Table of Contents

Introduction

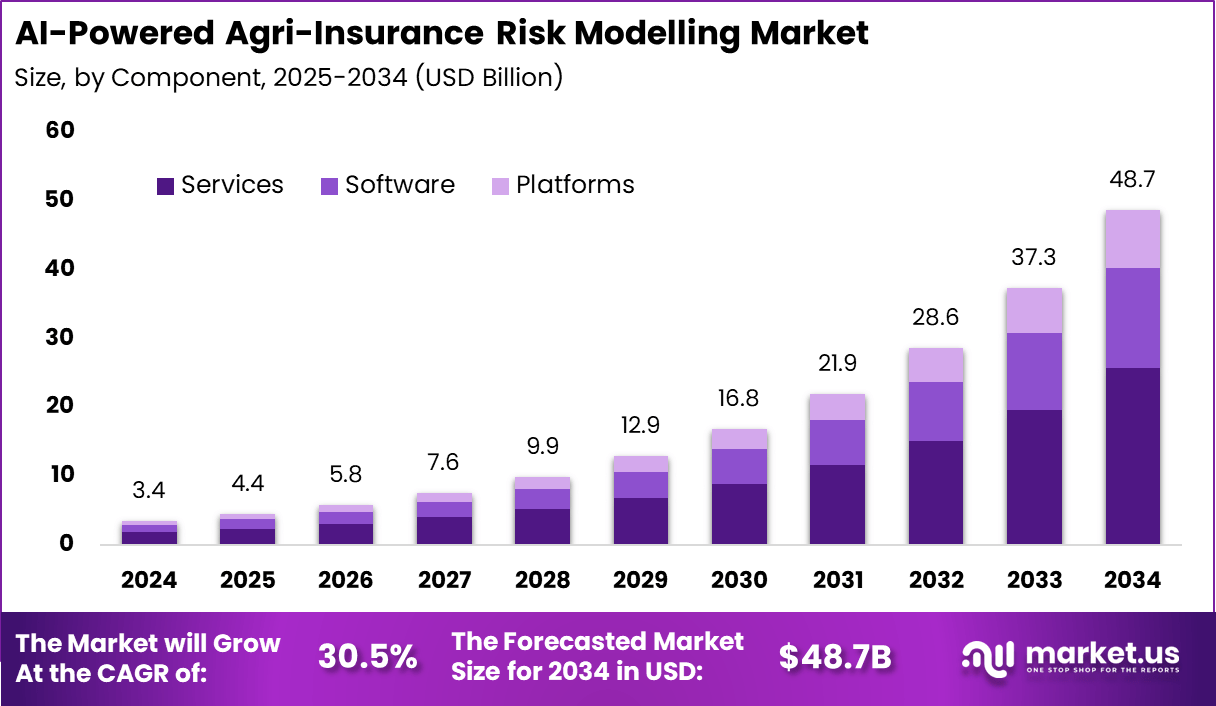

The Global AI-Powered Agri-Insurance Risk Modelling Market is expected to reach USD 48.7 billion by 2034, growing from USD 3.4 billion in 2024, with a robust CAGR of 30.5% during the forecast period from 2025 to 2034. In 2024, North America dominated the market, accounting for 36.7% of the market share and generating USD 1.2 billion in revenue.

The growing adoption of artificial intelligence in the agriculture insurance industry is driving this market growth. AI-powered risk models enable insurers to better predict crop yields, assess risks, and optimize claims management, contributing to more accurate and cost-efficient insurance offerings.

How Growth is Impacting the Economy

The rapid expansion of AI-powered agri-insurance risk modelling is positively impacting the global economy by transforming the agricultural insurance sector. As AI technology enhances risk assessment capabilities, insurance providers can more accurately price policies, reducing financial uncertainty for farmers and boosting their resilience to climate-related risks.

This leads to a more stable agricultural sector, which is critical for the global economy, especially in developing regions dependent on agriculture. AI is also driving innovations in data analysis, enabling the development of more personalized insurance solutions that cater to specific regional and environmental factors, ultimately improving economic productivity and growth.

➤ Unlock growth! Get your sample now! – https://market.us/report/ai-powered-agri-insurance-risk-modelling-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

AI-powered risk modelling tools help agri-insurance companies reduce the cost of claims and administrative processes by improving the accuracy of risk assessments and enhancing decision-making. However, transitioning to AI-driven models requires investment in technology infrastructure and skilled personnel.

For agricultural businesses, the rising costs of climate-related risks can be mitigated by adopting AI-enhanced insurance, which ensures better coverage, faster claims processing, and fewer errors in risk evaluation. Furthermore, the integration of AI into risk management may shift how companies approach underwriting and claims, creating efficiencies in the supply chain.

Sector-Specific Impacts

- Agricultural Insurance Providers: By leveraging AI models, insurance companies can better evaluate risk factors such as weather patterns, soil conditions, and crop health, improving pricing accuracy and claims processing.

- Farmers: AI-driven insurance models offer farmers tailored policies that account for the unique environmental risks they face, improving access to affordable coverage.

- Technology Providers: Companies that offer AI solutions for agri-insurance, including data analytics, machine learning models, and IoT integrations, are experiencing increased demand for their services.

Strategies for Businesses

Agri-insurance companies should focus on adopting AI-powered tools to enhance risk assessment, improve underwriting processes, and optimize claims management. Partnering with technology providers that specialize in agricultural data analytics and AI models will be essential for staying competitive. Additionally, insurers must invest in educating their workforce and clients about the benefits of AI in risk modelling to drive adoption and ensure the integration of these technologies into business practices. Furthermore, a focus on customer personalization will be crucial to attract and retain clients in a competitive market.

Key Takeaways

- The AI-powered agri-insurance risk modelling market is expected to grow at a CAGR of 30.5%, reaching USD 48.7 billion by 2034.

- North America captured 36.7% of the market share in 2024, generating USD 1.2 billion in revenue.

- AI in agri-insurance is transforming risk assessment, underwriting, and claims processes by offering more precise, data-driven insights.

- Businesses should invest in AI technologies and build partnerships with data analytics firms to stay ahead of the curve.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=157073

Analyst Viewpoint

The future of AI in agri-insurance is extremely promising, with increasing demand for advanced risk modelling solutions in response to climate change and fluctuating agricultural conditions. As the market matures, AI will enable more accurate, personalized insurance offerings that can address specific risks faced by farmers and agribusinesses.

In the coming years, we expect the rapid growth of AI tools in this space, especially as insurers adopt machine learning and big data to enhance their decision-making processes. With continual advancements in AI and the growing importance of sustainability in agriculture, the sector’s future looks bright.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Crop Insurance | Increased climate-related risks and demand for tailored crop coverage. |

| Livestock Insurance | Need for precise risk modelling to protect against diseases, climate, and market fluctuations. |

| Agricultural Risk Assessment | Growing reliance on data analytics and AI for accurate risk evaluation in farming. |

| Claims Processing | Adoption of AI for faster, more efficient claims handling and fraud prevention. |

Regional Analysis

North America holds the largest share of the AI-powered agri-insurance risk modelling market, with a market share of 36.7% and USD 1.2 billion in revenue in 2024. The region benefits from a highly developed insurance sector, technological advancements, and strong adoption of AI. In contrast, the APAC region is expected to see rapid growth during the forecast period, driven by the increasing need for agricultural insurance solutions in emerging economies and the growing use of AI technologies in agriculture.

➤ Don’t Stop Here—check Our Library

- Smart Image Labeling Market

- All-flash Array Market

- Emotion AI Advertising Terminal Market

- AI in Precision Agriculture Market

Business Opportunities

The growing adoption of AI in the agri-insurance sector presents numerous business opportunities. Companies can develop AI-driven risk models that cater to specific agricultural sectors, such as crop insurance or livestock protection. Partnerships between agri-tech companies and insurance providers will be crucial for creating customized, AI-powered solutions. Additionally, businesses can capitalize on the demand for data analytics services, offering tools for climate prediction, yield estimation, and risk management. As the market grows, the development of specialized platforms to support agri-insurance applications will also present significant opportunities.

Key Segmentation

The AI-powered agri-insurance risk modelling market can be segmented as follows:

- By Application: Crop Insurance, Livestock Insurance, Agricultural Risk Assessment, Claims Processing

- By Technology: Machine Learning, IoT, Big Data, Predictive Analytics

- By End-User: Insurance Providers, Farmers, Government Agencies

- By Region: North America, Europe, APAC, Latin America, Middle East & Africa

Key Player Analysis

The AI-powered agri-insurance risk modelling market features technology providers specializing in AI solutions for the agriculture and insurance sectors. These players offer a wide range of services, including machine learning models, data analytics, and IoT-driven platforms to enhance risk assessment and claims management. Key strategies in the market include developing partnerships with insurance firms, advancing research and development, and focusing on regulatory compliance to ensure the widespread adoption of AI-driven risk models.

- IBM (Agri-focused AI Insurance Solutions)

- Swiss Re

- Generali

- Aon plc

- Bayer’s Climate Corp

- Indigo Ag

- AgroGuard

- AgRisk Analytics

- AgriShield

- Lemonade (Agri-Insurance Al)

- Munich Re

- AXA XL

- Allianz SE

- John Deere (Precision Agri-Insurance)

- Taranis

- Descartes Labs (Agri-Risk Al)

- Syngenta (Al Risk Modelling)

- Swiss Re’s Digital Ecosystem Partners

- Blue River Technology (Al for Agri-Risk)

- Munich Re’s Al Agri-Insurance Ventures

- Others

Recent Developments

- Partnerships between AI technology firms and agricultural insurers to enhance risk prediction models (January 2025).

- Launch of machine learning-powered platforms for more precise crop insurance risk assessments (February 2025).

- Adoption of IoT technologies in livestock insurance to track health and environmental conditions (March 2025).

- Integration of big data analytics for better risk management and real-time claims processing (April 2025).

- Government collaborations to support the adoption of AI in agricultural insurance in emerging markets (May 2025).

Conclusion

The AI-powered agri-insurance risk modelling market is poised for rapid growth. Driven by increasing demand for data-driven, AI-enhanced risk management solutions. As North America continues to lead the market, other regions, particularly APAC, will experience significant growth due to the rising need for precision in agricultural risk assessment. The future of this market looks bright, with AI offering significant improvements in efficiency, accuracy, and customer satisfaction across the agriculture and insurance sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)