudulent activities. AI-driven fraud prevention systems can significantly reduce the occurrence of fraud, with some banks reporting a reduction in false payment card declines by half, simultaneously slashing overall fraud rates.

Moreover, AI facilitates early detection of fraud, minimizing potential financial impacts and preventing widespread damage. These systems also reduce the operational costs associated with manual monitoring and analysis, making the process more cost-effective for organizations.

Major Challenges

- Data Security and Control: Outsourcing AI fraud detection raises significant data security and compliance concerns, with companies risking exposure of sensitive data and a loss of control over their fraud detection processes.

- High False Positive Rates: AI-driven systems can generate a high volume of false positives, eroding customer trust and potentially leading to lost sales if not properly managed(Marketing Scoop).

- Adaptation to Evolving Tactics: Fraudsters continuously innovate, using technologies like deepfakes and sophisticated phishing attacks. AI systems must constantly evolve to keep up with these new tactics, requiring frequent retraining and updates.

- Privacy and Ethical Concerns: The integration of AI in fraud detection can lead to privacy violations as these systems often collect and analyze vast amounts of personal data, raising ethical concerns regarding data usage and consent.

- Complexity in Implementation: Establishing effective AI fraud detection is technically challenging. It requires integrating complex AI models that can analyze vast datasets quickly and accurately, which can be resource-intensive and require significant expertise.

Top Opportunities

- Enhanced Detection Capabilities: AI can analyze massive data sets in real-time to identify subtle signs of fraud that are undetectable by human analysts or traditional software, significantly improving detection rates and reducing false negatives.

- Cost Reduction: By automating the detection process, AI can help reduce the labor costs associated with manual reviews and minimize the financial losses from fraud through earlier detection and response.

- Scalability: AI systems can handle large volumes of transactions, making them suitable for enterprises and financial institutions that process a high number of interactions, thus maintaining effectiveness even as transaction volumes grow.

- Real-time Processing: AI enables the real-time analysis of transactions, which is crucial in preventing fraud before it impacts the business financially, enhancing customer trust and satisfaction.

- Advanced Analytical Insights: AI can provide deeper insights into fraud trends and patterns, helping organizations to not only react to fraud incidents but also to predict and prevent future threats, thereby strengthening their overall security posture.

Recent Developments

- SAP SE and Google Cloud Partnership Expansion (May 2023): SAP and Google Cloud expanded their partnership to co-engineer data replication and federation technologies, enhancing fraud detection capabilities. This collaboration allows businesses to integrate data across SAP software and Google Cloud’s BigQuery, utilizing AI and machine learning to improve fraud detection models and generate trusted insights for financial and business outcome.

- ACI Worldwide and Microsoft Azure Collaboration (June 2023): ACI Worldwide announced a collaboration with Microsoft Azure to enhance its fraud management capabilities using AI-driven solutions. This partnership is aimed at offering real-time fraud prevention services, leveraging Azure’s cloud infrastructure to scale and improve detection efficiency across various sectors, including banking and payments.

- Experian plc’s New Product Launch (July 2023): Experian launched an advanced AI-based fraud detection solution designed to combat identity theft and synthetic fraud. The new solution integrates machine learning algorithms with real-time analytics to offer a robust defense against emerging fraud tactics in the financial services sector.

- Verisk Analytics Acquisition of Automated AI Solutions (August 2023): Verisk Analytics acquired a startup specializing in automated AI solutions for fraud detection in the insurance industry. This acquisition is intended to strengthen Verisk’s fraud analytics capabilities, particularly in identifying and mitigating fraudulent claims more efficiently.

Future Trends and Innovations in AI in Fraud Detection

The future of AI in fraud detection looks promising with continuous advancements leading to more sophisticated solutions. Innovations are likely to include the development of hybrid models that combine multiple types of machine learning to enhance the detection of both known and emerging fraud patterns.

Real-time detection capabilities are expected to become standard, enabling immediate responses to potential fraud, thus significantly mitigating associated risks. Additionally, the integration of AI across different channels and organizations is anticipated to enhance the scope and effectiveness of fraud detection systems, allowing for a more comprehensive approach to preventing fraud across various platforms and industries.

Conclusion

The application of AI in fraud detection is becoming increasingly sophisticated, enabling organizations to defend against and adapt to the evolving landscape of fraud. While these advancements significantly enhance security measures, they also require ongoing updates and refinements to keep pace with the equally advancing tactics of fraudsters. Businesses must continue to invest in these technologies, not just to combat current threats but also to prepare for future challenges in the realm of digital security. As AI continues to evolve, it will play a crucial role in shaping the strategies for fraud prevention and risk management across various industries.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)