Table of Contents

Introduction

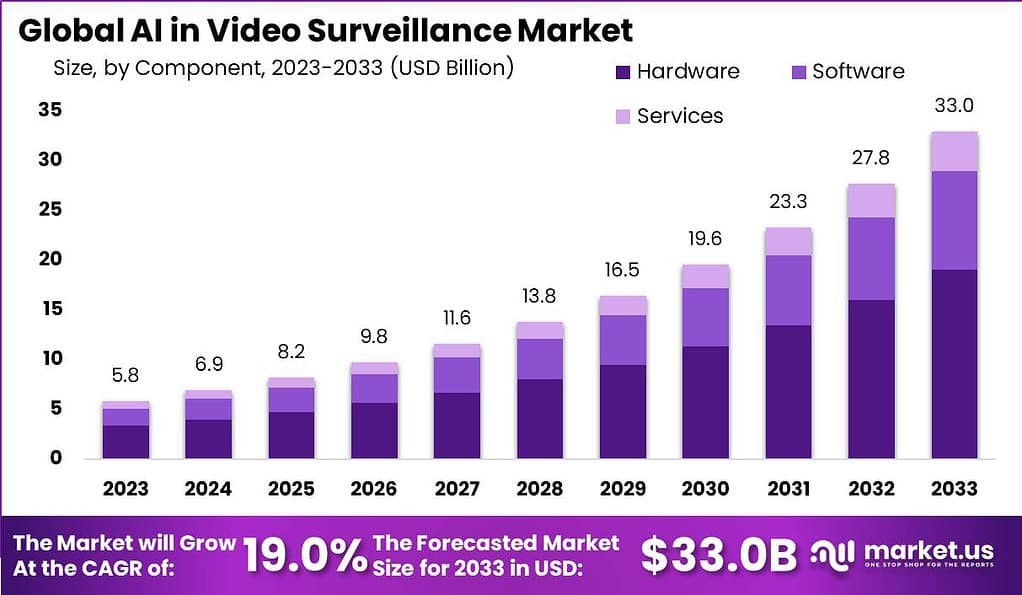

The global AI in Video Surveillance Market is poised for substantial growth, with an estimated worth of USD 33.0 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 19% throughout the forecast period. This market segment encompasses the integration of artificial intelligence technologies into surveillance systems, empowering them to analyze real-time video footage, identify objects, recognize patterns, and predict potential security breaches. These advancements have revolutionized security and surveillance practices, enhancing accuracy and efficiency in monitoring activities.

Several factors contribute to the rapid expansion of the AI in video surveillance market. Primarily, the escalating demand for heightened public safety and security measures propels the adoption of AI-powered surveillance systems. Additionally, advancements in machine learning and computer vision technologies have democratized access to these systems, making them more effective and accessible.

Despite its promising growth trajectory, the AI in video surveillance market encounters challenges. Privacy invasion concerns loom large as surveillance systems become more sophisticated, prompting the need to balance security imperatives with individual privacy rights. Moreover, the high implementation costs associated with AI-powered video surveillance systems pose financial barriers, compounded by the need for skilled professionals to operate and maintain these systems.

To learn more about this report – request a sample report PDF

Key Takeaways

- The AI in Video Surveillance Market is estimated to reach USD 33.0 billion by 2033, with a robust Compound Annual Growth Rate (CAGR) of 19% throughout the forecast period.

- In 2023, the Hardware segment held a dominant position in the market, capturing over 57.8% share.

- Cloud-Based deployment mode led the market in 2023, with over 68.1% share.

- Intrusion Detection held a dominant market position in 2023, with over 45% share.

- In the same year, the Commercial segment held a dominant position, capturing more than 38.5% share.

- Asia-Pacific Leadership: In 2023, Asia-Pacific held a dominant market position, capturing over 41.1% share. The region’s rapid urbanization and infrastructure development drive significant investments in AI-enabled surveillance.

AI in Video Surveillance Statistics

- The AI Global Surveillance Index reports that 75 out of 176 countries use AI surveillance technologies extensively.

- In the Americas, AI security cameras achieve 72% accuracy in vehicle detection, whereas Europe shows a lower accuracy of 57%, highlighting regional differences in system performance.

- According to the International Data Corporation, by 2022, 40% of police agencies will adopt digital tools like live video streaming to enhance safety and create new response strategies. This reflects the increasing dependence on AI and digital technologies in advancing public security framework.

- The Global Artificial Intelligence Market is projected to escalate remarkably from USD 177 billion in 2023 to approximately USD 2,745 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 36.8% during the forecast period from 2024 to 2033.

- In the specific segment of edge-based AI processing for video surveillance cameras, the year 2023 witnessed an impressive investment of $2.2 billion. This substantial financial input is directed towards enhancing the functionality of smart cameras, enabling quicker response capabilities and minimizing the costs associated with data transmission.

- The deployment of AI-powered video analytics within law enforcement and governmental agencies marked a significant trend in 2023, with 75% of these entities adopting the technology. This move contributed to a 20% increase in case clearance rates, underlining the effectiveness of AI in public safety and crime prevention.

- Investments in AI-enabled video analytics solutions that utilize deep learning for improved object classification and event detection reached $1.4 billion in 2023. Such advancements underscore the growing reliance on precise technology solutions in security and surveillance sectors.

- The transportation and logistics sector reported a 68% adoption rate of AI-powered video surveillance systems in 2023, aimed at asset monitoring, theft reduction, and operational efficiency enhancement. This strategic implementation resulted in a 12% reduction in losses.

- Funding directed towards the development of privacy-preserving AI algorithms for video surveillance amounted to $980 million in 2023. These innovations are critical in maintaining a balance between achieving security objectives and adhering to data protection regulations, thereby upholding privacy without compromising surveillance efficacy.

- The video surveillance industry also embraced cloud-based and subscription-based service models with an investment of $680 million in 2023. These developments have facilitated broader accessibility and scalability of AI video surveillance technologies across various business sizes.

- In the healthcare sector, 70% of organizations implemented AI-driven video surveillance systems in 2023, leading to a 12% decrease in adverse events. These systems are instrumental in enhancing patient safety, monitoring staff performance, and improving facility management.

- The integration of AI-powered video analytics with advanced video management systems (VMS) and security information and event management (SIEM) systems saw an investment of $820 million in 2023. This integration significantly boosts security orchestration and response capabilities across multiple domains.

- Lastly, 75% of critical infrastructure operators, including those in utilities and energy sectors, adopted AI-powered video surveillance in 2023 to enhance physical security and prevent unauthorized access, achieving an 18% reduction in security incidents.

Emerging Trends

- Increased AI and Cloud Integration: The combination of AI and cloud technologies is enhancing the capabilities of video surveillance systems, enabling advanced data analysis and predictive analytics.

- Enhanced Edge Computing: AI capabilities are increasingly being integrated directly into cameras (‘at the edge’), allowing for real-time data processing and reducing the need for extensive data transmission.

- Sustainability Initiatives: There’s a growing focus on developing energy-efficient and environmentally sustainable technologies within the video surveillance industry.

- Wider Adoption of AI in Diverse Applications: AI is being utilized across various sectors, including retail, healthcare, and urban infrastructure, to improve operational efficiencies and security.

- Growth of AI-Driven Predictive Analytics: Video surveillance systems are evolving to include predictive analytics, using AI to anticipate and mitigate potential security threats before they occur.

Top Use Cases

- Real-Time Threat Detection: AI enhances video surveillance systems with the ability to detect potential security threats in real-time, significantly improving response times.

- Facial Recognition for Enhanced Security: AI-driven facial recognition is used for security checks and access control, streamlining entry management into sensitive areas.

- Traffic and Crowd Management: AI-powered video surveillance is employed in urban settings for traffic flow and crowd control, aiding in congestion prevention and public safety.

- Retail Analytics for Business Insights: Retailers utilize AI-enhanced video surveillance to analyze customer behavior, optimize store layouts, and enhance customer service.

- Incident Prevention and Analysis: AI technologies enable early detection of irregular patterns or unsafe behaviors, helping to prevent accidents and ensuring public safety.

Major Challenges

- Data Privacy Concerns: The extensive use of AI in surveillance raises significant privacy issues, particularly regarding continuous monitoring and data storage.

- High Initial Costs: Implementing AI-driven surveillance systems involves substantial upfront investments, which can be a barrier for many organizations.

- Data Accuracy and Reliability: Issues with the accuracy and reliability of video analytics can undermine the effectiveness of surveillance systems.

- Cybersecurity Risks: As surveillance systems become more connected, they are increasingly vulnerable to cyber threats.

- Regulatory Compliance: Navigating the complex regulatory landscape, especially concerning data protection laws like GDPR and CCPA, poses a challenge.

Market Opportunities

- Integration with Emerging Technologies: The fusion of AI with IoT and cloud computing presents significant growth opportunities for enhancing surveillance capabilities.

- Smart City Initiatives: Increasing deployment of AI surveillance in smart city projects offers substantial market potential.

- Retail and Transportation Applications: AI-driven analytics are becoming essential in sectors such as retail for optimizing store layouts and in transportation for traffic management.

- Advancements in AI Technologies: Continuous improvements in AI, deep learning, and computer vision technologies are expanding the scope and effectiveness of surveillance systems.

- Global Market Expansion: Particularly in the Asia-Pacific region, there is a strong growth trajectory supported by advances in AI technology and increased security needs.

Key Growth Drivers

- Increasing Security Concerns: Rising demand for enhanced security measures across various sectors, including commercial and government, drives market growth.

- Technological Advancements: Continuous improvements in AI, machine learning, and computer vision technologies enhance surveillance system accuracy and efficiency.

- Government Initiatives: Many governments are implementing strict regulations and initiatives to enhance public safety, driving significant investments in surveillance infrastructure.

- Smart City Projects: The global push towards smart cities presents a significant opportunity for AI in video surveillance market growth, as these projects integrate various IoT technologies.

Challenges Faced

- High Implementation Costs: The high cost associated with implementing and maintaining AI-enhanced video surveillance systems is a significant restraint.

- Privacy and Ethical Concerns: Surveillance overreach and erosion of personal privacy pose challenges to adoption, necessitating responsible use and adherence to data protection laws.

Recent Developments

- Honeywell’s Safe City Project: In March 2023, Honeywell partnered with Bengaluru City Police to implement the Safe City project. Over 4,100 video cameras were deployed across strategic locations in the city. These cameras, connected to a command center utilizing machine learning and AI, aim to enhance situational awareness and facilitate prompt police response.

- Dahua Technology’s AcuPick Technology: In May 2023, Dahua Technology introduced AcuPick video search technology, a cutting-edge solution designed to improve the efficiency and accuracy of locating target videos. With its user-friendly interface and advanced search capabilities, AcuPick sets a new standard in the industry by providing quick and precise video search operations.

- Motorola Solutions’ V700 Body Camera: In May 2023, Motorola Solutions, through its subsidiary Avigilion, unveiled the V700 body camera. This mobile broadband-enabled camera offers real-time field intelligence and collaboration for public safety agencies. With its high-definition sensor adapting to low lighting conditions, the V700 ensures clear, accurate recordings of events, resembling the visual capabilities of the human eye.

Conclusion

The AI in video surveillance market is poised for significant expansion, driven by the dual forces of technological advancement and growing security demands across various sectors. While the market faces challenges related to privacy, costs, and cybersecurity, these are balanced by opportunities in technological integration, smart city applications, and sector-specific advancements. The strategic implementation of AI in video surveillance not only enhances security but also offers operational efficiencies, making it a critical component in modern security infrastructures. As the market evolves, stakeholders must navigate these challenges and opportunities to fully capitalize on the transformative potential of AI in surveillance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)