Table of Contents

Introduction

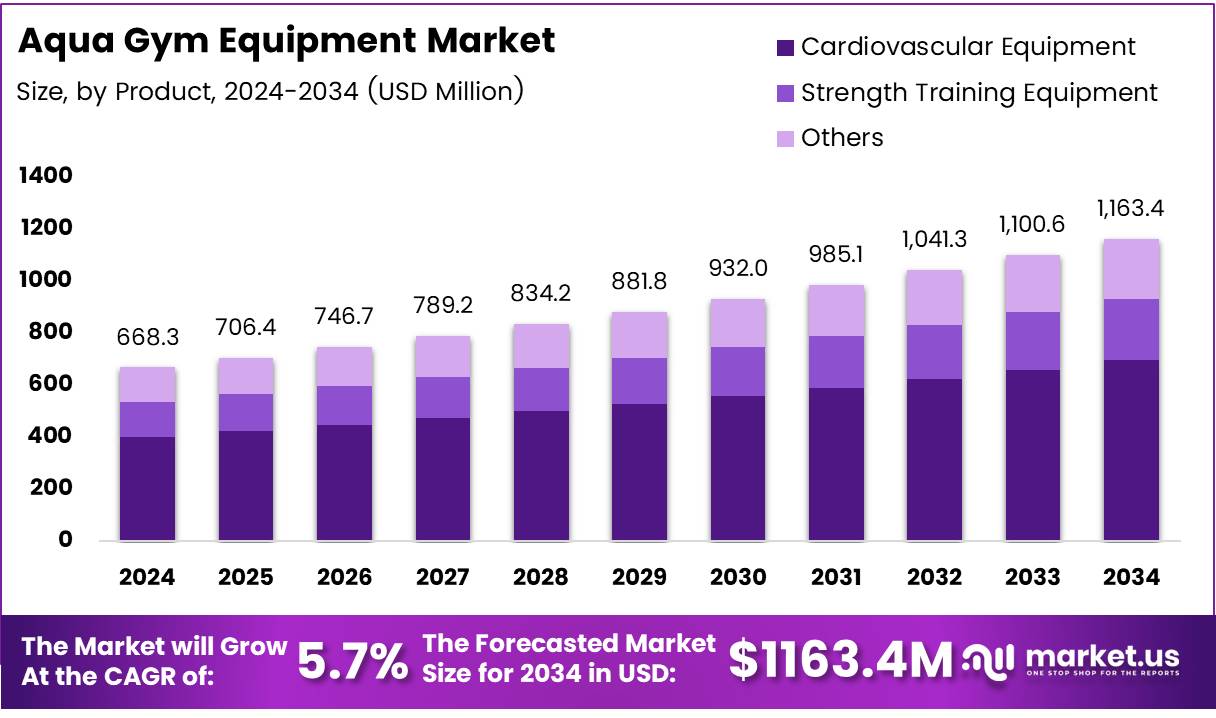

The global Aqua Gym Equipment Market is witnessing strong growth, driven by a growing emphasis on low-impact fitness solutions and rehabilitation therapies. Projected to reach USD 1,163.4 Million by 2034, the market is set to grow from USD 668.3 Million in 2024, at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period from 2025 to 2034.

Aqua gym equipment plays a crucial role in accessible and joint-friendly workouts, particularly for seniors, rehabilitation patients, and fitness enthusiasts seeking effective yet low-impact workout solutions. The increasing popularity of water-based fitness programs and the demand for safer exercise methods are key factors fueling the market’s expansion.

Key Takeaways

- The Aqua Gym Equipment Market is expected to grow from USD 668.3 Million in 2024 to USD 1,163.4 Million by 2034, with a CAGR of 5.7%.

- Cardiovascular Equipment led the product segment in 2024, with a 60.1% market share, driven by demand for low-impact aquatic workouts.

- Specialty Stores dominated the distribution channels in 2024, holding 48.6% of the market share.

- North America held the largest regional share in 2024, valued at USD 267.3 Million, representing 40.5% of the global market.

Key Market Segments

By Product

- Cardiovascular Equipment: Dominated the market in 2024, accounting for 60.1% of the market share. This category is driven by the rising preference for low-impact workouts, which offer heart-healthy benefits.

- Strength Training Equipment: Following cardiovascular products, strength training equipment offers resistance-based exercises in water, gaining traction in rehabilitation centers and specialized fitness studios.

- Others: This category includes balance trainers and flexibility-enhancing tools, which are growing in popularity, especially among athletes and seniors.

By Distribution Channel

- Specialty Stores: In 2024, specialty stores captured 48.6% of the market share, offering expert guidance and personalized services to consumers.

- Department Stores and Supermarkets: These retail formats cater primarily to casual buyers, providing convenience and wider accessibility.

- Online: The online sales channel is witnessing rapid growth, thanks to its vast product selection and competitive pricing.

- Others: Fitness clubs and water parks also contribute to the promotion and usage of aqua gym equipment.

Drivers

- Increasing Health Consciousness: Post-pandemic, people are more focused on their health and wellness. The demand for low-impact fitness solutions that promote overall health while reducing the risk of injury is driving the adoption of aqua gym equipment.

- Rising Popularity of Water-Based Workouts: Water offers natural resistance, which makes it easier on joints, making aquatic exercises particularly appealing for the elderly, people recovering from injuries, and those looking for joint-friendly workout options.

- Technological Advancements: New developments in aqua gym equipment, such as ergonomic designs and durable materials, are enhancing the overall appeal of these products and encouraging wider adoption.

- Government Support: Several governments are promoting aquatic therapy as part of public health initiatives, helping to further integrate aqua gym equipment into rehabilitation centers and fitness facilities.

Use Cases

- Seniors and Rehabilitation Patients: Water-based exercises offer a safe and effective way for seniors to maintain fitness and mobility, while rehabilitation patients can use aqua gym equipment to recover post-surgery or injury.

- Fitness Enthusiasts: Low-impact, full-body workouts offered by aqua gym equipment appeal to fitness enthusiasts who are looking for effective alternatives to traditional gym exercises.

- Sports Recovery: Athletes, particularly those in high-impact sports, use aquatic workouts to accelerate recovery, prevent injuries, and build strength without over-stressing their joints.

Major Challenges

- High Initial Investment: The cost of specialized equipment for water-based workouts is one of the major barriers to adoption. Small gyms, wellness studios, and individuals may struggle with the upfront costs of setting up such facilities.

- Maintenance Costs: Aqua gym equipment is exposed to water and chlorine, which can cause wear and tear over time. Regular maintenance and part replacements add to the long-term operational costs, potentially deterring some consumers.

- Market Penetration in Emerging Regions: In some emerging markets, the high costs of both the equipment and the necessary infrastructure are limiting market growth.

Business Opportunities

- Expansion into Home Fitness: The growing trend of home fitness, especially post-pandemic, is creating demand for compact, affordable aqua gym solutions that can be used in home pools.

- Smart Equipment: The integration of wearable technology with aqua gym equipment, such as fitness trackers and smartwatches, offers a potential area for growth. These devices can track performance metrics like heart rate and calories burned, making the workouts more engaging and personalized.

- Eco-friendly Products: The increasing focus on sustainability presents an opportunity for manufacturers to innovate with eco-friendly materials and energy-efficient designs, appealing to environmentally-conscious consumers.

Regional Analysis

North America

In 2024, North America led the global market with a share of 40.5%, valued at USD 267.3 Million. The region’s dominance is driven by high health awareness, the rising adoption of water-based fitness programs, and a well-established fitness infrastructure.

Europe

Europe shows significant growth potential, supported by an aging population and a widespread adoption of water-based rehabilitation programs. Public health initiatives promoting physical well-being have also boosted demand for aqua gym equipment in the region.

Asia Pacific

The Asia Pacific region is rapidly growing due to increasing urbanization, a burgeoning middle class, and rising health consciousness. Countries like China, Japan, and Australia are witnessing a surge in fitness club memberships, driving demand for aqua gym equipment.

Latin America

The market in Latin America is progressing steadily, with Brazil and Mexico leading the way in fitness adoption. Growing awareness about health and wellness is fostering interest in alternative fitness solutions like aqua workouts.

Recent Developments

- Startup Investment in Aqua Rehabilitation: In November 2024, a UK-based startup secured £500k to develop innovative aqua rehabilitation technology aimed at transforming recovery therapies.

- Acquisition in Fitness Sector: In January 2024, PROMOUNTINGS® acquired AQUA TRAINING BAG®, expanding its presence in the combat fitness and training equipment market.

- Partnership for Growth: In February 2025, Waterland Private Equity partnered with WellNess to expand a premium fitness club chain in France, focusing on innovation and international growth.

Conclusion

The Aqua Gym Equipment Market is poised for significant growth, fueled by rising health consciousness, technological advancements, and increasing demand for low-impact fitness solutions. With a strong focus on user-specific needs and environmental sustainability, the market presents numerous opportunities for businesses. The integration of wearable technology and the expansion of home-based fitness solutions offer further avenues for innovation and growth in the coming years. As the global market continues to expand, aqua gym equipment will play an essential role in promoting safer, more effective fitness routines across diverse demographics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)