Table of Contents

Introduction

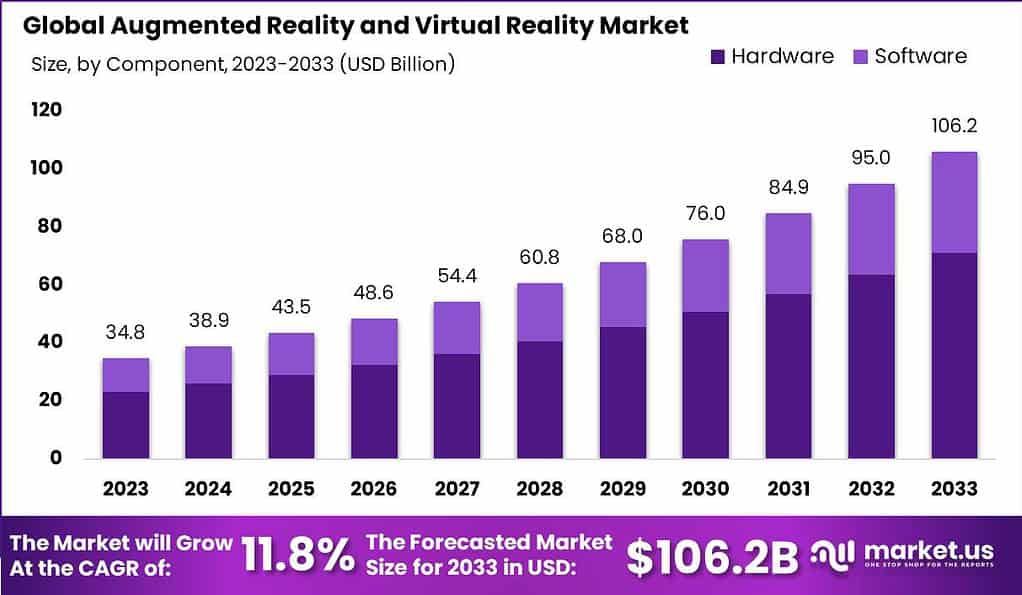

According to Market.us, the worldwide market for Augmented Reality (AR) and Virtual Reality (VR) is projected to reach approximately USD 106.2 billion by 2033, up from USD 34.8 billion in 2023. This represents a compound annual growth rate (CAGR) of 11.8% over the forecast period from 2024 to 2033.

Augmented Reality (AR) and Virtual Reality (VR) are immersive technologies that are becoming increasingly popular. AR enhances real-world environments with digital data, improving user interaction and perception. VR, in contrast, immerses users in a completely virtual environment. Both technologies provide distinctive experiences and are used in various industries. The market’s growth is primarily driven by technological advancements that improve the immersive experience through better graphics and more responsive interfaces.

Additionally, the widespread availability of AR-capable smartphones and affordable VR headsets is making these technologies accessible to a larger audience. Businesses are also recognizing the potential of AR and VR to improve efficiency and training, driving further investment. Despite the promising growth, the AR and VR market faces several challenges. High development costs for AR and VR content can limit market expansion, and there can be technical issues, such as latency and limited battery life, that affect user experience. Moreover, health concerns such as nausea and eye strain, as well as privacy and data security issues, remain significant barriers.

Opportunities in the AR and VR market are witnessing a significant surge as these technologies increasingly integrate into various sectors like entertainment, education, healthcare, and industry. In retail, AR apps allow customers to visualize products in their own space before purchase, enhancing consumer decision-making. In education, VR can create engaging learning environments that simulate real-life experiences. Healthcare also benefits from VR for surgical training and therapy, offering safe and controlled settings for professionals to hone their skills and treat patients.

Key Takeaways

- The Augmented Reality (AR) and Virtual Reality (VR) market is anticipated to achieve a valuation of USD 106.2 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 11.8% from USD 34.8 billion in 2023. This projection underscores a robust expansion trajectory over the forecast period.

- In the year 2023, AR technology asserted market dominance, capturing a 61.0% share. The AR segment is diverse, encompassing Marker-based AR, Markerless AR, and Projection-based AR. Marker-based AR finds extensive application across advertising, gaming, and education sectors due to its interactive capabilities. Conversely, Markerless AR is predominantly utilized in the retail sector for its ability to enhance shopping experiences without the need for physical markers.

- Hardware components, including headsets, glasses, and sensors, maintained a predominant position in the market landscape, constituting over 67% of the total market share in 2023. These components are essential for delivering immersive and effective AR and VR experiences.

- The Gaming and Entertainment sectors emerged as principal end-users, collectively holding more than 32% of the market share in 2023. Notably, the gaming sector has been a significant proponent of AR and VR technologies, leveraging these tools to create more engaging and realistic user experiences.

- Geographically, the Asia-Pacific region led the market, with a share exceeding 35% in 2023. This leadership is driven by swift technological progress, a substantial consumer base, and considerable investments in AR and VR technologies, particularly in nations such as China, Japan, and South Korea.

Top AR and VR Statistics

- The Augmented Reality (AR) market is projected to reach a valuation of USD 591.7 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 39.5% from 2024 to 2033. In 2024, the market size is expected to be approximately USD 29.6 billion.

- Similarly, the Extended Reality (XR) market is anticipated to grow significantly, with a projected value of USD 519.5 billion by 2032, starting from USD 49.6 billion in 2023. This market is expected to achieve a steady growth rate of 30.8% over the forecast period from 2024 to 2033.

- The Global Mixed Reality market is also on a robust growth trajectory, with an expected market size of USD 1,224.0 billion by 2032, up from USD 52.6 billion in 2023. The market is poised to grow at a CAGR of 43.2% during the forecast period from 2023 to 2032.

- Market engagement is significant, with approximately 1.4 billion active AR user devices globally.

- Notably, around three-quarters of adults under the age of 44 are familiar with AR, and AR-based shopping has been shown to prompt nearly half of all consumers to increase their spending. A study from the US indicated that 32% of AR users engage with the technology simply because they enjoy it.

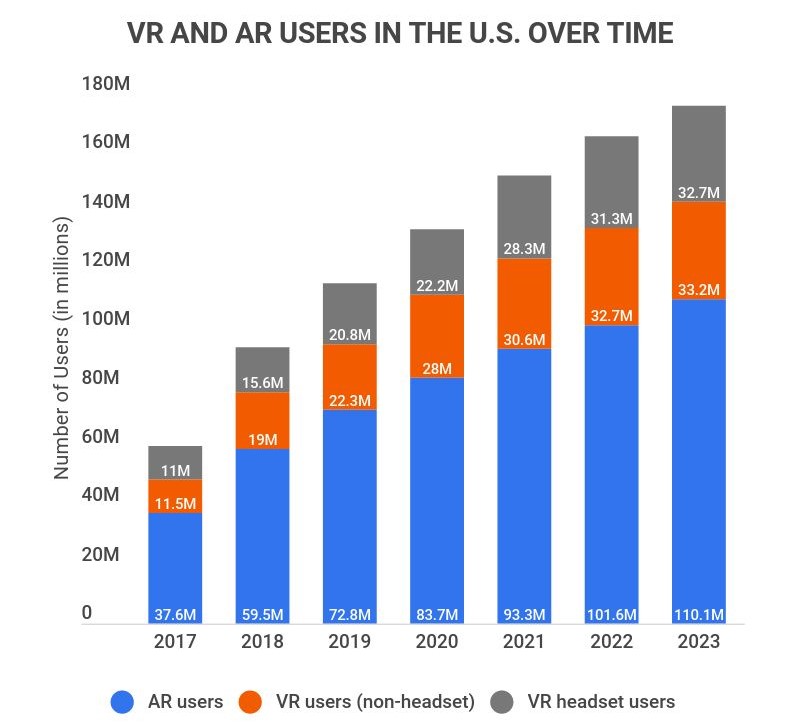

- In the United States, there are 65.9 million VR users, representing 15% of the population, and 110.1 million AR users.

- Worldwide, the VR user base exceeds 171 million. The VR industry itself has a market size of USD 7.72 billion.

- Familiarity with VR is also notable; 47% of Americans are aware of VR technologies. Among tech leaders, 70% anticipate AR revenues to surpass those of VR. Additionally, conversion rates with AR are 40% higher compared to other technologies.

- Business leaders overwhelmingly agree, with 94% stating that the primary motivation for AR usage is enjoyment.

- However, challenges persist, as 52% of retailers report needing more time to integrate AR into their systems effectively. In the U.S., approximately 37% of consumers express excitement about engaging with VR.

- The potential for VR in retail is particularly promising, projected to reach approximately USD 19 billion by 2030.

Virtual Reality Statistics By Users

Source: zippia.com

Emerging Trends

- Wearable AR Experiences: Devices like Apple Vision Pro are pushing the boundaries of AR, offering high-resolution displays and immersive experiences which are becoming more accessible to the general public.

- 5G Connectivity: This technology enhances AR and VR applications by reducing latency, thus improving the speed and reliability of data transmission for better user experiences.

- Cloud-based VR: Increasing reliance on cloud computing allows VR users to enjoy high-quality, interactive experiences without needing expensive hardware, which can facilitate collaborative and immersive environments.

- Enhanced Interactivity with Gesture and Eye Tracking: New technologies are enhancing the way users interact with digital environments by allowing more natural and intuitive controls through physical gestures and eye movements.

- Integration in Retail and Marketing: AR is being increasingly used for virtual try-ons and product demonstrations, revolutionizing the shopping experience by allowing customers to visualize products in a real-world context.

- AR in Navigation: Both indoor and outdoor navigation are benefiting from AR technologies, making travel and exploration more intuitive and information-rich.

- Virtual Tourism and Remote Exploration: VR technologies are enabling immersive travel experiences from the comfort of one’s home, providing detailed previews of destinations and interactive exploration tools.

Top Use Cases

Below is a list of AR use cases that Americans are most interested in:

| Rank | AR Use | Percentage of Americans Interested |

| 1 | Gaming | 32% |

| 2 | Travel/Driving | 12% |

| =3 | Music | 11% |

| =3 | Immersive Environments | 11% |

| 5 | History | 10% |

| =6 | Training/Education | 9% |

| =6 | Watching Movies/TV | 9% |

| 8 | Imaginary Environments | 7% |

Top Use Cases for Augmented Reality and Virtual Reality

- Education and Training: Both AR and VR are being leveraged for educational purposes, providing interactive and engaging learning experiences that can depict complex subjects in a more comprehensible way.

- Healthcare: AR is aiding in surgical procedures by overlaying crucial data over the real-time view of the patient, whereas VR is used in therapy and rehabilitation.

- Entertainment and Media: VR is revolutionizing the entertainment industry by allowing users to interact with media content in immersive environments, such as stepping inside a movie or participating in virtual concerts.

- Real Estate and Architecture: AR and VR help in visualizing buildings and interiors before they are built, providing a virtual tour of architectural designs and properties.

- Manufacturing and Prototyping: 3D design and virtual prototyping speed up the development process and reduce costs by allowing designers to test and alter designs virtually before physical models are created.

- Advertising and Marketing: AR and VR are transforming advertising by creating more engaging and interactive experiences that can attract and retain consumer interest more effectively.

- Public Safety and Emergency Response: Training and simulation for emergency services are enhanced by VR, providing realistic scenarios that improve response times and decision-making in crisis situations.

Major Challenges

- High Development Costs: The significant expenses associated with developing AR and VR technologies can be prohibitive. High-end devices and the integration of complex optics are particularly costly, impacting the accessibility of these technologies for wider adoption.

- Limited Field of View: Current AR and VR devices often have a restricted field of view (FOV), which can diminish the user’s immersive experience. Achieving a wider FOV is crucial but presents substantial technical challenges.

- Device Comfort and Design: The bulkiness of head-mounted displays can lead to discomfort and limited use duration. Making these devices lighter and more comfortable remains a challenge for manufacturers.

- Consumer Adoption: Despite the potential of AR and VR, consumer adoption rates are uneven, often tethered to early adopters and technology enthusiasts. Broadening the market base beyond this group is essential for mainstream acceptance.

- Interoperability and Standardization: There is a need for greater standardization across platforms and devices to ensure compatibility and facilitate broader usage. This includes unified software environments and hardware interfaces.

Market Opportunities for AR and VR

- Industrial and Healthcare Applications: Both sectors present significant growth opportunities for AR and VR. Industrial uses include training, simulation, and maintenance, while healthcare applications range from surgery assistance to patient education and psychological therapy.

- Enhanced Remote Collaboration: As remote work becomes more prevalent, AR and VR technologies can play a crucial role in creating more engaging and effective virtual meeting spaces and collaborative environments.

- Education and Training: These technologies can transform educational methodologies by providing immersive learning experiences that increase engagement and retention of information.

- Retail and Marketing Innovations: AR and VR offer novel ways for brands to engage with consumers, such as virtual try-ons, immersive advertisements, and enhanced shopping experiences that could drive higher conversion rates.

- Expansion into New Regional Markets: Particularly in Asia Pacific, which leads in AR and VR adoption due to its rapid technological advancements and integration into various sectors like education, healthcare, and manufacturing.

Recent Developments

- January 2024: Sony launched an immersive spatial content creation system, which includes an XR head-mounted display equipped with high-quality 4K OLED Microdisplays and controllers optimized for intuitive interaction with 3D objects. This system, powered by Qualcomm’s Snapdragon XR2+ Gen 2 Platform, supports high-performance XR experiences for creators.

- January 2024: HTC collaborated with Qualcomm and other partners to leverage the new Snapdragon XR2+ Gen 2 Platform, enhancing AR/VR/MR hardware capabilities for consumer and enterprise applications.

- May 2024: Google announced a strategic partnership with Magic Leap to advance XR technologies. This collaboration combines Magic Leap’s AR optics expertise with Google’s technology platforms to create immersive AR solutions.

- January 2024: Samsung, in partnership with Google and Qualcomm, is set to use the new Snapdragon XR2+ Gen 2 Platform in its upcoming XR devices. This collaboration aims to enhance the user experience and performance of AR and VR applications.

- January 2024: Microsoft announced the discontinuation of its Windows Mixed Reality Platform. This move comes after years of supporting the platform, which enabled PC headset users to run AR/VR/MR applications. The company is refocusing on its industrial Metaverse platform, supporting upcoming VR/MR services through its Mesh product.

- May 2023: Meta entered into discussions with Magic Leap for a multiyear deal focusing on AR headset technology. This partnership aims to integrate Magic Leap’s expertise in optics with Meta’s AR initiatives.

Conclusion

The AR and VR markets are poised for significant expansion, driven by technological advancements and increasing application across multiple industries. While challenges such as high costs and limited consumer adoption exist, the potential for innovative solutions in healthcare, industrial applications, and remote collaborations presents substantial opportunities for growth. As technology progresses and becomes more integrated into everyday use, the barriers to entry are expected to decrease, making AR and VR more accessible to a broader audience.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)