Table of Contents

Introduction

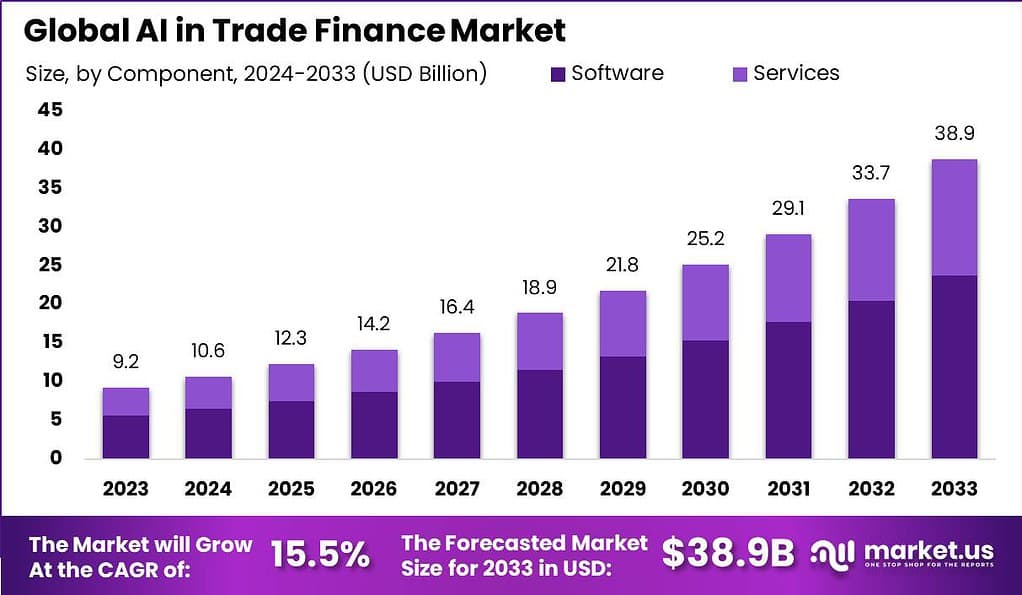

The AI in Trade Finance market is experiencing robust growth, projected to reach USD 38.9 billion by 2033, with a compound annual growth rate (CAGR) of 15.5% from 2024 to 2033. This growth is driven by AI’s transformative impact on trade finance operations, enhancing efficiency and security across various applications.

One of the primary growth drivers is the increasing demand for automation and streamlined processes in trade finance. AI helps in reducing manual errors and operational costs, which is highly beneficial for banks and financial institutions. Furthermore, the expansion of international trade requires robust systems that can handle complex transactions and regulatory compliance, areas where AI excels.

However, the market faces several challenges. The adoption of AI in trade finance involves high initial investments and significant changes to existing systems. There is also a persistent concern regarding data security and privacy, as trade finance often deals with sensitive and confidential information. Additionally, the lack of standardization and regulatory clarity on the use of AI in financial services poses a barrier to its full potential.

Despite these challenges, the opportunities presented by AI in trade finance are vast. AI can greatly enhance decision-making processes with predictive analytics and risk assessment capabilities. It also opens doors for innovation in financial products and services, offering a competitive edge to those who adopt this technology early. Moreover, there is an increasing trend towards sustainable and transparent financing, where AI can play a crucial role in monitoring and reporting financial flows.

AI in Trade Finance Statistics

- The AI in Trade Finance Market is projected to reach a valuation of USD 38.9 Billion by 2033, with a robust CAGR of 15.5% during the forecast period from 2024 to 2033.

- The Artificial Intelligence Market size is expected to be worth around USD 2,745 billion by 2032, from USD 177 Billion in 2023, growing at a CAGR of 36.8% during the forecast period from 2024 to 2033.

- In 2023, the Software segment emerged as a predominant force within the AI in Trade Finance market, capturing a substantial 61% market share.

- The Cloud segment also demonstrated a commanding presence in 2023, amassing over 70% of the market share in the AI in Trade Finance market.

- Machine Learning technology held a significant position in the AI in Trade Finance market in 2023, accounting for more than 35% of the market share.

- The Trade Documentation and Validation segment also maintained a strong market position in 2023, capturing over 25% of the market share within the AI in Trade Finance sector.

- The Banks segment achieved a dominant role in the AI in Trade Finance market in 2023, securing a market share exceeding 45%.

- Lastly, North America held a dominant market position in the AI in Trade Finance market in 2023, capturing more than a 35% share and generating USD 3.2 billion in revenue.

- The World Trade Report 2018 suggests that the broad implementation of digital technologies, including AI, could lead to a significant reduction of up to 17% in global trade costs.

- AI is already revolutionizing the field of trade finance with notable advancements. For instance, BNP Paribas, a leading bank, has successfully deployed an AI solution operational in 15 countries.

- Since its launch in 2022, this AI system has processed nearly 40,000 transactions, showcasing the practical application and effectiveness of AI in streamlining and enhancing trade finance operations.

Emerging Trends in AI in Trade Finance

- Digital Trade Platforms: The rise of digital trade platforms is a prominent trend, offering unified ecosystems where all trade participants including banks, buyers, and sellers can collaborate seamlessly. This enhances the efficiency and security of transactions, providing comprehensive solutions that integrate payment processing, document verification, and risk management.

- Adoption of Blockchain Technology: Blockchain technology is being increasingly adopted to streamline multi-party transactions in trade finance. It minimizes the need for intermediaries, enhances transparency, and reduces delays and disputes, leading to more efficient and secure trade processes.

- Artificial Intelligence and Machine Learning: AI and ML are transforming risk assessment and management in trade finance by enabling more accurate credit risk evaluations and predictive analytics. These technologies help in automating complex processes and providing personalized financial solutions, ultimately improving decision-making and financial inclusivity.

- Sustainable Trade Finance: There’s a growing focus on environmental and social governance (ESG) within trade finance. Financial products are increasingly linked to sustainability goals, promoting environmentally and socially responsible trade activities. This includes green bonds and loans that incentivize sustainable practices among businesses.

- Regulatory and Compliance Advances: Enhanced regulatory compliance, particularly in anti-money laundering (AML) and counter-terrorism financing (CTF), is critical in today’s trade finance landscape. Institutions are leveraging advanced digital solutions, including AI and biometrics, to improve the security and integrity of transactions and ensure adherence to global standards.

Top Use Cases of AI in Trade Finance

- Automated Risk Assessment: AI enhances the ability to analyze vast amounts of data to assess creditworthiness and predict potential disruptions, facilitating more informed lending decisions and reducing potential losses.

- Real-Time Tracking and Monitoring: Advanced AI-driven platforms provide real-time tracking of shipments and financial transactions, enabling businesses to monitor progress and manage risks more effectively. This includes tracking the status of goods and ensuring timely payments which enhance trust and reliability in trade relationships.

- Digital KYC and Fraud Detection: AI technologies are employed to streamline Know Your Customer (KYC) processes and enhance fraud detection capabilities. This helps in quicker onboarding, reduces manual errors, and strengthens security measures against financial crimes.

- Supply Chain Finance Optimization: AI facilitates more efficient management of supply chain finance by predicting cash flow needs and optimizing the financial health of the supply chain network. This is crucial for maintaining resilience and operational continuity in uncertain economic conditions.

- Integration with Blockchain for Secure Transactions: AI combined with blockchain technology ensures the execution of secure and transparent trade finance transactions. Smart contracts automate agreements and minimize the need for manual intervention, thus speeding up operations and reducing overhead costs.

Major Challenges

- Data Quality and Integration: One of the primary challenges is ensuring the consistency and quality of data used in AI models. Effective AI systems require high-quality, unbiased data, which can be difficult to obtain in the diverse and complex trade finance sector. The integration of disparate data sources into a cohesive system is essential but challenging due to the varying standards and formats used across different organizations and regions.

- Regulatory and Compliance Risks: The regulatory landscape for AI in trade finance is still evolving. Financial institutions must navigate complex and often conflicting regulations across different jurisdictions. Ensuring compliance while implementing AI solutions adds another layer of complexity and risk. There is also the challenge of aligning AI’s rapid development with slower-moving regulatory frameworks.

- Ethical and Transparency Issues: The use of AI in trade finance raises ethical concerns, particularly related to transparency and decision-making processes. AI systems can function as “black boxes,” making it difficult to understand how decisions are made. This lack of transparency can lead to mistrust among stakeholders and challenges in meeting regulatory requirements for explainability.

- Technological and Operational Integration: Implementing AI requires significant changes to existing systems and processes. The integration of AI into legacy systems can be complex and costly. Additionally, the operational shift towards AI-driven processes requires substantial training and change management efforts to ensure that employees can effectively use and trust these new technologies.

- Security and Fraud Detection: While AI can enhance security and fraud detection, it also presents new challenges. AI systems must be robust enough to handle sophisticated cyber threats. Ensuring the security of AI systems and the data they process is crucial, as any vulnerabilities could be exploited by malicious actors.

Market Opportunities

- Enhanced Efficiency and Cost Reduction: AI can significantly streamline trade finance processes by automating routine tasks such as document verification and data entry. This automation reduces processing times and operational costs, making trade finance more efficient and cost-effective.

- Improved Risk Management: AI systems can analyze large volumes of data to identify patterns and anomalies that may indicate potential risks. This capability allows for more accurate risk assessments and better-informed decision-making, helping institutions manage credit and operational risks more effectively.

- Increased Trade Opportunities: AI can facilitate access to trade finance for small and medium-sized enterprises (SMEs) by providing more accurate credit assessments and reducing the perceived risks associated with financing these entities. This inclusivity can stimulate economic growth by enabling more businesses to participate in global trade.

- Compliance and Fraud Detection: AI enhances compliance by automating the monitoring of transactions for suspicious activities and ensuring adherence to regulatory requirements. Advanced AI models can detect and prevent fraud by identifying unusual patterns and behaviors in real-time.

- Customer Experience and Engagement: AI-driven tools, such as chatbots and virtual assistants, can improve customer service by providing instant responses and personalized support. These tools can handle a variety of inquiries and processes, enhancing customer satisfaction and engagement.

Recent Developments

- AI-Driven Trade Finance Solutions (March 2023): Microsoft has been focusing on integrating AI into trade finance through its Azure AI platform. By leveraging AI for risk assessment and compliance checks, Microsoft aims to enhance the efficiency and security of trade finance transactions.

- Launch of SAP Business Network for Trade Finance (April 2023): SAP introduced a new AI-driven platform to connect businesses and financial institutions. This platform aims to streamline trade finance processes, reduce fraud, and improve transaction transparency using AI and blockchain technology.

- Acquisition of AI Firm (September 2023): Accenture acquired an AI startup specializing in financial services automation. This acquisition is expected to bolster Accenture’s capabilities in automating trade finance processes and enhancing AI-driven insights for better decision-making.

- AI-Powered Trade Finance Services (August 2023): Genpact introduced AI-powered services to streamline trade finance operations, including invoice processing, credit assessment, and compliance monitoring. The company uses machine learning algorithms to automate and optimize these processes.

Conclusion

In conclusion, the use of AI in trade finance holds immense potential for transforming the industry. Growth factors such as process automation, improved decision-making, and enhanced customer experiences are driving the adoption of AI technologies. However, challenges related to data quality, regulatory compliance, and skill requirements need to be addressed. By leveraging the opportunities presented by AI, financial institutions can unlock new levels of efficiency, profitability, and risk management in the trade finance market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)