Table of Contents

Introduction

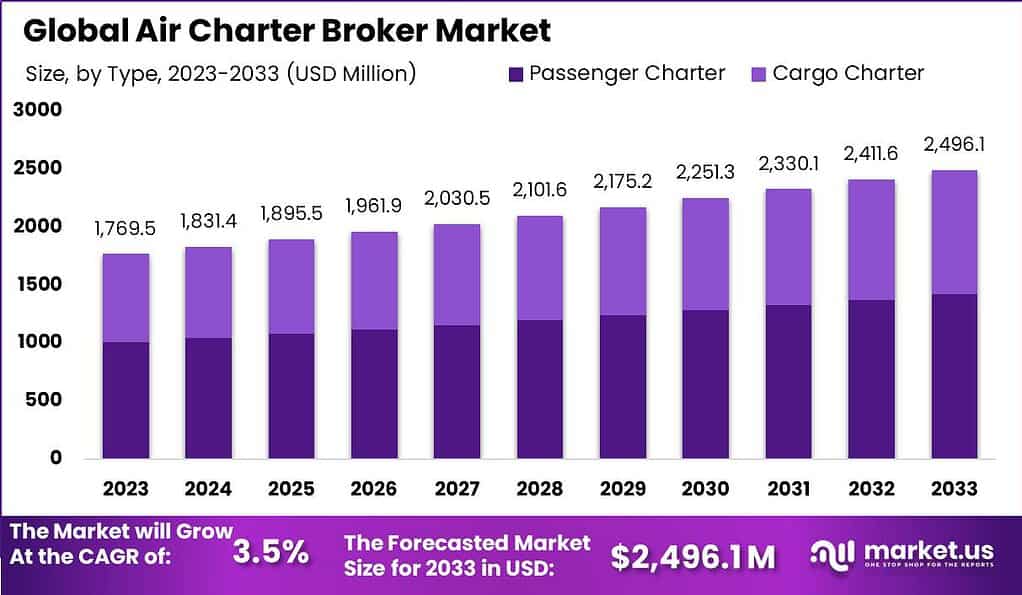

The Air Charter Broker Market is projected to grow steadily, reaching an estimated value of USD 2,496.1 Million by 2033, with a compound annual growth rate (CAGR) of 3.5% throughout the forecast period. Air charter brokers play a crucial role as intermediaries between individuals or organizations seeking private air transportation and aircraft operators. They facilitate the booking and arrangement of charter flights, offering clients various options tailored to their specific requirements, such as aircraft type, itinerary, and passenger capacity.

The market’s growth is fueled by the increasing demand for private air travel and the convenience it offers. Air charter brokers provide valuable expertise and assistance in navigating the complexities of chartering an aircraft, including flight planning, aircraft selection, negotiation of terms, and ensuring compliance with safety regulations. They simplify the process for clients, offering access to a wide network of aircraft operators.

Luxury travel, business aviation needs, and the desire for personalized travel experiences are driving the demand for private air charter services. Air charter brokers leverage their industry knowledge, relationships with aircraft operators, and real-time availability to offer clients tailored solutions. However, the industry faces challenges, such as intense competition, necessitating differentiation through exceptional customer service and reliability.

To learn more about this report – request a sample report PDF

Opportunities for growth and innovation abound in the air charter broker market. Brokers can cater to niche markets like sports teams, celebrities, and government officials, and leverage technology to enhance the booking process and customer experiences. The adoption of online booking platforms, mobile apps, blockchain technology, and AI/ML solutions is expected to streamline operations and improve efficiency.

Air Charter Broker Market Analysis

- Market Growth Projection: The air charter broker market is anticipated to reach an approximate value of USD 2,496.1 Million by 2033. This growth trajectory underscores a significant expansion from earlier figures.

- Market Share by Region (2023): North America continues to lead in the air charter broker industry, holding a dominant share of over 31%. This indicates strong market presence and operational efficacy within this geographical segment.

- Technology Integration (2024): The integration of Virtual Reality (VR) and Augmented Reality (AR) technologies is poised for a significant uptake, expected to increase by 30% year-over-year. These technologies are being employed to enhance the visualization of aircraft interiors and amenities, providing a more immersive customer experience.

- Sustainable Travel Options (2023): A robust 70% of air charter brokers are projected to offer carbon offsetting options by 2023. This initiative reflects the growing industry commitment to sustainable air travel practices.

- Data Analytics Utilization (2024): The employment of predictive analytics and data mining to optimize charter flight routes and pricing strategies is anticipated to grow by 25%. This trend highlights the increasing reliance on sophisticated data tools to enhance operational efficiency and customer satisfaction.

- Real-time Flight Monitoring (2023): The integration of real-time flight tracking and monitoring systems is expected to be adopted by over 80% of air charter brokers. This technology is critical for improving operational reliability and enhancing passenger safety.

- Voice-Enabled Virtual Assistants (2024): The adoption of voice-enabled virtual assistants for managing air charter bookings is forecasted to increase by 35%. This technology simplifies the booking and management processes, offering a more streamlined user experience.

- Integrated Trip Planning Services (2023): Over 65% of air charter brokers will provide comprehensive trip planning services, including arrangements for ground transportation and accommodations, reflecting a move towards full-service offerings.

- Drone Technology for Maintenance (2024): The use of drones for conducting aircraft inspections and maintenance is expected to rise by 20%. Drones offer a cost-effective and efficient solution for routine safety checks and maintenance operations.

Plan your Next Best Move. Purchase the Report for Data-driven Insights @ https://market.us/purchase-report/?report_id=105823

Air Charter Broker Statistics

- ACS achieved sales amounting to ~$770 million in the first half of the current financial year (February 1 – July 31), marking a significant 49% increase compared to the same period in the previous year. This growth was observed across all three major divisions of the company.

- According to a 2023 report by Deloitte, there was a noticeable rise in the preference for air charter broker services among private jet owners and high-net-worth individuals. Approximately 82% of this demographic utilized these services for arranging their private flights, an increase from 72% in 2022.

- A substantial investment of ~$480 million was directed towards the development of AI-powered booking and optimization algorithms for air charter brokers in 2023. These innovations aim to improve the efficiency of flight scheduling and matching processes within the private aviation sector.

- Approximately $380 million was invested in integrating air charter broker platforms with corporate travel management systems. This strategic enhancement seeks to streamline booking procedures and facilitate better expense reporting for businesses.

- An investment of ~$240 million focused on developing air charter broker solutions with advanced security features. The objective of these enhancements is to elevate the safety, convenience, and efficiency of air travel.

Emerging Trends

- Personalization of Services: The air charter broker market is increasingly focusing on personalizing private air travel experiences to meet the unique preferences and needs of individual customers. This includes tailoring itineraries, providing a selection of aircraft, and customizing onboard amenities.

- Technological Advancements: The integration of advanced technologies such as artificial intelligence, blockchain, and Internet of Things (IoT) devices is enhancing customer service, security, and operational efficiency in the air charter broker market.

- Sustainability Initiatives: There is a growing trend towards sustainability within the industry, with an emphasis on reducing the carbon footprint of flights and promoting eco-friendly travel options.

- Expansion of Cargo Charter Services: The demand for cargo charter services is increasing, driven by the surge in global e-commerce and the need for timely delivery of goods. This trend is notably pushing the growth of the cargo charter segment within the market.

- Strategic Partnerships and Collaborations: Air charter brokers are forming strategic alliances with airlines, private jet operators, and technology providers to expand their service offerings and geographic reach. Such partnerships are aimed at enhancing service quality and market penetration.

Top Use Cases

- Business Travel: Facilitating travel for business purposes, especially for top executives who require flexible scheduling and privacy, is a primary use case. This includes quick, efficient, and secure transport to multiple locations.

- Private Leisure Travel: Catering to high-net-worth individuals and families seeking personalized and exclusive travel experiences, often to remote or multiple destinations without the hassle of commercial flight schedules.

- Sports and Entertainment Logistics: Providing logistical support for sports teams and entertainment crews, enabling them to meet tight schedules across various locations, often with specific equipment and space requirements.

- Emergency and Medical Transport: Offering rapid response transport for medical emergencies, including transporting patients or medical supplies across regions where time-sensitive interventions are critical.

- Government and Diplomatic Missions: Assisting in the transportation of government officials and diplomats, especially for sensitive or urgent international engagements where security and timeliness are paramount.

Major Challenges

- Overcapacity and Pricing Pressure: The air charter broker market has experienced significant overcapacity, leading to downward pressure on charter rates. This situation stems from the expansion of cargo capacity during the pandemic, which has persisted, affecting pricing even as passenger services resume.

- Market Fragmentation: The air charter broker market is fairly disjointed, with varying priorities among businesses. Some focus on technological advancements to boost efficiency, while others emphasize traditional personalized services.

- Economic Uncertainties: Broader economic factors, including global financial slowdowns and geopolitical conflicts, influence market stability and impact consumer confidence, which in turn affects demand for air cargo services.

- Fuel Costs: Rising fuel prices pose a significant challenge by increasing operational costs for air charter services. Higher fuel expenses can lead to increased charter rates, potentially driving away cost-sensitive customers.

- Regulatory Changes: The air charter market also faces challenges from evolving regulations, which can impact operational flexibility and increase compliance costs.

Market Opportunities

- Personalization of Services: There is growing demand for customized air travel solutions that cater to the specific needs and preferences of individual clients. This includes offering a variety of aircraft and personalized amenities, which can significantly enhance customer satisfaction and loyalty.

- Technological Advancements: The integration of advanced technologies such as AI, blockchain, and IoT in operations can improve efficiency, safety, and customer service, opening up new avenues for growth.

- Expansion in Private Air Travel: Increasing demand for private air travel, driven by its convenience and the ability to avoid crowded commercial flights, especially during health crises, presents significant opportunities for market growth.

- Sustainable Practices: There is a notable shift towards sustainability in the aviation sector, with more operators updating fleets with fuel-efficient or zero-emission aircraft and exploring alternative fuels, which can attract environmentally conscious consumers.

- Diversification into New Markets: As the global economy recovers and new markets emerge, there are opportunities for air charter brokers to expand their services into new regions and sectors, potentially increasing their market share.

Recent Developments

- Air Charter Service (ACS): In October 2022, ACS launched a dedicated time-critical division called ACS Critical Time. This division streamlines various services for urgent shipment requests, combining integrated trucking solutions, on-demand cargo airplane charters with onboard couriers, and next-flight-out alternatives.

- Air Partner: In January 2022, Wheels Up, a US-based private aviation company, acquired Air Partner, a UK-based aircraft charter service provider. The acquisition strengthened Wheels Up’s international presence and expanded its offerings in personal aviation services.

Conclusion

In conclusion, the Air Charter Broker Market has witnessed significant growth and transformation in recent years. The increasing demand for private air travel, coupled with the convenience and flexibility offered by air charter services, has fueled the expansion of this market. Air charter brokers play a crucial role in connecting customers with suitable aircraft and facilitating seamless travel experiences.

One of the key drivers of the Air Charter Broker Market is the growing preference for personalized and exclusive travel. High-net-worth individuals, corporate executives, and celebrities often require private air travel for various reasons, including privacy, time efficiency, and access to remote locations. Air charter brokers act as intermediaries, leveraging their extensive networks and industry expertise to match clients with the most suitable aircraft and operators.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)