Table of Contents

Introduction

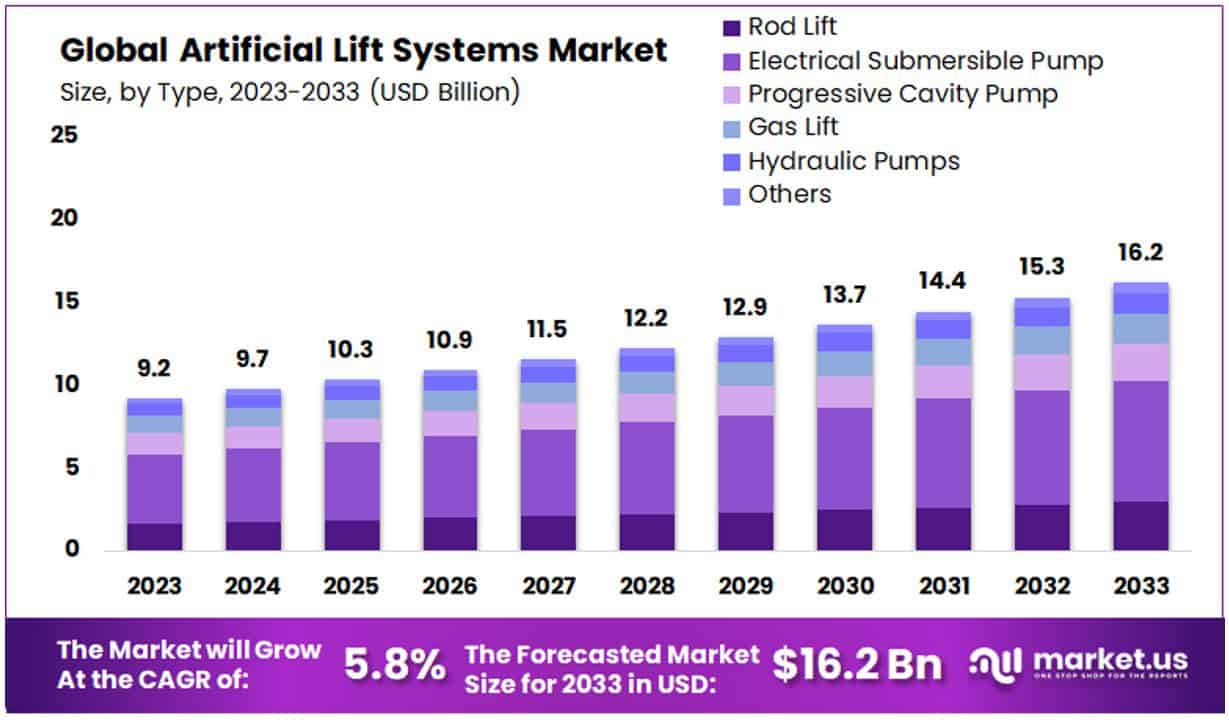

The Global Artificial Lift Systems market is projected to grow from USD 9.2 billion in 2023 to approximately USD 16.2 billion by 2033, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period from 2024 to 2033.

Artificial Lift Systems (ALS) are technologies and equipment used in the oil and gas industry to enhance the extraction of hydrocarbons from reservoirs when the natural pressure within the well is insufficient. These systems increase production rates by reducing the pressure in the wellbore, allowing oil or gas to flow more efficiently to the surface.

Common types of artificial lift systems include rod lifts, electric submersible pumps (ESPs), gas lifts, and progressive cavity pumps (PCPs), each tailored to different well conditions and requirements.

The Artificial Lift Systems Market refers to the global industry encompassing the production, distribution, and deployment of these advanced extraction technologies. It serves as a critical segment within the upstream oil and gas industry, addressing the need for efficient resource recovery, particularly in mature oil fields and unconventional reservoirs.

This market includes diverse stakeholders such as equipment manufacturers, service providers, oilfield operators, and technology developers. The scope of this market is shaped by ongoing developments in well completion techniques, innovations in lift technologies, and evolving energy demands.

The growth of the Artificial Lift Systems Market is driven by several key factors. Firstly, the increasing number of mature oil fields, coupled with declining well pressures, necessitates the adoption of artificial lift solutions to maintain production levels.

Secondly, the expansion of shale oil and gas exploration, particularly in North America, has accelerated the demand for effective lift systems, given the lower pressure and productivity of these wells. Thirdly, technological advancements, such as real-time monitoring and automation of lift systems, are enhancing operational efficiency and driving adoption. Additionally, rising global energy consumption and the push to maximize recovery rates from existing wells further contribute to the market’s growth.

The demand for artificial lift systems is expected to remain robust, driven by ongoing energy requirements, particularly from emerging economies. The oil and gas sector’s shift towards more efficient production methods is also fueling demand for advanced lift systems.

Enhanced oil recovery (EOR) projects and unconventional resource development, such as tight oil and shale gas, create a consistent need for artificial lift solutions. Furthermore, the adoption of digital oilfield technologies, which enable predictive maintenance and optimization of artificial lift systems, is becoming an essential aspect of demand dynamics.

Opportunities in the Artificial Lift Systems Market are significant, especially with the industry’s focus on reducing operational costs and improving recovery rates. Emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, offer vast potential due to their increasing energy needs and expanding oil and gas production activities.

Moreover, the transition towards more sustainable and energy-efficient systems, such as electric submersible pumps with enhanced energy optimization capabilities, presents a growth avenue for manufacturers. Integration of IoT and AI in artificial lift systems for predictive analytics and performance optimization is another promising area that can unlock new efficiencies and cost savings for operators.

Key Takeaways

- Artificial Lift Systems Market Projected to reach USD 16.2 Billion by 2033, growing from USD 9.2 Billion in 2023, with a CAGR of 5.8% from 2024 to 2033.

- Electrical Submersible Pumps (ESPs) lead the market with a 45.4% share, followed by Rod Lifts, Progressive Cavity Pumps, Gas Lifts, Hydraulic Pumps, and emerging technologies.

- Pump-assisted mechanisms hold the majority share at 68.2%, driven by ESPs and Progressive Cavity Pumps, while gas-assisted mechanisms remain crucial in certain conditions due to their lower costs and adaptability.

- Onshore operations dominate with 82.6% of the market share, primarily due to easier access, lower costs, and broader lift solutions. Offshore operations are smaller but growing rapidly due to exploration in deepwater reserves.

- North America leads the market with a 37.6% share, supported by extensive onshore fields, while Europe follows with a 20.8% share, reflecting its mature oilfield operations.

Artificial Lift Systems Statistics

- Global Use Of the 2 million oil wells globally, about 1 million rely on artificial lift systems.

- Sucker-Rod Pumps These are the most common, used in over 750,000 wells worldwide, particularly in low-production wells in the U.S.

- US Stripper Wells Around 80% of low-production wells in the U.S. utilize sucker-rod pumps.

- High-Rate Wells Electric Submersible Pumps (ESPs) and gas lift systems are preferred for offshore and high-output wells.

- ESPs Prevalence Electric Submersible Pumps represent around 40% of all artificial lift installations worldwide.

- Gas Lift Systems Comprise approximately 15% of artificial lift setups globally.

- Improved ESP Runtime Advanced ESP applications now achieve over 1,000 days of continuous operation.

- Modern Rod Pumps These systems achieve up to 99% uptime in ideal conditions.

- Digital Optimization Reduces failures in artificial lift systems by up to 45%.

- Artificial lift can prolong the life of a well by 5 to 15 years on average.

- Adoption in artificial lift systems increased by 35% in 2023.

- Reduces energy usage in artificial lift operations by up to 25%.

- New ESP models have a 40% longer mean time between failures compared to 2020 models.

- Next-generation ESPs offer up to 15% more energy efficiency.

- Artificial lift increases well production by 15-40% on average.

- The average cost to install an ESP system ranges from $150,000 to $300,000.

- Middle East Market Growth The region’s artificial lift market expanded by 12% in 2023.

- In corrosive environments, advanced materials extend pump life by 40%.

- Machine Learning Enhances production optimization by 35%.

Emerging Trends

- Adoption of Advanced Technologies: The integration of artificial intelligence (AI), machine learning, and Internet of Things (IoT) technologies is optimizing artificial lift operations. These advancements enable real-time monitoring, predictive maintenance, and improved decision-making, leading to increased efficiency and reduced operational costs.

- Focus on Unconventional Resources: There’s a growing emphasis on extracting oil and gas from unconventional sources like shale formations. Artificial lift systems are being tailored to address the unique challenges of these reservoirs, which often require specialized equipment to manage issues like high viscosity and low permeability.

- Emphasis on Environmental Sustainability: The industry is prioritizing the development of eco-friendly artificial lift solutions. This includes designing systems that reduce energy consumption, minimize emissions, and comply with stringent environmental regulations, reflecting a broader commitment to sustainable practices .

- Expansion in Offshore Applications: There’s an increasing deployment of artificial lift systems in offshore environments. Advancements in technology are enabling efficient operations in deepwater and ultra-deepwater fields, supporting the expansion of offshore oil and gas production .

- Market Growth and Consolidation: The artificial lift systems market is experiencing steady growth, driven by rising energy demand and the need to enhance production from existing wells. This growth is accompanied by industry consolidation, with major players acquiring smaller companies to strengthen their market positions and offer integrated solutions

Top Use Cases

- Enhancing Production in Mature Fields: As reservoirs age, their natural pressure declines, leading to reduced production rates. Artificial lift methods, such as electric submersible pumps (ESPs) and gas lift systems, are employed to boost production, thereby extending the economic life of these wells. Notably, mature fields contribute to approximately 70% of global oil and gas production .

- Exploiting Unconventional Resources: In formations like shale or tight sands, where natural permeability is low, artificial lift systems are vital. They assist in overcoming reservoir resistance, enabling the extraction of hydrocarbons that would otherwise remain untapped. The increasing development of shale gas reserves, especially in regions like North America, has heightened the demand for such systems .

- Offshore Production Optimization: Offshore wells, particularly those in deep waters, often face challenges related to pressure and temperature. Artificial lift solutions, including subsea ESPs and gas lift systems, are utilized to enhance production rates and ensure the efficient transport of fluids to the surface. The offshore segment is anticipated to grow significantly, driven by increased exploration activities and investments.

- Heavy Oil Production: Extracting heavy oil is challenging due to its high viscosity. Artificial lift methods, such as progressive cavity pumps (PCPs) and hydraulic pumps, are effective in moving heavy oil to the surface, making production economically viable.

- Gas Well Deliquification: In gas wells, the accumulation of liquids can hinder gas production. Artificial lift techniques, like plunger lift systems, are used to remove these liquids, allowing for continuous and efficient gas flow. This method is particularly common in wells with high gas-to-oil ratios

Major Challenges

- Volatility in Oil Prices: The artificial lift systems market is significantly affected by fluctuations in crude oil prices. Lower oil prices can lead to reduced investment in oil extraction technologies, which directly impacts the demand for artificial lift systems.

- High Initial Investment Costs: The deployment of artificial lift systems involves substantial initial investments, particularly in offshore and complex onshore fields. The cost of advanced components such as corrosion-resistant pumps and sensors can be high, making it a major financial challenge for operators.

- Technological Complexity and Maintenance: Artificial lift systems, especially those operating in harsh environments like deepwater or ultra-deepwater settings, require advanced technology and frequent maintenance. The need for continuous innovation in pump technology and system monitoring adds complexity and cost.

- Environmental Regulations: Stricter environmental regulations demand the use of renewable energy sources to operate artificial lift equipment. This shift requires additional capital expenditure and adaptation, posing a challenge for traditional oil and gas producers who are more reliant on conventional energy sources.

- Reservoir Characteristics: The efficiency of artificial lift systems heavily depends on the characteristics of the reservoir. In unconventional resources like shale, which often have complex geologies and low temperatures, the adaptation and effectiveness of standard lift technologies can be limited. This requires customized solutions, which can escalate costs and technical demands.

Top Opportunities

- Increasing Demand for Energy and Petrochemicals: The global rise in energy consumption propels the need for efficient oil and gas extraction methods. Artificial lift systems enable operators to maximize production from existing wells, thereby meeting the escalating demand for hydrocarbons.

- Mature Oil Fields Requiring Enhanced Recovery: A substantial portion of the world’s oil and gas production comes from mature fields. As these fields age, maintaining production levels becomes challenging due to declining reservoir pressure. Artificial lift systems, such as electric submersible pumps (ESPs), are vital for sustaining and enhancing output from these mature assets .

- Technological Advancements in Extraction Techniques: Innovations in artificial lift technologies, including the development of intelligent lift systems with real-time monitoring and data analytics capabilities, are improving operational efficiency. These advancements allow for optimized production rates and reduced downtime, making oil and gas extraction more cost-effective .

- Expansion of Unconventional Oil and Gas Resources: The exploration and development of unconventional resources, such as shale oil and gas, often necessitate the use of artificial lift systems due to their unique geological characteristics. As unconventional resource development continues to expand, the demand for artificial lift technologies is expected to rise .

- Increase in Offshore Exploration and Production: Growing investments in offshore oil and gas exploration are creating opportunities for artificial lift system providers. Offshore wells, particularly in deepwater environments, often require specialized lift systems to enhance production, thereby driving market growth.

Key Player Analysis

- Schlumberger Limited (SLB): A leading provider of technology for the oil and gas industry, Schlumberger offers integrated artificial lift solutions, including electric submersible pumps (ESPs), gas lift, and surface pumps. In the fourth quarter of 2022, Schlumberger reported revenue of $7.9 billion, marking a 27% year-over-year increase.

- Halliburton Company (HAL): Halliburton delivers a range of artificial lift services and products. In the first quarter of 2024, Halliburton’s total revenue was $5.8 billion, with increased activity in artificial lift services contributing to this figure.

- Weatherford International plc (WFRD): Weatherford provides comprehensive artificial lift solutions. In the first quarter of 2023, Weatherford reported revenues of $1.186 billion, a 26% year-over-year increase, with growth in artificial lift activity contributing to this performance.

- Dover Corporation (DOV): Through its subsidiary, Dover Artificial Lift, the company offers a variety of lift solutions. While specific financial data for the artificial lift segment is not readily available, Dover Corporation’s overall performance includes contributions from this sector.

- National Oilwell Varco, Inc. (NOV): NOV provides equipment and services for artificial lift systems. Although detailed financial metrics for their artificial lift segment are not specified here, the company’s overall revenue streams are supported by its diverse product offerings, including artificial lift solutions.

Recent Developments

- In 2024, Silverwell Technology Inc. made a significant advancement by expanding the reach of its Digital Intelligent Artificial Lift (DIAL) gas lift optimization system to Africa. The company secured a major contract with an offshore operator in Nigeria. This deployment is projected to enhance the net present value (NPV) of each well by up to $50 million over its lifespan, suggesting substantial financial benefits. The contract is expected to accelerate the adoption of DIAL technology across West Africa and potentially other parts of the continent.

- In 2024, Research Capital Corp. analyst Bill Newman reiterated a Speculative Buy rating for Condor Energies Inc. (TSX.V: CDR), setting a target price of CA$5.35, as highlighted in an October 16 research report. This update followed Condor’s recent achievements in Uzbekistan, where its artificial lift program led to a 100% to 300% increase in gas flow rates across the first three wells, adding an additional 330 barrels of oil equivalent per day (boe/d). Encouraged by this performance, Condor has mobilized a second workover rig, with operations slated to begin in early November 2024.

- In 2024, Riata Capital Group announced the sale of Extract Companies, LLC, a fully-integrated provider of artificial lift systems, to NOV (NYSE: NOV), a global leader in technology-driven energy solutions. While the financial terms of the deal were not disclosed, the acquisition aligns with NOV’s strategy to enhance its portfolio in the artificial lift segment and support North American energy producers with more comprehensive services.

- In 2024, SLB introduced two new cutting-edge artificial lift systems: the Reda™ Agile™ compact wide-range electric submersible pump (ESP) system and the rodless Reda PowerEdge™ electric submersible progressing cavity pump (ESPCP) system. These innovations are designed to deliver improved reliability and efficiency in artificial lift operations, marking another step forward in SLB’s commitment to advancing energy production technology.

Conclusion

Artificial lift systems are essential in the oil and gas industry for enhancing production from wells with declining natural pressure. Their significance is growing due to the increasing number of mature oilfields and the shift towards unconventional resources like shale gas and tight oil, which often require artificial lift techniques for efficient extraction. The global market for artificial lift systems is experiencing robust growth, driven by rising energy demand and technological advancements that improve extraction efficiency.

However, challenges such as oil price volatility can impact market stability. Key industry players including Schlumberger Ltd., Baker Hughes Company, Halliburton Company, and NOV Inc.are actively developing innovative solutions to address these challenges and meet the evolving needs of the industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)