Table of Contents

- Introduction

- Editor’s Choice

- Anti-Money Laundering Market Overview

- Anti-Money Laundering Software Market Statistics

- Amount of Money Laundered Per Year

- Top Origins of Laundered Money

- Money Laundering Events Across the Globe

- Judicial Convictions for Money Laundering Crimes

- Top AML Software Solutions

- AML Software Investment Statistics

- Regulations for Anti-Money Laundering Software Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Anti-money Laundering Software Statistics: Anti-money laundering (AML) software is crucial for financial institutions to detect and prevent illegal activities like money laundering and terrorism financing.

It monitors transactions in real-time, using advanced technologies like AI and machine learning to identify suspicious patterns.

Key features include transaction monitoring, customer due diligence (CDD), watchlist filtering, and regulatory reporting for compliance with laws like the USA PATRIOT Act and EU directives.

AML software integrates seamlessly with banking systems, ensuring comprehensive monitoring and reducing the risk of legal penalties and reputational damage.

The market for AML software continues to grow due to increasing regulatory demands and the complexity of global financial transactions.

Editor’s Choice

- In 2023, the global Anti-Money Laundering (AML) software market revenue was recorded at USD 2.6 billion.

- By 2033, the market is anticipated to achieve a total revenue of USD 10.3 billion. With software revenue at USD 6.85 billion and services revenue at USD 3.45 billion.

- On-premise deployments account for 68% of the market share. Reflecting the continued reliance on traditional, internally managed systems that offer robust security and control.

- The regional analysis of the global Anti-Money Laundering (AML) market reveals a predominant share held by North America, accounting for 46.0% of the market.

- In 2024, the top 20 origins of laundered money are dominated by the United States. Which accounts for $13,20,228 million annually, representing 46.3% of the total.

- Investment in anti-money laundering (AML) and financial crime (FinCrime) technology companies showed significant fluctuations from 2018 to 2022.

- In the United States, the Bank Secrecy Act (BSA) mandates that financial institutions implement AML programs, conduct customer due diligence, and file suspicious activity reports (SARs) to detect and prevent money laundering.

Anti-Money Laundering Market Overview

Global Anti-Money Laundering Market Size Statistics

- The global Anti-Money Laundering (AML) market has exhibited significant growth over the past decade at a CAGR of 15.25%.

- In 2021, the market revenue was valued at USD 1.18 billion.

- This figure increased to USD 1.36 billion in 2022 and further to USD 1.57 billion in 2023.

- The upward trajectory continued, with the market reaching USD 1.81 billion in 2024 and USD 2.08 billion in 2025.

- By 2026, the revenue surged to USD 2.40 billion, followed by USD 2.77 billion in 2027.

- The market maintained its robust growth, hitting USD 3.19 billion in 2028 and USD 3.67 billion in 2029.

- Entering the next decade, the market revenue climbed to USD 4.23 billion in 2030 and USD 4.88 billion in 2031.

- The trend persisted, with the market reaching USD 5.62 billion in 2032 and an impressive USD 6.48 billion in 2033.

- This consistent growth underscores the increasing importance and investment in AML solutions globally.

(Source: market.us)

Competitive Landscape of Global Anti-Money Laundering Market Statistics

- The presence of several key players marks the competitive landscape of the global Anti-Money Laundering (AML) market.

- Tata Consultancy Services Limited holds the largest market share at 18%, followed closely by NICE Actimize with 17%.

- Oracle Corporation commands a significant portion of the market, with 12%. While Cognizant Technology Solutions Corporation accounts for 10% of the market.

- BAE Systems and SAS Institute Inc. each hold a 9% share.

- ACI Worldwide Inc. and Fiserv Inc. each control 8% of the market.

- The remaining 10% is distributed among various other key players. Indicating a moderately fragmented market with significant contributions from both large and niche entities.

(Source: market.us)

Regional Analysis of Global Anti-Money Laundering Market Statistics

- The regional analysis of the global Anti-Money Laundering (AML) market reveals a predominant share held by North America, accounting for 46.0% of the market.

- Europe follows with a 22.0% share, indicating strong adoption and regulatory frameworks in these regions.

- The Asia-Pacific (APAC) region contributes 18.0% to the market, reflecting growing awareness and implementation of AML solutions.

- South America and the Middle East & Africa (MEA) hold smaller shares, with 8.0% and 6.0%, respectively. Indicating emerging opportunities and potential for growth in these regions.

(Source: market.us)

Anti-Money Laundering Software Market Statistics

Global Anti-Money Laundering Software Market Size Statistics

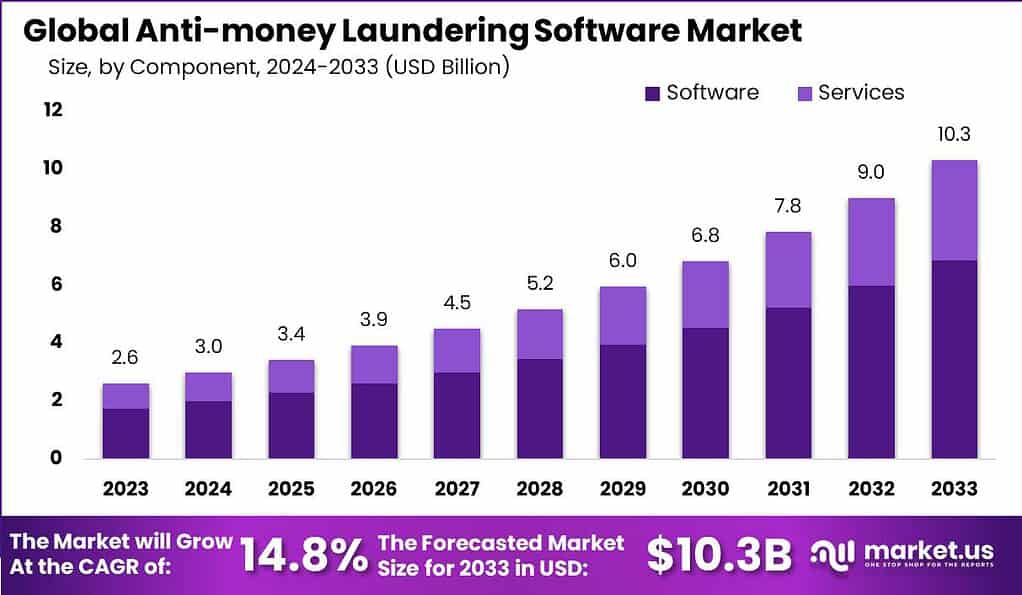

- The global Anti-Money Laundering (AML) software market has demonstrated robust growth at a CAGR of 14.8%, with revenues increasing significantly over the years.

- In 2023, the market revenue was recorded at USD 2.6 billion.

- This figure is projected to rise to USD 3.0 billion in 2024 and further to USD 3.4 billion in 2025.

- The upward trend continues, with revenues expected to reach USD 3.9 billion in 2026 and USD 4.5 billion in 2027.

- By 2028, the market is anticipated to generate USD 5.2 billion, and by 2029, it is projected to reach USD 6.0 billion.

- Entering the next decade, the market revenue is forecasted to climb to USD 6.8 billion in 2030 and USD 7.8 billion in 2031.

- The growth trajectory is expected to persist. With revenues reaching USD 9.0 billion in 2032 and an impressive USD 10.3 billion in 2033.

- This consistent increase highlights the escalating demand for AML software solutions worldwide.

(Source: market.us)

Global Anti-Money Laundering Software Market Size – By Component Statistics

- The global Anti-Money Laundering (AML) software market is segmented by component, encompassing both software and services revenue.

- In 2023, the total market revenue was USD 2.6 billion. With software contributing USD 1.73 billion and services adding USD 0.87 billion.

- By 2024, the market is projected to reach USD 3.0 billion. With software revenue at USD 2.00 billion and services at USD 1.01 billion.

- The growth trend continues in 2025, with total revenue anticipated at USD 3.4 billion. Comprising USD 2.26 billion from software and USD 1.14 billion from services.

- By 2026, the market is expected to generate USD 3.9 billion. With software at USD 2.59 billion and services at USD 1.31 billion.

- The upward trajectory persists in 2027, with a total revenue of USD 4.5 billion. Including USD 2.99 billion from software and USD 1.51 billion from services.

- In 2028, the market is forecasted to reach USD 5.2 billion. With software revenue of USD 3.46 billion and services revenue of USD 1.74 billion.

More Insights

- By 2029, the total market is projected to be USD 6.0 billion. With software and services contributing USD 3.99 billion and USD 2.01 billion, respectively.

- In 2030, the market is expected to achieve USD 6.8 billion. With software at USD 4.52 billion and services at USD 2.28 billion.

- By 2031, the total market revenue is forecasted at USD 7.8 billion. With software revenue of USD 5.19 billion and services revenue of USD 2.61 billion.

- In 2032, the market is projected to reach USD 9.0 billion. With software contributing USD 5.99 billion and services USD 3.02 billion.

- Finally, by 2033, the market is anticipated to achieve a total revenue of USD 10.3 billion. With software revenue at USD 6.85 billion and services revenue at USD 3.45 billion.

- This consistent growth highlights the expanding demand for both AML software and related services.

(Source: market.us)

Global Anti-Money Laundering Software Market Share – By Deployment Mode Statistics

- The global Anti-Money Laundering (AML) software market is segmented by deployment mode, with a significant preference for on-premise solutions.

- On-premise deployments account for 68% of the market share. Reflecting the continued reliance on traditional. Internally managed systems that offer robust security and control.

- In contrast, cloud-based deployments hold a 32% market share, indicating a growing trend toward flexible, scalable, and cost-effective solutions.

- This distribution highlights the ongoing transition within the industry as organizations increasingly explore cloud options while maintaining substantial investments in on-premise infrastructures.

(Source: market.us)

Amount of Money Laundered Per Year

- In a 2009 report from the United Nations Office on Drugs and Crime (UNODC). it was found that criminal proceeds from drug trafficking and organized crime constituted 3.6% of global GDP. With approximately 2.7% (USD 1.6 trillion) of these funds being laundered.

- These findings are consistent with earlier estimates by the International Monetary Fund in 1998. Which indicated that global money laundering could range from two to five percent of the world’s GDP.

- Using 1998 data, this translates to money laundering estimates ranging from USD 590 billion to USD 1.5 trillion.

- At that time, the lower estimate was equivalent to the entire economic output of a nation similar in size to Spain.

(Source: United Nations Office on Drugs and Crime (UNODC))

Top Origins of Laundered Money

- In 2024, the top 20 origins of laundered money are dominated by the United States. Which accounts for $13,20,228 million annually, representing 46.3% of the total.

- Italy follows with $1,50,054 million (5.3%), and Russia contributes $1,47,187 million (5.2%).

- China and Germany are also significant sources, with $1,31,360 million (4.6%) and $1,28,266 million (4.5%) respectively.

- France adds $1,24,748 million (4.4%), and Romania $1,15,585 million (4.1%).

- Other notable origins include Canada with $82,374 million (2.9%). The UK with $68,740 million (2.4%), and Hong Kong with $62,856 million (2.2%).

- Spain contributes $56,287 million (2%), while Thailand accounts for $32,834 million (1.2%).

- South Korea and Mexico each provide approximately $21,240 million and $21,119 million, respectively (0.7% each).

- Austria, Poland, and the Philippines follow closely. Each with figures around $20,231 million, $19,714 million, and $18,867 million (0.7% each).

- The Netherlands and Japan contribute $18,362 million and $16,975 million (0.6% each). While Brazil rounds out the list with $16,786 million (0.6%).

- This data highlights the varied geographical sources of laundered money. Emphasizing the global nature of this illicit activity.

(Source: Journal of Money Laundering Control)

Money Laundering Events Across the Globe

- Globally, money laundering events are predominantly linked to drug trafficking, which accounts for 29.30% of cases.

- Financial fraud follows closely, constituting 22.20% of money laundering incidents.

- Direct money laundering activities represent 17.60% of the total events.

- Other miscellaneous activities contribute 14.30% to the overall statistics.

- Anti-Money Laundering (AML) compliance failures account for 9.50%, highlighting significant gaps in adherence to regulatory standards.

- Violations of AML policies are responsible for 3% of the events.

- International sanctions breaches constitute 1.80%, while regulatory breaches and reporting failures each account for 1.20% of money laundering events.

- This distribution underscores the diverse nature of activities contributing to global money laundering. Emphasizing the need for comprehensive measures across various sectors.

(Source: Smart Search)

Judicial Convictions for Money Laundering Crimes

- From 2013 to 2017, the sentencing for money laundering convictions by the courts in Hong Kong varied significantly by term of imprisonment.

- In 2013, there were 68 convictions resulting in sentences under two years, and 36 convictions with sentences between 2 to 4 years. 15 convictions leading to 4 to 6 years of imprisonment, and 5 cases resulting in sentences over six years.

- The following year, 2014, saw a decrease in shorter sentences, with 56 under two years. While the number of convictions resulting in 2 to 4 years increased to 61. Sentences of 4 to 6 years were relatively stable at 16, and those over six years dropped to 2.

- In 2015, the number of sentences under two years remained steady at 57, while those for 2 to 4 years rose to 68.

- However, there was a significant decline in 4 to 6 years sentences to just 3, and only 1 case resulted in over six years of imprisonment.

- In 2016, the number of sentences under two years increased to 62, but there was a decline in sentences of 2 to 4 years to 34. Only 2 cases resulted in 4 to 6 years imprisonment, with no sentences over six years.

- By 2017, the trend of shorter sentences continued, with 50 under two years, 31 between 2 to 4 years. 4 cases resulting in 4 to 6 years, and just 1 case resulting in a sentence over six years.

- This data reflects a trend towards shorter prison terms for money laundering convictions in Hong Kong during this period.

(Source: Statista)

Top AML Software Solutions

- The AML software market is rapidly expanding. Offering a range of solutions tailored to meet compliance needs for businesses of all sizes.

- Refinitiv World-Check Risk Intelligence offers reliable data to prevent illegal activities.

- Trulioo automates KYC and KYB compliance to meet AML and CDD requirements.

- Lightico simplifies KYC processes through digital identification.

- Sanction Scanner provides cost-effective AML solutions.

- DueDil aids businesses in KYB compliance and customer onboarding through its API.

- PassFort assists in risk management and compliance.

- Encompass offers KYC automation for financial and professional services.

- Dow Jones Risk & Compliance provides global third-party risk solutions.

- Oracle Financial Crime and Compliance Management protects financial integrity with AML solutions.

- Unit21 offers comprehensive risk and compliance management applications.

(Source: Lightico)

AML Software Investment Statistics

Global Investment in AML and FinCrime Tech Companies

- Investment in anti-money laundering (AML) and financial crime (FinCrime) technology companies showed significant fluctuations from 2018 to 2022.

- In 2018, the total investment was USD 0.8 billion across 166 deals.

- This increased slightly to USD 0.9 billion in 2019, although the number of deals decreased to 142.

- The year 2020 saw a substantial jump in investment to USD 2.2 billion despite a slight decline in deals to 141.

- The upward trend continued in 2021, with investments peaking at USD 3.7 billion across 181 deals, indicating heightened interest and confidence in the sector.

- However, in 2022, investment levels dropped to USD 2.1 billion with 170 deals. Reflecting a more cautious approach in the market.

- This data highlights the dynamic nature of investment in AML and FinCrime technology. Driven by evolving regulatory requirements and the increasing complexity of financial crimes.

(Source: fintech.global)

Regulations for Anti-Money Laundering Software Statistics

- Regulations for anti-money laundering (AML) software vary significantly across different countries, reflecting diverse legal frameworks and enforcement practices.

- In the United States, the Bank Secrecy Act (BSA) mandates that financial institutions implement AML programs, conduct customer due diligence, and file suspicious activity reports (SARs) to detect and prevent money laundering.

- Germany‘s AML efforts are governed by the Money Laundering Act (GwG), which sets out requirements for customer due diligence, record-keeping, and reporting of suspicious transactions.

- In Hong Kong, the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) requires financial institutions to establish AML programs. Conduct thorough customer due diligence, and report suspicious transactions.

- India‘s Prevention of Money Laundering Act (PMLA) mandates similar measures, with stringent penalties for non-compliance and a robust framework for reporting and analyzing suspicious transactions.

- Globally, the Financial Action Task Force (FATF) provides a comprehensive framework of recommendations to help countries implement effective AML measures.

- These regulations ensure that AML software can effectively support financial institutions in complying with local and international standards. Thereby enhancing the global fight against financial crimes.

(Source: Federal Deposit Insurance Corporation (FDIC), Sanction Scanner, Financial Action Task Force (FATF), Financial Crime Academy)

Recent Developments

Acquisitions:

- IBM’s Acquisition of MyInvenio: In April 2021, IBM acquired MyInvenio, a company specializing in process mining software. This acquisition enhances IBM’s AI-powered automation capabilities and strengthens its AML offerings by integrating process mining technology to help organizations streamline business processes and improve compliance efforts.

New Product Launches:

- Google Cloud’s AML AI Tool: In June 2023, Google Cloud launched a new AI-powered Anti-Money Laundering tool, designed to help financial institutions detect money laundering more efficiently. The tool uses AI to analyze bank information, including network patterns and KYC data, to create risk scores and monitor for suspicious activity. HSBC, a test customer, reported a significant increase in true positive risk detection and a reduction in alert volumes by 60%.

- Hummingbird’s Design-Centric AML Platform: In 2023, Hummingbird, a provider of AML software, introduced a new platform that leverages design thinking to improve the user experience for compliance professionals. This platform aims to simplify AML processes and enhance the efficiency of financial crime investigations.

Funding:

- Hummingbird’s Series B Funding: Hummingbird raised $30 million in Series B funding led by Battery Ventures in 2023. The funds will be used to expand their AML software solutions and enhance their design-focused approach to compliance.

- Investments in AI and Cloud-based Solutions: The AML software market continues to see significant investments in AI and cloud-based technologies to improve detection and compliance. These investments aim to reduce operational costs and improve the scalability and efficiency of AML solutions.

Market Growth:

- Global Market Expansion: The growth is driven by the increasing adoption of digital banking services, the need for regulatory compliance, and the expansion of cloud-based AML solutions.

- Regional Insights: North America dominated the AML market in 2022. Holding a revenue share of more than 29.0%. The growth in this region is fueled by stringent regulations and high spending on AML solutions by financial institutions. The Asia-Pacific region is anticipated to witness significant growth due to rising digitalization and regulatory pressures.

Innovation and Trends:

- AI and Machine Learning Integration: The integration of AI and machine learning into AML solutions is enhancing the ability to detect and prevent financial crimes. These technologies enable more accurate risk scoring, reduced false positives, and improved efficiency in monitoring and reporting suspicious activities.

- Cloud-based Solutions: The shift towards cloud-based AML solutions is accelerating due to their cost-effectiveness, scalability, and flexibility. These solutions are particularly attractive to small and medium enterprises that require robust AML capabilities without the need for extensive IT infrastructure.

Conclusion

Anti-money Laundering Software Statistics – Anti-money laundering (AML) software is crucial for financial institutions to comply with regulations and combat financial crimes.

It automates processes like customer due diligence, transaction monitoring, and suspicious activity reporting, enhancing the Fraud Detection and Prevention of illicit activities.

AML software helps institutions adhere to stringent regulations such as the Bank Secrecy Act in the US. Germany’s Money Laundering Act, Hong Kong’s AMLO, and India’s PMLA.

As financial crimes evolve, AML software remains vital in safeguarding the financial system and ensuring regulatory compliance.

FAQs

Anti-Money Laundering (AML) software is a specialized tool designed to help financial institutions and other regulated entities comply with AML regulations. It automates the process of detecting, investigating, and reporting suspicious financial activities that may indicate money laundering, terrorist financing, or other financial crimes.

AML software typically includes features such as customer due diligence (CDD), transaction monitoring, sanctions screening, suspicious activity reporting (SAR), and risk assessment. These tools help institutions verify customer identities, monitor transactions for unusual patterns, screen against sanctions lists, report suspicious activities to regulatory authorities, and assess the risk levels of customers and transactions.

AML software is crucial for financial institutions as it helps ensure compliance with national and international AML regulations, thereby avoiding legal penalties, fines, and reputational damage. It also helps in protecting the financial system from being exploited for money laundering and other illicit activities.

AML software supports regulatory compliance by automating the processes required to meet AML regulatory requirements. This includes maintaining detailed records of customer information, monitoring transactions for suspicious activity, generating reports for regulatory bodies, and ensuring that all activities are in line with the latest AML laws and guidelines.

AML software must comply with various national and international regulations such as the Bank Secrecy Act (BSA) in the United States. The Money Laundering Act (GwG) in Germany, the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) in Hong Kong, and the Prevention of Money Laundering Act (PMLA) in India. Additionally, it must align with global standards set by the Financial Action Task Force (FATF).