Table of Contents

Introduction

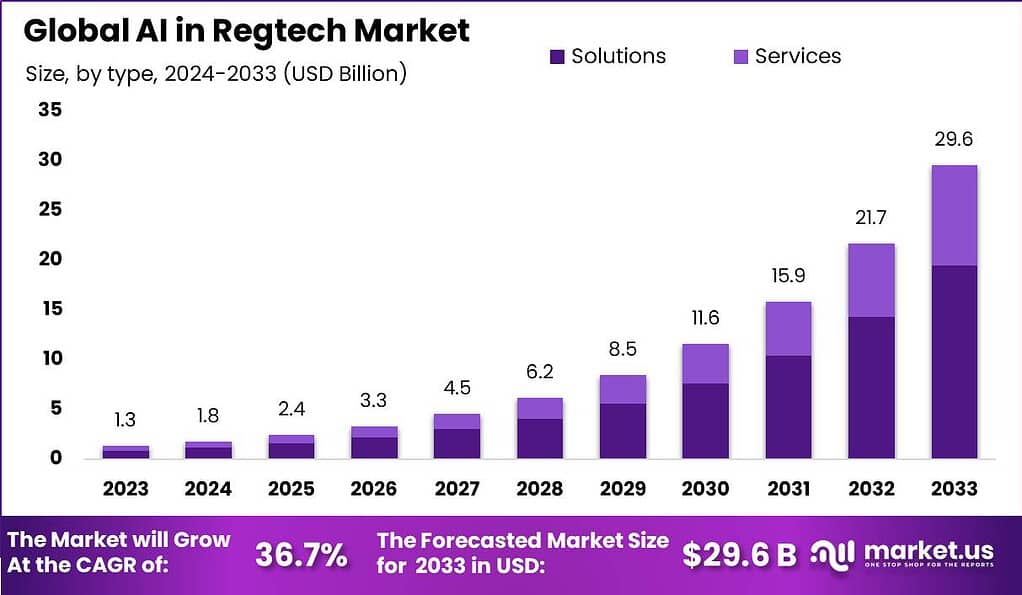

The global market for AI in regulatory technology (Regtech) is projected to grow significantly in the coming years. By 2033, it is estimated to reach around USD 29.6 Billion. This is a substantial increase from USD 1.3 Billion in 2023. The market is expected to grow at a compound annual growth rate (CAGR) of 36.7% during the forecast period from 2024 to 2033. This growth indicates a strong trend in the adoption of AI technologies to meet regulatory requirements across various industries.

The AI in Regtech (Regulatory Technology) market has experienced remarkable growth in recent years as organizations seek innovative solutions to navigate the increasingly complex regulatory landscape. Regtech refers to the use of technology, including artificial intelligence (AI), to streamline and automate regulatory compliance processes. AI in Regtech leverages machine learning algorithms, natural language processing, and data analytics to enhance regulatory compliance, risk management, and reporting capabilities.

To learn more about this report – request a sample report PDF

However, challenges such as the need for high initial investment and concerns over data privacy pose hurdles. Despite these challenges, the market presents substantial opportunities for new entrants. Innovators and startups have the chance to create unique solutions that address unmet needs within this space, particularly in developing regions that are yet to fully embrace AI in regulatory processes. The combination of high demand for compliance solutions and the transformative potential of AI in simplifying regulatory complexities makes this market ripe for growth and innovation.

Key Takeaways

- The AI in regtech market was valued at USD 1.3 billion in 2023 and is projected to reach USD 30.5 billion by 2033, growing at a CAGR of 36.7% during the forecast period.

- In 2023, the solution segment held a dominant share of 65.9% in the AI in regtech market.

- The regulatory compliance application led the market with a 30.6% share in 2023.

- Unsupervised learning was the predominant operation mode, capturing 41.4% of the market in 2023.

- North America led the regional market distribution with a 36.7% share in 2023.

AI in Regtech Statistics

- Adoption Rates and Preferences: The adoption of artificial intelligence (AI) in RegTech solutions, spanning Financial Risk, Financial Crimes Risk Management (FCRM), and Governance, Risk & Compliance (GRC) is substantial, with approximately 70% of institutions incorporating AI to manage risk and compliance.

- Notably, reservations about AI are minimal, with only 4% of institutions expressing hesitancy towards integrating AI technologies.

- Technological Implementation: The primary technologies employed in these RegTech solutions are Machine Learning (ML) and Natural Language Processing (NLP). A significant 11% of these institutions now consider NLP as an integral part of their technological framework, highlighting its growing importance in the field.

- Market Growth Projections: The global market for AI is poised for remarkable expansion. It is projected to soar from USD 177 billion in 2023 to approximately USD 2,745 billion by 2032, registering a compound annual growth rate (CAGR) of 36.8% over the forecast period from 2024 to 2033.

- Motivations for AI Implementation: The primary motivations for integrating AI within RegTech are compliance demands (64%), cost reduction (56%), and the enhancement of process and analysis accuracy (44%).

- Benefits Realized: A considerable majority of respondents (71%) identified time savings as a principal benefit derived from the use of AI in RegTech, which underscores the efficiency AI brings to regulatory processes.

- Impact on Regulatory Reporting: Around 42% of respondents believe that the most significant impact of AI will be on improving data validation for regulatory reporting, indicating a shift towards more reliable and accurate compliance data.

Emerging Trends

- Blockchain Integration: Many companies are using blockchain to ensure the security and transparency of financial transactions, which aids in compliance and fraud prevention.

- Cyber Threat Management: With the rise in cyber threats, AI and machine technologies are increasingly used to enhance cybersecurity measures in regulatory environments.

- Autonomous Delivery and Data-First Strategies: Companies are moving towards autonomous regulatory compliance solutions that prioritize data analysis to streamline operations.

- AI and Machine Learning in Compliance: These technologies are central to modernizing risk management and compliance processes, offering automated monitoring and predictive analytics.

- Cloud-Based Regulatory Solutions: Cloud computing is providing scalable and cost-effective solutions for regulatory compliance, enhancing flexibility and collaboration between regulatory bodies and financial institutions.

Top Use Cases

- Automated Compliance Monitoring: AI systems can continuously monitor data to ensure adherence to regulatory requirements, significantly reducing the workload on human employees.

- Enhanced Due Diligence: AI aids in thorough and rapid due diligence for anti-money laundering and KYC processes.

- Fraud Detection and Prevention: Machine learning models are used to detect and prevent fraud by analyzing behavioral patterns and flagging anomalies.

- Risk Management and Prediction: AI tools use historical data to predict potential risks and compliance breaches, allowing preemptive action.

- Regulatory Reporting: AI enhances the accuracy and efficiency of regulatory reporting by automating the generation and submission of required reports.

Major Challenges

- Data Privacy and Security: As AI models in RegTech often handle vast amounts of sensitive data, ensuring compliance with data protection laws like GDPR is critical. This challenge is exacerbated by the generative capabilities of AI, which must be carefully managed to maintain data integrity and security.

- Complex Regulatory Environment: The varying and evolving nature of regulations across different regions and industries makes it difficult to implement a one-size-fits-all AI solution. Companies must continuously adapt their AI tools to comply with local and international laws.

- Integration with Existing Systems: Incorporating AI technologies into existing regulatory frameworks often requires substantial customization. Financial institutions must evaluate their current systems to effectively integrate new AI capabilities without disrupting their ongoing operations.

- High Costs and Resource Intensity: Developing and training effective AI models for RegTech purposes can be resource-intensive and expensive, particularly for smaller firms that might lack the necessary capital and technical expertise.

- Reliability and Accuracy of AI Outputs: Ensuring the accuracy of AI-generated data and reports is vital to avoid costly errors in compliance and risk assessments. Financial institutions must rigorously test AI solutions to validate their reliability before full-scale implementation.

Market Opportunities

- Enhanced Compliance and Risk Management: AI can significantly improve the efficiency and accuracy of compliance processes by automating routine tasks and providing predictive analytics to foresee and mitigate risks.

- Cost Reduction: By automating data-intensive tasks such as document analysis and report generation, AI can help reduce operational costs associated with regulatory compliance.

- Improved Customer Experience: AI-driven chatbots and customer service tools can provide a more personalized and efficient customer experience, enhancing satisfaction and retention rates.

- Real-time Monitoring and Reporting: AI enables continuous monitoring and real-time reporting of regulatory compliance, helping institutions respond swiftly to regulatory inquiries and avoid penalties.

- Market Expansion and Innovation: The growing demand for RegTech solutions provides ample opportunities for innovative firms to develop new products and expand into emerging markets, particularly in regions like Asia-Pacific, which is projected to experience the fastest growth.

Recent Developments in Regulatory Technology

- Acquisition and Product Launch by Archer: In February 2024, Archer, a leading firm in regulatory technology solutions, completed the acquisition of Compliance.ai, a renowned supplier of AI-driven regulatory change management solutions. Following this acquisition, Archer launched a series of AI-driven Regtech solutions, aimed at enhancing compliance processes and risk management for financial institutions.

- Launch of RegVerse by Surge Ventures: Surge Ventures, a fintech company based in California, introduced RegVerse in October 2023. RegVerse is an AI-driven compliance platform designed to advance the capabilities of regulatory technology. This platform focuses on streamlining compliance operations, thereby enabling financial organizations to adapt to regulatory changes more efficiently.

- Enhancements to Trulioo’s Identity Verification Platform: In January 2023, Trulioo, an innovator in global identity verification solutions, announced significant enhancements to its identity verification platform. These improvements are aimed at boosting the speed and accuracy of processes essential for regulatory compliance, enhancing the ability of businesses to meet complex regulatory requirements swiftly.

- FundApps’ Acquisition of Silverfinch: In a strategic move to expand its AI capabilities, FundApps, a provider of regulatory reporting solutions, announced the acquisition of Silverfinch in October 2023. This acquisition is part of FundApps’ initiative to broaden its regulatory compliance offerings, particularly focusing on enhancing data-driven compliance through advanced AI technologies.

Conclusion

The AI in RegTech market is poised for significant expansion, driven by the increasing complexity of regulatory environments and the growing volume of digital data. While the integration of AI presents several challenges, including data privacy concerns and the need for substantial investment, the potential benefits in terms of enhanced compliance efficiency, reduced costs, and improved risk management are substantial. Financial institutions that effectively leverage AI technologies can not only enhance their compliance functions but also gain a competitive advantage by adopting more proactive and predictive regulatory strategies. As the technology continues to evolve, those who embrace these innovations can expect to lead in the increasingly complex world of regulatory technology.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)