Table of Contents

Introduction

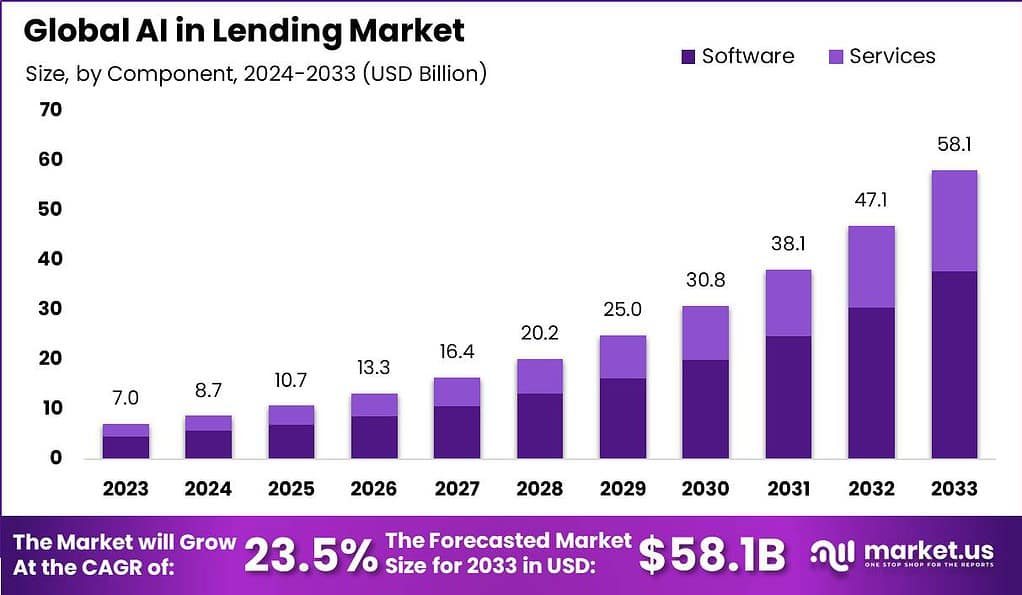

The Global AI in Lending Market is poised for significant expansion, with its value projected to soar from USD 7.0 billion in 2023 to around USD 58.1 billion by 2033, growing at a robust annual rate of 23.5% from 2024 to 2033. This growth is primarily driven by the increasing adoption of AI technologies in the financial sector, which enables more efficient processing, risk assessment, and personalized customer experiences. AI’s capability to analyze large volumes of data quickly and accurately is transforming lending practices, making them faster and more reliable.

One of the key growth factors for the AI in lending market is the increasing volume of data generated by financial institutions. AI algorithms can analyze large amounts of data quickly and extract valuable insights. This enables lenders to make more informed decisions regarding loan approvals, risk assessment, and personalized lending offers.

Additionally, AI-powered chatbots and virtual assistants have transformed the customer experience in lending. These AI-driven tools can provide instant responses to customer queries, offer personalized recommendations, and streamline the loan application process. As customer expectations continue to evolve, AI is becoming an essential tool for lenders to deliver efficient and convenient services.

Furthermore, the rise of alternative lending platforms, such as peer-to-peer lending and online marketplace lending, has created opportunities for new entrants in the lending market. AI technology can help these newcomers compete with traditional financial institutions by leveraging advanced algorithms for credit scoring, fraud detection, and loan underwriting.

To learn more about this report – request a sample report PDF

Key Takeaways

- The Global AI in Lending Market is growing rapidly. By 2033, it is expected to reach USD 58.1 billion, increasing from USD 7.0 billion in 2023. This growth represents a CAGR of 23.5%.

- In 2023, the software segment was leading the market, with over 65% share.

- The cloud-based segment also held a strong position in 2023, capturing more than 70% share of the market.

- Machine Learning (ML) and Predictive Analytics were key players in 2023, holding over 51% of the market share.

- Banks and Financial Institutions (BFSI) dominated the market in 2023, with a share of more than 45%.

- North America was the leading region in 2023, capturing over 40% of the market share.

AI in Lending Statistics

- A revealing study shows that 85% of banks globally use AI to automate lending. This change has significantly boosted efficiency and user experience.

- Switching from manual data processing to AI has improved accuracy to nearly 99%.

- In our fast-paced world, AI saves time by reducing the loan processing time to just 30 to 60 seconds.

- A Capgemini report states that over 60% of lenders are investing heavily in AI to enhance decision-making.

- Deloitte’s survey reveals that 50% of respondents have cut operational costs thanks to AI in lending.

- According to Accenture, 79% of banking executives believe AI will transform how they gather information and interact with customers.

- A PricewaterhouseCoopers survey found that 52% of financial services businesses are making “substantial investments” in AI.

- Evolve Mortgage Services noted that their AI-driven platform reduced mortgage loan processing time from 45 days to 15 days.

- An IBM report indicated that 77% of banks expected to adopt AI solutions for customer service by 2022.

Emerging Trends

- Increased Use of Alternative Data Sources: The AI lending industry is turning to new data types like utility bills and rental payments to evaluate borrowers. This helps in making lending decisions more inclusive and comprehensive.

- Focus on Responsible Lending: There’s a growing emphasis on ensuring that lending practices are fair and comply with regulations. This includes using AI to make credit more accessible while still being responsible.

- Automation of Lending Decisions: AI is increasingly used to automate decisions in lending, which speeds up the process and reduces costs. While not all decisions can be automated, especially in complex cases, the trend is towards more automation where possible.

- Integration with Digital Banking Services: AI is becoming more integrated with other digital banking services, offering a seamless experience that spans from loan application to money management.

- Regulatory Technology (RegTech) Adoption: As the regulatory environment becomes more complex, AI is being used more to ensure compliance through automated systems that can handle regulatory changes efficiently.

Top Use Cases

- Credit Scoring: AI models are used to analyze traditional and non-traditional data to predict a borrower’s creditworthiness more accurately than traditional models.

- Fraud Detection: AI helps in identifying potential fraud by analyzing patterns and anomalies in application data, reducing the risk of losses.

- Risk Management: By analyzing vast amounts of data, AI can predict the likelihood of a borrower defaulting, thereby aiding in risk assessment and mitigation.

- Personalized Lending Offers: AI algorithms can tailor lending offers to individual needs based on their financial behavior and preferences, enhancing customer satisfaction and engagement.

- Operational Efficiency: AI automates routine tasks such as document verification and data entry, allowing staff to focus on more strategic activities that require human intervention.

Major Challenges in AI in Lending

- Ethical Considerations and Bias Prevention: AI systems can unintentionally perpetuate biases if trained on biased data. Ensuring fairness and avoiding discrimination based on race, gender, or other factors is a significant challenge. Algorithms need constant monitoring and adjustment to prevent such issues from affecting lending decisions.

- Data Security and Privacy: Protecting sensitive borrower data is crucial. AI systems often require large datasets, which include personal and financial information. Ensuring this data remains secure and private, especially in light of past breaches like the Equifax incident, is a significant concern for lenders.

- Complexity and Explainability: Many AI models, particularly deep learning models, are often seen as “black boxes,” making it difficult to understand how they arrive at specific decisions. This lack of transparency can lead to distrust among users and regulatory bodies, complicating the adoption of AI in lending.

- Integration with Existing Systems: Incorporating AI into traditional lending processes can be challenging. Many financial institutions still rely on legacy systems that are not designed to handle modern AI tools, requiring significant investment and restructuring to integrate new technologies effectively.

- High Expectations and Over-Promising: The potential of AI often leads to high expectations that can be difficult to meet. When AI fails to deliver on these promises, it can lead to disappointment and skepticism among stakeholders, making it harder to gain widespread acceptance and trust.

Market Opportunities

- Enhanced Credit Scoring Models: AI can improve credit scoring by analyzing alternative data sources such as social media activity and transaction histories. This allows for more accurate assessments and can help include borrowers with limited credit history, expanding access to credit.

- Fraud Detection and Prevention: AI systems are highly effective at detecting and preventing fraud by identifying patterns and anomalies in large datasets. This can significantly reduce the incidence of fraudulent activities in the lending process, enhancing overall security.

- Streamlined Loan Processing: AI can automate many parts of the loan processing workflow, including data entry, document verification, and applicant evaluation. This leads to faster decision-making and improved efficiency, benefiting both lenders and borrowers.

- Personalized Financial Products: AI enables lenders to offer more personalized financial products and services by analyzing individual borrower data and preferences. This can increase customer satisfaction and loyalty, as well as cross-selling opportunities for lenders.

- Improved Risk Assessment: AI can enhance risk assessment by creating more accurate and dynamic models that account for a broader range of variables. This allows lenders to better evaluate borrower risk and tailor loan terms accordingly, reducing the likelihood of defaults and improving financial outcomes.

Recent Developments

- In recent months, notable advancements have shaped the landscape of AI in the lending market. For instance, in May 2024, Upstart Holdings Inc. took a pioneering step by introducing the industry’s first AI certification program specifically tailored for financial services. This program equips industry leaders with the necessary knowledge and expertise to effectively harness AI in their lending practices, showcasing a commitment to fostering innovation and promoting best practices.

- Another significant development occurred in February 2024 when Zest AI introduced LuLu, an impressive generative AI model aimed at revolutionizing lending organizations’ performance optimization and strategic decision-making. LuLu simplifies access to industry data and delivers valuable insights, thereby enhancing the efficiency and effectiveness of AI-driven lending solutions. This innovation holds great promise for lenders seeking to unlock the full potential of AI and stay competitive in an evolving marketplace.

Conclusion

In conclusion, the integration of artificial intelligence (AI) into the lending market has significantly transformed the industry, offering unprecedented opportunities and challenges. AI has revolutionized the lending process by enhancing efficiency, accuracy, and risk assessment, ultimately benefiting both borrowers and lenders.

By leveraging AI algorithms, financial institutions can now analyze vast amounts of data in real-time, enabling faster loan approvals and reducing the overall processing time. This streamlined approach has greatly improved the customer experience, allowing borrowers to access funds quickly and conveniently. Additionally, AI-powered chatbots and virtual assistants have enhanced customer service, providing personalized assistance and answering queries promptly.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)